Introduction

Fixed Indexed Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index, such as the S&P 500. Fixed Index Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to mis-sell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

In this article, we delve into the F&G Safe Income Advantage Fixed Indexed Annuity. The F&G Safe Income Advantage is a deferred, fixed-indexed annuity that could be a viable choice for individuals seeking a straightforward fixed-indexed annuity with an emphasis on lifetime withdrawals and principal protection. The product features guaranteed lifetime income options, allowing for the selection between level and increasing income streams. Following comprehensive due diligence, this report presents an impartial and detailed analysis of this plan.

The review of the F&G Safe Income Advantage Fixed Indexed Annuity will be broken into multiple subcategories:

- Product Description

- Product Policy

- Rates and Costs

- Accessing your Money

- Riders

- What Makes This Product Stand Out?

- What I Don’t Like

- Company Details

- Conclusion

Product Description

The F&G Safe Income Advantage is a Fixed Indexed Annuity (FIA) that provides the annuitant the opportunity to earn returns tied to a market index, without exposing them to the downside risks of the market. This plan may be particularly fitting for those nearing retirement, who have dual objectives of growing and preserving their retirement savings. A significant unique selling proposition (USP) of this plan lies in its provision for guaranteed lifetime annual payments, establishing a reliable income stream that cannot be outlived.

Let’s have a look at the high-level fine print of the F&G Safe Income Advantage annuity, and then we will discuss each point in detail.

| Product Name | Safe Income Advantage |

|---|---|

Issuing Company | |

AM Best Rating | A (3rd of 13 ratings) |

Tenure | 10 years |

Maximum Issue Age | 80 Years |

Minimum Initial Purchase Amount | $10,000 |

Surrender Charge Schedule | 12%, 11%, 10%, 9%, 8%, 7%, 6%, 5%, 4%, 3%, 0% |

Crediting Period |

|

Plan Types |

|

Indexes |

|

Free Withdrawals | 10% after the first completed contract year |

Death Benefit | Greater of account value or minimum guaranteed surrender value (MGSV) |

Free Benefits | Full access to account value (without incurring surrender or MVA charges) in case of:

|

Riders | The annuitant has to choose:

|

Product Policy

How does the F&G Safe Income Advantage Annuity policy work?

An annuitant, up to a maximum issue age of 80, can purchase the F&G Safe Income Advantage annuity with a minimum initial investment of $10,000. In exchange, they will earn returns linked to a market index, calculated through a specific formula that will be elaborated upon later. These returns are credited according to the chosen crediting period. Beyond the standard crediting period, certain events can trigger additional earnings credits: on free withdrawals, for long-term care events, terminal illness or injury events, or upon the payment of a death benefit. However, the principal selling proposition of the product is not its potential for interest growth, but the guaranteed lifetime income payments it offers, a feature that will be explored in greater detail in a subsequent section of this review.

The F&G Safe Income Advantage annuity offers the annuitant the choice of one or more of the three indexes to determine the index interest earnings. They are the S&P 500, BlackRock Market Advantage Index, and the Balanced Asset 5 Index. The S&P 500 offers the annuitant an option to choose from four crediting strategies, four from the Balanced Asset 5 Index, and two from the BlackRock Market Advantage Index (making it a total of 10 indexing strategies). Besides this, it also provides an option to choose from a fixed interest rate of 2%. We will discuss each available index briefly:

1. S&P 500 Index

The S&P 500 index is one of the most popular and oldest indexes in the world. It tracks 500 large-cap publicly traded stocks listed in the United States. It is a reliable index and has often succeeded in the test of time. It is very important to note that the F&G Safe Income Advantage annuity offers the S&P 500 index with participation rates or cap rates in place, meaning that you will be credited only a part of the S&P 500 return to your annuity. These rates tend to change frequently; I will discuss more on the rates shortly.

2. BlackRock Market Advantage Index

The BlackRock Market Advantage Index is structured to provide an investment portfolio that is both diversified and managed for volatility. The index seeks to outperform traditional multi-asset class benchmarks by balancing investments across five key macroeconomic drivers that influence asset classes' performance, ensuring a more stable risk-adjusted return profile. Key components of this index include various iShares® ETFs, the iShares S&P GSCI Commodity-Indexed Trust, and cash holdings. The primary aim is to limit risk through a daily volatility-control mechanism. With a 6% Target Volatility, it has the flexibility to leverage up to 125% exposure. While these volatility controls may result in less fluctuation in rates of return when compared with indexes that don’t use them, they also may reduce the overall rate of return compared with those other indexes.

3. CIBC Balanced Asset 5 Index:

The Balanced Asset 5 Index takes a classic approach to its portfolio construction with a 60/40 allocation. Combined with rebalancing and volatility control features, the index seeks to provide excess returns across market conditions through a tactical combination of equity and fixed-income ETFs.The CIBC Balanced Asset 5 Index was created in June 2020 and targets a 5% annualized realized volatility. While these volatility controls may result in less fluctuation in rates of return when compared with indexes that don’t use them, they also may reduce the overall rate of return compared with those other indexes.

Note: In addition to allocating the funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest. These Fixed Rates tend to change from time to time. The Fixed Rate at the time of updating this article was 2.5%, which, in my opinion, is relatively low when compared to other annuities at this time.

Rates and Costs

The earnings crediting formula

It is important to know that we don’t simply get the index return credited to our annuity. There are a few rates and caps that the company has in place that affect our earnings. These rates tend to change over time, and the updated rates can always be checked with the help of your advisor. You can also check out their website for the latest rates.

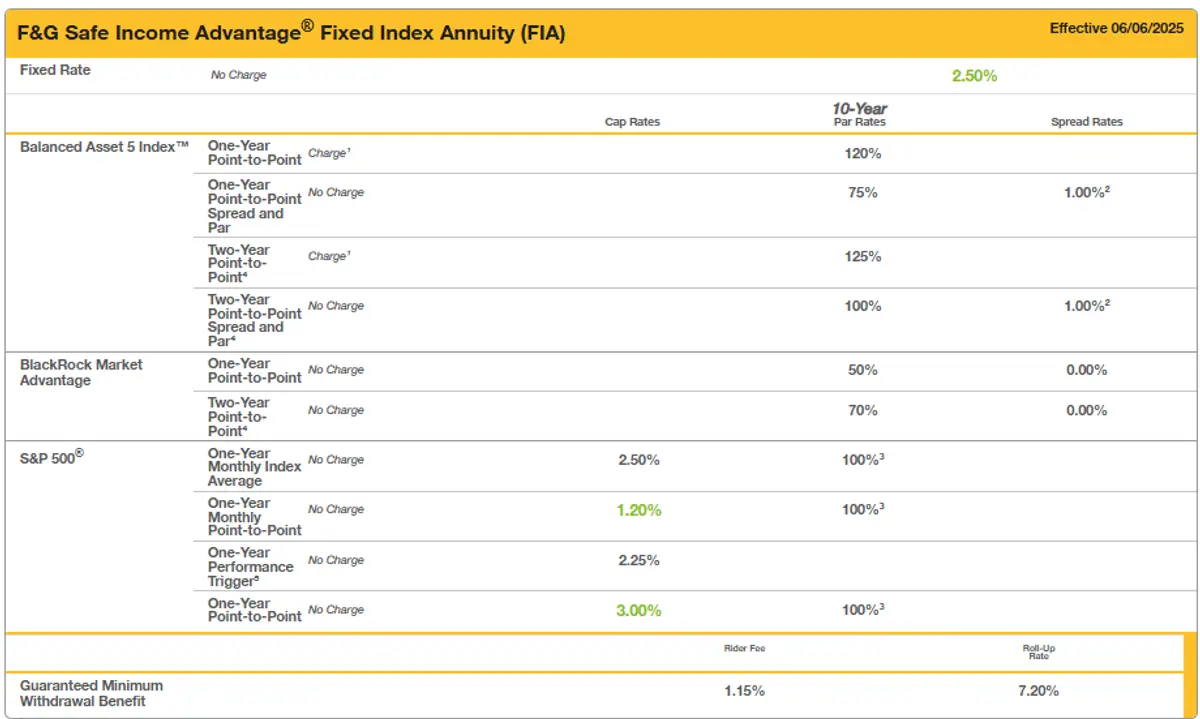

Let’s have a look at the F&G Safe Income Advantage rate sheet (as of December 2025) to understand how the earnings are determined.

The first thing to note is that we have an option to choose between three indexes, and each index has multiple strategies. All in all, it gives us an option to allocate our contract to a maximum of 11 strategies (10 index-based and one fixed). The company displays different types of crediting strategies across these indexes. The index allocation rate (participation rate) and the cap rates are the most important. Let’s understand all the strategies employed by F&G.

- Point to point with Participation Rate: The participation rate describes the annuitant’s participation percentage in a return of an index. For example, suppose the participation rate is 60%, and the index returned 10% over the agreed time (generally one-year point-to-point). In that case, the annuitant will be eligible for only 60% of the return, i.e., 6%.The formula for the same is (Participation Rate % X Index Return).

- Point to point with Cap: Cap rate is the most important terminology in an FIA. It means at what rate your interest-earning capacity is capped. For example, if an index returned 13% but your contract’s cap rate is 7%. In this situation, You will be eligible for an interest credit of 7% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest you can earn is the cap rate.

- Performance Trigger: A flat or positive index return triggers the declared interest rate to be credited to the contract value. If the index return is negative, no interest is credited, but there will be no loss, and the contract value will remain the same. The declared interest rate is set at contract issue and applies for the entire withdrawal charge period. In the above rate chart, the declared rate on gain for the S&P 500 Index is 2.25%. It means that if the S&P Index doesn’t go negative for a given 1-year period (even if the growth is 0% and not negative), the interest credited to the annuity will be 2.25% irrespective of the S&P 500 actual return.

- Spread and Par Rate: This indexing strategy applies BOTH participation rate and spread to determine the index interest credit. Let’s take an example where the participation rate is 60%, the spread is 2%, and in a given year, the index returned 10%. In this case, the interest credited to the annuity account would be 60% of 10% (PR), less 2% (SP), i.e., 4%. Ideally, You should never opt for the Spread + Participation index crediting strategy.

- One-Year Monthly Index Average: This strategy begins by recording the initial value of a selected index at the onset of the contract term. Subsequently, the index's value is captured monthly. After a one-year duration, these monthly index values are aggregated and then averaged by dividing the total by 12. This average, along with a set maximum rate (called a cap rate), helps decide the interest added to the annuity. The cap rate is like a ceiling, limiting the maximum interest one can earn.

When allocating premiums in a fixed-indexed annuity, individuals can distribute their money across these different indexing strategies. This means you can decide how much of your premium goes into each strategy, allowing for a tailored approach to potential growth and risk based on your financial goals and comfort level.

Performance Enhancement by Paying Charge: The F&G Safe Income Advantage annuity has an option to enhance Performance by paying a charge. Through this, you can opt to increase the Participation Rates, Cap Rates, and Declared Rates and/or reduce the spreads. In the above chart, you will notice that the indexing options with “charge” have higher participation rates and caps when compared to their “no charge” counterparts. At the time of writing this article, this charge was set at 1.25% annually. It is subtracted from the crediting option’s account value at the beginning of the interest crediting period.

You will notice that the cap rates and participation rates in the F&G Safe Income Advantage annuity are quite low (even for the charged strategies), while some of their other annuities, like F&G Accumulator Plus, offer one of the highest rates in the market. It is because this annuity’s core strength doesn’t lie in growth or accumulation but in its GLWB rider, which provides relatively higher guaranteed lifetime income payments that you cannot outlive (unless you make excess withdrawals). So, it doesn’t make sense to opt for this annuity if your purpose is growth or accumulation. We will discuss the GWLB rider offered by this annuity shortly.

Accessing your Money

Each year, you are entitled to a 10% free withdrawal of your contract value without incurring any charges, fees, or penalties.

Should your needs change unexpectedly and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies; although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for the F&G Safe Income Advantage annuity

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11+ |

|---|---|---|---|---|---|---|---|---|---|---|---|

Surrender Charge % | 12% | 11% | 10% | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 0% |

Any time a withdrawal incurs a surrender charge, a Market Value Adjustment (MVA) will be made. For withdrawals above the annual penalty-free withdrawal amount for the purpose of a required minimum distribution, waivers for terminal illness, healthcare, etc, F&G will waive any surrender charges and market value adjustments.

Once the surrender charge period ends, you can typically access your full contract value without fees. However, any withdrawal reduces both your contract value and, if applicable, the income base tied to optional riders, which may impact future guaranteed income.

An annuitant can also convert the contract into a stream of guaranteed income, known as annuitization. They can choose from various payout options designed to meet different needs.

Life Only – Provides income for as long as you live.

Joint and Survivor Life – Continues payments over two lifetimes, often used by couples.

Life with Period Certain (up to 30 years) – Pays income for life, but guarantees payments for a minimum period even if death occurs earlier.

Period Certain (up to 30 years) – Provides guaranteed payments for a set number of years, regardless of lifespan.

Single Life or Joint Life with Cash Refund – Ensures that if the annuitant(s) pass away before receiving payments equal to the original premium, the difference is refunded to beneficiaries.

Single Life or Joint Life with Installment Refund – Similar to the cash refund, but any remaining balance is paid out over time in installments.

These options allow flexibility in balancing lifetime income needs with legacy goals, offering a way to customize how and when funds are accessed in retirement.

Death Benefit

Greater of account value or minimum guaranteed surrender value (MGSV)

Riders

The most important part of this annuity discussion is the GWLB rider it comes with. This rider enables you to have a stream of guaranteed lifetime income payments that you cannot outlive.

An income base in the F&G Safe Income Advantage annuity is set up as the foundation for calculating future guaranteed withdrawal amounts. This base grows at a guaranteed compound annual growth rate of 7.2%, regardless of market conditions. Specifically, at the rate of 7.2%, if no withdrawals are made within the first 10 years, the income base is guaranteed to double.

Your rider’s Income Base is NOT the same as the annuity’s Account Value. The Account Value is available for withdrawal and is used to determine the Cash Surrender Value of your fixed-indexed annuity. On the other hand, think of the Income Base as a value that is used just to calculate your Lifetime Income Withdrawal amount. This value has no cash value or surrender value and cannot be withdrawn in a lump sum. The rider's charge is determined based on your Income Base; however, it is deducted from your account value.

A withdrawal from your Accumulated Value will reduce the rider’s Income Base (and thus the amount of future Lifetime Income Withdrawals) proportionally. For example, withdrawing 10 percent from your Accumulated Value will reduce your Income Base by 10 percent too.

Accessing your Lifetime Income Withdrawal

Your Lifetime Income Withdrawal depends on your income base at the time you start lifetime income withdrawals. Thus, the later you start your lifetime income withdrawals, the more your lifetime income withdrawal amount.

The F&G Safe Income Advantage offers three types of Lifetime Income Withdrawals:

- Level Income: Predictable income you can’t outlive. Consider it as a “retirement paycheck” that remains the same and is guaranteed for life.

- Earnings-Indexed Income: An opportunity to grow your lifetime income streamThis option gives you the opportunity to increase your income based on a percentage of the Interest Credits, if any, that are applied each year to your annuity’s Accumulated Value. If you elect this option, you’ll begin with an income amount that’s lower than the Level Income option.

- Inflation-Adjusted Income: The potential to grow your future purchasing powerWith this option, you have the potential to increase your income over time based upon movements in the most recently published CPI-U (Consumer Price Index-All Urban Consumers-not seasonally adjusted) inflation index. This may help increase your future purchasing power. If you elect this option, you’ll begin with an income amount that’s lower than the Level Income option.

To calculate the Maximum Lifetime Income, the following formula is used:

Income Base at the time of first withdrawal * Lifetime Income Withdrawal Percentage

The lifetime income withdrawal percentage is influenced by the age at which you commence lifetime income withdrawals, as well as the choice between single-life or joint withdrawals.

To illustrate level income, if a client invests $100,000 in this annuity and refrains from making withdrawals for ten years, the income base will ascend to $200,000. If the client is 70 years old when starting lifetime payments, with a hypothetical 6% lifetime withdrawal rate, they would be entitled to receive 6% of $200,000, which amounts to $12,000 annually for the rest of their life. This holds true even if the account value falls to zero, provided the depletion is not a result of excessive withdrawals. The guaranteed withdrawal percentage is determined at the time the policy is initiated.

Additionally, this rider comes with an impairment multiplier, which is discussed as follows:

- Impairment Multiplier: If the annuitant becomes impaired, as defined by the inability to complete two of six activities of daily living (ADLs), and has held the premium in the annuity for a minimum of 10 years without taking withdrawals or starting income, the GWLB rider activates an impairment multiplier. This multiplier doubles the annual payout amount that the annuitant would otherwise receive. For joint annuitants, the increase is by a factor of 1.5 instead of double.

- Qualification for Impairment: To qualify for the impairment benefits, specific conditions outlined in the annuity contract must be met. If qualified and the account value is above zero, the annuitant will receive the increased payments due to the impairment multiplier.

- Cost of Rider: This incurs a cost of 1.15% of the Income Base per year (as of the date of this article), with a guarantee that the fee will not surpass 1.50%.

Also, as with most annuities, the Safe Income Advantage has free in-built home health care, nursing home, and terminal illness waivers.

Nursing Home Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is confined to a Qualified nursing home for at least 60 consecutive days. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Terminal Illness Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is diagnosed with a terminal illness with a prognosis of 12 months or less. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Home Health Care Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is unable to perform at least 2 of 6 activities of daily living (for at least 60 days and is expected to continue for at least 90 days after requesting withdrawal. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician. While many annuities offer Nursing Home and Terminal Illness Waivers, the Home Health Care waiver is not something that many annuities offer.

Contract/Administrative Charge

The F&G Safe Income Advantage annuity does not impose any annual contract or administrative fees. Nevertheless, it includes a mandatory Guaranteed Withdrawal for Life Benefit (GWLB) rider, which incurs a cost of 1.15% of the Income Base per year (as of the date of this article), with a guarantee that the fee will not surpass 1.50%. The specifics of the rider are elaborated on in the subsequent section.

What Makes this Product Stand Out?

The F&G Safe Income Advantage is a good fixed-indexed annuity if your primary goal is getting lifetime income withdrawals. This annuity offers some of the features that not many fixed-indexed annuities offer. The ones that I like the most are:

- Guaranteed and certain growth of income baseThe F&G Safe Income Advantage ensures a guaranteed and predictable increase in your income base, promising to double it over a span of ten years. Regardless of market fluctuations, your income base will expand at consistent rates, allowing you to ascertain the amount of your lifetime income payouts at any given moment during the tenure of your annuity.

- Multiple options for lifetime income payoutsFrom the outset, clients have the flexibility to select how they wish to receive their income through the F&G Safe Income Advantage annuity, with three distinct options available. The first is level payments, which provide a steady income stream for life. The second and third options are increasing income strategies: one offers a guaranteed increment on each contract anniversary, and the other is tied to the Consumer Price Index for Urban Consumers (CPI-U), with the potential to increase annually up to a predetermined cap or remain constant, depending on inflation metrics.

- 2X Payments on Impairment: If the annuitant qualifies for impairment and the account value is greater than $0, lifetime income payments will double (or increase by 1.5 times for a joint contract).

- Penalty-free withdrawal on terminal illness or home or nursing care: This no-fee rider is automatically included for the annuity owner at issue and includes a Qualified Nursing Care, Terminal Illness, and Home Health Care waiver.

- Low minimum purchase amount: The minimum purchase amount for this annuity is low at $10,000. Many of the popular annuities available in the market require a high minimum purchase amount of anywhere between $25,000 and $100,000. The low minimum purchase requirement enables even small investors to purchase annuity products.

What I Don’t Like

This product is generally good on all fronts for people looking for income growth; still, there are some features that I believe could add more value for the annuitant. Some of the features that I don’t like about the policy are:

- High Surrender Charge - The surrender charge of the F&G Safe Income Advantage fixed-indexed annuity is on the higher side when compared to similar annuities in the market. If you think that there is a possibility that you will need to surrender the policy, the F&G Safe Income Advantage annuity may not be the perfect annuity for you.

- Not a Good Annuity for Growth or Accumulation - The Safe Income Advantage may not be optimal for growth or accumulation objectives due to its relatively low cap and participation rates, making it less suitable if your aim is to maximize wealth buildup.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Fidelity National Financial

F&G is a subsidiary of Fidelity National Financial. Fidelity National Financial is one of the oldest title insurance companies and has been in the business for over 18 decades. It is a Fortune 500 company ranking #313.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

AM Best | A (3rd of 13 ratings) |

Moody’s | A3 (7th of 21 ratings) |

S&P | A- (7th of 21 ratings) |

Fitch | A- (7th of 21 ratings) |

Fidelity has managed to maintain strong ratings for many years. Fidelity is considered to be strong and stable financially. As of year-end 2024, some of the other financial highlights for Fidelity include its:

- $15.3 billion in total sales / direct written premium

- $50 billion of a total investment portfolio

- $51.6 billion Assets Under Management (AUM)

- $85 billion in total assets

- $622 million in net income

Thus, going by the operating history and financial numbers, we can safely gauge that you can trust your savings with F&G.

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. So, it’s very important to have a stream of income that can grow safely and steadily. This not only helps you mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

The F&G Safe Income Advantage stands out as an annuity that ensures a secure and predictable income for life, lessening financial risk. It provides a fixed stream of income in your retirement years with benefits such as tax deferral, principal protection, and a market index-linked income option without market risk exposure. For those prioritizing guaranteed and stable lifetime income streams that cannot be outlived, the F&G Safe Income Advantage annuity might be a fitting choice to consider.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. Delve deeper into our extensive reviews.