Introduction

Fixed Indexed Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index, such as the S&P 500. Fixed Indexed Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to mis-sell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

In this article, we will discuss in depth the F&G Prosperity Elite (with Protection Package) Fixed Indexed Annuity. The F&G Prosperity Elite (with Protection Package) is a deferred, fixed-indexed annuity with a primary focus on providing lifetime income payments, protecting principal, and facilitating legacy planning. This annuity features a range of effective indexing options capable of generating relatively high index interest credits for your account. Following extensive research and thorough due diligence, I present a comprehensive and unbiased analysis of this plan.

The review of the F&G Prosperity Elite (with Protection Package) Fixed Indexed Annuity will be broken into multiple subcategories:

- Product Description

- Product Policy

- Rates and Costs

- Accessing your Money

- Riders

- What Makes This Product Stand Out?

- What I Don’t Like

- Company Details

- Conclusion

Product Description

The F&G Prosperity Elite is a Fixed Indexed Annuity (FIA) plan that offers the annuitant (annuity investor) an opportunity to earn a portion of market index-linked return without having to incur the risk of market downside. This is a suitable plan for individuals seeking a fixed indexed annuity designed to grow and protect their retirement savings, while also offering the option to leave a legacy for their beneficiary(ies).

Let’s have a look at the high-level fine print of the F&G Prosperity Elite Fixed Indexed Annuity, and then we will discuss each point in detail.

| Product Name | F&G Prosperity Elite |

|---|---|

Package Options (Annuitant Chooses Any 1) |

|

Issuing Company | |

AM Best Rating | A (3rd of 13 ratings) |

Withdrawal Charge Period(s) | 7,10, and 14 years |

Maximum Issue Age | 85 Years |

Minimum Initial Purchase Amount | $10,000 |

Surrender Charge Schedule | Varies as per withdrawal-charge period opted |

Crediting Period and Strategies |

|

Plan Types |

|

Indexes |

|

Free Withdrawals | 10% of the annuity’s Accumulated Value per year, starting from year 2 |

Benefits |

|

Death Benefit | Two Options:

(It is covered in detail in the review) |

Surrender Value | Account Value (less any withdrawal charges/MVA) |

RMD Friendly | Yes |

The F&G Prosperity Elite Fixed Indexed Annuity offers the option to select between two distinct packages: (i) the Enhancement Package and (ii) the Protection Package. Essentially, each package transforms this annuity into a uniquely different product.

The enhancement package is focused more on the death benefit, and the protection package is a blend of both lifetime income withdrawals and death benefits. Both packages have a different cost structure. We have discussed the F&G Prosperity Elite (with Enhancement Package) in an earlier review.

The F&G Prosperity Elite Fixed Indexed Annuity is almost identical for all three policy tenures, except for the crediting strategies and surrender charge schedule. For ease of discussion and better clarity, we will focus on the F&G Prosperity Elite 10 with Protection Package (unless otherwise specified) for the remainder of this article.

Product Policy

How does the F&G Prosperity Elite (with Protection Package) Annuity policy work?

Any annuitant (maximum age at the time of policy issue: 85) can purchase the F&G Prosperity Elite (with Protection Package) Fixed Indexed Annuity with a minimum initial purchase amount of $10,000, and in return, they will earn market index interest credits (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, various events may trigger earnings credits, including free withdrawals, long-term care events, terminal illness, or injury events, or when a death benefit is payable.

Account Value - As soon as the annuitant makes a premium payment, an “Account Value” is created, equal to your total premium paid plus an 12% premium bonus (vested over a period of 10 years) plus any interest earned from your chosen allocations, less withdrawals adjusted by any Market Value Adjustments (MVAs), and charges for the Protection Package.

Income Base Account - Another account, an Income base account, is established, which is the higher of:

- Initial Contribution Plus 18% Bonus: Consists of the initial premium plus an 18% bonus, applied exclusively to the initial premium. It's important to note that this amount is reduced proportionally for any withdrawals, and the bonus rate is subject to change.

- Initial Premium Increased by the Enhanced Guaranteed Minimum Withdrawal Benefit (EGMWB) Rider rate, compounding at 10% annually for up to 10 years or until the start of withdrawal payments, whichever occurs first. Similar to the initial contribution, this growth is adjusted proportionally for withdrawals, and the compounding rate is subject to change.

- Account Value (including vested premium bonus)

Additionally, a Death Benefit Base account is established, comprising the greatest of (i) account value (including the vesting bonus), (ii) the initial premium plus a vesting bonus applied exclusively to the initial premium. This account accrues at a simple interest rate of 5% annually over 10 years, or until reaching the age of 85 (or the age of the older owner in cases of joint ownership), or upon the death of the annuitant, whichever occurs first. The sole purpose of this account is to determine the lump sum payment to the annuitant’s beneficiary in the event of the annuitant’s demise. The beneficiary can choose the death benefit payment option from one of the following two options: 1) Paid as a lump sum, or 2) Paid as payments over at least 5 years.

We will discuss the income benefit and the death benefit in detail in the “Riders” part of this review.

Now, let’s see how the "account value" earns market interest credits in this annuity.

Interest Indexing Options

The F&G Prosperity Elite annuity offers the annuitant the ability to choose from one or more of the five indexes to determine their earnings crediting formula. They are the S&P 500 Index, Balanced Asset 5 Index, Barclays Trailblazer Sectors 5 Index, GS Global Factor Index, and Gold Commodity Index. The annuity offers annuitants the choice of multiple strategies tied to these indexes. Besides this, it also provides an option to choose from a fixed interest rate of 3.75%. All in, the annuitant gets to choose from 11 strategies (10 index-based and 1 fixed. Let’s discuss each available index briefly:

1. S&P 500 Index

The S&P 500 index is one of the most popular and oldest indexes in the world. It tracks 500 large-cap publicly traded stocks listed in the United States. It is a reliable index and has often succeeded in the test of time.

2. Barclays Trailblazer Sectors 5 Index

Trailblazer aims to track a diversified portfolio of assets with the highest return potential for a given level of risk. Trailblazer utilizes 14 ETFs that provide diversified exposure to the stock and bond markets, plus a cash component. The ETFs are the growth engines of the portfolio and provide the potential for earning returns. However, since stocks and bonds carry risks, so do the ETFs.

The Barclays Trailblazer Sectors 5 Index was created in July 2016 and targets a 5% annualized realized volatility. While these volatility controls may result in less fluctuation in rates of return when compared with indexes that don’t use them, they also may reduce the overall rate of return compared with those other indexes.

3. Balanced Asset 5 Index

The Balanced Asset 5 Index takes a classic approach to its portfolio construction with a 60/40 allocation. Combined with rebalancing and volatility control features, the index seeks to provide excess returns across market conditions through a tactical combination of equity and fixed-income ETFs.

The Balanced Asset 5 Index was created in June 2020 and targets a 5% annualized realized volatility. While these volatility controls may result in less fluctuation in rates of return when compared with indexes that don’t use them, they also may reduce the overall rate of return compared with those other indexes.

4. GS Global Factor Index

The GS Global Factor Index, formulated by Goldman Sachs International, dynamically allocates between Global Equities, influenced by factors like Value and Momentum, and U.S. Bonds, symbolized by 10-year U.S. Treasury Futures. A non-yielding Hypothetical Cash Position is also included. Each month, the Index adjusts asset volatility multipliers based on an economic signal. During rebalancing, it aims for equal risk contributions from assets, adjusting for market indicators. Weights are averaged over ten days and tweaked to meet a 5% Volatility Target with a 150% leverage cap. Again, while these volatility controls may result in less fluctuation in rates of return when compared with indexes that don’t use them, they also may reduce the overall rate of return compared with those other indexes.

5. Gold Commodity Index

The Gold Commodity Index tracks the price performance of gold, offering investors a standardized benchmark to measure the market value of this precious metal. Typically composed of gold futures contracts and related financial instruments, such indices reflect the movements in gold prices, influenced by factors like global economic conditions, currency fluctuations, and market demand for gold.

Note: In addition to allocating the funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest. These Fixed Rates tend to change from time to time. The Fixed Value Rate at the time of writing this article was 3.75%.

Rates and Costs

The earnings crediting formula

The earnings crediting formula is the most important part of this annuity discussion. It is essential to note that we don’t simply receive the index return credited to our annuity. There are a few rate-limiting mechanisms (in the form of cap rates, participation rates, and triggers) that the company has in place that affect our earnings. These rates are subject to change over time, and you can always verify the updated rates with the assistance of your advisor. You can also check out their website for the latest rates.

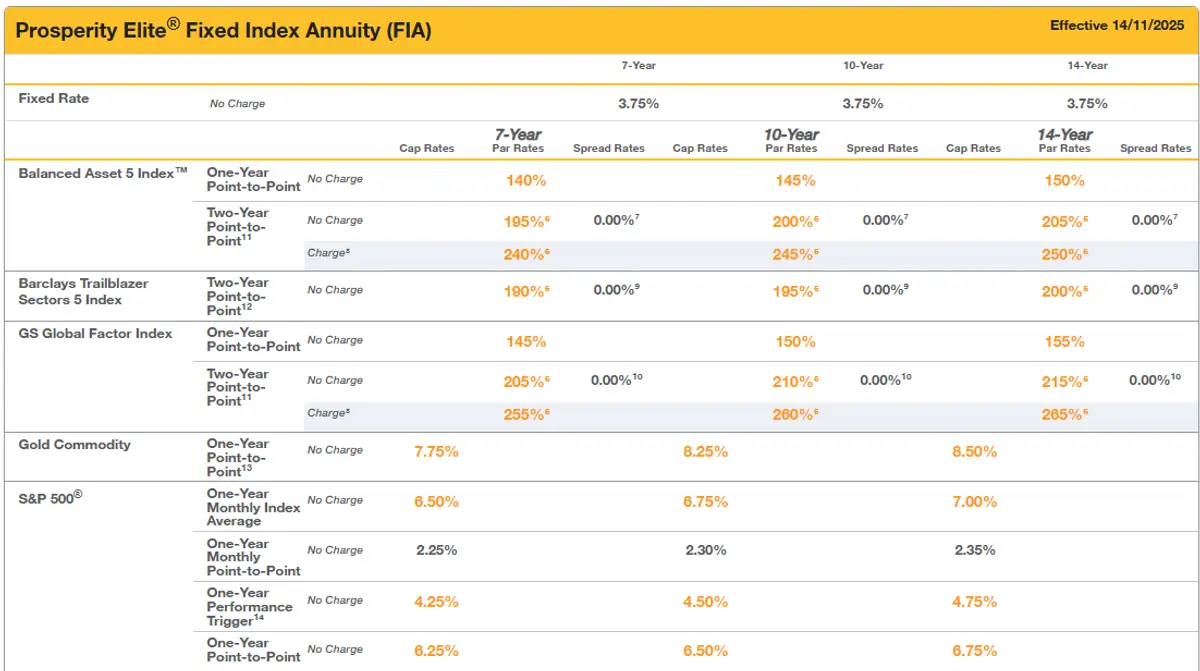

Let’s take a look at the F&G Prosperity Elite rate sheet (as of December 2025) to understand how earnings are determined.

The first thing to note is that we have an option to choose between five indexes, and each index has multiple strategies. All in all, it gives us an option to allocate our contract to a maximum of 11 strategies (10 index-based and one fixed). The company displays multiple types of rates across all strategies. The index allocation rate (participation rate) and the cap rates are the most important.

- Point to point with Participation Rate: The participation rate describes the annuitant’s participation percentage in a return of an index. For example, suppose the participation rate is 60%, and the index returned 10% over the agreed time (generally one year). In that case, the annuitant will be eligible for only 60% of the return, i.e., 6%. The formula for this is (Participation Rate% × Index Return).

- Point to point with Cap: Cap rate is the most important terminology in an FIA. It means at what rate your interest-earning capacity is capped. For example, if an index returned 13% but your contract’s cap rate is 7%. In this situation, You will be eligible for an interest credit of 7% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest you can earn is the cap rate.

- Spread and Par Rate: This indexing strategy applies BOTH the participation rate and the spread to determine the index interest credit. Let’s take an example where the participation rate is 60%, the spread is 2%, and in a given year, the index returned 10%. In this case, the interest credited to the annuity account would be 60% of 10% (PR), less 2% (SP), i.e., 4%. Ideally, you should never opt for the Spread + Participation index crediting strategy.

- Performance Trigger Rate: A flat or positive index return triggers the declared interest rate to be credited to the contract value. If the index return is negative, no interest is credited, but there will be no loss, and the contract value will remain the same. The declared interest rate is set at contract issue and applies for the entire withdrawal charge period. In this case, the declared rate on gain for the S&P 500 Index is 4.50%. It means that if the S&P Index doesn’t go negative for a given 1-year period (even if the growth is 0% and not negative), the interest credited to the annuity will be 4.50% irrespective of the S&P 500's actual return. This option is advantageous if you anticipate that the index will experience minimal growth but will not decline.

- One-Year Monthly Index Average: This strategy begins by recording the initial value of a selected index at the onset of the contract term. Subsequently, the index's value is captured monthly. After a one-year duration, these monthly index values are aggregated and then averaged by dividing the total by 12. This average, along with a set maximum rate (called a cap rate), helps decide the interest added to the annuity. The cap rate is like a ceiling, limiting the maximum interest one can earn.

When allocating premiums in a fixed-indexed annuity, individuals can distribute their money across these different indexing strategies. This means you can decide how much of your premium goes into each strategy, allowing for a tailored approach to potential growth and risk based on your financial goals and comfort level.

Performance Enhancement by Paying a Charge: The F&G Prosperity Elite annuity has an option to enhance Performance by paying a charge. Through this, you can opt to increase the Participation Rates, Cap Rates, and/or reduce the spreads. In the above chart, you will notice that the indexing options with “charge” have higher participation rates and caps when compared to their “no charge” counterparts. At the time of writing this article, this charge was set at 1.25% annually. It is subtracted from the crediting option’s account value at the beginning of the interest crediting period.

The F&G Prosperity Elite offers good rates for accumulation. The cap rates that the annuity provides, even on indexes like the S&P 500, are on the higher side when compared to other similar annuities.

If I were to choose the indexing strategies, I would have opted for one or many of the following strategies:

- S&P 500 1-year point-to-point with Cap

- S&P 500 1-year monthly index average with Cap

- S&P 500 1-year declared rate on gain

- Balanced Asset 5 2-year point-to-point with participation rate

- GS Global Factor Index 2-year point-to-point with participation rate

There are very few Indexed annuities that offer high caps and par rates. You should be aware that insurance companies frequently adjust their rates, so it's essential to monitor the latest rates. You should consult a trusted financial advisor to determine which indexes and strategies best suit your needs.

Accessing your Money

Each year, you are entitled to a 10% free withdrawal of your contract value without incurring any charges, fees, or penalties.

Should your needs change unexpectedly and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies; although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for the F&G Prosperity Elite annuity:

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15+ |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

14-year Surrender Charge % | 14.75% | 13.75% | 12.75% | 11.75% | 10.75% | 10% | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 2% | 0% |

10-year Surrender Charge % | 12% | 11% | 10% | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 0% | ||||

7-year Surrender Charge % | 10% | 9% | 8% | 7% | 6% | 5% | 4% | 0% |

Any time a withdrawal incurs a surrender charge, a Market Value Adjustment (MVA) will be made. For withdrawals above the annual penalty-free withdrawal amount for the purpose of a required minimum distribution, F&G will waive any surrender charges and market value adjustments.

Note that this surrender charge schedule is only valid for the F&G Prosperity Elite annuity product for select states. For complete details about each state, you may contact your trusted financial advisor.

Once the surrender charge period ends, you can typically access your full contract value without fees. However, any withdrawal reduces both your contract value and, if applicable, the income base tied to optional riders, which may impact future guaranteed income.

An annuitant can also convert the contract into a stream of guaranteed income, known as annuitization. They can choose from various payout options designed to meet different needs.

Life Only – Provides income for as long as you live.

Joint and Survivor Life – Continues payments over two lifetimes, often used by couples.

Life with Period Certain (up to 30 years) – Pays income for life, but guarantees payments for a minimum period even if death occurs earlier.

Period Certain (up to 30 years) – Provides guaranteed payments for a set number of years, regardless of lifespan.

Single Life or Joint Life with Cash Refund – Ensures that if the annuitant(s) pass away before receiving payments equal to the original premium, the difference is refunded to beneficiaries.

Single Life or Joint Life with Installment Refund – Similar to the cash refund, but any remaining balance is paid out over time in installments.

These options allow flexibility in balancing lifetime income needs with legacy goals, offering a way to customize how and when funds are accessed in retirement.

Contract/Administrative Charge

The F&G Prosperity Elite annuity levies no annual contract or administrative fees. However, the Protection Package comes with two riders: 1) Enhanced Guaranteed Minimum Death Benefit Rider (EGMDB), which costs 0.6% of the death benefit, and 2) Enhanced Guaranteed Minimum Withdrawal Benefit Rider (EGMWB), which costs 0.95% of the income base on each contract anniversary.

Benefits and Riders

The main highlight of the F&G Prosperity Elite (with Protection Package) Fixed Indexed Annuity is the Guaranteed Minimum Death Benefit Rider (GMDB) and Enhanced Guaranteed Minimum Death and Withdrawal Benefit Rider that it offers.

Enhanced Guaranteed Minimum Death Benefit Rider (EGMDB)

This rider offers the beneficiary(s) of the annuitant access to an enhanced death benefit. A Death Benefit Base account is established, comprising the higher of either the account value ( including the total vesting bonus) or initial premium plus a vesting bonus (applied exclusively to the initial premium) growing at a simple interest rate of 5% annually over 10 years, or until reaching the age of 85 (or the age of the older owner in cases of joint ownership), or upon the death of the annuitant, whichever occurs first.

The beneficiary can choose the death benefit payment option from one of the following two options: 1) Paid as a lump sum and 2) Paid as payments over at least 5 years.

Lumpsum Payment Option: Calculated as the greatest of:

- Death Benefit Base

- Minimum Guaranteed Surrender Value

Multi-Year Payment Option: Based on greater of

- Minimum Guaranteed Surrender Value

- Initial premium plus 18% bonus on the initial premium only

- Initial premium plus 10% compound interest for up to 10 years, until age 85 (older owner if joint owners) or the date of death or beginning of income withdrawals, whichever is first

Cost: The EGMDB is the first of the two mandatory riders of the protection package, and it costs 0.6% of the highest guaranteed death benefit on each contract anniversary.

Enhanced Guaranteed Minimum Withdrawal Benefit Rider (EGMWB)

This rider offers the annuitant to receive a scheduled income for life that you cannot outlive.

An Income base account is established, which is calculated as the greatest of:

- Initial Contribution: Consists of the initial premium plus an 18% bonus, applied exclusively to the initial premium. It's important to note that this amount is reduced proportionally for any withdrawals, and the bonus rate is subject to change.

- Initial Premium Increased by the Enhanced Guaranteed Minimum Withdrawal Benefit (EGMWB) Rider rate, compounding at 10% annually for up to 10 years or until the start of withdrawal payments, whichever occurs first. Similar to the initial contribution, this growth is adjusted proportionally for withdrawals, and the compounding rate is subject to change.

- Account Value (including vested premium bonus)

- Minimum Guaranteed Surrender Value

The lifetime income withdrawal amount is calculated as a percentage of the income base that we just discussed. The starting percentages are as follows:

The initial percentages are set at the beginning, and after the age of 50, these percentages gradually increase with each year you postpone the start of your lifetime income payments. For instance, if you begin receiving lifetime income payments at the age of 50, you are entitled to an annual payment that is 3.3% of your income base.

Impairment Multiplier: If the annuitant meets qualifications for impairment and the account value > $0, payments increase 2X (1.5X if joint contract). The following conditions should be met for the impairment multiplier:

- The Enhanced Guaranteed Minimum Withdrawal Benefit Rider has been in effect for three years; five years in HI and IL.

- The annuitant is unable to perform at least 2 of 6 activities of daily living, certified by a licensed physician, and requires the care of a licensed caregiver

- The impairment began at least one year after the contract issue and is expected to be permanent

- The annuitant is 60 years or older and a U.S. resident

Cost: This EGMWB is the second of the two mandatory riders of the protection package, and it costs 0.35% of the income base account on each contract anniversary.

Also, as with most annuities, the Prosperity Elite has free in-built home health care, nursing home, and terminal illness waivers.

- Nursing Home Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is confined to a Qualified nursing home for at least 60 consecutive days. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

- Terminal Illness Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is diagnosed with a terminal illness with a prognosis of 12 months or less. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

- Home Health Care Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is unable to perform at least 2 of 6 activities of daily living (for at least 60 days and is expected to continue for at least 90 days after requesting withdrawal. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician. While many annuities offer Nursing Home and Terminal Illness Waivers, the Home Health Care waiver is not something that many annuities offer.

What Makes This Product Stand Out?

The F&G Prosperity Elite is an ideal fixed-indexed annuity for lifetime income payments and legacy planning. This annuity offers some of the features that not many fixed-indexed annuities offer. The ones that I like the most are:

- Good Indexing Options - The F&G Prosperity Elite annuity offers very good Indexing crediting strategies on some of the good-performing indexes, such as the S&P 500 Index.

- A Blend of Income and Death Benefits - This annuity features riders that uniquely combine income and death benefits. Typically, annuities excel in offering either robust income options or advantageous death benefits. However, this particular annuity stands out by effectively catering to both needs.

- Penalty-free withdrawal on terminal illness or home or nursing care - This no-fee rider is automatically included for the annuity owner at issue and includes a Qualified Nursing Care, Terminal Illness, and Home Health Care waiver.

- Low minimum purchase amount - The minimum purchase amount for this annuity is low at $10,000. Many of the popular annuities available in the market require a high minimum purchase amount of anywhere between $25,000 and $100,000. The low minimum purchase requirement enables even small investors to purchase annuity products.

- Premium Bonus - Even with relatively decent cap and participation rates, this plan offers a 12% bonus on the premiums paid in the first year. This bonus vests over the withdrawal charge period.

What I Don’t Like

This product is generally good on all fronts for people looking for income and death benefits; still, there are some features that I believe could add more value for the annuitant. Some of the features that I don’t like about the policy are:

- Higher Surrender Charge - The surrender charge of the F&G Prosperity Elite fixed indexed annuity is on the higher side when compared to similar annuities in the market. If you think that there is a possibility that you will need to surrender the policy, the F&G Prosperity Elite annuity may not be the perfect annuity for you.

- The Costs Associated with the Riders are Marginally Higher - the death benefit rider incurs a fee of 0.6% of the highest death benefit annually, whereas the income benefit rider charges 0.35% of the income base each year. In my assessment, these riders are somewhat expensive, suggesting that the company might have had the opportunity to price them more competitively.

- Complex to Understand - The Prosperity Elite FIA includes multiple riders with several moving parts, which can make the product somewhat complex to understand. You should carefully review how each rider works, along with its associated costs, before deciding whether to add it to your contract.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Fidelity National Financial

F&G is a subsidiary of Fidelity National Financial. Fidelity National Financial is one of the oldest title insurance companies and has been in the business for over 18 decades. It is a Fortune 500 company ranking #313.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

AM Best | A (3rd of 13 ratings) |

Moody’s | A3 (7th of 21 ratings) |

S&P | A- (7th of 21 ratings) |

Fitch | A- (7th of 21 ratings) |

Fidelity has managed to maintain strong ratings for many years. Fidelity is considered to be strong and stable financially. As of year-end 2024, some of the other financial highlights for Fidelity include its:

- $15.3 billion in total sales / direct written premium

- $50 billion of a total investment portfolio

- $51.6 billion Assets Under Management (AUM)

- $85 billion in total assets

- $622 million in net income

Thus, by using the operating history and financial numbers, we can safely gauge that you can trust your savings with F&G.

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. So, it’s very important to have a stream of income that can grow safely and steadily. This not only helps you mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

The F&G Prosperity Elite (with Protection Package) annuity is tailored for individuals looking to enhance their savings with reduced risk. As a fixed-indexed annuity, it provides the benefits of tax deferral, principal protection, and a risk-free method to participate in the market index. If you are exploring options for a Fixed Indexed Annuity with a primary focus on securing lifetime income payments that are guaranteed for life and aiming to leave a legacy, the F&G Prosperity Elite annuity could be worth considering.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. Delve deeper into our extensive reviews here.