Fixed Indexed Annuity Application Process Explained: Step-by-Step Guide for U.S. Annuitants

Written byNikhil Bhauwala

CFA, Lead Writer

7 min read

Updated

%2BApplication%2BProcess%2Bin%2Bthe%2BU.S-800x400.webp&w=3840&q=75)

Purchasing a fixed indexed annuity (FIA) in the United States involves a detailed and highly regulated process designed to protect consumers and ensure product suitability. This comprehensive guide walks through each stage of the FIA application process, from the initial client interview and suitability assessment to the submission of forms and delivery of the final annuity contract. Along the way, we provide real examples and excerpts from leading insurance carriers such as Allianz, Athene, and American Equity, illustrating the key documents and disclosures involved at every step. Whether you're an industry professional or a prospective buyer, this resource offers a clear and practical roadmap for navigating the complexities of FIA issuance.

Step 1: Initial Inquiry and Client Interview

Overview: The process begins with a client expressing interest in a fixed indexed annuity. The insurance agent or financial advisor will meet with the client to discuss their retirement goals, financial situation, and whether an FIA is an appropriate solution.

Fact-Finding: The agent conducts a needs analysis – asking about the client’s age, income, assets, risk tolerance, and retirement objectives. This often involves an informal fact finder or questionnaire (not a formal submission to the insurer, but for the agent’s use). The goal is to determine if an FIA suits the client’s needs (e.g. desire for principal protection with index-linked growth, need for future income guarantees, etc.).

Product Education: The agent explains how FIAs work, including crediting methods, index options, caps or participation rates, any fees for optional riders, the surrender charge period, and potential penalties for early withdrawal. At this stage the client may be shown a product brochure or an illustration of the annuity’s potential performance. For example, Allianz provides brochures like “Understanding Fixed Index Annuities” to help explain how interest is credited and the guarantees involved. If a specific product was quoted, such as the Allianz 222 FIA, a product illustration may be generated showing hypothetical values. (In many cases, the agent will later include a copy of the illustration in the application packet if required by the insurer or state regulations.)

Regulatory Disclosures: Even before an application is taken, certain disclosures are often provided to the client:

A “Buyer’s Guide to Fixed Deferred Annuities” (an NAIC-required consumer guide) is given in many states at or before the time of application. This guide explains annuity basics, surrender charges, tax treatment, etc., in plain language.

If the client is a senior (often age 65+), additional senior-specific notices may be required. For example, in California, a notice must caution seniors about the consequences of liquidating assets to purchase an annuity.

No formal paperwork is submitted in Step 1, but the client should come away informed about the FIA’s benefits and limitations. If the client decides to proceed, the process moves on to suitability screening and paperwork.

Step 2: Suitability Assessment and Pre-Sale Disclosures

Overview: Before an application is formally submitted, both the agent and the insurance company must determine that the annuity is suitable for the client’s financial situation. Suitability is mandated by regulation (NAIC Suitability in Annuity Transactions Model Regulation), and it requires documentation of the client’s financial profile and why the product makes sense for them. Several disclosure forms are also completed at this stage, especially if the client has existing annuities or life insurance.

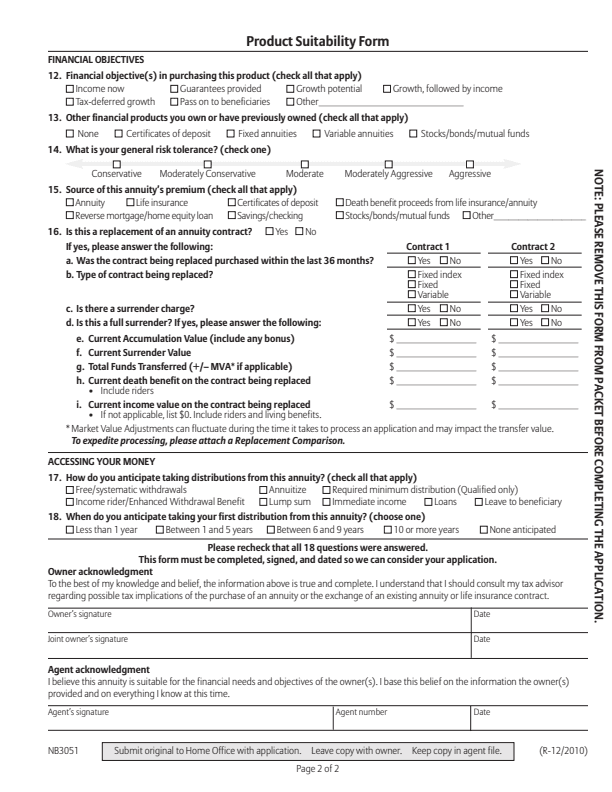

Suitability Questionnaire: The client (with the agent’s help) must fill out a detailed Annuity Suitability Questionnaire or Product Suitability Form. This form captures the client’s financial information and objectives to ensure the FIA meets their needs. For example, Allianz’s Product Suitability Form begins with an explanation that “before we can process your application and issue your contract, we need to confirm that the annuity purchase suits your current financial situation and long-term goals”. It then asks for specifics such as:

Financial Status: monthly income, monthly living expenses, resulting disposable income, total liquid assets, net worth, and existing annuity holdings. (This helps verify that the client isn’t investing too much of their assets into an illiquid annuity and that they can afford it.)

Financial Objectives: the reasons for purchasing the annuity (e.g. “income now,” “growth potential,” “guarantees,” “tax-deferred growth,” “legacy to beneficiaries,” etc.).

Risk Tolerance: a question about the client’s risk tolerance (from conservative to aggressive) to ensure they understand an FIA’s risk/return profile.

Other Assets and Experience: what other financial products the client owns or has owned (stocks, CDs, other annuities, etc.), to gauge their experience.

Liquidity Needs and Time Horizon: the form typically asks how long the client plans to hold the annuity (minimum number of years until they might need access to the funds) and whether they anticipate any changes (e.g. retirement, needing nursing care, etc.) during that period.

Intended Use and Withdrawals: whether the client intends to take systematic withdrawals, annuitize the contract, use an income rider, or leave the value to heirs (this helps ensure the product’s features align with expectations).

Replacement Details: if the new annuity is replacing an existing annuity or life insurance, details about the old contract (current value, surrender charges, death benefits, etc.) are recorded. The form will ask “Is this a replacement of an annuity contract? Yes/No” and if yes, further information like surrender charges on the old policy and any bonuses on the new one must be documented.

Both the client and the agent sign the suitability form, usually at the end, attesting that the information is accurate and that they believe the annuity is suitable. This completed suitability form is submitted along with the application and is reviewed by the insurer’s suitability review team. Example: The Allianz suitability form excerpt below shows how comprehensive these questions can be, covering income, assets, and even whether the client expects significant life changes in the near future:

Excerpt from Allianz’s Product Suitability Form, capturing detailed financial information to ensure the annuity sale is appropriate.

Replacement and Exchange Forms: If the client has existing life insurance or annuity contracts, additional forms are required to comply with replacement regulations:

Replacement Notice: This is a standardized disclosure (often based on an NAIC model) that the client and agent must sign, and a copy is left with the client. It explains what a replacement is and urges the client to compare the old and new contracts carefully.

Internal Exchange/1035 Forms: If the annuity is funded via a 1035 exchange (tax-free transfer from another annuity or life policy) or a qualified plan rollover/transfer (like moving funds from a 401(k) or IRA), the client will sign a transfer authorization form. This form authorizes the new insurer to contact the current financial institution or insurer and initiate the transfer of funds. It includes details of the account to be transferred (account numbers, financial institution, estimate of amount, etc.). The agent will help the client fill this out for each account being moved.

Product Disclosures & State-Specific Forms: At or before application, the client may need to sign product-specific and state-specific disclosure forms:

Product Disclosure Statement / Owner Acknowledgment: Most carriers require a client-signed disclosure that summarizes the annuity’s key features, interest crediting method, cap/participation rates (at issue), any bonus, surrender charge duration and percentages, any applicable Market Value Adjustment (MVA) feature, and rider fees. This is often called an “Owner’s Acknowledgment of Annuity Disclosure”. It ensures the client understands the product they are buying. For example, an insurer’s disclosure might clearly state: “This annuity has a 10-year surrender charge period with initial charges starting at 9% in year 1 and declining to 0% by year 11. Withdrawals exceeding the penalty-free amount are subject to these charges and an MVA (if applicable). The annuity’s values are linked to an index but are not direct stock market investments. Guarantees are backed by the insurer.” The client signs this to acknowledge understanding. (In fact, a carrier notes that all such charges and provisions are described in detail in the disclosure statement and urges the client to understand them.)

At the end of Step 2, the key outcome is that all necessary suitability and disclosure forms are completed and signed. The client has formally affirmed that they understand the annuity’s features and that it fits their financial situation, and the agent has documented the basis for the recommendation. Now the actual application can be finalized.

Step 3: Completing the Annuity Application Forms

Overview: With suitability established, the agent and client fill out the official annuity application and any accompanying forms. This paperwork provides the insurer with all the personal and contract-specific information needed to issue the policy. FIA applications are usually several pages long and can be filled out on paper or via an e-Application system.

Key components and documents in the application packet include:

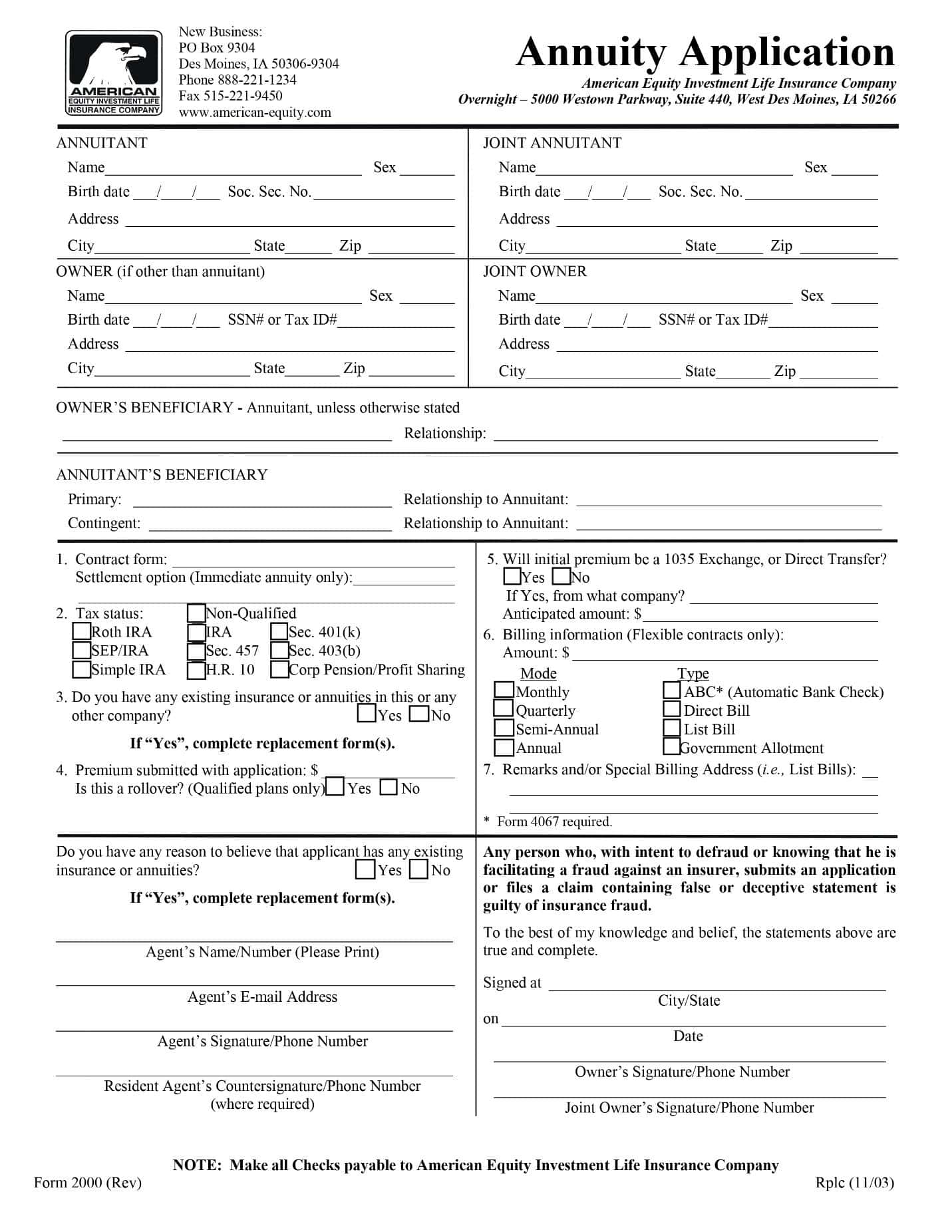

Annuity Application Form: The primary document that captures the contract details and parties involved. It typically includes:

- Owner and Annuitant Information: Name, address (must be a physical address, not just a P.O. Box due to Patriot Act requirements for identity verification), date of birth, Social Security Number or Tax ID, gender, citizenship (U.S. citizen or if not, a W-8BEN may be required), etc. If the owner and annuitant are different (or if there are joint owners), their information is listed as well. For instance, a sample American Equity annuity application begins by collecting the Annuitant’s name, birthdate, SSN, and address, then the Joint Annuitant or Owner info, etc. The screenshot below shows an example of these fields on a blank application:

Portion of a blank American Equity annuity application form, requesting personal information for the Annuitant and Owner.

Beneficiary Designations: The form will have a section to designate primary and contingent beneficiaries for the death benefit. Typically, at least one primary beneficiary is required (spousal continuation is often only available if the spouse is sole primary beneficiary). The applicant can allocate percentages among multiple beneficiaries (must total 100%). Some carriers have a separate beneficiary addendum if there are many beneficiaries beyond the space provided.

Product Selection: The specific annuity product name is indicated, often with a product code or option to check the exact product. If the FIA has optional riders (e.g., an Income Rider or Enhanced Death Benefit Rider), those are selected here as well. For example, Athene’s application has a field for “Product Name” and a line to list any riders elected. The agent will ensure the correct product version (which can vary by state or feature set) is written in.

Premium and Purchase Type: The application asks how much money is going into the annuity and from what source. This section covers:

The premium amount (initial contribution). If it’s a single-premium FIA, just the lump sum is stated. If it’s a flexible-premium annuity, there may be fields for initial and planned future contributions.

The type of money: non-qualified (personal savings) or qualified (IRA, Roth IRA, etc.). The form often has checkboxes to specify if it’s an IRA, Roth IRA, SEP, etc., or if it’s a 401(k)/403(b) rollover. For IRAs, sometimes the contribution tax year is asked if it’s a current year contribution.

Source of Funds: The app will note if the premium is coming via 1035 exchange, direct transfer, rollover, or a new cash payment.

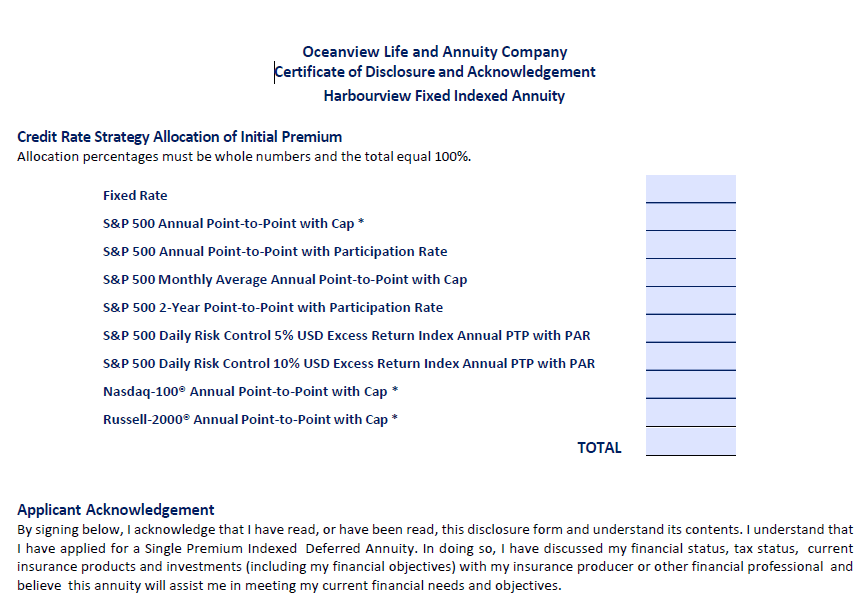

Credit Rate Strategy Allocation of Initial Premium: The annuitant must select how their initial premium will be allocated among various indexing strategies. For example, the Oceanview Harbourview Fixed Indexed Annuity offers the following credit rate strategy allocation options:

Owner and Annuitant Statements: Toward the end of the application, there are often a series of acknowledgments that the owner (and annuitant, if different) must agree to by signing the form. These typically include:

A statement that all answers are true and complete to the best of their knowledge (fraud warning).

An acknowledgment of the Free Look Period (the right to cancel the contract within a certain number of days after delivery). Many applications explicitly remind clients that they can cancel if not satisfied. (This period is commonly 10 days, or longer for seniors or replacements – the exact duration will also be stated on the policy cover when issued.)

A statement that the client believes the annuity meets their financial objectives and that they have discussed the product features.

For contracts with premiums coming in later (e.g., via transfer), a note that the contract will not be issued until all funds are received and minimum premium requirements are met, and that interest will not start accruing until the issue date.

The owner (and joint owner, if any, and sometimes the annuitant if not the owner) must sign and date the application. By signing, the client attests to the statements above.

Double-Checking: Both the agent and client should review the application packet thoroughly to ensure all questions are answered and forms signed. In addition, certain large premium cases (e.g., over $1,000,000) may require prior home office approval, so the agent might need to get a tentative green light from the company before submission.

Once everything is in good order, the agent or agency submits the full application package to the insurer’s New Business or Contracting department for processing.

Step 4: Application Submission and Underwriting Review

Overview: After the application is sent to the insurance company, the process moves to the back-office. Even though health underwriting is typically not required for fixed indexed annuities (there’s no medical exam; issuance is not based on mortality risk like life insurance), the insurer will rigorously review the application for completeness, compliance, and suitability. This step ensures all conditions are met before the contract is issued.

New Business Processing: Upon receiving the application (whether by mail, fax, secure upload, or e-application system), the insurer’s new business team checks that the application is “In Good Order” (IGO). This means all required forms are present and properly filled out. If something is missing or incorrect (not “IGO”), the case is often pended and the agent is contacted to supply the needed info or form.

Suitability Review: In parallel, the insurer’s suitability review team (could be part of compliance) examines the Product Suitability Form and related info. They will confirm that the client’s financial profile fits within the company’s suitability guidelines for that product. For example, they check that the client has sufficient liquid assets after this purchase (many companies have rules like not more than X% of liquid assets should be put into annuities unless strong rationale), that the client’s income supports their living expenses, and that the client’s stated objectives align with the annuity’s purpose. If something looks problematic – e.g., a 75-year-old client putting 80% of their assets into a 10-year surrender annuity – the reviewer might reach out for more information or require the agent to justify the suitability. They could even decline to issue if it violates suitability standards. In most cases, if the suitability form was filled out thoroughly and the agent did their due diligence, this review is passed. The agent might receive a call or email with follow-up questions if needed. Once the reviewer signs off, they’ll mark the application as approved for suitability.

Compliance Checks: The insurer also performs identity verification and anti-money-laundering (AML) checks. The requirement of collecting a government-issued ID and physical address (no P.O. Box) on the application ties into the USA PATRIOT Act Customer Identification Program. They may use third-party services to verify that the SSN and name match and that the address is legitimate. Unusual situations (e.g., premium coming from a foreign bank account, or the owner is a trust in another country) could trigger additional AML scrutiny.

Underwriting (medical/financial): As mentioned, medical underwriting is generally not applicable for fixed annuities. There is no health questionnaire or exam. However, financial underwriting in the sense of ensuring the premium amount and source make sense for the client’s net worth and income is part of suitability. Some carriers also have maximum issue age limits (often around 80-85 for FIAs) to protect older clients from long surrender periods; if an application comes in for someone near or at the limit, the company will check it carefully. In rare cases, if an annuity has an enhanced rider (like a long-term care rider), the client might need to answer a few health questions for that rider eligibility – but typical FIAs with standard income riders do not require this. Thus, “underwriting” for an FIA mostly refers to the suitability and compliance review.

Rate Lock (if applicable): Some FIA carriers offer a rate lock on the interest crediting terms (caps, participation rates, bonuses) or a holding of the application interest rate for a certain period. For example, if the client signed the application when the cap was 5%, but by the time the policy issues the cap changed, some companies honor the better of the old or new cap if the funds were received within a set timeframe. If an illustration was used to lock in a payout or feature (more common with income annuities or MYGAs), the agent ensures the application was submitted within that rate lock window. This is a behind-the-scenes aspect that the new business team manages.

Pending Requirements: If anything is missing (a form not signed, a question unanswered, replacement notice absent while client said existing = Yes, etc.), the insurer will mark the case as “Not In Good Order” (NIGO) and communicate a requirement or outstanding item to the agent or agency. The agent must then quickly resolve it (get a correction or form signed by client). This back-and-forth can add days or weeks, so agents strive to submit everything correctly the first time.

Once all requirements are satisfied, suitability is approved, and funds are ready, the insurer can proceed to issue the annuity contract. The case is effectively approved at this point (there’s usually no concept of “decline” unless suitability fails or the client is outside guidelines; in those rare cases the application might be rejected and premium returned).

Step 5: Contract Issuance and Policy Delivery

Overview: In this step, the insurance company formally issues the annuity contract – creating the legal contract documents – and then the contract is delivered to the client. This involves generating the policy pages, verifying all the elected features are correctly included, and then sending the packet out. The client (and often the agent) will then sign a delivery receipt to acknowledge they got the policy.

Contract Assembly: Once the application is approved and the premium is in place (or at least initial premium if multiple contributions), the insurer will print/generate the annuity contract. A typical FIA contract consists of:

A Contract Data page (Schedule page) – this is a summary page at the front that lists key specifics: the Owner and Annuitant name(s), the Contract Number, the Effective Date (issue date), the single or initial premium amount, the annuity product name and plan type (e.g., 10-year FIA), any elected rider(s) and their charges, the guaranteed minimum interest rate or minimum values, and the surrender charge schedule. For example, the contract data page will show a table like “Surrender Charge Percentage: Year1 X%, Year2 Y%, … Year10 Z%” and perhaps the Market Value Adjustment formula if applicable. It may also list the initial crediting options chosen (e.g., “50% of premium to S&P 500 Annual Point-to-Point with 5% Cap, 50% to Fixed Account at 2% rate” as of issue).

The General Provisions and Definitions – legal language defining terms, describing how and when interest is credited, how surrenders and withdrawals work, the death benefit provisions, any annuitization options, etc. It will state conditions like the Free-Look Right (the right to cancel in a given number of days). For instance, a specimen contract states: “Right to Return and Cancel: The Contract may be returned for any reason within 30 days after the owner receives it for a full refund of any premium paid...”. (Free look periods vary by state; 10 days is common, but 30 days is standard in some cases like replacement or senior sales as noted earlier.)

Rider endorsements: If the client purchased an optional rider (e.g., an Income Rider), the contract will include an endorsement or rider document detailing that benefit’s terms (such as fees, roll-up rates for income base, conditions for exercise).

Annuity schedules: Some FIAs provide a policy schedule for interest crediting, showing, for example, the current cap or participation rate applicable on the issue date for each index strategy. (These can change in the future, but initial rates are often locked for the first term, typically one year, after which the company can declare new rates.)

Signatures: The contract is signed by an officer of the insurance company (usually printed on the cover or last page) to execute the contract. The client’s original application is usually attached to the contract and made part of it (this is why it is important that the application be accurate, as it becomes part of the legal agreement).

Issue Packet Contents: Along with the actual contract, the packet from the insurer might include:

A Welcome Letter or cover letter, often congratulating the client on their purchase and recapping the product name, account number, and perhaps the agent’s name.

The annuity contract document (as described above, often a booklet).

A copy of the application and any amendments.

Owner’s Manual or FAQ: Some carriers include a user-friendly pamphlet on “How to access your account, how to make withdrawals, FAQ about your new annuity” etc.

Annuitant ID card or Account Access info: A few insurers issue wallet cards with the contract number, or instructions to register online for account access.

Delivery Receipt form: If not sent separately, the policy packet will contain a Delivery Receipt to be signed by the client (and often by the agent) confirming the date the client received the policy.

Once the policy is delivered and the delivery receipt is returned to the company, the contract is active and in force. The client will subsequently receive periodic statements (usually annually or quarterly) showing interest credits and account values. The agent’s role may shift to service (answering questions or helping with any withdrawals or beneficiary changes in the future).

At AnnuityRatesHQ, we understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. Dive deeper into our extensive reviews here.