Sentinel Retirement Plus Multiplier Annuity Fixed Indexed Annuity Review

Written byNikhil Bhauwala

CFA, Lead Writer

2 min read

Updated

Introduction

Fixed Index Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index. Fixed Index Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to missell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

This article provides an in-depth review of the Sentinel Retirement Plus Multiplier Fixed Indexed Annuity. The Sentinel Retirement Plus Multiplier is a relatively new indexed annuity that may be a suitable option for those seeking accumulation, tax-deferred growth, and principal protection. It is designed for annuitants focused on optional riders to either have enhanced earning capabilities or a guaranteed lifetime withdrawal benefit rider. The annuity offers several indexing options that have the potential to deliver reasonable returns in line with market performance. After conducting extensive research and due diligence, I present an unbiased and thorough analysis of this product.

The review of the Sentinel Retirement Plus Multiplier Fixed Indexed Annuity will be broken into multiple subcategories:

- Product Description

- Product Policy

- Rates and Costs

- Riders

- What Makes This Product Stand Out?

- What I Don’t Like

- Company Details

- Conclusion

Product Description

The Sentinel Retirement Plus Multiplier is a Fixed Indexed Annuity (FIA) plan that offers the annuitant (annuity investor) an opportunity to earn a market index-linked return without having to incur the risk of market downside. This is a suitable plan for people who are looking for a fixed indexed annuity that offers greater flexibility in terms of lifetime withdrawals and aims to grow and protect their retirement savings.

Let’s have a look at the high-level fine print of the Sentinel Retirement Plus Multiplier Fixed Indexed Annuity, and then we will discuss each point in detail.

| Product Name | Retirement Plus Multiplier |

|---|---|

Issuing Company | |

AM Best Rating | B++ (6th of 13 ratings) |

Withdrawal Charge Period(s) | 5,7, 10 years |

Maximum Issue Age | 85 Years |

Minimum Initial Purchase Amount | $10,000 |

Crediting Period and Strategies | 1/2/3 year point-to-point with participation rate, 1-year point-to-point with caps, or 1-year fixed with interest rate guaranteed |

Plan Types | IRA, Roth IRA, Nonqualified Account, SEP IRA, SIMPLE IRA, 401(a), etc. |

Indexes | S&P 500 Index and Aging of America Index |

Free Withdrawals | 10% of the annuity’s Accumulated Value per year. |

Death Benefit | Upon the annuitant’s death, the beneficiary will get greater of (i) Account Value or (ii) Surrender Value |

Riders | Annuitant has to chose from any one of the following paid riders Growth Benefit Rider Income Multiplier Rider |

Free Benefits | Free Nursing Home and Terminal Illness Waivers |

Surrender Value | Account Value less any withdrawal charges/ MVA |

RMD Friendly | Yes |

Product Policy

How does the Retirement Plus Multiplier Fixed Indexed Annuity policy work?

Any annuitant (maximum age at the time of policy issue: 85) can purchase the Retirement Plus Multiplier Fixed Indexed Annuity with a minimum initial purchase amount of $10,000, and in return, they will earn market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, there are various events that may trigger earnings credit: On free withdrawals, for a long-term care event or terminal illness or injury event, or when a death benefit is payable.

The Retirement Plus Multiplier Fixed Indexed Annuity offers the annuitant the ability to choose from one or both of the two indexes (S&P 500 Index and Aging Of America Index) to determine their earnings crediting formula. Both indexes offer 3 crediting strategies each, and the plan also offers a fixed-rate guaranteed interest strategy to choose from, making a total of 7 strategy options. Apart from this, the annuitant also has to choose from one of the two paid riders available with this annuity. We will discuss each available index briefly:

1. S&P 500 Index

The S&P 500 index is one of the most popular and oldest indexes in the world. It tracks 500 large-cap publicly traded stocks listed in the United States. It is a reliable index and has often succeeded in the test of time. It is very important to note that, similar to most other annuities, the Retirement Plus Multiplier Indexed Annuity offers the S&P 500 index with cap rates, and participation rates in place, meaning that your interest-earning capacity is limited. These rates change frequently; I will discuss the rates in detail shortly.

2. Aging of America Index

The Aging of America Index is designed to track and measure the economic impact of the growing older population in the United States. It typically includes companies involved in healthcare, senior living, financial services catering to retirees, and other sectors that serve the needs of older Americans. The index is dynamic, adjusting its composition to reflect changing market conditions and demographic trends, and serves as a benchmark for investors and policymakers to understand and capitalize on the economic implications of an aging population. By tracking this index, investors can gain insights into how the aging of America is influencing various aspects of the economy and potentially identify investment opportunities aligned with this long-term demographic trend.

It is very important to note that like other Fixed Indexed Annuities, the Sentinel Life Retirement Plus Fixed Indexed Annuity comes with cap rates, participation rates, etc., for these indexes, meaning that you will be credited only a part of the index return to your annuity. These rates change frequently; I will discuss these rates more briefly.

Note: In addition to allocating the funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest. These Fixed Rates change from time to time. The Fixed Value Rate for the 10-year withdrawal charge period at the time of writing this article was 3.00%.

The earnings crediting formula

The earnings crediting formula is the most important part of this annuity discussion. It is important to know that we don’t simply get the index return credited to our annuity. There are a few rates, caps, and triggers that the company has in place that affect our earnings. These rates tend to change over time, and the updated rates can always be checked on the company’s website.

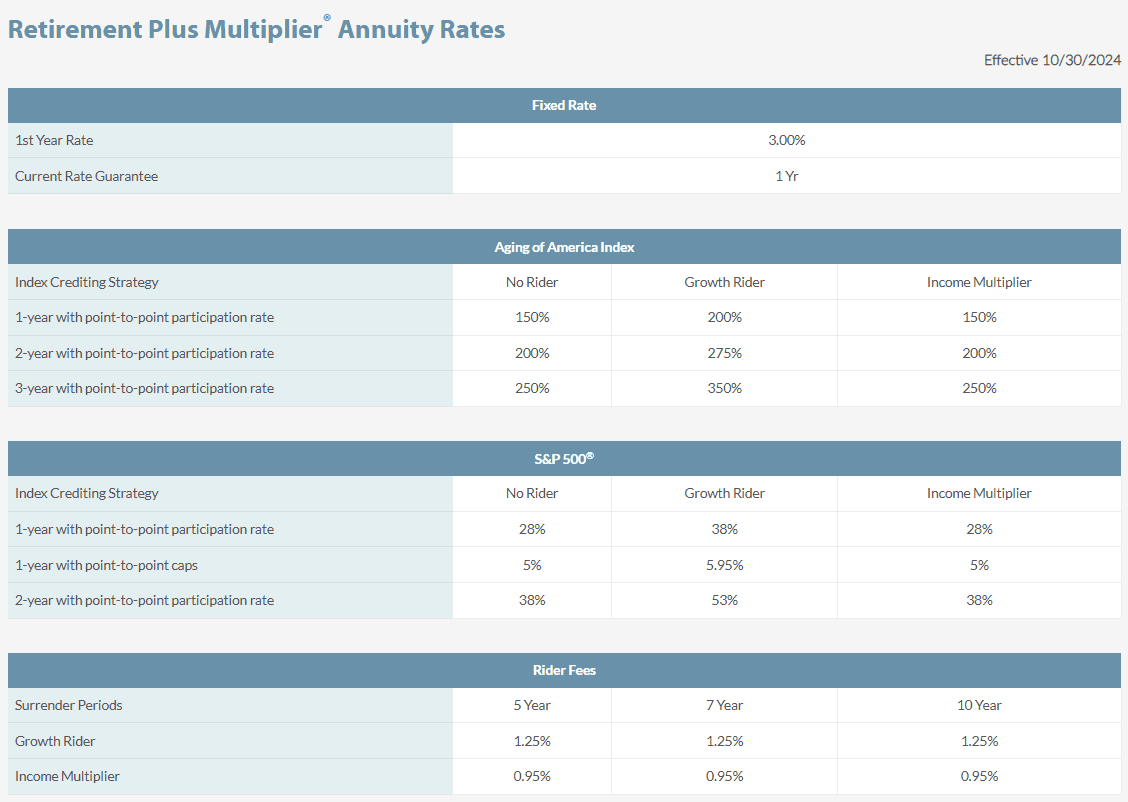

Let’s have a look at the Sentinel Retirement Plus Multiplier Fixed Index Annuity rate sheet (as of the date of updating this article) to understand how the earnings are determined.

From the rate chart above, you'll observe that there are interest-crediting options linked to two indices: the S&P 500 Index and the Aging of America Index. Each index offers three interest-crediting options, along with an additional fixed option, bringing the total to seven available options. Let’s have a look at different terms that are used by the company in the Retirement Plus Multiplier Fixed Indexed Annuity chart rate:

Cap Rates: This refers to the rate at which your interest-earning capacity is capped. For example, if an index returns 12% but the contract’s cap rate is 6%, the annuitant will be eligible for an interest credit of 6% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest that can be earned is the cap rate.

Participation Rate (PR): The participation rate describes the annuitant’s participation percentage in a return of an index. For example, suppose the participation rate is 150%, and the index returned 4% over the agreed time. In that case, the annuitant will be eligible for 150% of the return, i.e., 6%.

Fixed Account Rate: If you opt for a fixed account rate, you simply earn the fixed rates for a particular period specified by the company before your policy begins. These rates are usually low/at par as compared to other fixed avenues, such as CDs and MYGAs, so you should avoid fixed rates in a general scenario. The 1-year fixed rate on this policy at the time of writing this article was 3.00%.

In this annuity, I find all three indexed options to be decent choices. The S&P 500 options are appealing due to their decent cap rates, while the Aging of America index stands out with its high participation rate. You might consider exploring a 40/40/20 allocation between the S&P 500, Aging of America, and the fixed account for a balanced approach.

Riders

Riders are one of the main highlights of the Sentinel Retirement Plus Multiplier Fixed Indexed Annuity. The Retirement Plus Multiplier Fixed Indexed Annuity comes with two options of paid riders, out of which the annuitant can choose any one:

Growth Benefit - For Increased Accumulation Benefit

Income Multiplier - For Guaranteed Lifetime Withdrawal Benefit

Growth Benefit Rider

The Growth Benefit Rider enhances the potential for accumulation in your annuity's index accounts. When you opt for this rider, both the cap rates and participation rates of your chosen indices are increased, allowing you to benefit more extensively from the market's positive performance.

Key highlights of the Growth Benefit Rider include:

Enhanced Growth Potential: The rider aims to foster better growth by providing higher index account caps and participation rates. This allows for a greater share in the gains from the indices you are invested in.

Market Loss Protection: There is a 0% floor, which protects the accumulation value from any potential market downturns, ensuring that your investment does not lose value even in volatile market conditions.

Guaranteed Minimum Value: After the first 10 years, the rider guarantees the greater of either the account value or 110% of the initial premium paid minus any withdrawals. This guarantee provides a substantial safety net for your investment.

The Growth Benefit Rider costs 1.25% of the annuity's account value annually, which is deducted each year to provide the enhanced growth potential and guarantees associated with this rider.

The above graph showcases a scenario with a $100,000 initial purchase premium entirely allocated to the Aging of America Index with a 1-year participation rate strategy. The example reflects various participation rates and index values from 2011 through 2021, illustrating potential growth trajectories both with and without the rider. This visual comparison highlights the rider's impact in enhancing the growth potential over time. Please note this is an illustrative example and not a prediction of future results.

Income Multiplier Rider

The Income Multiplier Rider, also known as the Guaranteed Lifetime Withdrawal Benefit Rider, can enhance your annuity's income potential. This optional rider ensures that you continue to receive lifetime income, even after your accumulation value has been fully withdrawn.

Key features include:

- Lifetime Income Stream: The rider guarantees a continuous stream of income for life, even after the account's accumulation value is exhausted.

- Flexibility for Single or Joint Income: You can elect the income option for yourself or include your spouse, providing tailored options for different life circumstances.

- Income Enhancing Bonus: The rider offers an income-enhancing bonus of up to 100% of your initial investment, boosting your overall retirement income.

The scenario in the accompanying graph uses a $100,000 initial premium, fully allocated to the Aging of America Index with a 1-year participation rate strategy, and shows the effect of the rider over 10 years. The Aging of America Index had values from 11/1/2011 to 11/1/2021, reflecting a 75% participation rate and the Guaranteed Lifetime Withdrawal Benefit Rider. The graph demonstrates how the Income Multiplier Bonus adds substantial value over time, with the income-enhancing bonus significantly increasing the overall income, as depicted in the red bars.

The cost of this rider is 0.95% of the annuity’s account value annually, providing this enhanced income potential and protection. This example is hypothetical and meant for illustration purposes, not a prediction of future results.

The Sentinel Retirement Plus Multiplier also comes with a Confinement and Terminal Illness Waiver. This no-fee benefit is automatically included for owners, providing them with a Confinement and Terminal Illness benefit.

Confinement Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is confined to a qualified nursing home. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Terminal Illness Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is diagnosed with a terminal illness. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Surrender/Early Withdrawal Charge

Should your needs change unexpectedly, and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies, although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for the Sentinel Retirement Plus Multiplier Fixed Indexed Annuity.

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11+ |

|---|---|---|---|---|---|---|---|---|---|---|---|

5-yr | 10% | 9% | 8% | 7% | 6% | ||||||

7-yr | 10% | 9% | 8% | 7% | 6% | 5% | 4% | ||||

10-yr | 10% | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 2% | 1% | 0% |

Market Value Adjustments - In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period. The surrender charge schedule is different for the different tenures of annuities and also changes for some states.

The surrender charge of Sentinel Retirement Plus Multiplier Fixed Indexed Annuity is in line with all the other annuity issuers.

Contract/Administrative Charge

The Sentinel Retirement Plus Multiplier Fixed Indexed Annuity levies no annual contract or administrative fees. However, it comes with two paid riders, out of which the annuitant has to compulsorily choose one. The Growth rider costs 1.25% annually, while the Income rider costs 0.95% annually.

What makes this product stand out?

The Sentinel Retirement Plus Multiplier Fixed Indexed Annuity offers a few features that make a favorable case for this annuity. The ones that I like the most are

The plan offers the S&P Index with multiple crediting methodologies.

Higher Cap Rates, Participation rates, and Fixed Account rates compared to other competitive annuities.

Riders significantly enhance earning potential

No annual contract, mortality & expense, or administrative fees

Free Confinement and Terminal Illness Waiver Benefit: This no-fee rider is automatically included for owners under age 65 and includes both a Qualified Nursing Care and Terminal Illness Benefit:

Multiple Payout Options: Lumpsum or Annuitization option with Life Only, Life with Period Certain, Joint and Survivor Life, etc.

What I don’t like

This product provides a good combination of growth and safety, making it suitable for those prioritizing stability. However, one drawback is the AM Best Rating of B++. While this reflects reasonable financial strength, it's not among the highest ratings available. For annuitants who are particularly focused on financial stability, a higher-rated insurer might offer more confidence in the policy's long-term security.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Sentinel Security Life Insurance Company

Sentinel Security Life is a financial services company that has been in business since 1948 and is based in Salt Lake City, Utah. This company offers a wide range of financial products, including:

Sentinel Security Life got its start when a group of Utah funeral directors saw that there was a need for an insurance product that could help families pay for funeral costs. This initial product was designed to help families pay for the final expenses of a loved one. Over the past seventy years, Sentinel Security Life has expanded to offer a more comprehensive suite of financial products and has also experienced many name changes throughout the years.

According to its 2023 financial statements, Sentinel Group has sold over $1.64 billion in annuity contracts, has a total adjusted capital in excess of $177.44 million, and is rated B++ by AM Best.

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. So, it’s very important to have a stream of income that can grow safely and steadily and have the ability to provide a guaranteed income during the retirement years. This not only helps you mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

Sentinel Retirement Plus Multiplier Fixed Indexed Annuity provides a balanced offering with good growth potential and financial security, further enhanced by its available riders. The Growth Benefit Rider boosts accumulation by increasing cap rates and participation rates, making it a valuable option for those looking to maximize market gains while maintaining downside protection. Additionally, the Income Multiplier Rider provides a reliable stream of lifetime income, even if the accumulation value is depleted, with an income-enhancing bonus that can significantly improve retirement income. While the riders come with added costs, they offer meaningful value by tailoring the annuity to meet both growth and income needs. However, the B++ AM Best Rating may be a consideration for those prioritizing top-tier financial strength. We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. Delve deeper into our extensive reviews.