Introduction

Fixed Indexed Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index. Fixed Indexed Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to mis-sell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

This article provides an in-depth review of the Delaware Life Momentum Growth Income Fixed Indexed Annuity, a deferred FIA introduced in 2025. Momentum Growth is designed for individuals who want a fixed-indexed annuity that allows them to set aside a portion of their gains and potentially enhance returns by taking a measured amount of additional risk, while still protecting their principal. If you are evaluating options that aim to balance growth flexibility, market-linked return potential, and downside protection, this product may be worth considering. After extensive research and due diligence, I present a comprehensive and unbiased analysis of this plan.

The review of the Delaware Life Momentum Growth Fixed Indexed Annuity will be broken into multiple subcategories:

Product Description

Rates and Costs Associated with the Delaware Life Momentum Growth Fixed Indexed Annuity

Accessing your Money

Riders

What Makes This Product Stand Out?

What I Don’t Like

Company Details

Conclusion

Product Description - Delaware Life Momentum Growth Fixed Indexed Annuity

The Delaware Life Momentum Growth is a Fixed Indexed Annuity (FIA) that offers annuitants the opportunity to earn a portion of market index–linked returns while protecting principal from market downturns. Unlike traditional FIAs that fully lock in gains, Momentum Growth allows annuitants to strategically set aside a portion of credited gains for potential reinvestment, creating an opportunity for enhanced returns by taking a measured amount of additional risk. This plan is well-suited for individuals seeking a fixed indexed annuity that combines downside protection with greater flexibility in how gains are managed, and growth potential is pursued.

Let’s take a closer look at the high-level fine print of the Delaware Life Momentum Growth Fixed Indexed Annuity, and then discuss each feature in detail.

| Product Name | Momentum Growth |

|---|---|

Issuing Company | Delaware Life Insurance Company |

AM Best Rating | A- (4th of 13 ratings) |

Withdrawal Charge Period(s) | 10 years |

Maximum Issue Age | 80 Years |

Minimum Initial Purchase Amount | $25,000 |

Crediting Period and Strategies | 1-year point-to-point with participation rate, 1-year point-to-point with cap rate, 1-year point-to-point with participation rate, and 1-year fixed with interest rate guaranteed |

Plan Types | IRA, Roth IRA, Nonqualified Account, SEP IRA, SIMPLE IRA, 401(a), etc. |

Indexes | S&P 500 Index, S&P 500 Dynamic Intraday TCA Index, Nasdaq-100 Vol Control 12% Index, and Barclays Aries Index |

Free Withdrawals | 10% of the annuity’s Accumulated Value per year. |

Death Benefit | Upon the annuitant’s death, the beneficiary will get the greater of (i) Account Value or (ii) Surrender Value |

Riders and Features |

|

Free Benefits | Nursing Home and Terminal Illness Waivers |

Surrender Value | Account Value less any withdrawal charges/ MVA |

Surrender Charge Schedule | 10%, 9%, 8%, 7%, 6%, 5%, 4%, 3%, 2%, 1%, 0% |

RMD Friendly | Yes |

Note - A bonus version of this product also exists, known as the Delaware Life Momentum Growth Plus Fixed Indexed Annuity, which includes additional features such as an upfront premium bonus and is covered in a separate review article.

How does the Delaware Life Momentum Growth Fixed Indexed Annuity policy work?

An annuitant (maximum age at the time of policy issue: 80) can purchase the Delaware Life Momentum Growth Fixed Indexed Annuity with a minimum initial purchase amount of $25,000, and in return, they will earn market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, various events may trigger earnings credit, including free withdrawals, long-term care events, terminal illness or injury events, or when a death benefit is payable. The annuity also offers the VersaGain and Index lock feature, which will be discussed in depth in the latter part of this annuity review.

The Delaware Life Momentum Growth Fixed Indexed Annuity allows annuitants to allocate their premium across multiple indexing strategies tied to four indexes: the S&P 500 Index, S&P 500 Dynamic Intraday TCS Index, Nasdaq-100 Vol Control 12% Index, and Barclays Aries Index, to determine how interest is credited. Each index offers a single crediting strategy, and the plan also includes a fixed-rate guaranteed interest option. In total, the annuity provides five crediting strategy choices. Below, we briefly discuss each available index.

S&P 500 Index: The S&P 500 Index is a widely recognized benchmark for the U.S. stock market, tracking the performance of 500 large publicly traded companies listed on American stock exchanges. It is a market-capitalization-weighted index, meaning larger companies have a greater impact on its value. The index covers approximately 80% of the total U.S. equity market capitalization and is considered one of the best representations of the overall U.S. stock market and economy.

S&P 500 Dynamic Intraday TCA Index: The S&P 500 Dynamic Intraday TCA Index is a financial index designed to provide exposure to the S&P 500 through the use of E-mini S&P 500 futures. This index employs a dynamic approach, utilizing 13 observation windows throughout the trading day to adapt to changing market conditions. By doing so, it aims to offer a more stable volatility experience for investors. The index combines a trend-following mechanism with the capability to rebalance multiple times during the day, allowing it to respond swiftly to market movements and optimize performance.

Nasdaq®-100 Volatility Control 12%™ Index: The Nasdaq-100 Volatility Control 12% Index is designed to provide exposure to the Nasdaq-100 while targeting a controlled volatility level of approximately 12%. It dynamically adjusts its allocation between the Nasdaq-100 and a cash component based on observed market volatility. When volatility rises, the index reduces equity exposure to manage risk, and when volatility falls, it increases exposure to capture growth potential. As a result, the index tends to deliver smoother return patterns than the traditional Nasdaq-100, though this volatility management can also limit upside participation during strong equity markets.

Barclays Aries Index: The Barclays Aries Index is a rules-based, multi-asset index designed to balance growth and risk management across varying market environments. It typically allocates among equities, fixed income, and cash-like instruments using systematic signals that respond to market trends and volatility conditions. By dynamically adjusting exposure, the index seeks to capture upside opportunities while mitigating drawdowns during periods of market stress. This adaptive structure makes the Barclays Aries Index suitable for investors looking for diversified, risk-aware growth rather than pure equity market exposure.

It is very important to note that, like other Fixed Indexed Annuities, the Delaware Life Momentum Growth Fixed Indexed Annuity comes with cap rates and participation rates for these indexes, meaning that you will be credited only a portion of the index return to your annuity. These rates change frequently; I will discuss these rates more briefly.

Note: In addition to allocating funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest rate. These Fixed Rates change from time to time. The first-year fixed rate for the 10-year withdrawal charge period, as of the time of writing this article, was 4.50%, which is relatively good compared to what other fixed indexed annuities provide.

The earnings crediting formula

The earnings crediting formula is one of the most important parts of this annuity discussion. It is important to know that we don’t simply get the index return credited to our annuity. The company has several rate-limiting mechanisms, including cap rates and participation rates that affect our earnings. These rates are subject to change over time, and the updated rates can be checked with your financial advisor or on the company’s website.

Let’s have a look at the Delaware Life Momentum Growth Fixed Index Annuity rate sheet (as of December 2025) to understand how the earnings are determined.

From the above rate chart, you will notice that there are 5 interest crediting options (1 fixed and 4 indexed). Let’s have a look at different terms that are used by the company in the Momentum Growth Fixed Indexed Annuity rate chart:

Cap Rate: This refers to the rate at which your interest-earning capacity is capped. For example, if an index returns 12% but the contract’s cap rate is 6%, the annuitant will be eligible for an interest credit of 6% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest that can be earned is the cap rate.

Participation Rate (PR): The participation rate describes the annuitant’s participation percentage in the return of an index. For example, suppose the participation rate is 150%, and the index returned 4% over the agreed time. In that case, the annuitant will be eligible for 150% of the return, i.e., 6%.

Fixed Account Rate: If you opt for a fixed account rate, you simply earn the fixed rates for at particular period specified by the company before your policy begins. These rates are usually low/at par as compared to other fixed avenues, such as CDs and MYGAs, so you should avoid fixed rates in a general scenario. The 1-year fixed rate on this policy at the time of writing this article was 4.50%.

Amongst these indexes, I prefer the S&P 500 Index with a cap option. I would avoid other indices because (i) all other indices are volatility-controlled indices, and (ii) the company offers a low participation rate for these indices.

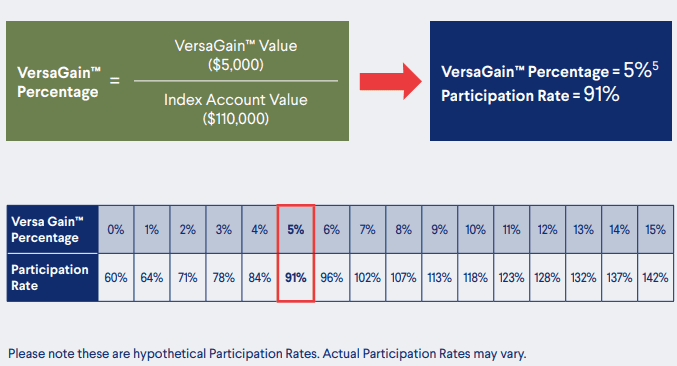

VersaGain Feature

VersaGain™ is a built-in crediting feature available with the Delaware Life Momentum Growth Fixed Indexed Annuity that introduces a controlled way to pursue higher growth by allowing annuitants to selectively risk a portion of previously earned index interest. Unlike a traditional fixed indexed annuity, where all credited gains are automatically locked in and protected, VersaGain gives you the ability to decide how much of your prior term’s gains you want to protect and how much you want to keep “at risk” in exchange for higher caps or participation rates in the next crediting term. This structure is designed to give investors greater control, customization, and the potential to capitalize on favorable market conditions.

How VersaGain Works

At the end of each index term, any index interest earned is referred to as Available Gain. You then select a Protected Auto-Credit Percentage, which determines how much of that Available Gain is permanently locked into your Protected Index Account Value. The remaining portion, if any, is allocated to the VersaGain Value, which stays exposed to market performance in the following term. While the Protected Index Account Value is not at risk of loss, the VersaGain Value can fluctuate with market movements, but in return, it qualifies for higher participation rates or caps in the next term.

Example of VersaGain in Action

Assume an annuitant invests $100,000 and earns a 10% index return, resulting in an Available Gain of $10,000 at the end of the first year. If the annuitant elects a 50% Protected Auto-Credit Percentage, then $5,000 is locked into the Protected Index Account Value, increasing it to $105,000. The remaining $5,000 is allocated to the VersaGain Value and remains exposed to market performance in the next term. Because part of the gain is now “at risk,” the annuitant qualifies for a higher participation rate or cap in the following year, potentially accelerating future growth.

Relationship Between Risk and Crediting Rates

A key aspect of VersaGain is that higher VersaGain exposure leads to higher crediting rates. As the percentage of gains left unprotected increases, participation rates for the next term rise accordingly, subject to product limits (currently capped at 15% of the Index Account Value). This creates a clear trade-off between protection and growth potential. Investors who protect 100% of gains experience results similar to a traditional FIA, while those who protect less may benefit from materially higher long-term accumulation if markets perform well.

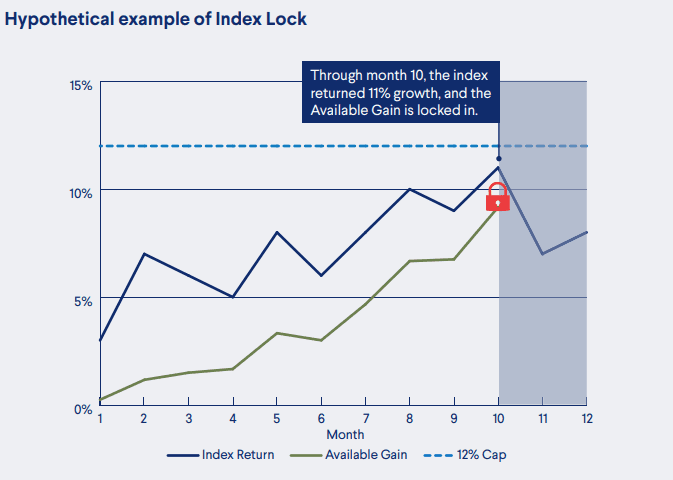

Locking in Gains Mid-Term

VersaGain also allows annuitants to lock in Available Gains at any point during the year, rather than waiting until the end of the term. This can be useful in volatile markets where gains appear earlier in the year and may not persist. Once gains are locked in, they are protected for the remainder of the term, though doing so may limit the maximum participation or cap that could otherwise be achieved by staying invested for the full term.

Why VersaGain Is Different From a Traditional FIA

In a traditional fixed indexed annuity, growth is capped and fully protected but also inherently limited. VersaGain introduces a measured risk-reward mechanism that allows investors to deliberately trade some protection for higher upside potential over time. While this does not eliminate market risk, it offers a structured way to pursue enhanced returns without exposing the original premium or previously protected gains to loss. As a result, VersaGain may appeal to investors who are comfortable with incremental risk and want more control over how aggressively their annuity participates in positive equity markets.

Who Should Use VersaGain (and Who Shouldn’t)

VersaGain is best suited for annuitants who are comfortable taking a measured and deliberate level of additional risk in pursuit of higher long-term growth. It may appeal to investors who already understand how traditional FIAs work and are looking for more control over how gains are treated rather than having everything automatically locked in. Individuals with a longer accumulation horizon, a moderate risk tolerance, and confidence in equity market recovery cycles may find VersaGain particularly attractive, as it allows them to selectively expose only earned gains (not principal) to potential market upside.

VersaGain may not be appropriate for highly conservative investors who prefer full protection of all credited gains at all times. Annuitants who value simplicity, predictability, and automatic protection may find the additional decision-making and trade-offs unnecessary. Similarly, investors nearing the point of income activation or those uncomfortable with short-term fluctuations in account value may be better served by traditional fixed indexed crediting strategies that fully lock in gains each year.

How Much Gain Should You Protect?

The most important VersaGain decision is how much of your Available Gain to protect versus leave exposed. Protecting 100% of gains effectively neutralizes the VersaGain feature and results in outcomes similar to a traditional FIA. On the other hand, leaving too much gain unprotected increases volatility without guaranteeing better results.

In my view, a balanced approach often makes the most sense. Protecting a meaningful portion of gains (for example, 50–70%) while allocating the remainder to VersaGain allows annuitants to preserve progress already made while still qualifying for higher participation rates or caps in subsequent terms. This approach aligns well with the product’s design philosophy: incremental risk taken only on earned gains, not principal, in exchange for incremental upside potential.

Accessing your Money

Each year, you are entitled to a 10% free withdrawal of your contract value without incurring any charges, fees, or penalties.

Should your needs change unexpectedly and you need to take an excess withdrawal (a withdrawal that exceeds the free withdrawal amount available in a given contract year), you may be entitled to access additional funds, although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for the Delaware Life Momentum Growth Fixed Indexed Annuity.

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11+ |

|---|---|---|---|---|---|---|---|---|---|---|---|

Surrender Charge % | 10% | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 2% | 1% | 0% |

Market Value Adjustments - In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period. The surrender charge schedule is different for the different tenures of annuities and also changes for some states.

The surrender charge of Delaware Life Momentum Growth Fixed Indexed Annuity is in line with all the other annuity issuers.

Once the surrender charge period ends, you can typically access your full contract value without fees. However, any withdrawal reduces both your contract value and, if applicable, the income base tied to optional riders, which may impact future guaranteed income.

An annuitant can also convert the contract into a stream of guaranteed income, known as annuitization. They can choose from various payout options designed to meet different needs.

Life Only – Provides income for as long as you live.

Joint and Survivor Life – Continues payments over two lifetimes, often used by couples.

Life with Period Certain (up to 30 years) – Pays income for life, but guarantees payments for a minimum period even if death occurs earlier.

Period Certain (up to 30 years) – Provides guaranteed payments for a set number of years, regardless of lifespan.

Single Life or Joint Life with Cash Refund – Ensures that if the annuitant(s) pass away before receiving payments equal to the original premium, the difference is refunded to beneficiaries.

Single Life or Joint Life with Installment Refund – Similar to the cash refund, but any remaining balance is paid out over time in installments.

These options allow flexibility in balancing lifetime income needs with legacy goals, offering a way to customize how and when funds are accessed in retirement.

Death Benefit

Upon the annuitant’s death, the beneficiary will get the greater of (i) the Account Value or (ii) the Surrender Value

Riders

The Momentum Growth is a plain-vanilla annuity that does not offer any optional paid income or death benefit riders. In my opinion, this actually appeals to many people who don’t understand or do not want to dive deep into the complex methodologies the riders often come up with. However, as with most annuities, the Momentum Growth has free in-built nursing home and terminal illness waivers.

Nursing Home Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is confined to a Qualified nursing home for at least 90 consecutive days. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Terminal Illness Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is diagnosed with a terminal illness with a prognosis of 12 months or less. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Contract/Administrative Charge

The Delaware Life Momentum Growth Fixed Indexed Annuity levies no annual contract or administrative fees.

What Makes this Product Stand Out?

The Delaware Life Momentum Growth Fixed Indexed Annuity offers a few features that make a favorable case for this annuity. The ones that I like the most are:

VersaGain™ Flexibility: The Momentum Growth FIA allows annuitants to use the VersaGain feature to selectively protect or re-risk a portion of previously earned gains in pursuit of higher future crediting rates. It gives annuitants the ability to adjust how much of their gains are protected versus exposed each crediting period, offering a high degree of customization based on changing market conditions and personal risk tolerance.

Index Lock Feature: The plan includes an Index Lock option that allows annuitants to lock in index gains during the crediting term, rather than waiting until the end of the term. This can be particularly useful in volatile markets, helping preserve gains when markets peak mid-term.

Multiple Crediting Methodologies on the S&P 500 Index: The annuity offers the S&P 500 Index with multiple crediting approaches, giving annuitants flexibility in how index-linked returns are earned.

No Annual Contract or Administrative Fees: The product does not charge annual contract fees, mortality and expense charges, or administrative fees, helping preserve net returns.

Free Confinement and Terminal Illness Waiver Benefit: This no-fee rider is automatically included for owners under age 65 and provides access to funds without surrender charges or MVA in the event of qualified nursing care or a terminal illness.

Multiple Payout Options: Annuitants may choose to take a lump sum or annuitize the contract using options such as Life Only, Life with Period Certain, or Joint and Survivor Life, offering flexibility in how benefits are ultimately distributed.

What I Don’t Like

Added Complexity Compared to Traditional FIAs: While VersaGain adds flexibility, it also increases complexity. Investors must actively decide how much gain to protect versus expose each term, which may be overwhelming for annuitants who prefer a simpler, more automatic structure.

Volatility-Controlled Index Lineup: Aside from the traditional S&P 500 Index, most of the available indexes are volatility-controlled. While this supports higher participation rates, it also limits upside potential during strong equity markets, which may disappoint growth-focused investors.

Not Ideal for Short-Term Income Planning: This product is best suited for accumulation over time. Investors planning to activate income in the near term may not fully benefit from VersaGain’s long-term growth mechanics.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Delaware Life Insurance Company

Delaware Life Insurance Company was founded in 2013 and is a subsidiary of Group 1001 Insurance Holdings, LLC. Group 1001 is a dynamic network of several insurance businesses. It is a relatively new player, but it is rapidly growing and making a name for itself in the market. In 2025, Delaware Life was top-rated in Barron’s 100 Annuities list.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

AM Best | A- |

S&P | A- |

Fitch Ratings | A- |

Although the ratings are not the best when we compare them with bigger players, they are good enough for you to consider buying an annuity.

Delaware Life Insurance Company has consistently maintained these ratings for many years. It is considered to be financially strong and stable. As of June 2025, the company had assets of $56.2 billion, with more than 324,000 active annuity and life insurance policies.

Going by the operating history, financial numbers, and ratings, we can safely gauge that you can trust your savings with Delaware Life Insurance Company.

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. Therefore, it’s crucial to have a steady stream of income that can grow safely and reliably, providing a guaranteed income during retirement years. This not only helps you mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

The Delaware Life Momentum Growth Fixed Indexed Annuity is a thoughtfully designed product for investors who want more control over how their annuity grows, without giving up the core protections that define fixed indexed annuities. Features such as VersaGain™ and the Index Lock option distinguish this annuity from traditional FIAs by allowing annuitants to selectively re-risk a portion of earned gains in pursuit of higher long-term growth. While this added flexibility introduces complexity and may not suit highly conservative investors, it can be attractive for those with a longer time horizon and a moderate risk tolerance. Overall, Momentum Growth is best positioned for investors who are comfortable making active allocation decisions and who want a middle ground between fully locked-in FIA growth and market-linked return potential, all within a protected framework.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors, including market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. To delve deeper into our extensive reviews, click here.

.png&w=1920&q=60)