Introduction

Fixed Index Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index. Fixed Index Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to missell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

This article provides an in-depth review of the Prosperity Life WealthSecure Pro Fixed Indexed Annuity. The Prosperity Life WealthSecure Pro Fixed Indexed Annuity is a deferred fixed-indexed annuity designed for individuals seeking tax-deferred growth and downside protection, with a core focus on addressing multiple client needs: tax-deferred accumulation, creating a stream of lifetime income that cannot be outlived, increasing income payments in the event of extended care needs. While this annuity is not optimized for leaving a legacy (in the form of enhanced death benefit), it performs well in accumulation, delivering secure lifetime income and care features. After extensive research and due diligence, I have provided an in-depth and unbiased analysis of this plan.

The review of the Prosperity Life WealthSecure Pro Fixed Indexed Annuity will be broken into multiple subcategories:

- Product Description

- Product Policy

- Rates and Costs

- Riders

- What Makes This Product Stand Out?

- What I Don’t Like

- Company Details

- Conclusion

Product Description

The Prosperity Life WealthSecure Pro is a Fixed Indexed Annuity (FIA) plan that offers the annuitant (annuity investor) an opportunity to earn a market index-linked return without having to incur the risk of market downside. This is a suitable plan for people who are looking for a fixed-indexed annuity that offers tax-deferred growth and downside protection with a core focus on accumulation and lifetime income benefits.

Let’s have a look at the high-level fine print of the Prosperity Life WealthSecure Pro Fixed Indexed Annuity, and then we will discuss each point in detail.

| Product Name | WealthSecure Pro |

|---|---|

Issuing Company | Prosperity Life Insurance Group |

AM Best Rating | A- (4th of 13 ratings) |

Withdrawal Charge Period(s) | 5, 7, and 10 years |

Maximum Issue Age | 85 Years |

Minimum Initial Purchase Amount | $2,000 |

Crediting Period and Strategies |

|

Plan Types |

|

Indexes |

|

Free Withdrawals | 10% of the annuity’s Accumulated Value per year |

Death Benefit | Upon the annuitant’s death, the beneficiary will get the Account Value without any surrender charges |

Free Benefits | Nursing Home Confinement and Terminal Illness Waivers |

Riders | The annuitant can choose from lifetime income and enhanced lifetime income riders |

Surrender Value | Account Value less any withdrawal charges/MVA |

Minimum Guaranteed Surrender Value | 87.5% of premium paid grown at 1% minus withdrawals and enhanced benefit fees |

RMD Friendly | Yes |

The features of the Prosperity Life WealthSecure Pro Fixed Indexed Annuity remain consistent across all three term durations, with the only variations being the rates and the withdrawal charge schedule associated with each term.

Product Policy

How does the Prosperity Life WealthSecure Pro Fixed Indexed Annuity policy work?

Any annuitant (maximum age at the time of policy issue: 85) can purchase the Prosperity Life WealthSecure Pro Fixed Indexed Annuity with a minimum initial purchase amount of $2,000, and in return, they will earn market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, there are various events that may trigger earnings credit: On free withdrawals, for a long-term care event or terminal illness or injury event, or when a death benefit is payable. All these interest credits are credited to a bucket called “Account Value.” This bucket is your annuity account balance, and all your withdrawals take place from it. The annuity also offers guaranteed lifetime income payments and care benefits, a feature that will be explored in greater detail in a subsequent section of this review.

The Prosperity Life WealthSecure Pro Fixed Indexed Annuity offers the annuitant to choose from one or more of the three indexes (S&P 500 Index, Fidelity US Quality Factor Index 5% ER, and Fidelity Stock for Inflation Index 5% ER) to determine their earnings crediting formula. The S&P 500 index has 2 crediting strategies, the Fidelity US Quality Factor Index has 5 strategies, and the Fidelity Stocks for Inflation Index has 5 strategies. The plan also offers a fixed-rate guaranteed interest strategy to choose from, making a total of 13 strategy options. We will discuss each available index briefly:

1. S&P 500 Index

The S&P 500 index is one of the most popular and oldest indexes in the world. It tracks 500 large-cap publicly traded stocks listed in the United States. It is a reliable index and has often succeeded in the test of time. It is very important to note that, similar to most other annuities, the Prosperity Life WealthSecure Pro Fixed Indexed Annuity offers the S&P 500 index with cap rates and participation rates in place, meaning that your interest-earning capacity is capped. These rates change frequently; I will discuss the rates in detail shortly.

2. Fidelity U.S. Quality Factor Index 5% ER

The Fidelity U.S. Quality Factor Index 5% ER is a rules-based strategy that adaptively allocates exposure between an equity portfolio and a fixed income component. The equity portion tracks the performance of the Fidelity U.S. Quality Factor Index, which focuses on large- and mid-cap U.S. companies with high-quality profiles. The fixed income component includes U.S. 10-year Treasury Note futures and cash. The index employs a volatility-targeting mechanism aiming to maintain a 5% annualized volatility. It adjusts exposure daily, potentially increasing allocation to the base index up to 150% when volatility is low, or decreasing it and allocating to cash when volatility is high. The index also incorporates a daily fee of 0.50% per annum.

3. Fidelity Stocks for Inflation Index 5% ER

The Fidelity Stocks for Inflation Index 5% ER is designed to provide exposure to large- and mid-cap U.S. companies that are well-positioned to perform in inflationary environments. It combines stocks with attractive valuations, high-quality profiles, and positive momentum signals, while tilting towards sectors that historically outperform during periods of inflation. Like its Quality Factor counterpart, this index also employs a volatility-targeting mechanism aiming for 5% annualized volatility. It adaptively allocates between its equity component (tracking the Fidelity Stocks for Inflation Factor Index) and a fixed income component consisting of U.S. 10-year Treasury Note futures and cash. The index adjusts its exposure daily based on market conditions and incorporates a 0.50% annual fee.

The Fidelity US Quality Factor Index 5% ER and Fidelity Stock for Inflation Index 5% ER are volatility-controlled indices designed to reduce market fluctuations. While they help minimize volatility, they also limit the potential upside of the index. Since a fixed indexed annuity (FIA) already protects against market downside, allocating funds to a volatility-controlled index effectively sacrifices some upside potential. To compensate for this, insurers typically offer higher participation rates for these indexes. However, unless the participation rate is significantly high, it’s advisable to avoid allocating a large portion of your premium to these indices or only dedicate a small portion to them as part of a diversified strategy.

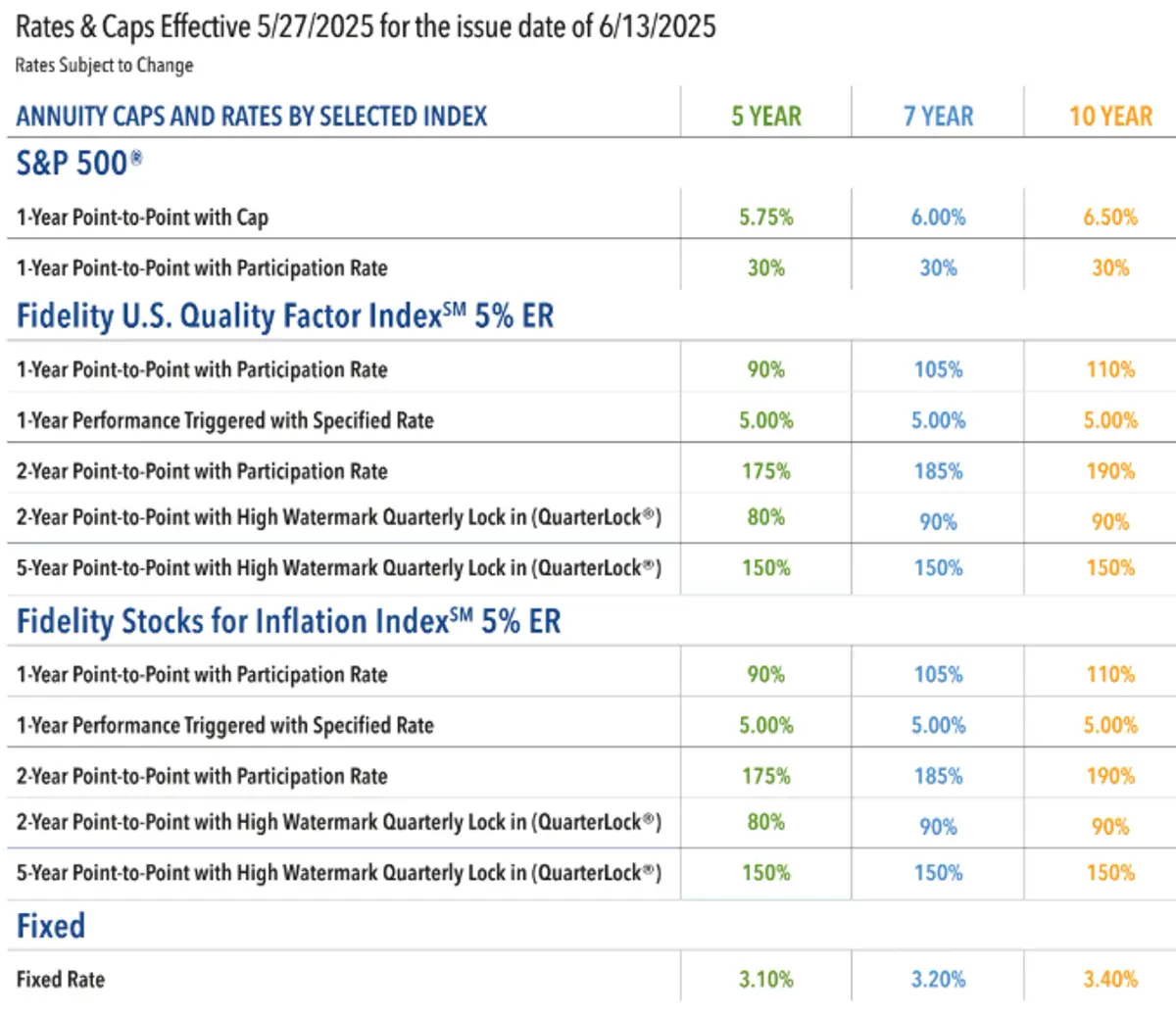

Note: In addition to allocating the funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest. These Fixed Rates change from time to time. The 1st year Fixed Value Rate for the 5, 7, and 10-year withdrawal charge period at the time of writing/updating this article was 3.10%, 3.20%, and 3.40%, respectively

It is very important to note that the Prosperity Life WealthSecure Pro Fixed Indexed Annuity comes with cap rates, participation rates, and performance-triggered rates for these indexes, meaning that you will be credited only a part of the index return to your annuity. These rates change frequently; I will discuss more on these rates more shortly.

Rates and Costs

The earnings crediting formula

The earnings crediting formula is the most important part of this annuity discussion. It is important to know that we don’t simply get the index return credited to our annuity. There are a few rates, caps, and other rates that the company has in place that affect your earnings. These rates tend to change over time, and the updated rates can always be checked through your trusted financial advisor.

Let’s have a look at the Prosperity Life WealthSecure Pro Fixed Indexed Annuity rate sheet (as of June 2025) to understand how the earnings are determined.

From the above rate chart, you will notice that there are 13 interest crediting options (1 fixed and 12 indexed). Let’s have a look at different terms that are used by the company in the Prosperity Life WealthSecure Pro Fixed Indexed Annuity chart rate:

- Point-to-point with Participation Rate (PR): The participation rate describes the annuitant’s participation percentage in a return of an index. For example, suppose the participation rate is 150%, and the index returned 4% over the agreed time. In that case, the annuitant will be eligible for 150% of the return, i.e., 6%.

- Point-to-point with Cap Rates: This refers to the rate at which your interest-earning capacity is capped. For example, if an index returns 12% but the contract’s cap rate is 6%, the annuitant will be eligible for an interest credit of 6% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest that can be earned is the cap rate.

- Performance-Triggered Index Option with Specified Rate: A flat or positive index return triggers the declared interest rate to be credited to the contract value. If the index return is negative, no interest is credited, but there will be no loss, and the contract value will remain the same. The declared interest rate is set at contract issue and applies for the entire withdrawal charge period. If the change in the value of the index during one year is zero or positive, the declared index gain interest rate is multiplied by the option’s account value to determine the index interest credits. The index interest credits pursuant to this option will never be less than zero. In this case, the performance-triggered rate for the Fidelity US Quality Factor Index is 5.00%. It means that if the Fidelity Index doesn’t go negative for a given 1-year period (even if the growth is 0% and not negative), the interest credited will be 5.00% irrespective of the Fidelity's actual return.

- High Watermark Quarterly Lock-In (QuarterLock®) Feature: The High Watermark Quarterly Lock-In (QuarterLock®) is a unique feature available across the 2-year and 5-year indexed terms for both the Fidelity U.S. Quality Factor Index 5% ER and the Fidelity Stocks for Inflation Index 5% ER. This feature helps maximize interest-earning potential by automatically locking in the highest quarterly anniversary index value during the indexed term. Once a quarterly high point is captured, it is locked in and protected for the remainder of the term, safeguarding gains even if the index experiences a decline afterward. This is particularly useful in volatile markets, as it ensures that mid-term index decreases do not erode previously earned gains.

- Fixed Account Rate: If you opt for a fixed account rate, you simply earn the fixed rates for a particular period specified by the company before your policy begins. These rates are usually low/at par as compared to other fixed avenues, such as CDs and MYGAs, so you should avoid fixed rates in a general scenario. The first-year fixed rate on the 5-year withdrawal charge policy at the time of writing this article was 3.10%.

When allocating premiums in a fixed-indexed annuity, individuals can distribute their money across these different indexing strategies. This means you can decide how much of your premium goes into each strategy, allowing for a tailored approach to potential growth and risk based on your financial goals and comfort level.

Among these indexes, I prefer the 1-year S&P 500 Index point-to-point cap rate strategy, the 2-year point-to-point Fidelity U.S. Quality Factor Index, and the 2-year point-to-point Fidelity Stocks for Inflation Index due to their generous cap and participation rates. I would avoid the 1-year point-to-point with participation rate on the S&P 500 and the 1-year strategies on the Fidelity indexes because of their relatively lower return earning potential.

The Prosperity Life WealthSecure Pro Fixed Indexed Annuity offers competitive cap rates, participation rates, and fixed rates, making it an attractive option for accumulation. Its primary appeal lies in its ability to balance growth potential with optional riders, available for an additional fee, that provide Guaranteed Lifetime Withdrawal Benefits (GLWB) and enhanced care withdrawal features. These riders offer flexibility for policyholders seeking guaranteed income and added care benefits. We will discuss these riders in detail in the next section.

Free Withdrawal and Surrender/Early Withdrawal Charges

Each year, you are allowed a 10% free withdrawal of your contract value without incurring charges, fees, or penalties.

Should your needs change unexpectedly, and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies, although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for the Prosperity Life WealthSecure Pro Fixed Indexed Annuity:

| Contract Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11+ |

|---|---|---|---|---|---|---|---|---|---|---|---|

10-Year Plan | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 2% | 1% | 0.5% | 0% |

7-Year Plan | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 0% | |||

5-Year Plan | 9% | 8% | 7% | 6% | 5% | 0% |

Market Value Adjustments - In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period. The surrender charge schedule is different for the different tenures of annuities and also changes for some states.

The surrender charge of the Prosperity Life WealthSecure Pro Fixed Indexed Annuity is in line with all the other annuity issuers.

Contract/Administrative Charge

The Prosperity Life WealthSecure Pro Fixed Indexed Annuity does not impose any annual contract or administrative fees. However, it includes mandatory rider fees for the two optional riders offered by the company. Below, we provide a detailed overview of the available rider options.

Riders

The Prosperity Life WealthSecure Pro Fixed Indexed Annuity offers two optional Guaranteed Lifetime Withdrawal Benefit (GLWB) riders – the Base GLWB Rider and the Enhanced GLWB Rider. Both riders provide policyholders with a reliable stream of lifetime income, but they differ in terms of features and costs.

1. Base GLWB Rider

The Base GLWB Rider ensures guaranteed income for life, provided that withdrawals do not exceed the Maximum Annual Withdrawal Benefit. Key features include:

- Guaranteed Lifetime Income: Payments are guaranteed to continue for life without requiring annuitization of the contract. Once withdrawals begin, the payment amount is locked in and will not decrease unless an excess withdrawal (above the benefit amount) is made.

- GLWB Rider Bonus: Both the GLWB Rider and Enhanced GLWB Rider provide a 5% Rider Bonus based on the initial premium of the contract. The bonus is applied to both the Guaranteed Withdrawal Benefit Value and the Performance Withdrawal Benefit Value. The rider bonus does not impact the contract’s accumulation value and is solely for income purposes. A 5% bonus allows you to start at a higher benefit value, which could result in a larger maximum annual withdrawal benefit.

- Guaranteed and Performance Withdrawal Benefit Values:

- Guaranteed Withdrawal Benefit Value: This value grows at a fixed 6% annual interest during the 10-year Accumulation Period, offering predictable growth.

- Performance Withdrawal Benefit Value: During the 10-year Accumulation Period, this value grows at 200% of the actual interest earned on the contract. After this period, no additional interest is credited if withdrawals have not started.

- Maximum Annual Withdrawal Benefit: The income amount is determined as a percentage of Ultimate Withdrawal Benefit Value, which is the greater of:

- The Guaranteed Withdrawal Benefit Value (GWBV)

- The Performance Withdrawal Benefit Value (PWBV)

- The Accumulation Value

The guaranteed withdrawal percentages are based on age, starting as early as 50, and are higher for single-life policies compared to joint-life options. Below is the Guaranteed Withdrawal Percentage chart for the Prosperity Life WealthSecure Plus Fixed Indexed Annuity:

Note: Lifetime Withdrawal Percentage increases by 0.10% for each attained age for both single life and joint lives.

For example, at age 65, the percentage is 4.50% for single life and 4.00% for joint lives. At age 66, these are 4.60% and 4.10%, respectively.

- Annual Rider Charge: The charge for the Base GLWB Rider is 1% of the greater of the Guaranteed Withdrawal Benefit Value or Performance Withdrawal Benefit Value prior to withdrawals.

2. Enhanced GLWB Rider

The Enhanced GLWB Rider builds on the features of the Base Rider and offers additional benefits for policyholders who face long-term care or permanent impairment. Key features include:

- Double Income for Care Needs: If the policyholder becomes permanently impaired (unable to perform 2 of 6 Activities of Daily Living), suffers cognitive impairment, or requires confinement to a long-term care facility, nursing home, or hospice, the annual benefit is doubled until the Accumulation Value is reduced to zero. After this period, standard benefits resume for life.

- Same Core Features as the Base Rider: Like the Base GLWB Rider, the Enhanced Rider includes GLWB Rider Bonus, Performance WBV, Guaranteed WBV, and the Ultimate WBV to determine withdrawal amounts.

- Annual Rider Charge: The cost for the Enhanced GLWB Rider is 1.20% of the greater of the Guaranteed or Performance Withdrawal Benefit Value prior to withdrawals.

Additional Features of GLWB Riders

- Minimum Issue Age: The minimum issue age for both riders is 40. If the contract is jointly owned, both owners must meet this age requirement.

Waiting Period: Payments cannot begin until the later of:

- Expiration of the waiting period, which matches the withdrawal charge period.

- The contract anniversary after the owner turns 50 (or the youngest joint owner, if applicable).

- Payment Frequency: Income payments can be taken monthly, quarterly, semi-annually, or annually, providing flexibility to policyholders.

Also, as with most annuities, the Prosperity Life WealthSecure Pro Fixed Indexed Annuity has free in-built nursing home and terminal illness waivers.

Nursing Home Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is confined to a Qualified nursing home for at least 90 consecutive days. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Terminal Illness Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is diagnosed with a terminal illness with a prognosis of 6 months or less. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

What Makes This Product Stand Out?

The Prosperity Life WealthSecure Pro Fixed Indexed Annuity offers a compelling combination of growth potential, flexibility, and optional income protection features, making it a strong choice for individuals seeking both accumulation and guaranteed lifetime income. Here’s what sets this product apart:

- Low Minimum Investment: The product’s low entry requirement makes it accessible to a wide range of investors.

- Good Accumulation Potential: Competitive cap rates, participation rates, and fixed rates offer strong growth potential with downside protection.

- Comprehensive Rider Options: Includes Base and Enhanced GLWB Riders for lifetime income, with the Enhanced Rider offering double income for long-term care needs.

- Balanced Growth and Income: Unlike many annuities that focus primarily on either accumulation or income, the WealthSecure Pro FIA strikes an effective balance between the two.

What I Don’t Like About This Product

- Volatility-Controlled Fidelity Indexes: While the Fidelity U.S. Quality Factor Index and Fidelity Stocks for Inflation Index offer high participation rates, they are volatility-controlled indexes. These indexes are designed to reduce volatility, but in doing so, they also limit upside growth potential. Since fixed indexed annuities already protect against downside risk, volatility controls may unnecessarily sacrifice returns.

Difference Between Prosperity Life WealthSecure Pro and Plus Fixed Indexed Annuity

The Prosperity Life WealthSecure Pro and Plus Fixed Indexed Annuity plans are very similar in structure and features, but there are a few key differences that may influence which product is best suited for your financial goals.

GLWB Rider Bonus vs. Accumulation Potential:

- The Pro plan offers a 5% bonus on the Guaranteed Lifetime Withdrawal Benefit (GLWB) rider values for both the Base and Enhanced riders. This makes it a decent choice for those prioritizing lifetime income, as the bonus boosts the ultimate withdrawal values.

- The Plus plan, on the other hand, provides slightly higher cap and participation rates, making it more attractive for individuals whose primary focus is on accumulation rather than income.

Recommendation: If your main goal is maximizing lifetime income, opt for the Pro plan. If you are focused on growing your accumulation value, the Plus plan may be the better choice.

2. Additional 10-Year Withdrawal Charge Schedule:

- The Pro plan comes with a 5, 7, and 10-year withdrawal charge schedule, making it more suitable for individuals with a longer investment horizon who don’t anticipate needing early access to their funds.

- The Plus plan (with a 5 and 7-year withdrawal charge schedule) may be better for those seeking more flexibility or a shorter commitment period.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Prosperity Life Insurance Group

Prosperity Life Insurance Group, established in 2009, is a prominent insurance organization offering a diverse range of life insurance, annuities, and supplemental health products. The group operates through its principal subsidiaries: SBLI USA Life Insurance Company, Inc. (SBLI USA), S.USA Life Insurance Company, Inc. (S.USA), and Shenandoah Life Insurance Company, each with a rich history exceeding 50 years in the insurance industry.

In 2019, Prosperity Life underwent a significant transition when Elliott Management Corporation acquired a majority ownership stake. This acquisition strengthened the company's financial strength and expanded its market presence. The company offers a comprehensive suite of insurance and annuities products tailored to meet diverse customer needs, including:

Permanent Life Insurance: Provides lifelong coverage with cash value accumulation, featuring products like Final Expense Whole Life, Universal Life, and Senior Life.

Term Life Insurance: Offers coverage for specific periods, including products such as Family Freedom Term, PrimeTerm to 100, and Simple Issue Term.

Universal Life Insurance: Includes Fixed Universal Life and Indexed Universal Life, catering to varying risk appetites and financial goals.

Fixed Annuities: Includes Multi-Year Guaranteed Annuity (MYGA) products like Select Choice and Select Choice Plus single premium annuities.

Fixed Indexed Annuities: Safe Solution single premium fixed indexed annuity offers fixed and indexed annuity options.

Through its subsidiaries, Prosperity Life serves over 300,000 policyholders across the United States. It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

AM Best | A- |

Kroll Rating | A- |

S&P Global | A- |

Going by the operating history and ratings, we can safely gauge that you can trust your savings with Prosperity Life Insurance Group.

Conclusion

With the advancements in healthcare and technology, the average American today lives longer than ever. So, it’s very important to have a retirement corpus that can grow safely and steadily and have the ability to provide a fixed stream of income during the retirement years. This not only helps you mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

The Prosperity Life WealthSecure Pro Fixed Indexed Annuity is a well-rounded product that effectively balances growth potential, income security, and flexibility. With its low minimum investment, competitive accumulation features, and optional Guaranteed Lifetime Withdrawal Benefit (GLWB) Riders, it caters to individuals seeking both market-linked growth and guaranteed lifetime income. The Enhanced Rider further adds value by offering double income for long-term care needs, making it a strong choice for retirees planning for health-related contingencies.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. Delve deeper into our extensive reviews.