Introduction

Fixed Indexed Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index, such as the S&P 500. Fixed Index Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to missell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

This article discusses an in-depth review of the Allianz Retirement Foundation ADV Fixed Indexed Annuity. Allianz Retirement Foundation ADV is a deferred, fixed-indexed annuity that claims to be a suitable option if you are looking for a lifetime income benefit, the safety of principal, enhanced withdrawal options, and tax deferral benefits. After extensive research and due diligence, I have provided an in-depth and unbiased analysis of this plan.

The review of the Allianz Retirement Foundation ADV Fixed Indexed Annuity will be broken into multiple subcategories:

- Product Description

- Product Policy

- Rates and Costs

- Accessing your Money

- Riders

- What Makes This Product Stand Out?

- What I Don’t Like

- Company Details

- Conclusion

Product Description

The Allianz Retirement Foundation ADV is a Fixed Indexed Annuity (FIA) plan that offers the annuitant (annuity investor) an opportunity to earn a market index-linked return without having to incur the risk of market downside. This is suited for people who are approaching retirement and aim to take lifetime monthly withdrawals once they retire.

Let’s have a look at the high-level fine print of the Allianz Retirement Foundation ADV Fixed Indexed Annuity, and then we will discuss each point in detail.

| Product Name | Allianz Retirement Foundation ADV |

|---|---|

Issuing Company | |

AM Best Rating | A+ (2nd of 13 ratings) |

Withdrawal Charge Period(s) | 7 years |

Maximum Issue Age | 80 Years |

Minimum Initial Purchase Amount | $10,000 |

Surrender Charge Schedule | 7-year: 6.50%, 6.00%, 5.00%, 4.00%, 3.00%, 2.00%, 1.00%, 0% |

Crediting Period and Strategies |

|

Plan Types |

|

Indexes |

|

Free Withdrawals | 10% of the annuity’s Accumulated Value; per year |

RMD Friendly | Yes |

Death Benefit | Upon the annuitant’s death, the beneficiary can either choose from:

|

Riders |

|

Surrender Value | Greater of Accumulated Value (less any withdrawal charges/MVA) and the Minimum Guaranteed Contract Value |

Product Policy

How does the Allianz Retirement Foundation ADV Fixed Indexed Annuity policy work?

An annuitant (maximum age at the time of policy issue: 80) can purchase the Allianz Retirement Foundation ADV Fixed Indexed Annuity with a minimum initial purchase amount of $10,000, and in return, they will earn market index interest credits (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, various events may trigger earnings credit: On free withdrawals, for a long-term care event or terminal illness or injury event, or when a death benefit is payable.

As soon as the annuitant makes a premium payment, an “Accumulation Account” is created, equal to the total premium paid plus any interest earned from the chosen allocations, less withdrawals, charges for riders, surrender charges, and adjusted by any Market Value Adjustments (MVAs).

Interest Indexing Options

The Allianz Retirement Foundation ADV Fixed Indexed Annuity offers the annuitant to choose from one or more of the four indexes (S&P 500 Index, Nasdaq-100® Index, Russell 2000® Index, Bloomberg US Dynamic Balance Index II) to determine their earnings crediting formula. All four indexes have one crediting strategy each. The plan also offers a fixed-rate guaranteed interest strategy to choose from, making a total of 5 strategy options. We will discuss each available index briefly:

1. S&P 500 Index

The S&P 500 index is one of the most popular and oldest indexes in the world. It tracks 500 large-cap publicly traded stocks listed in the United States. It is a reliable index and has often succeeded in the test of time. It is very important to note that, similar to most other annuities, the Allianz Retirement Foundation ADV Fixed Indexed Annuity offers the S&P 500 index with cap rates in place, meaning that your interest-earning capacity is capped. These rates tend to change frequently; I will discuss more on the rates shortly. In this annuity, all other indexes also have caps in place.

2. NASDAQ-100 Index

The NASDAQ-100 Index is another of the world’s most popular indexes that track 100 of the largest domestic and international non-financial companies listed on the NASDAQ Stock Exchange, based on market capitalization. It has a total market cap of $3.5 trillion as of the end of 2020. The NASDAQ-100 Index has a proven history of growth, impact, and performance.

The NASDAQ-100 Index was created in January 1985 and tracks 100 of the largest companies listed on the NASDAQ across sectors like Industrial, Technology, Retail, Telecommunication, etc., except Financial Services.

3. Russell 2000 Index

The Russell 2000 Index is another one of the world’s most popular indexes that track 2000 of the smaller companies included in the Russell 3000 Index. It has a total market cap of $3.5 trillion as of the end of 2020. The Russell 2000 Index has a proven history of growth, impact, and performance. The Russell 2000 Index was created in January 1984. The Russell 2000 is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.

4. Bloomberg US Dynamic Balance Index II

Bloomberg US Dynamic Balance Index II reflects the performance of an index strategy that uses the S&P 500 Index and the Bloomberg Barclays US Aggregate RBI Series 1 Index. The S&P 500 Index is a well-established benchmark for U.S. equity markets. The Bloomberg Barclays US Aggregate RBI Series 1 Index is designed to track the Bloomberg Barclays US Aggregate Bond Index —a well-established benchmark for the U.S. bond markets. The Bloomberg US Dynamic Balance Index II was created in August 2015 and targets a low annualized realized volatility, which limits the return potential of the index.

Note: In addition to allocating the funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest. These Fixed Rates tend to change from time to time. The Fixed Value Rate at the time of writing this article was 3.00%. This rate may change from time to time and can vary from state to state. You can check out the company's website for the latest rates.

Rates and Costs

The earnings crediting formula

The earnings crediting formula is the most important part of this annuity discussion. It is important to know that we don’t simply get the index return credited to our annuity. There is a rate-limiting mechanisms in the form of a cap rate that the company has in place that affect the interest credits. These rates tend to change over time, and the updated rates can always be checked on the company’s website.

The formula to calculate the earnings credited is:

- For Strategies with Caps: Index return over a given crediting period, with a maximum potential of earning the cap rate

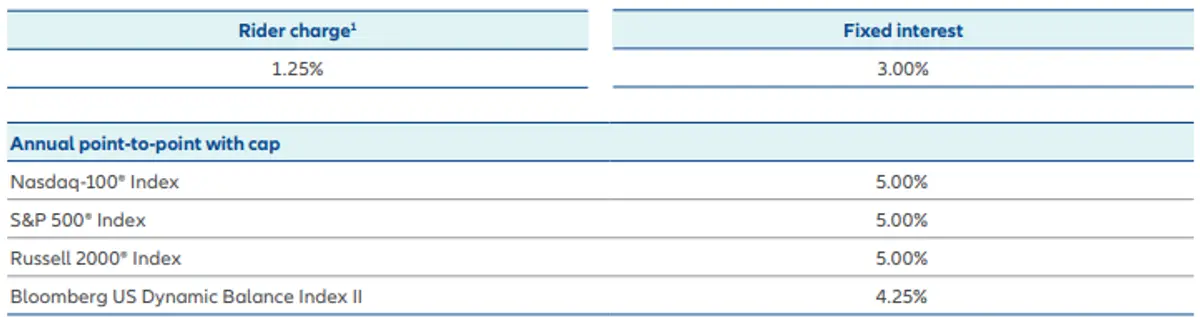

Let’s have a look at the Allianz Retirement Foundation ADV Fixed Index Annuity rate sheet to understand how the earnings are determined.

From the above rate chart, you will notice that there are 5 interest crediting options (1 fixed and 4 indexed). Let’s have a look at different terms that are used by Allianz in the Retirement Foundation ADV rate chart:

- Cap Rates: This refers to the rate at which your interest-earning capacity is capped. For example, if an index returns 12% but the contract’s cap rate is 6%, the annuitant will be eligible for an interest credit of 6% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest that can be earned is the cap rate.

- Fixed Account Rates: If you opt for a fixed account rate, you simply earn the fixed rates for a particular period specified by the company before your policy begins. These rates usually tend to be low as compared to other fixed avenues, such as CDs and MYGAs, so you should avoid fixed rates in a general scenario. The 1-year fixed rate on this policy at the time of writing this article was 3.00%.

In my opinion, the S&P 500, Nasdaq-100, and Russell 2000 will be the ideal indices to choose from this plan, as they are highly transparent, reliable, and have always survived the test of time. On the other hand, it must be kept in mind that the Bloomberg US Dynamic Balance Index II is a volatility control index that limits the true return-earning potential of the index. So, given similar cap rates, it is a no-brainer to go with the former three indexes only.

3. Benefit Charge: The annual benefit charge is a significant aspect of the annuity contract, consisting of a percentage of the accumulation value, and is deducted monthly. Currently, this charge is 1.25% for the first year, and it may change each year for the life of the contract, not exceeding 1.25%. The rider charge will continue for the life of the contract, even after lifetime income payments have begun. Rates are declared at issue and on each contract anniversary and are guaranteed for one year.

Additionally, the minimum annual cap for the annual point-to-point with cap crediting method is set at 0.25%. The minimum fixed interest rate is 0.10% per year.

I am not impressed with this charge structure, as there are several other annuities that provide similar (or even better) benefits without any additional charges. Also, the minimum cap that the company promises is too low - although I don’t think that they will actually decrease the rate to that extent, still, they can if they want to.

Accessing your Money

Each year, you are allowed a 10% free withdrawal of your contract value without incurring charges, fees, or penalties.

Should your needs change unexpectedly, and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies; although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for Allianz Retirement Foundation ADV Fixed Index Annuity.

| Completed Contract Years | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7+ |

|---|---|---|---|---|---|---|---|---|

Surrender Charge % | 6.50% | 6.00% | 5.00% | 4.00% | 3.00% | 2.00% | 1.00% | 0% |

In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period.

Note that this surrender charge schedule is only valid for the Allianz Retirement Foundation ADV Fixed Index Annuity product for select states. For complete details about each state, you may visit the product’s brochure.

The surrender charge of Allianz Retirement Foundation ADV Fixed Index Annuity is pretty much in line with all the other annuity issuers.

Once the surrender charge period ends, you can typically access your full contract value without fees. However, any withdrawal reduces both your contract value and, if applicable, the income base tied to optional riders, which may impact future guaranteed income.

An annuitant can also convert the contract into a stream of guaranteed income, known as annuitization. They can choose from various payout options designed to meet different needs.

Life Only – Provides income for as long as you live.

Joint and Survivor Life – Continues payments over two lifetimes, often used by couples.

Life with Period Certain (up to 30 years) – Pays income for life, but guarantees payments for a minimum period even if death occurs earlier.

Period Certain (up to 30 years) – Provides guaranteed payments for a set number of years, regardless of lifespan.

Single Life or Joint Life with Cash Refund – Ensures that if the annuitant(s) pass away before receiving payments equal to the original premium, the difference is refunded to beneficiaries.

Single Life or Joint Life with Installment Refund – Similar to the cash refund, but any remaining balance is paid out over time in installments.

These options allow flexibility in balancing lifetime income needs with legacy goals, offering a way to customize how and when funds are accessed in retirement.

Death Benefit

Your beneficiary(s) can receive the greater of the accumulation value, guaranteed minimum value, or cumulative withdrawal amount as a lump sum (this option doesn't include any bonuses).

Riders - Income Benefit Rider for Enhanced Lifetime Income Withdrawals

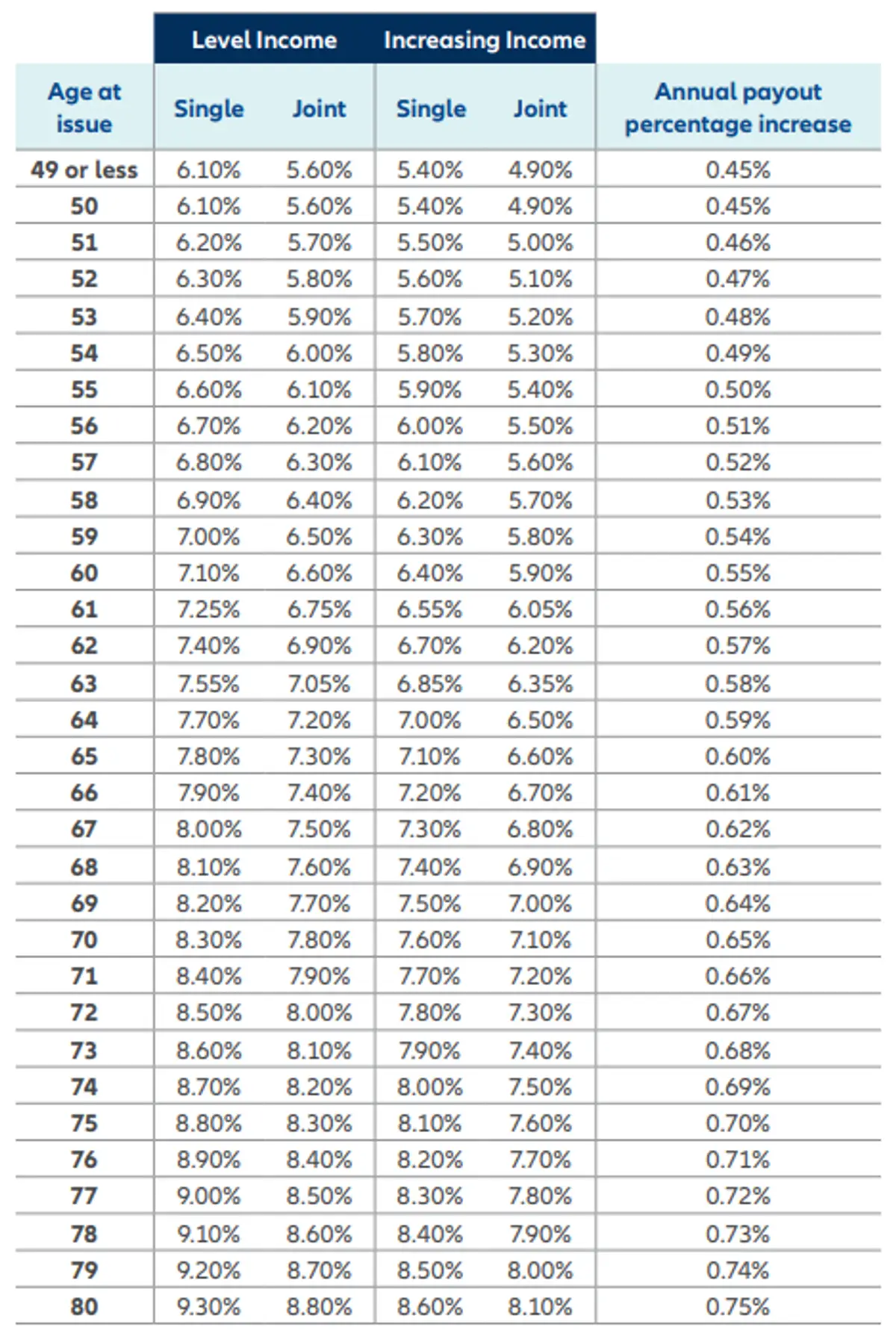

Suppose you want to withdraw your money in a lump sum or through a traditional annuitization route. In that case, you will be entitled to withdraw from your accumulated value (account without any premium or interest bonus). However, with the Income Benefit Rider, you can also withdraw your money as a lifetime income payments with two options: (i) level income for life and (ii) increasing income.

- Level Income: This option provides a predictable, dependable income for life. The withdrawal percentage is fixed at the time income withdrawals begin and does not change. This option may be a good choice for individuals who value stability and predictability in their income stream. Knowing exactly how much income you'll receive each month can provide peace of mind and make budgeting easier.

- Increasing Income: This option also provides income for life, but with an opportunity for payment increases. The withdrawal percentage starts smaller but has the potential to increase each crediting period based on the interest rate credited to your allocation options in your contract. This option can be attractive for individuals concerned about inflation or increasing retirement expenses. While the initial income may be lower than with the Level Income option, the potential for income increases can help maintain purchasing power over time.

The schedule below shows lifetime income withdrawal percentages (as a percent of the annuity’s accumulation value) for both single and joint plans, for level and increasing options, respectively. Remember that you can start lifetime withdrawals only at age 50 or older.

Lifetime Withdrawals Working Example

At the time you begin income payments, the percentage of your annuity’s accumulation value that can be withdrawn for life depends on (i) whether you elect the single or joint option, and (ii) whether you choose level or increasing income withdrawals.

Suppose the annuity was issued at age 60, and you wait 5 years before starting lifetime income. If you select the single option with level withdrawals, your withdrawal rate would be the base 7.10% (from the table) plus 0.55% for each year you deferred, i.e., 7.10% + (5 × 0.55%) = 9.85% of the accumulation value, fixed for life until death.

Example:

- Issue age: 60

- Deferral period: 5 years (payments begin at age 65)

- Accumulated value at time of income start: $200,000

- Option chosen: Single Life, Level Withdrawals

Step 1: Determine withdrawal percentage

From the table, at age 60, the single-life level withdrawal percentage is 7.10%.

Since income was deferred for 5 years, you add 0.55% per year:

7.10% + (5 × 0.55%) = 9.85%.

Step 2: Apply the withdrawal percentage to the accumulated value

$200,000 × 9.85% = $19,700 annually.

Step 3: Lifetime income

This $19,700 payment is locked in for life. The annuitant will receive this annual income every year until death, regardless of market performance or how long they live.

If you instead chose the single option with increasing withdrawals, your base would start at 6.40% plus the same deferral credits, i.e., 6.40% + (5 × 0.55%) = 9.15% of the accumulation value. However, unlike level withdrawals, your income payments here are not fixed for life, but increase annually in line with the interest credited to your allocation account, giving growth potential over time.

Contract/Administrative Charge

The Allianz Retirement Foundation ADV Fixed Index Annuity levies no annual contract or administrative fees. However, as discussed earlier, there’s a compulsory annual benefit charge of 1.25%, consisting of a percentage of the accumulation value.

What makes this product stand out?

- Very Straightforward Annuity: The Allianz Retirement Foundation ADV is a very straightforward annuity with just four indexing options. Generally, fixed indexed annuities come with a lot of bells and whistles, which might not be easy to comprehend for every individual.

- Option for enhanced and increasing lifetime withdrawals

- Free benefits like the Nursing Home Benefit and the Cumulative Withdrawal Amount Benefit

What I don’t like

I don’t like a lot of things about the Allianz Retirement Foundation ADV Fixed Index Annuity. Most of them are those that limit the income-earning and withdrawing capacity of an annuitant.

- No Index Lock Feature: The index lock feature is one of the unique features offered by Allianz. However, this annuity misses that.

- Low Realistic Returns: As a conservative policy, the realistic return expectations are pretty average. It is not the best policy for someone who is looking only for growth and accumulation.

- Benefit Charge: This annuity comes with a mandatory benefit charge of 1.25% of accumulated value, which I believe is on the higher side. Various other annuities offer similar (or even better) features without any benefit charge.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Allianz Life Company

Allianz Life Company has been in business since 1896. It is a subsidiary of Allianz SE, one of the oldest financial services and insurance companies, and has been in the business for over 13 decades. It has been one of the largest providers of fixed and fixed-indexed annuities in the US for many years and has regularly been in the top ten Fixed Indexed Annuity Sales. Allianz SE is a Fortune 500 company.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

AM Best | A+ (2nd of 16 ratings) |

Moody’s | Aa2 (5th of 21 ratings) |

S&P | AA (3rd of 21 ratings) |

Allianz Life Company has managed to maintain decent ratings for many years. It is considered to be strong and stable financially. As of year-end 2024, some of the other financial highlights for Allianz SE include its:

- EUR 17.8 billion in total sales / direct written premium

- EUR 43.1 billion of total stockholders’ equity

- EUR 7.8 billion in net operating income

- EUR 137.1 billion in total assets

Thus, going by the operating history and financial numbers, we can safely gauge that you can trust your savings with Allianz Annuity Life Company.

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. So, it’s very important to have a stream of income that can grow safely and steadily and have the ability to provide a guaranteed income during retirement years. This not only helps you to mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

Coming to the Allianz Retirement Foundation ADV Fixed Indexed Annuity, I believe that this might not be the best product out there. It has fewer features than similar products by other annuity providers. The annuity also charges a benefit charge, which is not charged in most other annuities offering similar features. Furthermore, it has a low-income earning potential, with the indexing options having somewhat lower caps.

However, this is a very straightforward annuity and thus might appeal to people who don’t want to get into understanding complex annuities. Also, Allianz is one of the strongest life insurance companies in the world; it may prove to be an ideal policy for a very conservative annuitant who is looking for income protection above anything.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. To dive deeper into our extensive reviews, click here.