Introduction

Registered Index-Linked Annuities (RILAs) are a type of annuity that combines features of traditional fixed indexed annuities and variable annuities, offering a balance between growth potential and risk control. Unlike fixed indexed annuities, which provide market participation with no risk of loss, RILAs introduce a degree of market risk in exchange for higher growth opportunities. Policyholders in a RILA can select customized risk and reward parameters, such as caps, floors, or buffers, allowing them to tailor the annuity to their financial goals and risk tolerance.

The Transamerica Structured Index Advantage Registered Index-linked Annuity (RILA) is designed to provide policyholders with flexibility, growth potential, and a level of downside protection. In this review, we will explore how the Transamerica Structured Index Advantage annuity works, its features, benefits, and drawbacks, helping you determine whether it aligns with your retirement and investment objectives. After extensive research and due diligence, I have provided an in-depth and unbiased analysis of this plan.

The review of the Transamerica Structured Index Advantage Registered Index-linked Annuity (RILA) will be broken into multiple subcategories:

- Product Description

- Product Policy

- Rates and Costs

- Riders

- Who Is This Annuity Suitable For?

- What I Don’t Like About This Annuity

- Company Details

- Conclusion

Product Description

The Transamerica Structured Index Advantage Registered Index-linked Annuity (RILA) is designed to provide policyholders with flexibility, growth potential, and a level of downside protection. It is best suited for individuals seeking higher growth potential than a fixed indexed annuity, with customizable downside protection to limit losses. It appeals to pre-retirees and retirees who want market exposure while maintaining control over their risk level. Let’s have a look at the high-level fine print of the Transamerica Structured Index Advantage Registered Index-linked Annuity (RILA), and then we will discuss each point in detail.

| Product Name | Structured Index Advantage RILA |

|---|---|

Issuing Company | Transamerica Life Insurance Company |

AM Best Rating | A (3rd of 13 ratings) |

Withdrawal Charge Period(s) | 6 years |

Maximum Issue Age | 85 Years |

Minimum Initial Purchase Amount | $10,000 |

Crediting Period and Strategies |

|

Plan Types |

|

Indexes |

|

Free Withdrawals | 10% of the annuity’s Accumulated Value per year |

Death Benefit | Return of Purchase Payment or Contract Value, whichever is higher, without any surrender charges for ages 0-70 |

Free Benefits |

|

Optional Benefits | Best entry (with or without credit advantage fees), Performance lock, and participation strategy (with credit advantage) |

Surrender Value | Account Value less any withdrawal charges/ MVA |

Product Policy

How Does the Transamerica Structured Index Advantage Registered Index-linked Annuity (RILA) Work?

The Transamerica Structured Index Advantage is a Registered Index-Linked Annuity (RILA) that provides a combination of market-linked growth, downside protection, and customizable features. It allows policyholders to balance risk and reward by selecting from multiple allocation options, including indexed and fixed-rate accounts. Here’s a detailed breakdown of how it works:

Initial Setup and Funding

- Minimum Payment: $10,000

- Maximum Payment (Without Prior Approval): $1,000,000

- Issue Age: 21 to 85 years old

- Plan Types: Traditional IRA, Roth IRA, SEP IRA, Beneficiary IRA, Non-Qualified, Non-Qualified Beneficiary (Stretch)

After making an initial payment, policyholders have the flexibility to choose how their funds will be allocated across various indexed accounts or the declared rate account. These allocation choices play a major role in how the annuity performs over time. Apart from the regular crediting period, there are various events that may trigger earnings credit: On free withdrawals, for a long-term care event or terminal illness or injury event, or when a death benefit is payable. All these interest credits are credited to a bucket called “Account Value.” This bucket is your annuity account balance, and all your withdrawals take place from it.

The Transamerica Structured Index Advantage Registered Index-linked Annuity (RILA) offers the annuitant to choose from one or more of the five indexes (S&P 500 Index, Fidelity World Factor Leaders Index, iShares Russell 2000 ETF, iShares US Technology ETF, and First Trust Equity Edge Index) to determine their earnings crediting formula:

- The Standard & Poor's 500 (S&P 500) is a stock market index that tracks the performance of 500 large-cap U.S. companies across various industries. It serves as a key indicator of the overall health of the U.S. equity market and is widely used as a benchmark for investment performance.

- The Fidelity World Factor Leaders Index is a rules-based index offering global exposure by combining domestic and international equities. It selects top companies based on factors such as value, momentum, quality, and low volatility, aiming to enhance risk-adjusted returns. The index is rebalanced semi-annually to maintain its targeted factor exposures.

- The iShares Russell 2000 ETF seeks to track the investment results of the Russell 2000 Index, which comprises small-capitalization U.S. equities. It provides investors with access to 2,000 small-cap domestic stocks in a single fund, making it a tool for diversifying a U.S. stock allocation and seeking long-term growth.

- The iShares U.S. Technology ETF aims to track the investment results of an index composed of U.S. equities in the technology sector. It offers exposure to companies involved in the development and production of technology products, services, and software. This ETF is commonly used by investors seeking to capitalize on the growth potential of the U.S. technology industry.

- The First Trust Equity Edge Index is designed to provide exposure to U.S. equities with specific investment characteristics. It employs a proprietary methodology to select and weight securities, aiming to enhance returns and manage risk. The index focuses on factors such as value, momentum, and quality to identify companies with favorable investment attributes.

Account Options

The allocation can be spread across multiple risk-controlled accounts and one Fixed Rate Account. These include a mix of 1-year, 2-year, and 6-year term accounts. The 6-year accounts offer the potential for higher returns through participation rates, while the 1-year accounts provide more flexibility by allowing annual adjustments and lock-in gains.

Rates and Costs

The earnings crediting formula

The earnings crediting formula is the most important part of this annuity discussion. It is important to know that we don’t simply get the index return credited to our annuity. There are a few rates, caps, and other rates that the company has in place that affect your earnings. These rates tend to change over time, and the updated rates can always be checked on the company’s website.

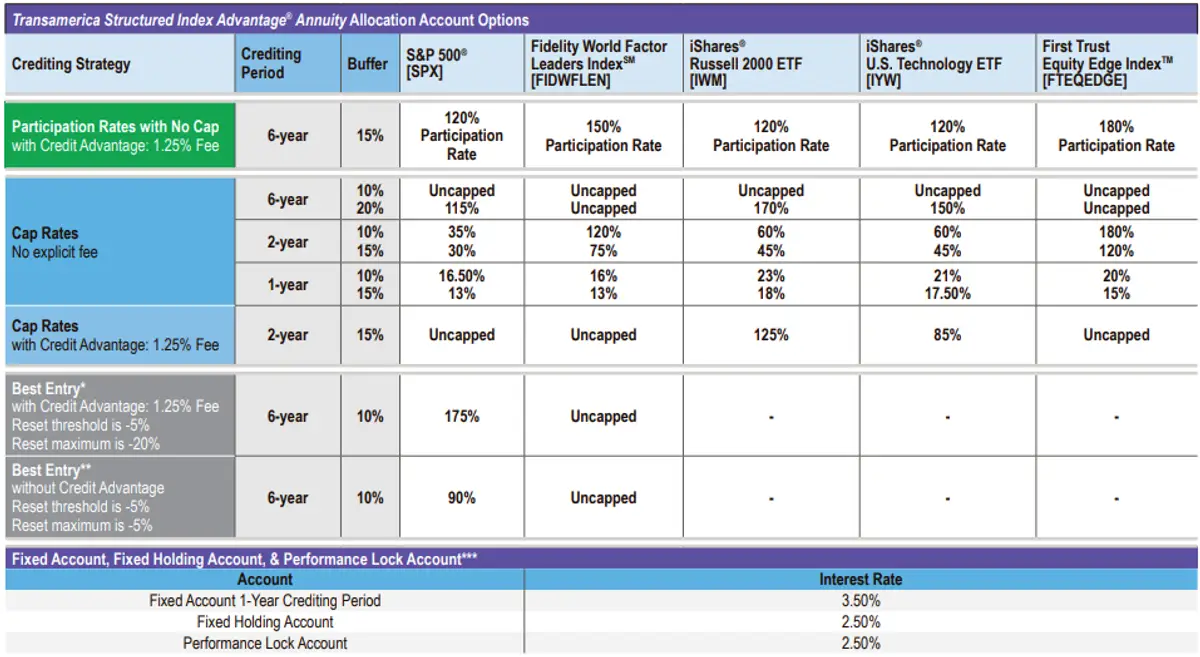

Let’s have a look at the Transamerica Structured Index Advantage Registered Index-linked Annuity (RILA) rate sheet (as of the date of updating this article) to understand how the earnings are determined.

From the above rate chart, you will notice that there are five indexes and multiple interest-crediting options tied to those indexes. Let’s have a look at different terms that are used by the company in the Transamerica Structured Index Advantage Registered Index-linked Annuity (RILA) rate chart:

- Point-to-point with Participation Rate (PR): The participation rate describes the annuitant’s participation percentage in a return of an index. For example, suppose the participation rate is 150%, and the index returned 4% over the agreed time. In that case, the annuitant will be eligible for 150% of the return, i.e., 6%.

- Point-to-point with Cap Rates: This refers to the rate at which your interest-earning capacity is capped. For example, if an index returns 12% but the contract’s cap rate is 8%, the annuitant will be eligible for an interest credit of 8% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest that can be earned is the cap rate.

- Fixed Account Rate: If you opt for a fixed account rate, you simply earn the fixed rates for a particular period specified by the company before your policy begins. These rates are usually low/at par as compared to other fixed avenues, such as CDs and MYGAs, so you should avoid fixed rates in a general scenario. The 1-year fixed rate on this policy at the time of writing this article was 3.50%.

Risk and Reward Control Customization

The Transamerica Structured Index Advantage RILA offers various crediting strategies that allow annuity holders to customize their exposure to market risk and reward. Below is an explanation of the terms in the rate chart, along with an example to demonstrate how they function:

Buffer: The buffer is the percentage of market loss that Transamerica absorbs during the crediting period. For example, a 10% buffer means that if the market declines by up to 10%, the annuity holder does not incur any losses. However, if the market loss exceeds the buffer, the policyholder’s account value will be reduced by the excess loss.

Example:

- Market decline: 12%

- Buffer: 10%

- Loss incurred by policyholder: 2% (12% - 10%)

Best Entry Crediting Strategy: The Best Entry strategy allows the policyholder to reset the initial index value to the most favorable observation point during the first few months of the crediting period.

- With Credit Advantage: The reset occurs on any of the six monthly observation days during the first six months of the crediting period.

Without Credit Advantage (No Fee): The reset occurs within the first three months based on three observation days.

- Observation Days: These are pre-scheduled dates (e.g., 1st, 8th, 15th, 22nd of the month) when the annuity's index value is monitored. The best-performing entry point is selected to maximize the annuity’s starting value.

Example of Best Entry Strategy

Let’s assume you select the Best Entry with Credit Advantage strategy:

- Allocation Date: January 1

- Observation Days: 1st, 8th, 15th, and 22nd of each month

- If the index value is lowest on February 15, the annuity will reset its starting point to that date, capturing more upside potential if the index rises thereafter.

Reset Threshold and Reset Maximum

The Reset Threshold defines the minimum percentage drop in the index value that must occur for a reset to be triggered. If the index value does not drop by at least this percentage, a reset will not occur.

Example:

- Reset Threshold: -5%

- If the index value drops 3%, no reset occurs.

- If the index value drops 6%, the reset is triggered, and the index value at that point is locked in as the starting point for the crediting period.

The Reset Maximum is the maximum allowable drop in the index value used for the reset. It limits how much of a drop in the index can be selected as the best entry point.

Example:

- Reset Maximum: -5%

- If the index drops by 10% at an observation point, the reset maximum applies, and the annuity will only recognize a 5% drop as the entry point, even though the actual drop was larger.

3. Credit Advantage Feature

The Credit Advantage feature is an optional enhancement available for an additional fee of 1.25% annually. It allows policyholders to boost their upside potential by increasing cap and participation rates across selected index account options. This feature is particularly beneficial for investors who are bullish about market performance and want to capture higher returns during their crediting period.

- Increased Participation and Cap Rates: By choosing Credit Advantage, you gain access to higher participation rates (percentage of the index gain credited to your account) and uncapped strategies that remove limitations on potential returns in some index options.

- Applies to Best Entry Strategy: When used with the Best Entry Strategy, Credit Advantage enhances the potential upside by offering access to the uncapped S&P 500 strategy and a high reset maximum of -20%. This means that if the index drops by as much as 20%, the strategy can still reset to that lower entry point, maximizing the potential gain when the index rises.

Example: Let’s assume you choose the 2-year with 15% buffer S&P 500 Index Account with Credit Advantage:

- Cap rate: 25% without Credit Advantage

- Cap rate with Credit Advantage: Uncapped

If you are bullish on the S&P 500 Index, the Credit Advantage feature, with an annual fee of 1.25%, allows you to earn uncapped returns on the 2-year S&P 500 indexing strategy. This can significantly boost your upside potential if the index performs exceptionally well.

However, if you believe that over the next two years the S&P 500 Index is unlikely to deliver a return of 25% or more (the cap rate of the strategy without Credit Advantage), it may not be worth selecting this feature, as the 1.25% fee will reduce your returns annually regardless of performance.

Ultimately, the Credit Advantage feature is ideal for those with a strong bullish outlook and a willingness to pay for enhanced growth potential. If you have a more conservative outlook or prefer lower costs, it may be better to stick with the standard capped strategy.

4. Performance Lock Feature

- This feature allows policyholders to lock in gains by setting an Interim Value at any point during the crediting period, free of charge.

Policyholders can choose between two options:

- Predefined Target: Set a growth target at the beginning of the crediting period for automatic lock-in when the target is reached.

- Manual Lock-In: Manually lock in gains at any time during the journey if market conditions are favorable.

- Once the Performance Lock is activated, additional index gains or losses will not affect the account until the next allocation anniversary. After the lock-in period, policyholders can reallocate to any available index strategy without having to wait for the end of the current crediting period.

The Performance Lock is useful when you want to secure gains during favorable market conditions and protect your earnings from potential future market downturns, especially if you believe that the index has peaked for this crediting period, allowing you to lock in returns without waiting for the full term to end.

Among the available indexing strategies, the following options stand out to me:

- 6-Year S&P 500 Index with 15% Buffer and 120% Participation Rate: This strategy is appealing due to its strong index, decent buffer, and high participation rate, which allows for enhanced upside potential while providing partial downside protection.

- 6-Year Fidelity World Factor Leaders Index with 20% Buffer (Uncapped): The combination of a decent 20% buffer and uncapped returns makes this strategy attractive for those seeking global market exposure without a cap on potential gains.

- 6-Year First Trust Equity Edge Index with 20% Buffer (Uncapped): Similar to the Fidelity strategy, this option offers a generous 20% buffer and uncapped returns, providing room for substantial growth while mitigating some downside risk.

- 2-Year Uncapped S&P 500 Index with 15% Buffer (Credit Advantage): This strategy provides access to uncapped returns on a shorter 2-year cycle with a decent 15% buffer.

You have the flexibility to allocate your premium across multiple crediting strategies, allowing you to diversify your growth potential based on different market indices and risk levels. This enables a balanced approach by combining strategies with varying buffers, participation rates, and cap structures.

Free Withdrawal and Surrender/Early Withdrawal Charges

Each year, you are allowed a 10% free withdrawal of your contract value, excluding any non-vested premium bonuses, without incurring charges, fees, or penalties.

Should your needs change unexpectedly, and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies, although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for the Transamerica Structured Index Advantage Registered Index-linked Annuity (RILA):

| Contract Year | 1 | 2 | 3 | 4 | 5 | 6 | 7+ |

|---|---|---|---|---|---|---|---|

10-Year Plan | 8% | 8% | 7% | 6% | 5% | 4% | 0% |

Market Value Adjustments - In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period. The surrender charge schedule is different for the different tenures of annuities and also changes for some states.

The surrender charge of the Transamerica Structured Index Advantage Registered Index-linked Annuity (RILA) is in line with all the other annuity issuers.

Contract/Administrative Charge

The Transamerica Structured Index Advantage Registered Index-linked Annuity (RILA) does not impose any annual contract or administrative fees.

Free Riders and Benefits

Like most annuities, the Transamerica Structured Index Advantage Registered Index-Linked Annuity (RILA) includes several free benefits designed to provide financial flexibility and support during critical times. These features allow policyholders to access their funds without penalties under specific conditions, enhancing the annuity’s overall value.

Withdrawal Waiver Benefits

Policyholders can access their full contract value without incurring surrender charges or Market Value Adjustments (MVA) under the following conditions:

- Nursing Home or Hospital Confinement: Applies if the policyholder is confined to a nursing home or hospital for 180 consecutive days after the annuity is issued.

- Terminal Illness Diagnosis: Applies if the policyholder is diagnosed with a terminal illness and has a life expectancy of less than one year.

- Unemployment Waiver: Provides flexibility by allowing penalty-free withdrawals if the policyholder faces involuntary job loss due to termination, layoff, or other qualifying events.

Return of Premium in Case of Death

- Free for issue ages 0-70: Full return of the premium amount to the beneficiary at no cost.

- Chargeable for issue ages 71-80: A 0.5% fee is applied annually to ensure a full return of premium in case of death.

Who Is This Annuity Suitable For?

The Transamerica Structured Index Advantage Registered Index-linked Annuity (RILA) is designed to meet the needs of a diverse group of investors seeking both growth potential and protection from market losses. With its customizable blend of buffers, floors, participation rates, and caps, it offers a level of control that appeals to a variety of financial goals and risk tolerances. Below, we outline who is most likely to benefit from this annuity.

- Pre-Retirees and Retirees Seeking Customizable Risk and Reward: Ideal for those seeking lifetime income with protection against market losses, but with the potential for upside growth.

- Investors Seeking Market Participation With Loss Protection: Suitable for those who want to participate in market gains while using buffers or floors to limit potential losses.

- Investors With a Medium to Long-Term Investment Horizon: Best for those who can commit funds for 6 years to maximize growth potential through higher participation rates.

- Those Seeking Tax-Deferred Growth: Provides tax-deferred growth, making it a good option for those looking to reduce current tax liabilities while growing wealth.

Who Might Not Find This Annuity Suitable?

While the Transamerica Structured Index Advantage Registered Index-linked Annuity (RILA) offers plenty of customization and protection features, it may not suit everyone. Here’s who might want to reconsider:

- Individuals Seeking Maximum Growth: The use of caps and buffers may limit upside growth, which could be less appealing to those looking for unlimited market participation.

- People With Short-Term Liquidity Needs: Withdrawals beyond the 10% free withdrawal limit are subject to surrender charges and interest adjustments, which may not work for those needing frequent access to funds.

- Young Investors: Younger individuals with a longer time horizon may prefer more aggressive growth-focused investments, such as equities or ETFs, rather than a structured annuity.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Transamerica Life Insurance Company

Transamerica Life Insurance Company, a subsidiary of Aegon N.V., is a well-established provider of life insurance and financial services in the United States. Headquartered in Cedar Rapids, Iowa, Transamerica offers a diverse range of products, including term life, whole life, and indexed universal life insurance policies, as well as annuities and mutual funds.

- Life Insurance: Term, whole life, index universal life, and final expense insurance

- Retirement Solutions: 401(k) plans, annuities, and other retirement planning products

- Investments: Mutual funds and other investment options

- Employee Benefits: Group insurance and retirement plans for businesses

However, despite its size and financial strength, Transamerica has faced some challenges in customer satisfaction:

- J.D. Power's 2023 U.S. Individual Life Insurance Study: Scored 757 out of 1,000, ranking below the industry average.

- National Association of Insurance Commissioners (NAIC): Reports a complaint index nearly three times higher than expected for a company of its size over the past three years, indicating a higher volume of customer complaints relative to its market share.

Common customer concerns include difficulties with claims processing, customer service responsiveness, and policy management.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

AM Best | A |

Moody's | A1 |

S&P Global | A+ |

As of December 2023, some of the financial highlights for Transamerica Life Insurance Company include its:

- $427 billion in Revenue Generating Investments

- $47 billion paid in benefits

- $5.1 billion in direct written premiums

- 3.1 million claims processed

- 10.3 million customers

Going by the operating history, financial numbers, and ratings, we can safely gauge that you can trust your savings with the Transamerica Life Insurance Company.

Conclusion

With the advancements in healthcare and technology, the average American today lives longer than ever. So, it’s very important to have a retirement corpus that can grow safely and steadily and have the ability to provide a fixed stream of income during the retirement years. This not only helps you mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

The Transamerica Structured Index Advantage Registered Index-Linked Annuity (RILA) offers a balance of market growth potential and downside protection, making it a suitable option for individuals seeking customizable exposure to market performance. Its features, such as the Credit Advantage for increased cap and participation rates, and the Performance Lock for securing gains during favorable conditions, enhance its appeal to investors who want more control over risk and rewards.

However, the additional fees associated with certain features, like Credit Advantage, can reduce overall returns, particularly if market performance is moderate or poor. This annuity may be a good fit for moderate to growth-oriented investors who are confident in market growth over the mid-to-long term and are willing to pay for increased upside potential. On the other hand, more conservative investors may prefer simpler annuity products with fewer moving parts and lower fees.

As always, it is essential to consult a trusted financial advisor to ensure that the Transamerica Structured Index Advantage RILA aligns with your financial goals, risk tolerance, and market outlook.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. Dive deeper into our extensive reviews.