Introduction

Fixed Index Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index, such as the S&P 500. Fixed Index Annuities have an inbuilt capital protection feature, so even if the index goes down, your principal will remain safe.

Annuities are complex products, and many advisors try to mis-sell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

This article discusses an in-depth review of the Silac Vega Bonus Fixed Indexed Annuity. Silac Vega Bonus is a deferred, fixed-indexed annuity that offers accumulation potential, tax deferral benefits, and an optional lifetime income & a death benefit rider with a benefit bonus. After extensive research and due diligence, I have provided an in-depth and unbiased analysis of this plan.

The review of the Silac Vega Bonus Fixed Indexed Annuity will be broken into multiple subcategories:

- Product Description

- Product Policy

- Rates and Costs

- Riders

- What Makes This Product Stand Out?

- What I Don’t Like

- Company Details

- Conclusion

Product Description

The Silac Vega Bonus Fixed Indexed Annuity offers the annuitant (annuity investor) an opportunity to earn a market index-linked return without incurring the risk of market downside. This might be a suitable plan for people who are approaching retirement and aim to grow and protect their retirement savings. This plan is also suitable for people who are looking for guaranteed lifetime income or plan to leave a legacy for their loved ones, in addition to protecting and growing their retirement savings.

Let’s have a look at the high-level fine print of Silac Vega Bonus Fixed Indexed Annuity, and then we will discuss each point in detail.

| Product Name | Vega Bonus Fixed Indexed Annuity |

|---|---|

Issuing Company | Silac Insurance Company |

AM Best Rating | B (7th of 13 ratings) |

Withdrawal Charge Period(s) | 7, 10 and 14 years |

Maximum Issue Age | 85 Years |

Minimum Initial Purchase Amount | $10,000 |

Surrender Charge Schedule | Varies for different tenure policies |

Crediting Period and Strategies |

|

Plan Types |

|

Indexes |

|

Free Benefits |

|

Additional Benefits | Wellness multiplier for wellness withdrawals |

Free Withdrawals | 5% of the annuity’s Accumulated Value; per year. |

Death Benefit | Beneficiary(s) will receive the full Account Value upon the death of the Owner with no surrender charges |

Riders | Free Income Enhancement Rider and Enhanced Death Benefit Rider |

Surrender Value | Greater of Accumulated Value (less any withdrawal charges/MVA) and the Minimum Guaranteed Surrender Value |

RMD Friendly | Yes |

The Silac Vega Bonus Fixed Indexed Annuity is almost identical for all policy tenures, except for the crediting strategies and surrender charge schedule. For ease of discussion and better clarity, we will discuss the Silac Vega Bonus 10 (unless mentioned otherwise) Fixed Indexed Annuity for the rest of the article.

Product Policy

How does the Silac Vega Bonus Fixed Indexed Annuity policy work?

Any annuitant (maximum age at the time of policy issue: 85) can purchase the Silac Vega Bonus 10 fixed indexed annuity with a minimum initial purchase amount of $10,000, and in return, they will earn market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, there are various events that may trigger earnings credit: On free withdrawals, for a long-term care event or terminal illness or injury event, or when a death benefit is payable. All these interest credits are credited to a bucket called “Account Value.” This bucket is your annuity account balance, and all your withdrawals take place from it.

At the same time, a different bucket called “Benefit Value” is established through which the lifetime withdrawals and other benefits are determined. Notably, in this bonus version of the annuity, the annuitant receives a 50% bonus (for issue age 0-80) on their Benefit Value at the inception of the annuity. Your Benefit Value will grow using a given index growth rate and multiplier, which we will see in detail in a later part of this review. The benefit base is only used to determine the lifetime withdrawal amount, and you can’t take any withdrawals from this account. We will return to this later in this review when we discuss the “riders” of this annuity.

The Silac Vega Bonus 10 Fixed Indexed Annuity offers the annuitant to choose from one or more of the five indexes (S&P 500 Index, S&P 500 Duo Swift Index, S&P 500 RavenPack Index, Barclays Atlas 5 Index, Nasdaq Gen 5 Index, Bloomberg Versa Index) to determine their earnings crediting formula. Each index has multiple strategies to choose from. The plan also offers a fixed-rate guaranteed interest strategy to choose from, making a total of 14 strategy options. We will discuss each available index briefly:

1. S&P 500 Index

The S&P 500 index is one of the most popular and oldest indices in the world. It tracks 500 large-cap publicly traded stocks listed in the United States. It is a reliable index and has often succeeded in the test of time. It is very important to note that, similar to most other annuities, the Silac Vega Bonus Fixed Indexed Annuity offers the S&P 500 index with caps, participation rates, and spreads in place, meaning that your interest-earning capacity is limited. These rates change frequently; I will discuss the rates in detail shortly.

2. S&P 500 Duo Swift Index

The S&P 500 Duo Swift Index is a specialized financial index designed to measure the performance of a controlled volatility version of the S&P 500. This index incorporates a risk control mechanism that operates on S&P 500 E-mini futures and includes a 10-year U.S. Treasury Bond futures overlay. The primary objective of the index is to manage volatility and reduce path dependency, making it a dynamic tool for investors seeking stability in volatile markets. While these volatility controls may lead to less fluctuation in returns compared to indices without such mechanisms, they also lower the potential overall rate of return in comparison to those other indices.

3. Barclays Atlas 5 Index

The Barclays Atlas 5 Index is a global financial index designed to provide stable and consistent returns through a diversified portfolio of equities and bonds from around the world. The Atlas 5 Index offers investors an opportunity to participate in approximately 90% of the global economy, expanding beyond the U.S.-centric focus of indices like the S&P 500. It aims to achieve this by targeting a 5% volatility level, utilizing techniques from Modern Portfolio Theory and Momentum Investing to optimize its component allocations daily. The index's dynamic structure allows it to adjust its exposure between equities and bonds depending on market conditions, potentially being fully uninvested if the risk/reward scenario is deemed unfavorable. Similar to any volatility-controlled index, this may lead to less fluctuation in returns compared to indices without such mechanisms; they also lower the potential overall rate of return in comparison to those other indices.

4. S&P 500 RavenPack AI Index

The S&P 500 RavenPack AI Index is a financial index that leverages artificial intelligence to analyze news sentiment and apply it to a sector rotation strategy within the S&P 500. Developed by S&P Dow Jones Indices in collaboration with RavenPack, the index measures exposure to the S&P 500 RavenPack AI Sentiment Index, which identifies sectors with the highest sentiment scores based on news analytics. The index employs a multi-asset approach, combining U.S. equities and fixed income, and incorporates a daily risk control mechanism to maintain a target volatility of 5%. Similar to any volatility-controlled index, this may lead to less volatility in returns compared to indices without such mechanisms; they also lower the potential overall rate of return in comparison to those other indices.

5. Nasdaq Gen 5 Index

The Nasdaq Generations 5 Index is a multi-asset, risk-controlled index designed to provide exposure to both the Nasdaq-100 Total Return Index and the Nasdaq Next Generation 100 Total Return Index. It also includes allocations to 10-year and 2-year U.S. Treasury futures, aiming to maintain a constant 5% volatility target. This index utilizes the truVol® Risk Control Engine, developed by Salt Financial, to dynamically manage allocations between its components and cash, enhancing its responsiveness and accuracy in volatility targeting. While this volatility-controlled mechanism causes less fluctuation in returns compared to indices without such mechanisms, it also lowers the potential overall rate of return in comparison to those other indices. The index is structured as a 70/30 blend of the Nasdaq-100 and the Nasdaq Next Generation 100 Indexes, with the remainder allocated to fixed income or cash.

6. Bloomberg Versa Index

The Bloomberg Versa 10 Index is a recently launched multi-asset benchmark specifically designed to address the evolving needs of the fixed indexed annuity market. It aims for a 10% volatility target by dynamically allocating its exposure across four major asset classes: US equities, US Treasuries, gold, and the US dollar. Each of these asset classes is tracked through its own dedicated volatility-targeted sub-index, allowing the index to respond in real time to changing market conditions and to balance performance with stability.

Note: In addition to allocating the funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest. The Fixed Value Rate for the 10-year withdrawal charge period at the time of writing this article was 2.00%. These Fixed Rates change from time to time. You can contact your trusted financial advisor to know the latest rates.

Rates and Costs

As mentioned earlier, all earnings, whether in the form of index credits or fixed rate credits, are credited to the "Account Value" bucket. However, it’s important to note that we do not receive the full index return in our account. This section explains how these index returns are calculated and added to our account value.

The earnings crediting formula

The earnings crediting formula is a crucial aspect of this annuity discussion. It’s essential to understand that the index return is not directly credited to our annuity. Instead, factors such as participation rates, cap rates, and spreads set by the company influence our earnings. These rates can change over time, so it’s advisable to consult with your trusted financial advisor for the latest rates.

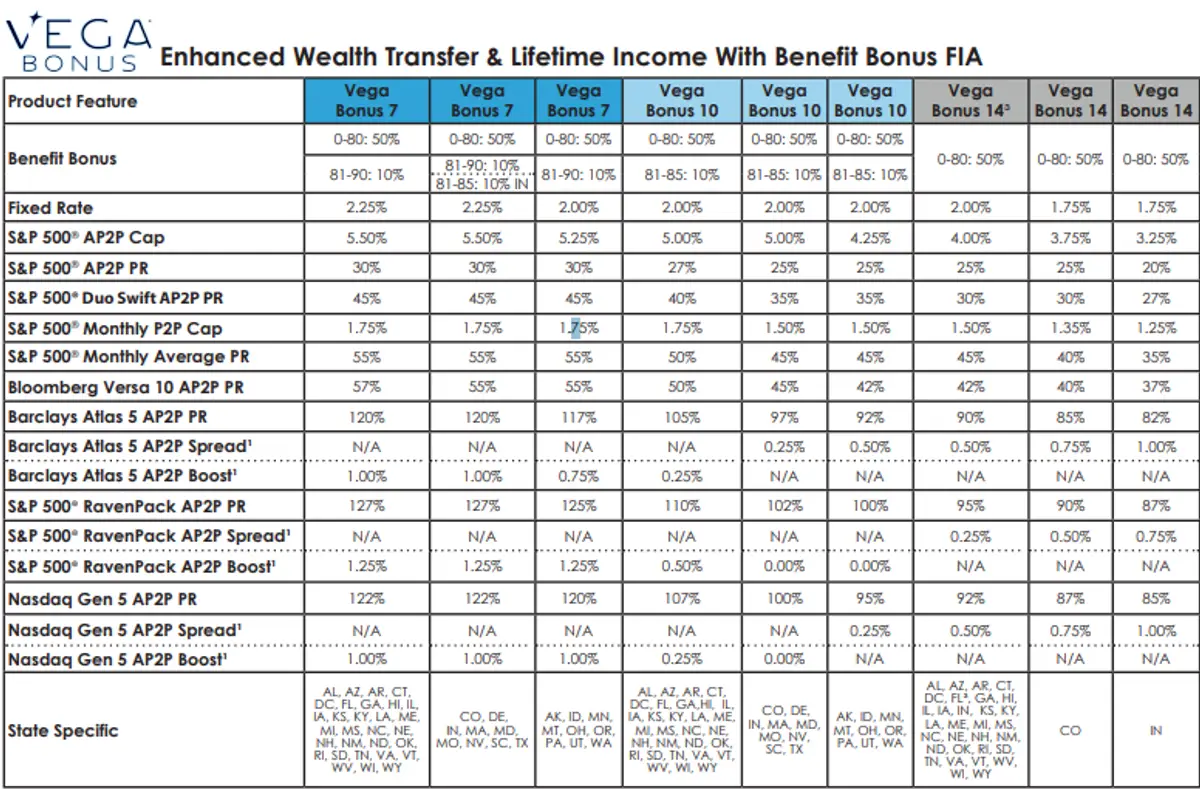

Let’s have a look at the Silac Vega Bonus Fixed Index Annuity rate sheet (as of July 2025) to understand how the earnings are determined.

From the above rate chart, you will notice that there are 16 interest crediting options (1 fixed and 15 indexed). Let’s have a look at different terms that are used by the company in the Vega Bonus Fixed Indexed Annuity chart rate:

- Point-to-point with Participation Rate (PR): The participation rate describes the annuitant’s participation percentage in a return of an index. For example, suppose the participation rate is 150%, and the index returned 4% over the agreed time. In that case, the annuitant will be eligible for 150% of the return, i.e., 6%.

- Point-to-point with Cap Rates: This refers to the rate at which your interest-earning capacity is capped. For example, if an index returns 12% but the contract’s cap rate is 6%, the annuitant will be eligible for an interest credit of 6% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest that can be earned is the cap rate.

- One-Year Monthly Index Average with Participation Rate: This strategy begins by recording the initial value of a selected index at the onset of the contract term. Subsequently, the index's value is captured monthly. After a one-year duration, these monthly index values are aggregated and then averaged by dividing the total by 12. This average, multiplied by the participation rate, helps decide the interest added to the annuity.

- Point-to-point with Spread: The amount of interest that the Company will credit is based on a declared spread on the selected index on an annual point-to-point basis. Once the index gain is determined (if any), the spread amount is subtracted. The remaining amount is what is credited to the contract for that term.

- Point-to-point with Boost: The amount of interest that the Company will credit is based on a declared boost on the selected index on an annual point-to-point basis. Once the index gain is determined (if any), the boost amount is added. The remaining amount is what is credited to the contract for that term.

- Fixed Account Rate: If you opt for a fixed account rate, you simply earn the fixed rates for a particular period specified by the company before your policy begins. These rates are usually low/at par as compared to other fixed avenues, such as CDs and MYGAs, so you should avoid fixed rates in a general scenario. The 1-year fixed rate on this policy at the time of writing this article was 2.00%.

When allocating premiums in a fixed-indexed annuity, individuals can distribute their money across these different indexing strategies. This means you can decide how much of your premium goes into each strategy, allowing for a tailored approach to potential growth and risk based on your financial goals and comfort level.

This annuity is not ideal for growth (as evidenced by the low participation and cap rates). However, if I had to choose among these indices, I would prefer the strategies with a monthly point-to-point cap on the S&P 500 Index, the S&P 500 RavenPack Index with a participation rate, and the Barclays Atlas point-to-point with a boost.

Riders and Benefits

The most important part of this annuity discussion is the free enhanced benefit rider it comes with. This rider enables you to have a stream of guaranteed lifetime income payments that you cannot outlive. The annuity also provides you with an optional enhanced death benefit, which enables you to leave a legacy for your loved ones.

Benefit Value

The Benefit Value is used to calculate both rider withdrawals and the Optional Enhanced Death Benefit in your annuity contract. Initially, the Benefit Value is set equal to the Initial Premium you pay into the annuity, plus a 50% bonus (issue age 0-80) or 10% bonus (issue age 81-85) of that amount. Over time, this value increases based on the account value interest credits and the Benefit Multiplier applied to those interest credits. The following benefit multiplier applies to the Vega Fixed Indexed Annuity:

Before Rider Payments Begin: The Benefit Multiplier is 175% of the index credits. This means that for every dollar of index credit earned in the account, $1.75 is added to the Benefit Value.

After Rider Payments Begin: The Benefit Multiplier decreases to 175%, meaning that for every dollar of index credit earned, $1.75 is added to the Benefit Value.

It’s important to emphasize that the Benefit Value is separate from the account value. While the account value represents the actual cash value of your annuity, the Benefit Value is a notional amount used solely for calculating rider payments and the enhanced death benefit. It's also important to understand that any withdrawal from your account will proportionally reduce your benefit value. For example, if you withdraw 10% of your account value, your Benefit Value will decrease by 10% as well.

Comparing Bonus and Standard Versions of the Vega Bonus Fixed Indexed Annuity: Key Trade-Offs and Considerations

It’s important to note that there is also a standard version of this annuity, the Vega Fixed Indexed Annuity, which does not include any bonus. Both the standard and bonus versions come with a free enhanced income rider at no additional cost. However, the bonus version has some trade-offs: while you receive a 50% initial bonus on the Benefit Value account, a closer look at the rate charts reveals that the bonus version offers slightly lower participation rates, cap rates, and other related factors. Additionally, the lifetime withdrawal percentages are marginally lower in the bonus version compared to the standard version.

Furthermore, in the standard version, the Benefit Value grows at 275% of interest credits before rider withdrawals begin, whereas in the bonus version, it grows at 175%. Thus, each option has its pros and cons, and your decision should depend on whether you prioritize the upfront bonus or prefer the potential for higher long-term growth with more favorable participation rates and a higher growth multiplier.

Accessing Rider Payments

In the Vega Bonus Fixed Indexed Annuity, annuitants have the flexibility to choose from three distinct Enhanced Withdrawal Benefits. Each option is designed to align with different retirement goals and financial strategies. Below, we explore these options in detail.

Increasing Lifetime Withdrawals: The Increasing Lifetime Withdrawals option allows annuitants to start with a lower initial payment, but with the potential for their payments to increase over time. This increase is tied to the growth of the Benefit Value account before withdrawals begin.

- How It Works: The Benefit Value account grows based on interest credits until the annuitant begins withdrawals. Once withdrawals start, a percentage of the Benefit Value is used to determine the payment amount. Although the initial percentage is lower, it increases each year, allowing for growing income over the annuitant's lifetime.

- Growth Potential: As the Benefit Value continues to accrue interest before withdrawals start, the potential for higher future payments increases. This is ideal for those planning for long-term income needs, especially in later retirement years.

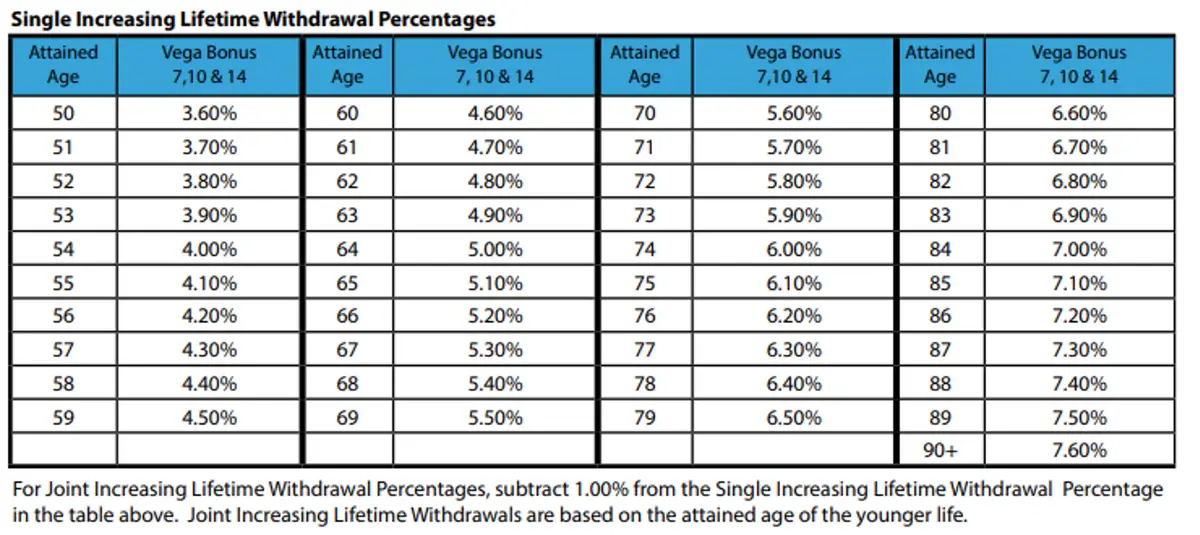

The chart below shows single increasing lifetime withdrawal percentages for the Vega Bonus Fixed Indexed Annuity:

Let’s walk through an example to illustrate how these increasing lifetime withdrawals work using the chart provided:

- Attained Age at Start: 60 years old

- Benefit Value (Hypothetical): $200,000

- Initial Withdrawal Percentage: According to the chart, the withdrawal percentage for an attained age of 60 is 4.60%.

Year 1 (Age 60):

- Annual Withdrawal: $200,000 * 4.60% = $9,200

Year 2 (Age 61):

- New Withdrawal Percentage: The withdrawal percentage increases to 4.70% at age 61.

- Annual Withdrawal: $200,000 * 4.70% = $9,400

Year 3 (Age 62):

- New Withdrawal Percentage: At age 62, the percentage increases again to 4.80%.

- Annual Withdrawal: $200,000 * 4.80% = $9,600

Progressing Forward:

- As the annuitant continues to age, the withdrawal percentage continues to increase. By the time the annuitant reaches age 70, the withdrawal percentage is 5.60%, resulting in an annual withdrawal of $11,200 from the same $200,000 Benefit Value.

- By age 80, the withdrawal percentage rises to 6.60%, translating into an annual withdrawal of $13,200 from the $200,000 Benefit Value.

This example demonstrates how the Increasing Lifetime Withdrawals option can provide a growing income stream over time. Starting with a lower percentage, the withdrawals increase as the annuitant ages, aligning with the need for potentially higher income later in retirement. This structure is especially beneficial for those who anticipate rising expenses or who wish to maintain their purchasing power as they get older.

In addition to the Single Increasing Lifetime Withdrawals, the Vega Bonus Fixed Indexed Annuity also offers an option for Joint Increasing Lifetime Withdrawals. This option is designed for couples who wish to receive lifetime income payments that continue as long as either spouse is alive. For Joint Increasing Lifetime Withdrawal Percentages, you need to subtract 1.00% from the Single Increasing Lifetime Withdrawal Percentage listed in the chart above. This adjustment reflects the fact that payments are designed to last for the lifetime of both individuals, making it a more conservative option. The Joint Increasing Lifetime Withdrawals are calculated based on the attained age of the younger spouse.

Once you opt for lifetime payments, you are guaranteed to receive those payments for the rest of your life, even if your account value eventually drops to zero. This means you will never outlive your income, providing peace of mind and financial security throughout your retirement. However, it's important to note that your account value should not reach zero due to excess withdrawals or other actions beyond the structured lifetime payments.

2. Level Lifetime Withdrawals

For those who prefer stability and predictability in their retirement income, the Level Lifetime Withdrawals option offers a consistent payment amount that remains the same for life. This option typically starts with higher payments than the increasing option.

- How It Works: Similar to the increasing option, the Benefit Value account grows prior to starting withdrawals. However, once withdrawals begin, a fixed percentage of the Benefit Value is used to determine the lifetime payment amount. This percentage does not change, ensuring a steady income stream.

- Predictability: The annuitant receives the same withdrawal amount for the rest of their life, making it easier to plan for fixed expenses and maintain financial stability without concern for market fluctuations.

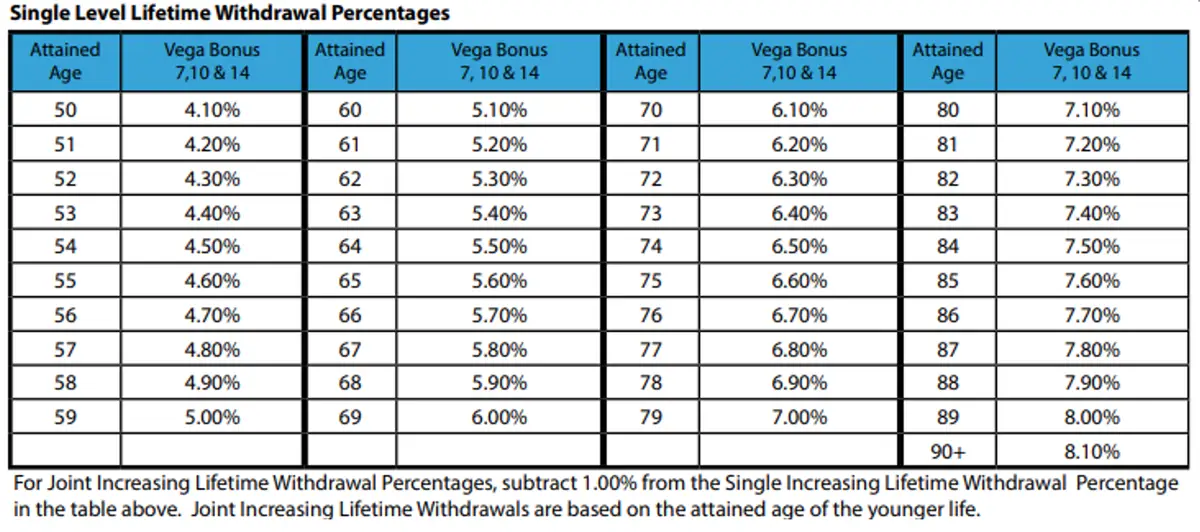

The chart below shows single level lifetime withdrawal percentages for the Vega Bonus Fixed Indexed Annuity:

Let’s explore an example to see how these level lifetime withdrawals work using the chart provided:

- Attained Age at Start: 65 years old

- Benefit Value: $200,000

- Initial Withdrawal Percentage: According to the chart, the withdrawal percentage for an attained age of 65 is 5.60%.

Year 1 (Age 65):

- Annual Withdrawal: $200,000 * 5.60% = $11,200

Year 2 (Age 66):

- Withdrawal Percentage Remains the Same: Unlike the Increasing Lifetime Withdrawals, the percentage does not change year to year. It remains fixed at 5.60%.

- Annual Withdrawal: $200,000 * 5.60% = $11,200

Year 3 (Age 67):

- Continued Fixed Withdrawal: The annuitant continues to receive the same amount each year.

- Annual Withdrawal: $200,000 * 5.60% = $11,200

This fixed payment continues each year, providing a steady income stream that does not vary, regardless of market conditions or changes in the annuitant's age.

In addition to the Single Level Lifetime Withdrawals, the Vega Fixed Indexed Annuity also offers an option for Joint Level Lifetime Withdrawals. This option is designed for couples who wish to receive lifetime income payments that continue as long as either spouse is alive. For Joint Level Lifetime Withdrawal Percentages, you need to subtract 1.00% from the Single Level Lifetime Withdrawal Percentage listed in the chart above. This adjustment reflects the fact that payments are designed to last for the lifetime of both individuals, making it a more conservative option. The Joint Level Lifetime Withdrawals are calculated based on the attained age of the younger spouse.

Once you opt for lifetime payments, you are guaranteed to receive those payments for the rest of your life, even if your account value eventually drops to zero. This means you will never outlive your income, providing peace of mind and financial security throughout your retirement. However, it's important to note that your account value should not reach zero due to excess withdrawals or other actions beyond the structured lifetime payments.

Wellness Withdrawals

The Vega Bonus Fixed Indexed Annuity includes an important feature known as Wellness Withdrawals, which automatically provides Lifetime Withdrawals to offer higher payments during times of need. This benefit is particularly valuable when the annuitant experiences a permanent impairment that prevents them from performing at least two of the six Activities of Daily Living (ADLs), such as bathing, dressing, or eating. To qualify, this impairment must be certified by a qualified physician and must have begun after the policy was issued.

The Wellness Withdrawals feature becomes available after a waiting period, which is 7 years for the Vega Bonus 7 and 10 years for the Vega Bonus 10 and Vega Bonus 14. Once the annuitant qualifies, their Lifetime Withdrawals are significantly increased by applying a Wellness Multiplier, doubling the withdrawal amount for single lifetime withdrawals or increasing it by 50% for joint lifetime withdrawals. This enhanced withdrawal continues for up to 5 policy years, providing critical financial support during the period when the annuitant's needs are greatest.

For example, if an annuitant under the Vega Bonus 10 was originally receiving $10,000 per year in Single Lifetime Withdrawals, this amount would increase to $20,000 annually during the wellness period, thanks to the Wellness Multiplier. This feature ensures that annuitants can maintain financial stability and meet increased expenses associated with their care, offering peace of mind during challenging times.

3. Accelerated Withdrawals

The Accelerated Withdrawals option is a unique feature of the Vega Bonus Fixed Indexed Annuity. This option allows annuitants to receive their Benefit Value over a specified period rather than stretching payments over a lifetime. It offers higher payments over a shorter duration.

- How It Works: Before lifetime payments begin, the annuitant can elect to receive their Benefit Value over a chosen time period. This flexibility can be beneficial for those who need larger payments earlier in retirement, perhaps for significant purchases or healthcare costs.

- Flexibility: Unlike the other options, Accelerated Withdrawals provide the opportunity to access more of your funds upfront. However, it's important to note that this option is no longer available once lifetime payments have begun.

Important: Since this option cannot be selected after lifetime payments start, it's crucial to consult with a financial advisor to carefully consider the timing and implications of this choice.

Optional Enhanced Death Benefit

In a typical annuity scenario, when an annuitant passes away, their beneficiaries receive the account value as a lump sum payment. However, the Vega Bonus Fixed Indexed Annuity offers an Optional Enhanced Death Benefit that provides an alternative approach, potentially increasing the financial legacy left to beneficiaries.

Normally, the death benefit is equal to the annuitant's account value. But if you opt for the Optional Enhanced Death Benefit, the death benefit is calculated based on the Benefit Value, which is typically higher than the account value due to the multipliers applied during the accumulation phase.

Benefit of Multipliers: The Benefit Value grows over time based on the Benefit Multiplier applied to the index credits. This means that, at the time of the annuitant’s death, the Benefit Value is likely to be significantly greater than the account value, providing a more substantial benefit to the beneficiaries.

However, one catch with the Enhanced Death Benefit is that, unlike the account value, which is paid out as a lump sum, the Benefit Value is distributed over a period of 5 years.

Terminal Illness, Nursing Home, and Home Health Care Benefits

In addition to the standard features of the Vega Bonus Fixed Indexed Annuity, the benefits also include the Terminal Illness Benefit, Nursing Home Benefit, and Home Health Care Benefit, each offering different levels of access to the account value under specific circumstances.

Terminal Illness Benefit: The Terminal Illness Benefit allows the annuitant to withdraw up to 100% of their account value if they are diagnosed with a terminal illness. To qualify, the illness must be such that it results in a life expectancy of 12 months or less. This benefit is available after the first policy year.

Nursing Home Benefit: The Nursing Home Benefit provides a similar level of financial flexibility by allowing the annuitant to withdraw up to 100% of their account value if they are confined to a nursing home for at least 90 consecutive days and meet the required eligibility criteria. This benefit is also available after the first policy year. It is designed to help cover the substantial costs associated with long-term care in a nursing facility, ensuring that the annuitant can maintain their quality of life without undue financial stress.

Home Health Care Benefit: The Home Health Care Benefit offers additional support for annuitants who wish to receive care in the comfort of their own home. Under this benefit, the annuitant can withdraw up to 20% of their account value each year for up to 5 policy years if they are unable to perform 2 of the 6 Activities of Daily Living (ADLs) without the assistance of another person and meet the eligibility requirements. Like the other benefits, this option becomes available after the first policy year. It provides a crucial financial resource for those who require in-home care, helping to cover the costs of home health services and enabling the annuitant to remain in their home environment for as long as possible.

Surrender/Early Withdrawal Charge

Should your needs change unexpectedly, and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies, although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for the Silac Vega Fixed Indexed Annuity.

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Surrender Charge % (7-year) | 12% | 12% | 11% | 10% | 9% | 7% | 4% | |||||||

Surrender Charge % (10-year) | 12% | 12% | 11% | 10% | 9% | 8% | 7% | 6% | 4% | 2% | ||||

Surrender Charge % (14-year) | 14.75% | 13.75% | 12.75% | 11.75% | 10.75% | 10% | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 2% |

Market Value Adjustments - In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period. The surrender charge schedule is different for the different tenures of annuities and also changes for some states.

I found that the surrender charge for the Silac Vega Bonus Fixed Indexed Annuity is relatively higher than those of other annuity issuers.

Contract/Administrative Charge

The Silac Vega Bonus Fixed Indexed Annuity levies no annual contract or administrative fees.

What Makes This Product Stand Out

The Vega Bonus Fixed Indexed Annuity offers several standout features that make it an attractive option for those seeking a flexible and comprehensive retirement solution. Here’s what sets this product apart:

- Good Annuity for Liquidity and Enhanced Lifetime Withdrawals: The Vega Fixed Indexed Annuity offers a variety of enhanced withdrawal options, calculated on a Benefit Value with an upfront bonus, all at no additional cost, making it a good product for lifetime income.

- Enhanced Death Benefit: This product offers an Optional Enhanced Death Benefit that ensures your beneficiaries receive a potentially larger payout, calculated based on the Benefit Value rather than just the account value. This feature can be especially valuable for those looking to maximize their legacy.

- Free Terminal Illness, Nursing Home, and Home Health Care Benefits: The inclusion of these benefits at no additional cost provides crucial financial support in the event of serious health challenges. With the ability to access up to 100% of your account value under certain conditions, this product offers peace of mind during difficult times.

- No Annual Contract, Mortality & Expense, or Administrative Fees

- Multiple Payout Options: The Vega Bonus Fixed Indexed Annuity provides flexibility in how you receive your payouts, whether through a lump sum or various annuitization options, such as Life Only, Life with Period Certain, or Joint and Survivor Life.

What I Don't Like

While the Vega Fixed Indexed Annuity offers many attractive features, there are a few aspects that might not appeal to everyone:

- Complexity of Options: The wide range of features and withdrawal options can be overwhelming, especially for those who prefer simpler, more straightforward financial products. Understanding all the nuances and conditions may require significant time and consultation with a financial advisor.

- Long Waiting Periods for Some Benefits: Certain benefits, like enhanced lifetime withdrawals, come with waiting periods of up to 10 years.

- Limited Growth Potential: While the product offers enhanced benefits and flexibility, the growth potential of the account value may be limited compared to other investment options, particularly if the market performs well, but lower caps or participation rates constrain you. That said, this annuity is not the best one for accumulation.

- Structured Payout for Enhanced Death Benefit: The Enhanced Death Benefit is paid out over five years, which might not suit beneficiaries who prefer or need a lump sum payment.

- Lower Free Withdrawal Limit: During the withdrawal-charge period, the annuity allows for free withdrawals of only 5% of the account value. This is lower than many competitors, which typically allow for 10% free withdrawals.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Silac Insurance Company

SILAC Insurance Company, originally founded as Equitable Life & Casualty Insurance Company in 1935, is Utah's oldest active life insurance company. The company, headquartered in Salt Lake City, Utah, has a rich history of providing life and health insurance, particularly focusing on the needs of seniors. In 2018, SILAC entered the annuity market, expanding its offerings to include a variety of innovative annuity products, such as Fixed Index Annuities and Multi-Year Guaranteed Annuities. SILAC is licensed to operate in 48 states and the District of Columbia, making it a significant player in the national insurance market.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

AM Best | B (7th of 13 ratings) |

KBRA | BBB |

SILAC's credit ratings reflect a moderate level of financial stability and suggest adequate creditworthiness. While SILAC is financially sound, it's important to consider its overall financial strength compared to higher-rated insurers. As of 2024, some of the financial highlights for SILAC Insurance Company include its:

- $4.4 billion in total cash and invested assets

- $738 million of total adjusted capital and surplus

- $14.8 billion in-force account value

- 120,000 plus policyholders

Conclusion

With advancements in healthcare and technology, the average American today lives longer than ever. Consequently, it's crucial to have a source of income that grows safely and steadily, and can provide a guaranteed income during retirement years. This strategy not only mitigates the risk of outliving your income but also ensures a decent standard of living in retirement.

The Vega Bonus Fixed Indexed Annuity offers a well-rounded package of features designed to provide flexibility, security, and financial support throughout retirement. With its 50% upfront bonus on the Benefit Value, coupled with a variety of free enhanced withdrawal options—including benefits for terminal illness, nursing home care, and home health care—this product ensures that annuitants have access to their funds when they need them most. The optional Enhanced Death Benefit and Wellness Withdrawals further enhance its appeal, making it a strong choice for those who want to maximize both their lifetime income and the legacy they leave behind.

However, potential buyers should weigh these benefits against certain drawbacks, such as the complexity of the product and the lower free withdrawal limit during the withdrawal-charge period. Additionally, while SILAC's credit ratings indicate adequate financial stability, prospective annuitants should consider the company's ratings in comparison to other insurers. Importantly, this annuity may not be the best suited for those primarily focused on accumulation and growth, as its structure is more geared towards providing steady income and enhanced benefits rather than maximizing investment returns. As with any financial product, it’s advisable to thoroughly review the details and consult with a financial advisor to ensure that it aligns with your specific retirement goals and needs.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. Delve deeper into our extensive reviews.