Introduction

In the face of the 2000-2010 market volatility, characterized by the dot-com bubble burst and the 2007-2009 financial crisis, indexed annuities emerged as a resilient investment option. This article delves into the performance of indexed annuities during a decade of financial extremes, illustrating their role in offering stability and growth amidst market fluctuations. We explore how these financial instruments, with their unique blend of equity market linkage and principal protection, provided a safeguard for investors against the era's unpredictability, outperforming traditional investment avenues like the S&P 500 in many instances.

Key Takeaways

- Resilience in Volatility: Indexed annuities demonstrated remarkable stability during the tumultuous 2000-2010 period, making them an appealing option for those seeking security in their investments.

- Balanced Investment Approach: By marrying the growth potential of equity markets with the safety of principal protection, indexed annuities presented a hybrid investment solution adaptable to diverse financial climates.

- Informed Selection: The effectiveness of indexed annuities hinges on understanding their mechanics, such as cap rates and surrender charges, emphasizing the importance of a well-informed investment choice.

Understanding Indexed Annuities

Indexed annuities, introduced in 1995, offer a unique proposition by combining the growth potential of equity markets with the principal protection typical of traditional fixed annuities. This distinct blend caters to the needs of those seeking better returns than bonds or certificates of deposit while providing security against volatile markets. It’s a delicate balance that hinges on several elements, including the cap rate and downside protection.

In simple terms, indexed annuities work towards balancing growth and risk reduction.

How Do Indexed Annuities Work?

Indexed annuities credit interest based on the performance of a benchmark index, such as the S&P 500, without directly investing in the stock market or equities. This approach provides a unique combination of growth potential and principal protection. During periods when the benchmark index performs well, the annuity account is credited with interest up to a predetermined cap. However, even if the index performs poorly, the annuitant's principal is protected by a guaranteed minimum interest rate, ensuring stability in volatile markets.

Protection and Growth:

- Principal Protection: Ensures investment safety during market declines, ideal for capital preservation.

- Growth Opportunity: Allows participation in market gains, subject to caps and rates, offering a balanced investment approach.

Cap Rate and Downside Protection

In indexed annuities, the cap rate sets the upper limit on the return that can be credited in a given year, regardless of the linked index’s performance. This plays a crucial role in the annuities’ risk management strategy. An important consideration is that the cap rates on indexed annuities can vary yearly, and these fluctuating rates can influence investment returns over the long term.

Indexed annuities include the following features:

- Cap Rate: The cap rate in an indexed annuity is the maximum rate of return that the annuity can credit to the account in a given period, typically one year, based on the performance of the underlying index. The cap rate limits the maximum return that an investor can earn in positive market conditions. The purpose of the cap rate is to limit the insurance company's exposure to high index gains, which is why it might be seen as part of the trade-off for providing downside protection, but it is not a feature that directly protects the principal.

- Participation Rates: Determine the share of index gains credited to the annuity, balancing growth with contractual terms.

- Downside Protection: Downside protection in indexed annuities is provided by the guaranteed minimum interest rate or the feature that the contract value will not decrease if the underlying index performs negatively. This characteristic ensures that even if the linked index loses value, the annuity's principal (or a portion of it, depending on the contract) is protected, and the account value will not decline as a result of poor market performance.

- Addressing the Needs of Risk-Averse Individuals: Indexed annuities are indeed designed to meet the needs of individuals who are risk-averse. They offer a way to participate in potential stock market gains without directly exposing the principal to market losses, making them appealing to those who seek growth opportunities but are concerned about the volatility and risks associated with direct equity investments.

However, it is important to note that the cap rate could also limit the potential return when the index performs particularly well, impacting the overall balance between risk and reward in the annuity investment.

The 2000-2010 Market Landscape

-1200x700.webp&w=3840&q=70)

The 2000-2010 market landscape was a tumultuous period, profoundly impacted by major financial events that contributed to significant market volatility. The bursting of the dot-com bubble in 2000, the September 11, 2001 attacks, and the collapse of the sub-prime mortgage market in 2007, all played a part in destabilizing the financial markets during this market storm.

During this time, the appeal of indexed annuities grew as they were perceived as a tool for downside protection and a source of stable returns.

The Role of Indexed Annuities

The 2007-2009 financial crisis underscored the significance of principal protection features in indexed annuities, prompting investors to consider them as a means to protect retirement savings from market downturns. After the tech bubble burst and financial crises involving major companies and banks in the 2000s, fixed index annuities demonstrated the value of diversification and perseverance, contributing to the stability of investors’ portfolios.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 reaffirmed the status of Fixed Indexed Annuities (FIAs) as fixed products, not securities, ensuring their continued role in providing retirement investment security.

Indexed Annuities Performance Comparison: 2000-2010

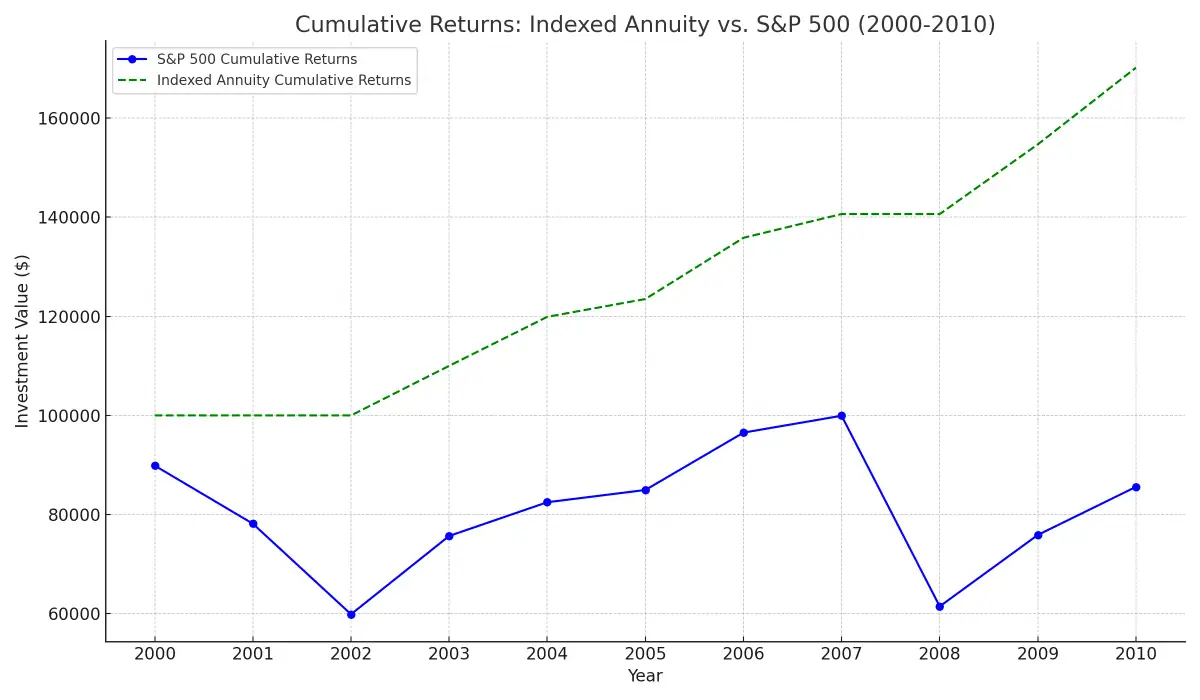

The period from 2000 to 2010 provides a vivid illustration of the indexed annuity's value proposition. Amidst the market's ups and downs, indexed annuities offered investors peace of mind and stable growth. The following charts and data highlight the performance comparison between a hypothetical indexed annuity and the S&P 500, showcasing the protective features of indexed annuities during this tumultuous decade.

Comparative Growth: Indexed Annuity vs. S&P 500 (2000-2010)

The provided examples, including graphs and tables, are for illustrative purposes and based on hypothetical scenarios.

This chart shows the account value growth of a $100,000 investment in both the S&P 500 and an indexed annuity from 2000 to 2010. The indexed annuity provides stability during market downturns and capped gains during upturns.

This chart illustrates the cumulative returns of an indexed annuity versus the S&P 500 over the same period, highlighting the annuity's protection against market losses and its potential for growth up to the cap rate.

Decade Overview: Stability and Performance of Indexed Annuities vs. S&P 500

The following example assumes that $100,000 was invested in a fixed-indexed annuity with a cap rate on the S&P 500 of 10%. It assumes no withdrawals were made on this annuity during 2000-2010.

| Year | S&P 500 Return (%) | Annuity Return (%) | Annuity Account Value ($) | Description |

|---|---|---|---|---|

2000 | -10.14% | 0.00% | $100,000.00 | Market Downturn; annuity protected from loss. |

2001 | -13.04% | 0.00% | $100,000.00 | Market Downturn; annuity protected from loss. |

2002 | -23.37% | 0.00% | $100,000.00 | Market Downturn; annuity protected from loss. |

2003 | 26.38% | 10.00% | $110,000.00 | Market growth. |

2004 | 8.99% | 8.99% | $119,889.00 | Market growth. |

2005 | 3.00% | 3.00% | $123,485.67 | Market growth. |

2006 | 13.62% | 10.00% | $135,834.24 | Market growth. |

2007 | 3.53% | 3.53% | $140,629.19 | Market growth. |

2008 | -38.49% | 0.00% | $140,629.19 | Market Downturn; annuity protected from loss. |

2009 | 23.45% | 10.00% | $14,692.10 | Market growth. |

2010 | 12.78% | 10% | $170,161.31 | Market growth. |

A comparison of indexed annuities with the S&P 500 during this decade reveals the strength of indexed annuities. While the S&P 500 experienced a significant loss, indexed annuities tied to stock market indexes such as the S&P 500 generally offered more stable returns and sometimes even outperformed the indexes to which they were correlated.

A comprehensive study in the Journal of Financial Planning revealed that from 1999 to 2010, fixed-indexed annuities (FIAs) outperformed well-known indexes like the S&P 500 over two-thirds of the time.

Stability in Market Downturns

One of the key features of indexed annuities is their stability during market downturns. Throughout the Dot Com stock market crash of 2000-2002 and the financial crisis of 2008, FIAs demonstrated notable stability, nearly doubling their sales from $6.5 billion to $11.7 billion and maintaining comparable returns to equities. They provide a principal protection mechanism that insulates the investor’s principal from market downturns by not directly participating in the stock index and implementing an annual lock-in of the principal.

Retirement Planning with Indexed Annuities

Indexed annuities play a significant part in retirement planning. They offer income stability and shield against sequence of return risk, which are fundamental for preserving financial stability during retirement. By tracking a stock market index, indexed annuities offer individuals a way to participate in market gains, making them a viable long-term investment option within a retirement portfolio.

As a strategy for retirement planning, indexed annuities merge potential for growth with downside protection, making them a sensible option for individuals aiming to ensure their financial future.

Financial Stability Amidst Market Volatility

Indexed annuities can provide financial stability during periods of market volatility. Most annuities provide a minimum rate of return that ranges from 1% to 3%, which guarantees a level of financial stability by ensuring that investors will receive a minimum return on at least 87.5 percent of their premium paid even during market downturns.

The tax deferral feature of indexed annuities allows investors to accumulate gains without paying taxes on them until distributions are taken, facilitating the growth of retirement funds over the long term.

Long-Term Investment Potential

The growth potential of indexed annuities makes them an attractive choice for long-term investment. They often offer better rates of return than certificates of deposit (CDs), which enhances their attractiveness for investors who are planning for retirement.

During the market recovery from 2003 to 2007, the growth of fixed index annuities was notable, demonstrating their capacity for steady appreciation even in fluctuating economic climates.

Balancing Risk and Reward

Indexed annuities offer a balance between risk and potential reward. By tracking a market index, they offer a middle ground between the high-risk, high-reward potential of direct stock market investments and the safety found in fixed annuities.

They can be incorporated into a diverse retirement portfolio, offering a steady income while also allowing for reflected market performance gains.

Choosing the Right Indexed Annuity for Your Needs

Selecting the appropriate indexed annuity is a crucial decision that should align with your financial goals, risk tolerance, and investment horizon. While understanding the mechanics like cap rates, participation rates, and surrender charges is essential, the emphasis here is on how these elements should influence your choice based on your individual needs and circumstances:

- Financial Objectives: Consider how the annuity fits into your broader financial plan. Are you looking for steady income in retirement, or is your focus on growing your investment? Different annuities offer varying degrees of growth potential and income stability.

- Riders: Most fixed indexed annuities offer optional riders tailored to meet the diverse needs of annuitants. If you're seeking a lifetime income stream that you cannot outlive, consider opting for an income rider. Alternatively, if your goal is to leave a legacy for your loved ones, an enhanced death benefit rider might be a suitable choice.

- Risk Tolerance: Assess your comfort level with market volatility. If you prioritize principal protection, look for annuities with higher guaranteed minimum interest rates and lower cap rates, which might offer more stability.

- Investment Horizon: Your time frame until you need to access funds from the annuity is critical. Longer-term investors might be more suited to annuities with higher participation rates but longer surrender periods, capitalizing on potential market growth over time.

- Surrender Charges and Access to Funds: Be mindful of the surrender period and associated charges. Ensure that the liquidity constraints align with your financial needs and that you have other liquid assets to cover unexpected expenses.

- Insurer's Financial Strength: The guarantees provided by indexed annuities are only as reliable as the insurance company's financial health. Research the insurer's ratings and financial stability to ensure they can uphold their commitments over the term of your annuity.

By carefully weighing these considerations, you can choose an indexed annuity that not only offers an attractive balance between risk and reward but also complements your overall financial strategy, providing peace of mind and a solid foundation for your future.

Summary

In conclusion, indexed annuities offer a unique blend of growth potential and principal protection, making them a vital part of a diversified investment portfolio. They provide a robust shield against market volatility and a reliable growth path, especially for long-term investments like retirement planning. The balance they strike between risk and reward, their resilience during market downturns, and their potential for higher returns make them a prudent choice for investors. As with any financial decision, choosing the right indexed annuity requires careful evaluation of various factors, including surrender charges, interest crediting methods, and the financial strength of the issuing company.

References

Frequently Asked Questions

Can you lose money in an indexed annuity?

Most fixed indexed annuities come with downside protection, which means you cannot lose any part of the premiums that you pay (unless you make excess withdrawals). However, it is possible to lose money in some indexed annuities if the performance of the index is negative, up to the specified "floor" in the contract. Be sure to review your contract for details.

What is the best way to deal with volatility and get the best return on your investment?

The best way to deal with volatility and get the best return on your investment is to invest regularly, avoid jumping in and out of the market, maintain a diversified portfolio, remember historical trends, and consult with a financial professional when needed.

How did indexed annuities perform during the years 2000-2010?

Indexed annuities offered stability during market downturns and limited gains during upturns, providing protection against market losses and potential for growth up to the cap rate. Overall, they performed well during the years 2000-2010.

What is the conclusion about indexed annuities as a retirement planning approach?

Indexed annuities offer a balanced approach to retirement planning, providing a middle ground between high-risk stock market investments and stable fixed annuities, making them a prudent choice for securing your financial future.

Hypothetical Disclosure: The graphs, tables, and examples provided herein are for illustrative purposes only and are based on hypothetical scenarios. They are not intended to represent, predict, or guarantee the future performance of any specific financial product, including indexed annuities. The performance figures do not account for fees, taxes, or charges that would impact actual investment returns. Market conditions, interest rates, and other factors can significantly affect the performance of financial products. Investors are encouraged to consult with a financial advisor before making any investment decisions, to ensure that any selected product aligns with their financial goals, risk tolerance, and investment horizon.