Introduction

Fixed Indexed Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index, such as the S&P 500. Fixed Indexed Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to mis-sell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

In this article, we will examine the Nationwide New Heights Select Fixed Indexed Annuity in detail. This product is a revamped version of the Nationwide New Heights Fixed Indexed Annuity and is available with surrender periods of 8, 9, 10, and 12 years. The plan is designed to support both lifetime income objectives and legacy planning. Following extensive research and due diligence, this article presents an in-depth and unbiased analysis of the product.

The review of the Nationwide New Heights Select Fixed Indexed Annuity will be broken into multiple subcategories:

- Product Description

- Product Policy

- Rates and Costs

- Accessing your Money

- Riders

- What Makes This Product Stand Out?

- What I Don’t Like

- Company Details

- Conclusion

Product Description

The Nationwide New Heights Select is a Fixed Indexed Annuity (FIA) plan that offers the annuitant (annuity investor) the opportunity to earn a portion of market index-linked return without incurring the risk of market downside. This plan is suitable for retirees or individuals approaching retirement who seek to grow and protect their retirement savings. It is also suitable for those seeking a guaranteed lifetime income or aiming to leave a legacy for their loved ones, while maintaining principal protection and growth potential.

Let’s have a look at the high-level fine print of Nationwide New Heights Select Fixed Income Annuity, and then we will discuss each point in detail.

| Product Name | New Heights Select |

|---|---|

Issuing Company | |

AM Best Rating | A+ (2nd of 13 ratings) |

Tenure | 8,9,10,12 years |

Maximum Issue Age | 80 Years (75 Years for the 12-year policy) |

Minimum Initial Purchase Amount | $25,000 ($10,000 for the 8-year policy) |

Surrender Charge Schedule | Varies for different tenure policies |

Strategy Terms |

|

Plan Types |

|

Indexes |

|

Free Withdrawals | 7% through the end of the Surrender Charge period |

Death Benefit | The death benefit will be equal to the greater of the Daily Accumulation Value (DAV) or the surrender value The DAV monitors the combined daily fluctuations in the elected strategy options and is the greater of (1) the contract value, plus any unrealized strategy earnings (strategy earnings that have not yet been credited to the contract), or (2) the Return of Purchase Payment Guarantee amount |

Optional Riders | The annuitant can choose any one of:

|

Free Benefits |

|

RMD Friendly | Yes |

The Nationwide New Heights Select policy is almost identical for all policy tenures, except for the crediting period and surrender charge schedule. For ease of discussion and clarity, we will focus on the New Heights Select 9 policy (unless otherwise mentioned) for the remainder of the article.

Product Policy

How does it work?

An annuitant (maximum age at the time of policy issue: 80) can purchase the New Heights Select 9 policy with a minimum initial purchase amount of $25,000; and in return, they will earn market index returns (calculated through a formula that we will discuss shortly), normally, credited once every one or three years (depending upon the option you chose). Apart from the one-year or three-year crediting period, various events may trigger earnings credit, including free withdrawals, long-term care events, terminal illness or injury events, or when a death benefit is payable.

The New Heights Select 9 offers the annuitant the option to choose from one or more of the seven indexes to determine their earnings crediting formula. Each of these indices has two strategies to choose from (making a total of 14 strategy options), and at any point in time, the contract may be allocated to a maximum of ten strategy options. We will discuss each available index briefly:

The S&P 500 index is one of the most popular and oldest indexes in the world. It tracks 500 large-cap publicly traded stocks listed in the United States. It is a reliable index and has consistently proven its worth over time.

It is essential to note that the New Heights Select plan offers a participation rate for the S&P 500 index, meaning that you will receive a credit for only a portion of the S&P 500 return in your annuity. These rates are subject to frequent changes; I will discuss them in detail shortly.

2. Goldman Sachs New Horizons Index

The Goldman Sachs New Horizons Index offers a dual-pronged approach to asset allocation aimed at enhancing returns and diversification. The Global Core Strategy encompasses a wide array of asset classes, including global equities, fixed income, commodities, credit, and real estate, and employs dynamic optimization for asset allocation. The Index employs a daily rebalancing mechanism to maintain a 5% volatility control level. This frequent reallocation is designed to mitigate risk during periods of market volatility. While this strategy can cushion the impact of market declines, it also constrains the potential for upside gains.

3. SG Macro Compass Index

The SG Macro Compass Index is designed to identify changes in the economic cycle and rotate asset class allocations, seeking to provide stable and consistent long-term appreciation in up, down, and sideways markets. Based on the economic outlook for expanding, contracting, or neutral markets, the Index may shift allocations of up to 13 underlying global assets in equities, bonds, and commodities with the aim of generating returns. The index is updated once every quarter.

The index was launched in August 2020, and it would be early to know about the long-term empirical performance of the index. This index also employs a daily rebalancing mechanism to maintain a 5% volatility control level, which limits both the downside and upside of the return potential.

4. NYSE Zebra Edge II Index

The NYSE® Zebra Edge® II Index evaluates the 500 largest publicly traded companies in the United States each quarter and removes the riskiest and most volatile companies, leaving fewer irrational equities. The index aims to eliminate the volatility and risk associated with popular and largely traded stocks. Again, this is a relatively new index, launched in October 2020, and we have limited actual empirical data to assess its performance. This index also employs a daily rebalancing mechanism to maintain a 5% volatility control level, which limits both the downside and upside of the return potential.

5. J.P. Morgan Mozaic II Index

The J.P. Morgan Mozaic II Index is built on investment philosophies designed to pursue positive returns across both favorable and unfavorable market environments. The index aims to deliver more consistent performance by actively managing volatility through dynamic asset allocation. It is broadly diversified, providing exposure across multiple asset classes including equities, fixed income, and commodities. However, as a volatility-controlled index, return outcomes are inherently smoothed, which limits both downside risk and upside participation.

6. Nasdaq-100 Volatility Control 10% PR Index

The Nasdaq-100 Volatility Control 10% PR Index is designed to offer exposure to the Nasdaq-100® Index while aiming to maintain a consistent volatility level of 10%. The index dynamically adjusts its exposure to the Nasdaq-100 based on real-time volatility assessments. When market volatility decreases, the index increases its exposure to the Nasdaq-100; conversely, during periods of heightened volatility, it reduces exposure, reallocating to cash positions that accrue interest at the Federal Funds Rate. This index also employs a daily rebalancing mechanism to maintain a 10% volatility control level, which limits both the downside and upside of the return potential.

7. Loomis Sayles Discovery Index

The Loomis Sayles Discovery Index is a growth-oriented, multi-asset benchmark designed to adapt to changing market conditions by reallocating across U.S. equities, global interest rate futures, and commodity futures. It employs a predictive forecasting methodology to assess market environments, categorized as resilient, moderate growth, or fragile, and adjusts its equity exposure accordingly. In resilient markets, the index allocates 100% to growth equities; in moderate growth conditions, it shifts to 100% value equities; and in fragile markets, it reduces equity exposure to 25% growth equities to mitigate risk. The index also incorporates two alternative strategies: a global rates strategy that uses short-term interest rate futures to manage interest rate risk, and a commodities strategy that aims to generate positive returns during inflationary periods by taking long positions in long-dated commodity futures and short positions in short-dated commodity futures. This index also employs a daily rebalancing mechanism to maintain volatility control level, which limits both the downside and upside of the return potential.

The Nationwide New Heights Select Fixed Indexed Annuity offers these indexes with participation rates and spreads. This means you will only receive a portion of the index return credited to your annuity. These rates are subject to frequent changes, which I will discuss in greater detail shortly. Also, unlike most other fixed-indexed annuities, this index doesn’t offer a fixed rate strategy.

It is important to note that, except for the S&P 500 Index, all the other indexes have a volatility control mechanism in place, which limits the overall return-earning capacity of the index.

Rates and Costs

The earnings crediting formula

The earnings crediting formula is one of the most important parts of this annuity discussion. It is essential to note that we don’t simply receive the index return credited to the annuity. There are a few rate-limiting mechanisms (in the form of participation rate and spreads) that the company has in place that affect our earnings. These rates are subject to change over time, and the updated rates can be checked on the company’s website at any time.

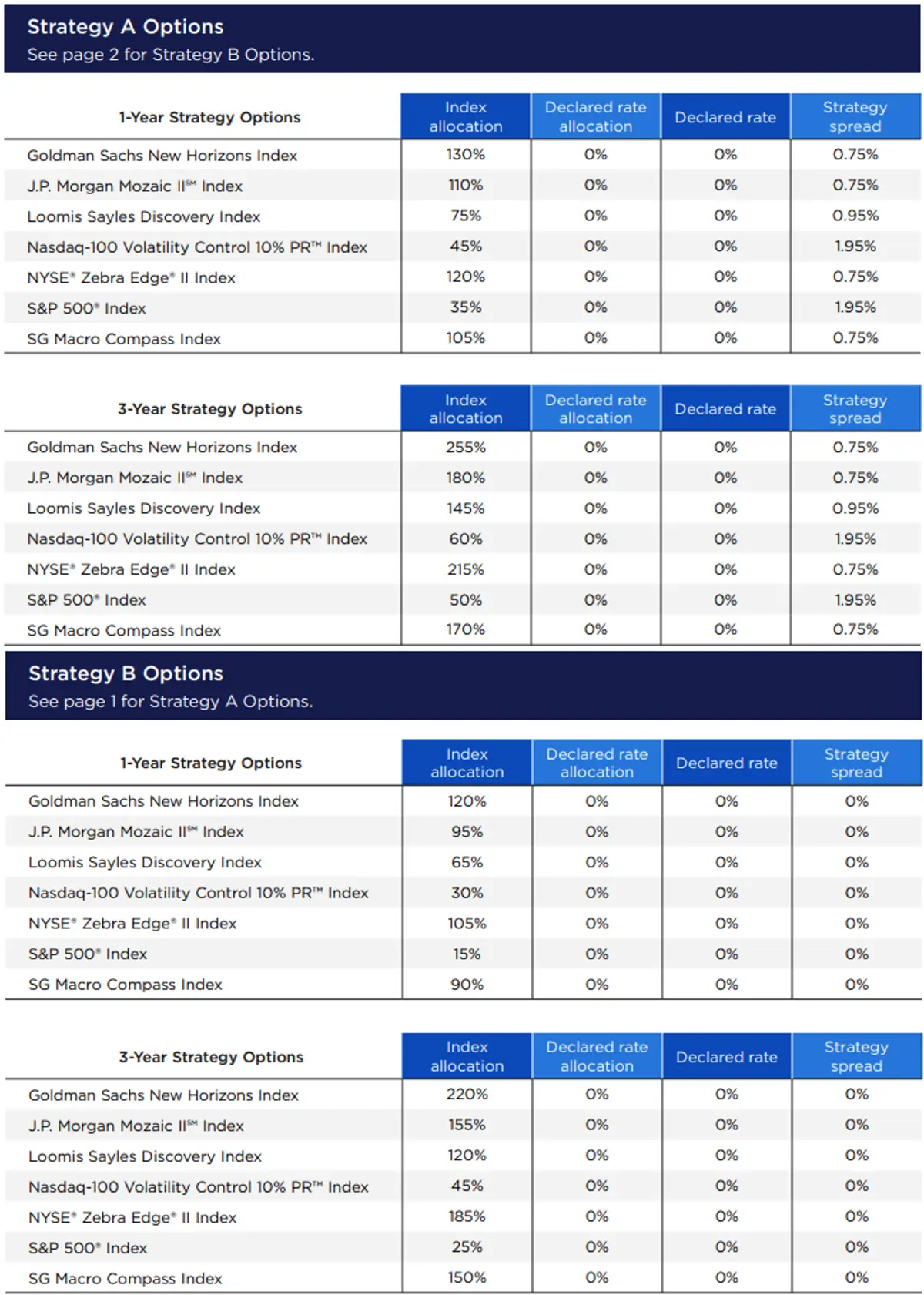

Let's take a closer look at the Nationwide New Heights Select 9 rate sheet to understand how earnings are calculated. Please note that these rates are current as of the time this article was edited (as of January 2026) and apply only to the Nationwide New Heights Select 9 FIA. For the most accurate and up-to-date rates, you may contact your trusted financial advisor or visit the company's website.

The first thing to note is that there are two strategy options (Strategy A or Strategy B), each offering seven index choices with 1-year and 3-year allocation periods. In total, an annuitant can choose from 14 strategies and may allocate the premium across multiple strategies, up to a maximum of 10 strategies. Among these, the index allocation rate (participation rate) and the strategy spread are the most important factors to consider.

- Index Allocation Rate or Participation Rate (PR): The participation rate describes the annuitant’s participation percentage in the return of an index. For example, suppose the participation rate is 60%, and the index returned 10% over the agreed time. In that case, the annuitant will be eligible for only 60% of the return, i.e., 6%.

- Index Allocation Rate with Strategy Spread: This indexing strategy applies BOTH the participation rate and the spread to determine the index interest credit. Let’s consider an example where the participation rate is 60%, the spread is 2%, and the index returned 10% in a given year. In this case, the interest credited to the annuity account would be 60% of 10% (PR), less 2% (SP), i.e., 4%.

You will note that in strategies where the index allocation rate is high (Strategy A), a strategy spread also exists. For instance, the S&P 500 3-year strategy A has an index allocation rate of 50%; still, a spread of 1.95% exists. It means if the index earns 25% over the 3-year period, the earnings that will be credited to the annuity account would be (25% * 0.50) - (1.95% * 3 years) = 6.65% over the three-year period or an annual return of less than 3%. On the surface, it appears that we are potentially earning the S&P 500 return, but in reality, we are nowhere near it. Therefore, it is crucial to compare rates before selecting your preferred index. Ideally, it is advisable not to choose a strategy with both index allocation rate and strategy spread.

Out of all these indexes, I prefer the Goldman Sachs New Horizons and the J.P. Morgan Mozaic II index the most because of their decent historical data, good performance over a relatively long period, and high index allocation rates offered by the companies.

Accessing your Money

Each year, you are entitled to a 7% free withdrawal of your contract value without incurring any charges, fees, or penalties.

Should your needs change unexpectedly and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies; although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. For all excess withdrawals, you will receive only a prorated amount of interim strategy earnings to date. Below is the Surrender Charge schedule.

| Completed Contract Years | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9+ |

|---|---|---|---|---|---|---|---|---|---|---|

Surrender Charge % | 9% | 9% | 9% | 9% | 8% | 7% | 6% | 5% | 4% | 0% |

Note that this surrender charge schedule is only valid for the New Heights Select 9 product in select states. The surrender charge schedule is different for the different tenures of annuities. For a quick comparison of surrender charges across different Nationwide products, you may visit their fixed indexed annuities product page here.

The surrender charge of New Heights Select fixed indexed annuity is pretty much in line with all the other annuity issuers.

Once the surrender charge period ends, you can typically access your full contract value without fees. However, any withdrawal reduces both your contract value and, if applicable, the income base tied to optional riders, which may impact future guaranteed income.

An annuitant can also convert the contract into a stream of guaranteed income, known as annuitization. They can choose from various payout options designed to meet different needs.

Life Only – Provides income for as long as you live.

Joint and Survivor Life – Continues payments over two lifetimes, often used by couples.

Life with Period Certain (up to 30 years) – Pays income for life, but guarantees payments for a minimum period even if death occurs earlier.

Period Certain (up to 30 years) – Provides guaranteed payments for a set number of years, regardless of lifespan.

Single Life or Joint Life with Cash Refund – Ensures that if the annuitant(s) pass away before receiving payments equal to the original premium, the difference is refunded to beneficiaries.

Single Life or Joint Life with Installment Refund – Similar to the cash refund, but any remaining balance is paid out over time in installments.

These options offer flexibility in balancing lifetime income needs with legacy goals, enabling you to tailor how and when funds are accessed during retirement.

Death Benefit

The death benefit will be equal to the greater of the Daily Accumulation Value (DAV) or the surrender value.

The DAV monitors the combined daily fluctuations in the elected strategy options and is the greater of (1) the contract value, plus any unrealized strategy earnings (strategy earnings that have not yet been credited to the contract), or (2) the Return of Purchase Payment Guarantee amount.

Contract/Administrative Charge

The New Heights Select does not levy any annual contract or administrative fees. However, the optional rider fees still apply.

Optional Rider Charge

The New Heights Select plan gives an option to select any one optional rider from four available riders (2 living benefits and 2 death benefits).

The costs of each are illustrated in the table below.

| Optional Riders | Cost (of accumulated value) |

|---|---|

Living Benefits | |

Nationwide High Point 365® Select Lifetime Income Rider | 0.95% |

Nationwide High Point 365® Select Lifetime Income Rider with Bonus | 1.10% |

Death Benefits | |

Nationwide High Point® Select Enhanced Death Benefit Rider | 0.50% |

Nationwide High Point® Select Enhanced Death Benefit Rider with Purchase Payment Bonus | 0.95% |

Note that these charges are calculated on the "income benefit base" of the contract, are assessed quarterly, and reduce the contract value and the minimum guaranteed contract value. All of these four riders are discussed briefly in the next section.

Riders

In an insurance policy, riders are an additional provision that can be added to enhance the benefits of the base policy. The New Heights Select Fixed Income Annuity allows the annuitant to choose any one additional rider from the four riders it offers. It offers two riders for living benefits and two riders for death benefits. We will briefly go through each of them.

Living Benefits Riders

The New Heights Select offers the annuitant two additional living benefit riders.

- Nationwide High Point 365 Select

- Nationwide High Point 365 Select with Bonus

The Nationwide High Point Select rider offers the annuitant an enhanced guaranteed lifetime income. Before diving into the fine print of the rider, it is important to first understand the Income Benefit Base. The Income benefit base is the amount on which the lifetime income amount is calculated. The income benefit base is NOT an income that is accrued to you. It is only used for calculating the lifetime income amount or the death benefits. In this case, the income benefit base at any point in time is the greater of:

- High Point Daily Accumulation Value - Calculated daily based on the index strategy you chose. The high point of the index is automatically locked; even if the index falls after locking in a high point, the high point value will be considered for the DAV calculation. Refer to the figure after this section to get more clarity on the High Point Daily Accumulation Value

- The Minimum Income Benefit Value, which guarantees daily growth of your purchase payment at a 1% compound annual rate for 10 years or until the first lifetime income withdrawal, whichever comes first

Now, the guaranteed lifetime income is calculated by multiplying:

{High Point Income Benefit Base} X {Payout Percentage} = Guaranteed Lifetime Income Amount

The payout percentage is based on the age of the covered life at contract issue and the number of completed contract years when lifetime income payments begin. If the joint option is elected, the payout percentage is based on the age of the younger spouse, which will result in a lower payout percentage. When your contract is issued, the range of payout percentages applicable to your contract will not change; however, payout percentages will increase within that set range every year, and income is deferred until the maximum payout percentage is reached. When your lifetime income payments begin, the payout percentage will not change.

The Nationwide High Point 365 Select rider costs an annual charge of 0.95% of the accumulated value and reduces the contract value and the minimum guaranteed contract value quarterly.

The Nationwide High Point 365 Select with Bonus is similar to the High Point 365 Select, but it offers a more generous calculation of the Income Benefit Base.

First, it directly applies a bonus of 30% to your purchase payment to calculate the minimum income benefit value. Second, it guarantees the daily growth of your purchase payment at an 9.5% compound annual rate for 12 years or until the first-lifetime income withdrawal, whichever comes first. (As compared to 1% in the former)

To summarize, the income benefit base at any point in time in this rider is the greater of:

- High Point Daily Accumulation Value

- The Minimum Income Benefit Value guarantees the daily growth of your purchase payment at a 9.5% compound annual rate for 12 years or until the first lifetime income withdrawal, whichever comes first.

The Nationwide High Point 365 Select with bonus rider costs an annual charge of 1.10% of the accumulated value and reduces the contract value and the minimum guaranteed contract value quarterly. In my opinion, it is better to opt for the bonus (if you are thinking of opting for the income rider), because it provides for a high-income Benefit Base at a low incremental cost (1.10% vs 0.95%)

Death Benefits Rider

The New Heights Select offers the annuitant two additional death benefit riders.

- Nationwide High Point Select Enhanced Death Benefit Rider

- Nationwide High Point Select Enhanced Death Benefit Rider with Purchase Payment Bonus

If you believe that you don’t require a lifetime guaranteed income and want to leave the money for your loved ones, the Nationwide High Point Select Enhanced Death Benefit is a suitable rider for you.

The death benefit riders offer the annuitant an enhanced death benefit based on the following calculation. The rider guarantees that the death benefit will grow in value equal to the greater of:

- High Point Daily Accumulation Value

The Minimum Enhanced Death Benefit Value, a daily guaranteed increase of the purchase payment at a 4% compound annual rate until the earliest of:

- The date, if any, the enhanced death benefit reaches 200% of the purchase payment

- The contract anniversary after the older annuitant reaches age 80

- The date the first death benefit is payable

The Nationwide High Point Select Enhanced Death Benefit rider incurs an annual charge of 0.50% of the enhanced death benefit value, which reduces the contract value and the minimum guaranteed contract value on a quarterly basis.

The Nationwide High Point Select EDB with Bonus is very similar to the former one, with just one difference that it offers a 4% bonus that is immediately credited to your purchase payment and provides a greater EDB growth.

The Nationwide High Point Select Enhanced Death Benefit rider costs an annual charge of 0.95% of the enhanced death benefit value and reduces the contract value and the minimum guaranteed contract value quarterly.

Note that rider costs are different for different tenure annuities. You can check rider costs for all tenures.

In my opinion, the quarterly costs almost offset the bonus, so you may consider giving this rider a pass.

What Makes This Product Stand Out?

The Nationwide New Heights Select offers several features that are not typically found in many fixed-indexed annuities. The ones that I like the most are:

- It Allows Daily Tracking: With the New Heights Select FIA, you get access to an online portal where you can track your potential earnings in real-time. It is known as the Daily Accumulation Value (DAV). Now, the DAV doesn’t mean that you can cash out that value on any given day; it is just a tracking feature. Still, the daily tracking feature helps you to be informed about the value you are deriving from your annuity. In addition, the DAV helps to complement two other features that are discussed as follows:

- Optional Lock-in of Positive Performance: As this is a Fixed Income Annuity, you are naturally protected from market downturns. But you may have a high chance of missing out on some of the one-off index gains between the two earnings crediting points. This is where the Optional Lock-in features come in handy. Generally, Index gains are automatically locked in at the end of the strategy term, but this feature gives you an option to manually lock in index gains once per strategy term. It means you can lock in index gains when you feel that the index is peaked. The figure below explains the feature graphically.

3. Earnings Capture on Withdrawals: Another unique feature of New Heights Select is that you will receive earnings to date on withdrawals for retirement expenses or if you need to take Required Minimum Distributions (RMDs). In simple terms, it means that you will also earn the index gains on the amount of withdrawal you make. These earnings are calculated on the DAV.

4. Optional Set of Income and Death Benefit Riders

5. No annual contract, mortality & expense, or administrative fees

6. Free Confinement and Terminal Illness Waiver Benefit: This no-fee rider is automatically included for owners under age 65 and includes both an Extended Care and Terminal Illness Benefit.

7. Multiple Payout Options: Lump sum or Annuitization option with Life Only, Life with Period Certain, Joint and Survivor Life, etc.

What I Don’t Like

This product is generally good if one opts for the lifetime income rider; still, there are some features that I don’t like about this annuity.

- Low Participation Rate on the S&P 500 Index - The participation rate on both the strategies of the S&P 500 Index is relatively low. Even with the low participation rate, the company still applies a strategy spread. The S&P 500 is the most popular index in the world, and the annuitant should be given a decent opportunity to participate in the S&P 500 index.

- Higher Single Premium Minimum Investment - The New Heights Select requires a minimum purchase amount of $25,000 as opposed to $10,000 that other annuities offer.

- Lower Free Withdrawals - The New Heights Select offers a free withdrawal of 7% of the annuity amount annually, while other annuities offer a free withdrawal of 10% per year.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Nationwide Life and Annuity Insurance Company

Nationwide Life Insurance Company is a leading U.S. life insurer and a wholly owned subsidiary of Nationwide Mutual Insurance Company. The company offers a broad range of retirement and protection solutions, including fixed and indexed annuities, life insurance, and long-term care products. It is one of the oldest life insurance companies, having been in the business for over nine decades. It is a Fortune 100 and 500 company, ranked #72 as of 2025.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

AM Best | A+ (2nd of 13 ratings) |

Moody’s | A1 (5th of 21 ratings) |

S&P | A+ (5th of 21 ratings) |

Nationwide has managed to maintain strong ratings for many years. Nationwide is considered to be strong and stable financially. In 2024, the company paid out over $20.7 billion in benefits and claims. As of year-end 2024, some of the other financial highlights for Nationwide Life Insurance Company include its:

- $68.5 billion in gross sales

- $28.3 billion of total adjusted capital

- $150 billion of a total investment portfolio

- $3.2 billion in net operating income

- $322.3 billion in total assets

Thus, going by the operating history and financial numbers, we can safely gauge that you can trust your savings with Nationwide.

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. So, it’s very important to have a stream of income that can grow safely and steadily and provide a fixed, guaranteed income during retirement years. This not only helps you mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

The Nationwide New Heights performs decently across various metrics, whether it's principal protection, offering a risk-free opportunity to participate in the market index, providing a guaranteed income stream, or facilitating legacy planning. If you're in the market for a Fixed Income Annuity, the Nationwide New Heights Select could be a good choice to consider.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. Delve deeper into our extensive reviews here.