The “Retirement Smile”: How Spending Changes in Retirement and Where Annuities Can Fit

Written byChase Ross

Senior Writer

6 min read

Updated

Introduction: Retirement Spending Is Not Linear

Many people believe that retirement spending remains constant (consumption smoothing) or simply increases in line with inflation but evidence is suggesting that this doesn’t hold as well as previously thought. Retirement spending typically follows a curved trajectory rather than a straight line. This pattern is often referred to as the “retirement smile,” a concept widely recognized in retirement research. In this article, we’ll explore what the retirement smile means, why spending patterns shift throughout retirement, and how annuities can sometimes play a role in managing these changes. We’ll also discuss situations where annuities may or may not be the right fit for your retirement plan.

What Is the “Retirement Smile”?

Definition of the Concept

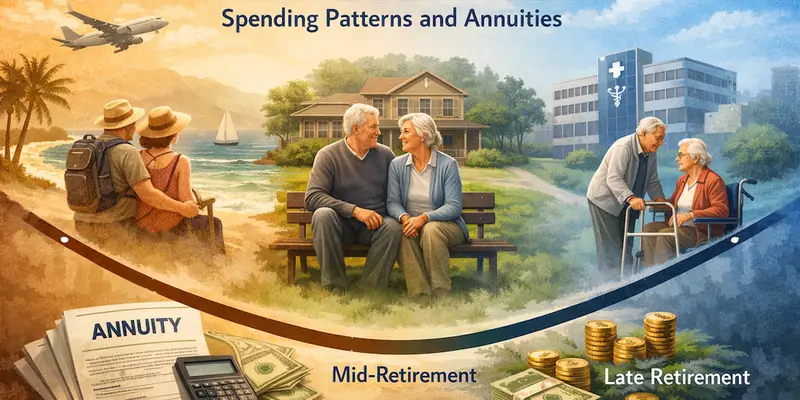

The “retirement smile” refers to a general pattern of spending that retirees experience, which tends to unfold over three main phases. In early retirement, spending tends to be higher as individuals often engage in travel, hobbies, and other activities. During mid-retirement, expenses usually decrease and stabilize. However, in late retirement, spending often rises again, often due to increased healthcare needs or other age-related costs. When charted over time these trends form a smile-shaped curve.

Origins and Research

This concept is grounded in retirement spending research, including a notable 2014 study conducted by David Blanchett. It’s important to note that the “retirement smile” reflects average trends across retirees rather than the unique experience of every individual, as spending patterns can vary widely from person to person.

The Three Phases of the Retirement Smile

Phase 1: Early Retirement

During early retirement retirees typically enjoy good health and an abundance of free time, which motivates them to participate in travel, pursue hobbies and spend time with family. This phase is marked by higher discretionary spending as individuals seek to maximize their newfound freedom after leaving the workforce. However, this period also comes with a key financial risk: market volatility early in retirement, known as sequence-of-returns risk, which can significantly impact long-term financial stability.

Phase 2: Mid-Retirement

Mid-retirement is characterized by a more routine and predictable lifestyle, with retirees spending less time traveling and more time at home. During this phase, discretionary spending tends to decrease, and core living expenses become the primary focus. As a result, this period often represents the lowest overall spending throughout retirement.

Phase 3: Late Retirement

In late retirement, individuals often experience reduced mobility and a decline in activity levels, leading to a shift in their spending patterns. While discretionary expenses such as travel and hobbies typically decrease, necessary costs, especially those related to medical care and assistance with daily living, tend to rise. As a result, even though retirees may spend less on optional items, overall expenses can increase due to the heightened need for healthcare and long-term care during this stage.

Why the Retirement Smile Matters for Planning

Traditional retirement planning often operates under the assumption that individuals will maintain constant real spending throughout their retirement years, or that their expenses will increase solely in line with inflation (consumption smoothing). However, the "retirement smile" concept demonstrates the importance of flexibility in managing spending patterns over time and underscores why guaranteed income sources can become increasingly valuable as individuals age. By recognizing the distinct spending phases of retirement, it becomes clear that aligning income sources, such as pensions, annuities, or Social Security, with these evolving financial needs can help retirees better navigate each phase and enhance long-term financial security.

How Annuities Can Support the Retirement Smile

What Annuities Do Well

Annuities can help retirees by converting their accumulated assets into a steady and predictable stream of income, which can alleviate concerns about outliving their savings. Additionally, annuities reduce longevity risk and allow individuals to shift some of the financial risk away from market performance.

Supporting the Middle and Late Phases of the Smile

Annuities are often most beneficial when used to cover essential, non-discretionary expenses and to replace or supplement pension income. For example, combining Social Security benefits with an annuity can create a reliable income floor, ensuring that basic living costs are met. This strategy allows retirees to use their portfolio assets more flexibly, particularly to support discretionary spending during the earlier years of retirement.

Timing Matters: Why Annuities Aren’t Always Bought at Retirement

Income annuities are flexible financial tools that can be purchased later in life, such as during an individual's 70s or 80s, and can be deferred to begin providing payments when expenses increase once more. This approach naturally corresponds with the upward phase of the retirement smile when spending tends to rise.

Managing Sequence and Longevity Risk

Annuities offer retirees the advantage of reducing the need to withdraw substantial amounts from their investment portfolios during periods of market volatility. By providing a steady stream of income that is not tied to market performance, annuities deliver greater financial stability and help ensure that retirees can meet their expenses regardless of market conditions.

Situations Where Annuities May Be Appropriate

Common Characteristics of Good Fit Scenarios

Individuals who prioritize predictable income rather than seeking or needing the highest possible returns, have essential expenses that are not fully covered by Social Security or pensions, or worry about outliving their financial resources may find annuities particularly appealing. On the other hand, households with little or no pension income and those wishing to streamline cash-flow planning as they age can benefit from the steady income and financial simplicity annuities provide.

Situations Where Annuities May Not Be a Good Fit

When Flexibility and Liquidity Are Critical

Investors who require immediate access to their principal, anticipate large or unpredictable expenses, or are early retirees with significant spending needs before their guaranteed income sources begin may find annuities less appealing.

Product and Cost Awareness (High Level)

It’s important to recognize that not all annuities are the same. Factors such as fees, product complexity (e.g., riders), and surrender restrictions can significantly affect the value and flexibility of an annuity. Understanding these tradeoffs is important before making any decisions, as they can impact both your financial outcomes and your ability to access funds if circumstances change.

Annuities as Part of a Broader Strategy, Not the Strategy

Annuities should be viewed as financial tools rather than one-size-fits-all solutions. They are most effective when coordinated with other elements such as Social Security, diversified investment portfolios, and thoughtful tax planning. Connecting this approach to the retirement smile concept, it’s clear that different income sources can be tailored to meet the unique needs of each phase of retirement, ensuring a more adaptable and secure financial strategy as circumstances and spending patterns evolve. Flexibility is key.

Conclusion: Matching Income to Life, Not Just Markets

Retirement spending patterns naturally change over time, so effective planning should reflect this reality. The “retirement smile” framework helps individuals consider more realistic spending patterns and design appropriate income strategies for each phase of retirement. While annuities may serve a helpful purpose for certain people, in specific amounts, and at the right time, it’s important to remember that understanding how spending needs evolve is just as vital as selecting the right investments. This flexible approach empowers retirees to make informed decisions tailored to their unique situations.