Introduction

Fixed Indexed Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index, such as the S&P 500. Fixed Indexed Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to mis-sell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

This article discusses an in-depth review of the Lincoln OptiBlend Fixed Indexed Annuity. OptiBlend Fixed Indexed Annuity is a deferred, fixed-indexed annuity that may be a suitable option if you are looking for a no-frills fixed indexed annuity with a core focus on growth and the safety of principal. This annuity offers decent indexing options that can provide better returns than similar annuities in the market. After extensive research and due diligence, I have provided an in-depth and unbiased analysis of this plan.

The review of the Lincoln OptiBlend Fixed Indexed Annuity will be broken into multiple subcategories:

- Product Description

- Product Policy

- Rates and Costs

- Accessing your Money

- Riders

- What Makes This Product Stand Out?

- What I Don’t Like

- Company Details

- Conclusion

Product Description

The Lincoln OptiBlend is a Fixed Indexed Annuity (FIA) plan that offers the annuitant (annuity investor) the opportunity to earn a portion of market-indexed return without incurring the risk of market downside. This is a suitable plan for individuals looking for a plain-vanilla fixed-indexed annuity (with no optional riders such as enhanced lifetime income, enhanced death benefit, etc.) and who aim to grow and protect their retirement savings.

Let’s have a look at the high-level fine print of the Lincoln OptiBlend Fixed Indexed Annuity, and then we will discuss each point in detail.

| Product Name | OptiBlend |

|---|---|

Issuing Company | |

AM Best Rating | A (3rd of 13 ratings) |

Withdrawal Charge Period(s) | 5, 7, and 10 years |

Maximum Issue Age | 85 Years |

Minimum Initial Purchase Amount | $10,000 |

Surrender Charge Schedule | Varies for different tenure policies |

Crediting Period and Strategies |

|

Plan Types |

|

Indexes |

|

Free Withdrawals | 10% of the annuity’s Accumulated Value; per year |

Death Benefit | Upon the annuitant’s death, the beneficiary can either choose from (i) Account Value (Lumpsum) or (ii) Guaranteed Minimum Value

|

Riders |

|

Surrender Value | Greater of Account Value (less any withdrawal charges/MVA) and the Minimum Guaranteed Value |

The OptiBlend Fixed Indexed Annuity is almost identical for all three policy tenures, except for the crediting strategies and surrender charge schedule. For ease of discussion and better clarity, we will discuss the OptiBlend Fixed Indexed Annuity 5 (unless mentioned otherwise) for the rest of the article.

Product Policy

How does the Lincoln OptiBlend Fixed Indexed Annuity 5 policy work?

An annuitant (maximum age at the time of policy issue: 85) can purchase the OptiBlend Fixed Indexed Annuity with a minimum initial purchase amount of $10,000, and in return, they will earn a portion of market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, various events may trigger earnings credit: free withdrawals, long-term care, terminal illness, injury, or when a death benefit is payable.

The Lincoln OptiBlend Fixed Indexed Annuity allows annuitants to allocate their premiums across multiple strategies tied to four underlying indexes (S&P 500 Index, Nasdaq Priva Index, S&P 500 10% Daily Risk Control Index, and the Capital Group Dividend Value ETF) to determine their earnings credit. Among these, the S&P 500 Index offers six crediting strategies, followed by the S&P 500 10% Daily Risk Control Index with three strategy options, while the Nasdaq Priva Index and the Capital Group Dividend Value ETF each provide one strategy. In addition, the contract includes a fixed-rate guaranteed interest option. Together, these provide a total of 12 strategy choices. In the following section, we will briefly discuss each available index option.

The S&P 500 index is one of the most popular and oldest indexes in the world. It tracks 500 large-cap publicly traded stocks listed in the United States. It is a reliable index and has often succeeded in the test of time.

It is very important to note that the Lincoln OptiBlend Fixed Indexed Annuity offers the S&P 500 index with caps, participation rates, and performance triggers in place, meaning that your interest-earning capacity is capped. These rates change frequently; I will discuss the rates in detail shortly.

The Nasdaq Priva Index is a rules-based, volatility-aware benchmark developed by Salt Financial and launched on August 1, 2025. Unlike traditional static indices, it uses daily rebalancing and volatility-driven weightings to dynamically adjust exposure based on changing market conditions. This design aims to capture market upside while reducing downside risk, offering a more adaptive framework for investors. With a base date of December 31, 2009, the index currently provides back-tested historical data and is classified as an “excess return” index, meaning its returns are reported net of a short-term cash rate.

3. S&P 500 10% Daily Risk Control Index

The S&P 500 Daily Risk Control 10% Index is a risk-managed benchmark that seeks to limit volatility to around 10% by dynamically adjusting allocations between the S&P 500 and cash on a daily basis. When volatility rises, the index shifts more into cash; when volatility falls, it increases equity exposure to maintain the target risk level. While the index effectively limits downside risk, it also tends to cap upside potential, particularly during strong bull markets.

4. Capital Group Dividend Value ETF

The Capital Group Dividend Value ETF (CGDV) is an actively managed equity ETF that primarily invests in dividend-paying large- and mid-cap U.S. companies, with a mandate to seek both income and capital appreciation by focusing on stocks with above-average dividend characteristics. The fund typically holds a concentrated portfolio of well-established companies such as Microsoft, NVIDIA, Broadcom, and Eli Lilly, that combine dividend income with quality growth potential. Designed for investors seeking a blend of dividend income and value-oriented equity exposure, CGDV offers diversified sector exposure, moderate volatility, and a forward dividend yield that can enhance total return over time.

Among the indices offered under this plan, the most prudent choice would likely be an S&P 500–based strategy, given its transparency, long-term performance history, and global benchmark status. The S&P 500’s simplicity and broad market representation make it easier for investors to understand how returns are generated. Additionally, I find the newly introduced Capital Group Dividend Value ETF appealing, particularly for its focus on dividend-paying, quality companies, which can provide a more balanced and potentially less volatile equity exposure within the indexed framework.

Note: In addition to allocating funds to the following indexes, the annuitant also has the option to allocate funds at a fixed interest rate. These Fixed Rates tend to change over time. The 1st-year Fixed Rate for the 5-year withdrawal charge period at the time this article was updated was 3.90%.

Rates and Costs

The earnings crediting formula

The earnings crediting formula is the most important part of this annuity discussion. It is very important to note that, like other fixed indexed annuities, the OptiBlend Fixed Indexed Annuity comes with rate-limiting mechanisms (such as cap rates, participation rates, performance triggers, etc.) for these indexes, meaning that you will be credited only a part of the index return to your annuity. These rates tend to change over time, and the updated rates can always be checked on the company’s website.

The formula to calculate the earnings credited is as follows:

- For Point-to-point Strategies with Participation: (Participation Rate % X Index Return)

- For Point-to-point Strategies with Caps: Index return over a given crediting period with a maximum potential of earning the cap rate.

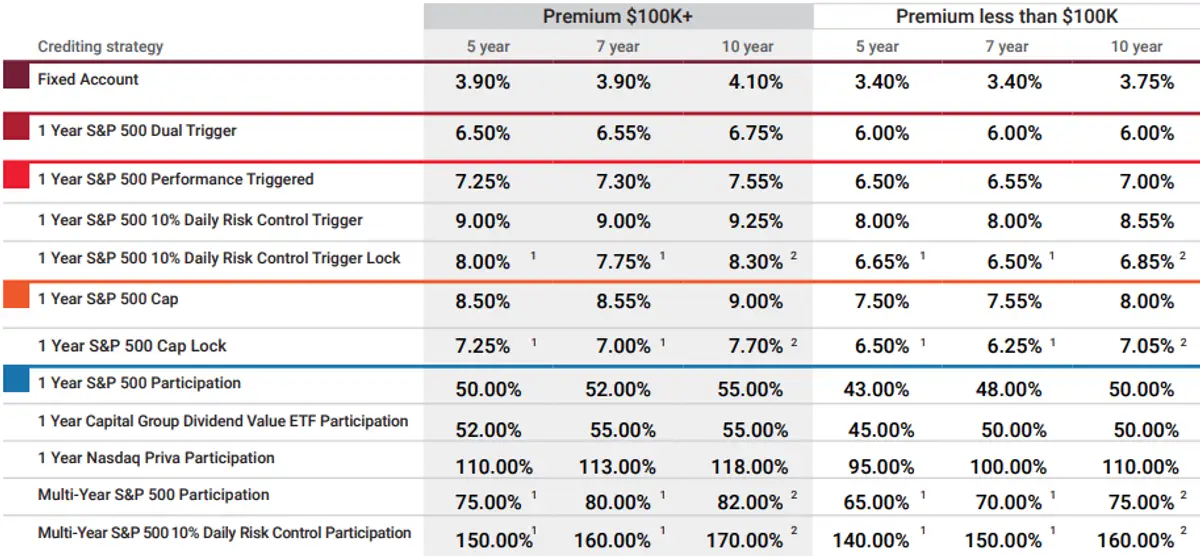

Let’s have a look at the Lincoln OptiBlend rate sheet (as of February 2026) to understand how the earnings are determined.

The table above shows that the OptiBlend annuity allows the annuitant to choose from 11 indexing options. We can see that there are four index options (S&P 500 Index, Nasdaq Priva Index, S&P 500 10% Daily Risk Control Index, and Capital Group Dividend Value ETF) and a number of crediting strategies such as participation, performance triggered, and caps tied to these indexes; Plus, there is also an option for a fixed account rate. Let's discuss these crediting strategies and see how they work.

- Participation Rate: The participation rate refers to the percentage of an index’s return that is credited to the annuitant. For example, if the participation rate is 150% and the index returns 4% over the contract term, the annuitant would receive 150% of that return, or 6%. However, a high participation rate does not always translate into higher returns. For instance, the company offers an attractive participation rate on the Nasdaq Priva Index, but the index itself is built in such a way that it limits its return-earning potential, so the overall credited return may still be lower than expected.

- Cap Rate: This refers to the rate at which your interest-earning capacity is capped. For example, if an index returns 12% but the contract’s cap rate is 6%, the annuitant will be eligible for an interest credit of 6% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest that can be earned is the cap rate.

- Performance-Triggered Index Option with Declared Rate: A flat or positive index return triggers the declared interest rate to be credited to the contract value. If the index return is negative, no interest is credited, but there will be no loss, and the contract value will remain the same. The declared interest rate is set at contract issue and applies for the entire withdrawal charge period. In this case, the performance-triggered rate for the S&P 500 Index is 7.25%. It means that if the S&P Index doesn’t go negative for a given 1-year period (even if the growth is 0% and not negative), the interest credited will be 7.25% irrespective of the S&P 500's actual return.

- Dual Trigger: At the end of the one-year indexed term, if the index has a positive change or remains flat, your account is credited with the trigger rate. If the index change is negative but less than the value of the trigger rate, the difference is credited. If the index is negative by the value of the trigger rate or more, your account is protected from loss, but no interest will be credited.

- Fixed Account Rate/Declared Rate: If you opt for a fixed account rate, you simply earn the fixed rate for a particular period specified by the company before your policy begins. These rates usually tend to be similar (or even lower) compared to other fixed avenues, such as CDs (which are even FDIC insured), so you should avoid fixed rates in a general scenario. The 1st-year fixed rate on this policy at the time this article was updated was 3.90%.

In my opinion, allocating your premiums to the 1-year S&P 500 performance-triggered, 1-year S&P 500 with a cap rate, and multi-year S&P 500 with a participation rate makes the most sense at this time. For these options, the company is offering relatively good rates when compared to the competitors.

Accessing your Money

Each year, you are allowed a 10% free withdrawal of your contract value, excluding any non-vested premium bonuses, without incurring charges, fees, or penalties.

Should your needs change unexpectedly, and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies, although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for the Lincoln OptiBlend Fixed Indexed Annuity.

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11+ |

|---|---|---|---|---|---|---|---|---|---|---|---|

Surrender Charge % (5-year withdrawal charge) | 9% | 8% | 7% | 6% | 5% | 0% | |||||

Surrender Charge % (7-year withdrawal charge) | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 0% | |||

Surrender Charge % (10-year withdrawal charge) | 9% | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 2% | 1% | 0% |

Market Value Adjustments - In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period. The surrender charge schedule is different for the different tenures of annuities and also changes for some states. For a quick comparison of surrender charges across different Lincoln products, you may visit their annuities product page.

The surrender charge of Lincoln OptiBlend Fixed Indexed Annuity is in line with all the other annuity issuers.

Once the surrender charge period ends, you can typically access your full contract value without fees. However, any withdrawal reduces both your contract value and, if applicable, the income base tied to optional riders, which may impact future guaranteed income.

An annuitant can also convert the contract into a stream of guaranteed income, known as annuitization. They can choose from various payout options designed to meet different needs.

Life Only – Provides income for as long as you live.

Joint and Survivor Life – Continues payments over two lifetimes, often used by couples.

Life with Period Certain (up to 30 years) – Pays income for life, but guarantees payments for a minimum period even if death occurs earlier.

Period Certain (up to 30 years) – Provides guaranteed payments for a set number of years, regardless of lifespan.

Single Life or Joint Life with Cash Refund – Ensures that if the annuitant(s) pass away before receiving payments equal to the original premium, the difference is refunded to beneficiaries.

Single Life or Joint Life with Installment Refund – Similar to the cash refund, but any remaining balance is paid out over time in installments.

These options offer flexibility in balancing lifetime income needs with legacy goals, enabling you to tailor how and when funds are accessed during retirement.

Death Benefit

Upon the annuitant’s death, the beneficiary will get the greater of (i) Account Value or (ii) Minimum Guaranteed Value

Riders

The Lincoln OptiBlend is a plain-vanilla annuity that does not offer any optional paid riders. In my opinion, this actually appeals to many people who don’t understand or do not want to dive deep into the complex methodologies the riders often come up with. However, as with most annuities, the OptiBlend FIA has free in-built nursing home and terminal illness waivers.

Nursing Home Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is confined to a Qualified nursing home for at least 90 consecutive days. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Terminal Illness Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is diagnosed with a terminal illness with a prognosis of 12 months or less. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Contract/Administrative Charge

The Lincoln OptiBlend Fixed Indexed Annuity levies no annual contract or administrative fees.

What Makes this Product Stand Out?

The Lincoln OptiBlend Fixed Indexed Annuity offers some features that not many fixed-indexed annuities offer. The ones that I like the most are:

- The plan offers the S&P Index with multiple crediting strategies

- Relatively higher caps, participation rates, and fixed rate: OptiBlend Fixed Indexed Annuity provides higher caps, even for a very popular index like the S&P 500. Similarly, it also offers higher participation rates than many of its competitors.

- No annual contract, mortality & expense, or administrative fees

- Free Confinement and Terminal Illness Waiver Benefit: This no-fee rider is automatically included for owners under age 65 and includes both a Qualified Nursing Care and Terminal Illness Benefit.

- High Guaranteed Minimum Surrender Value: The Guaranteed Minimum Surrender Value is equal to 100% of the premium accumulated at 0.10% annual growth (credited daily) prior to withdrawals. This is one of the highest Guaranteed Minimum Surrender Values I have seen, while for other popular annuities, this rate is usually only 87.5% of the premium accumulated.

- Multiple Payout Options: Lump-sum or annuitization with Life Only, Life with Period Certain, Joint and Survivor Life, etc.

What I Don’t Like

This product is generally good on all fronts for people looking for growth; still, there are some features that could add more value for the annuitant. Some of the features that I don’t like about the policy are:

- There are no optional riders to choose from

- Although the annuity offers good strategies on the S&P 500 Index, I don’t like the other index that the company offers for the interest crediting strategy.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Lincoln National Life Insurance Company

Lincoln National Life Insurance Company has been in the business since 1905. It is one of the largest and oldest providers of fixed and fixed indexed annuities in the US and has been regularly in the top ten Fixed Indexed Annuity Sales.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

AM Best | A (3rd of 13 ratings) |

S&P | A+ (5th of 21 ratings) |

Fitch Ratings | A+ (5th of 19 ratings) |

Moody's Investors Service | A2 (6th of 21 ratings) |

Lincoln National Life Insurance Company has managed to maintain decent ratings for many years. It is considered to be strong and stable financially. In 2025, the company paid out nearly $7.76 billion in claims and benefits. As of year-end 2025, some of the other financial highlights for Lincoln National Life Insurance Company include its:

- $18.21 billion in total sales

- $10.91 billion of stockholders' equity

- $1.18 billion in net income

- $417.2 billion in total assets

Thus, going by the operating history and financial numbers, we can safely gauge that you can trust your savings with Lincoln National Life Insurance Company.

Conclusion

With the advancements in healthcare and technology, the average American today lives longer than ever. So, it’s very important to have a retirement corpus that can grow safely and steadily and have the ability to provide a fixed stream of income during the retirement years. This not only helps you mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

The Lincoln OptiBlend FIA helps you grow your retirement account with less risk. Through its relatively higher caps, participation rates, and performance-trigger rates, it offers faster growth with principal protection. The product’s plain vanilla nature (with no optional paid riders) might also appeal to people who don’t like to deep-dive into the complex methodologies often associated with the riders. If you are considering buying a Fixed Indexed Annuity that is purely growth-oriented, the Lincoln OptiBlend FIA may be a good option to consider.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. Delve deeper into our extensive reviews here.