How Do Interest Rates Affect Immediate Annuity Payments?

Written byAnnuityRatesHQ Editorial Team

Staff

2 min read

Updated

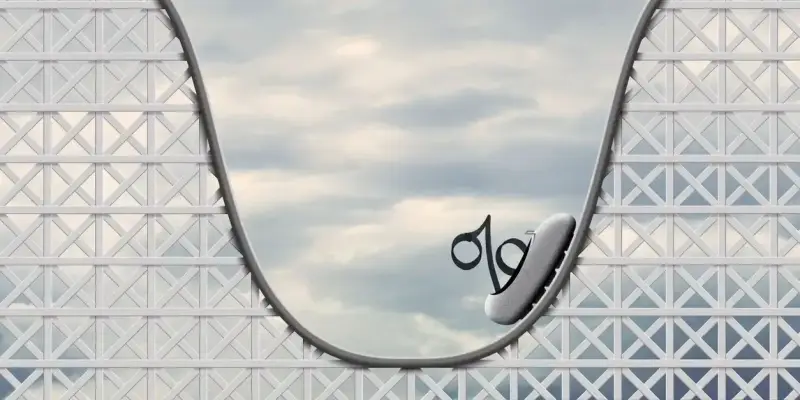

Interest rates directly impact immediate annuity payments: higher rates enable larger payments due to better investment returns on the insurer's part, while lower rates result in smaller payments as the insurer earns less on its investments.

Understanding Immediate Annuities

Immediate annuities are financial vehicles designed to provide a steady stream of income in exchange for a lump sum payment. They are popular among retirees looking for guaranteed income. The amount of each payment depends on several factors, including the sum invested, the term of the annuity, and significantly, the prevailing interest rates at the time of purchase.

The Role of Interest Rates

Interest rates serve as a critical determinant in the calculation of annuity payments. Insurance companies invest the lump sum into various financial instruments, primarily bonds, and the income generated from these investments funds the annuity payments. Thus, the interest rate environment at the time of purchase can significantly influence the size of the annuity payments.

Types of Immediate Annuities

Immediate annuities come in two main types: fixed and variable. Fixed immediate annuities offer guaranteed payments, influenced by the interest rates at the time of purchase. Variable annuities, on the other hand, provide payments that can fluctuate based on the performance of the underlying investment options, although they may also include minimum payment guarantees affected by interest rates.

Strategic Considerations for Annuity Purchase

The timing of an immediate annuity purchase is crucial. Buying an annuity when interest rates are high can secure a higher income stream, enhancing your financial stability in retirement. Conversely, purchasing during a period of low interest rates might lead to smaller payments, potentially impacting your retirement lifestyle.

Conclusion

Interest rates play a pivotal role in determining the payments from an immediate annuity. Prospective buyers should carefully consider the current interest rate environment when planning to purchase an annuity, as it can significantly affect their retirement income. Consulting with a financial advisor can provide valuable insights and help in making an informed decision that aligns with your retirement goals.