Introduction

Fixed Indexed Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index (such as S&P 500). Fixed Indexed Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to mis-sell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

In this article, we examine the F&G SecureIncome Fixed Indexed Annuity in detail. F&G SecureIncome is a straightforward fixed indexed annuity designed to provide tax-deferred growth and principal protection, with a primary focus on delivering guaranteed lifetime income. Interest crediting is offered through straightforward options, including fixed interest and S&P 500–linked strategies, without requiring direct market participation. Based on extensive research and careful review of the product structure and disclosures, this article presents a comprehensive and unbiased analysis of the F&G SecureIncome annuity.

The review of the F&G SecureIncome Fixed Indexed Annuity will be broken into multiple subcategories:

Product Description

Rates and Costs Associated with the F&G SecureIncome Fixed Indexed Annuity

Accessing your Money

Riders

What Makes This Product Stand Out?

What I Don’t Like

Company Details

Conclusion

Product Description - F&G SecureIncome Fixed Indexed Annuity

The F&G SecureIncome is a Fixed Indexed Annuity (FIA) plan that offers the annuitant (annuity investor) the opportunity to earn a portion of a market index-linked return without incurring the risk of market downside. This is a suitable plan for individuals seeking a fixed indexed annuity that provides greater flexibility in lifetime withdrawals and aims to grow and protect their retirement savings.

Let’s have a look at the high-level fine print of the F&G SecureIncome Fixed Indexed Annuity, and then we will discuss each point in detail.

| Product Name | SecureIncome |

|---|---|

Issuing Company | Fidelity & Guaranty Life Insurance |

AM Best Rating | A (3rd of 13 ratings) |

Withdrawal Charge Period(s) | 7 years |

Surrender Charge Schedule | 9%, 8%, 7%, 6%, 5%, 4%, 3%, 0% |

Maximum Issue Age | 85 Years |

Minimum Initial Purchase Amount | $10,000 |

Crediting Period and Strategies | 1-year point-to-point with participation rate, 1-year point-to-point with cap rate, 2-year point-to-point with cap rate, 1-year point-to-point performance trigger, or 1-year fixed with interest rate guaranteed |

Plan Types | IRA, Roth IRA, Nonqualified Account, SEP IRA, SIMPLE IRA, 401(a), etc. |

Indexes | S&P 500 Index |

Free Withdrawals | 10% of the annuity’s Accumulated Value per year |

Death Benefit | Upon the annuitant’s death, the beneficiary will get the greater of (i) Account Value or (ii) Surrender Value |

Free Benefits | Free Nursing Home, Home Health Care, and Terminal Illness Waivers |

Riders | Built-in paid Enhanced Guaranteed Minimum Withdrawal Benefit (EGMWB) Rider for Guaranteed Lifetime Income Payments |

Surrender Value | Account Value less any withdrawal charges/ MVA |

RMD Friendly | Yes |

How does the F&G SecureIncome Fixed Indexed Annuity policy work?

An annuitant (maximum age at the time of policy issue: 85) can purchase the F&G SecureIncome annuity with a minimum initial purchase amount of $10,000, and in return, they will earn market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, various events may trigger earnings credits, including free withdrawals, long-term care events, terminal illness or injury events, or when a death benefit is payable. All these interest credits are credited to a bucket called “Account Value.” This bucket represents your annuity account balance, and all withdrawals are made from it.

At the same time, a separate bucket called the “Income Base” is established, through which the “lifetime income payment” is determined. The Income Base grows at a predetermined growth rate, which will be detailed in a later part of this review. This Income Base is only used for determining the lifetime withdrawal amount, and you can’t take any withdrawals from this account. We will return to this when we discuss the “riders” of this annuity later in this review.

The F&G SecureIncome Fixed Indexed Annuity offers the annuitant to choice from one or more of the four crediting strategies tied to the S&P 500 index to determine their earnings credit. The plan also offers a fixed-rate guaranteed interest strategy to choose from, making a total of 5 strategy options.

S&P 500 Index: The S&P 500 Index is one of the most widely recognized and oldest indexes in the world. It tracks 500 large-cap publicly traded stocks listed in the United States. It is a reliable index that has often stood the test of time. It is very important to note that the F&G SecureIncome annuity offers the S&P 500 index with rate-limiting mechanisms (such as participation rates and cap rates) in place, meaning that you will be credited only a portion of the S&P 500 return to your annuity. These rates tend to change frequently; I will discuss the rates in detail shortly.

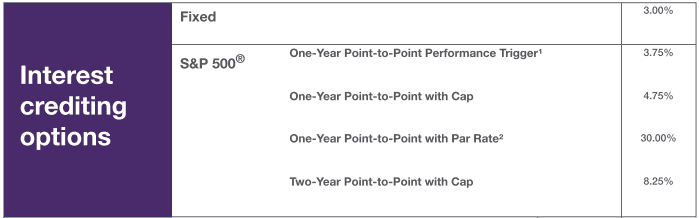

Note: In addition to allocating funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest rate. Like the index rates, these fixed rates are also subject to change over time. The fixed rate at the time of writing this article was 3.00%.

The earnings crediting formula

The earnings crediting formula is one of the most important parts of this annuity discussion. It is essential to note that we don’t simply receive the index return credited to our annuity. The company has several rate-limiting mechanisms (such as cap rate, participation rate, spreads, etc) in place that impact our earnings. These rates are subject to change over time, and you can verify the updated rates with the assistance of your advisor or on the company’s website.

Let’s have a look at the F&G SecureIncome rate sheet (as of January 2026) to understand how the earnings are determined.

From the above rate chart, you will notice that there are five interest crediting options (one fixed and four indexed). Let’s have a look at different terms that are used by the company in the F&G SecureIncome Fixed Indexed Annuity rate chart:

Cap Rates: This refers to the rate at which your interest-earning capacity is capped. For example, if an index returns 12% but the contract’s cap rate is 5%, the annuitant will be eligible for an interest credit of 5% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest that can be earned is the cap rate.

Participation Rate (PR): The participation rate describes the annuitant’s participation percentage in the return of an index. For example, suppose the participation rate is 40%, and the index returned 10% over the agreed time. In that case, the annuitant will be eligible only for 40% of the return, i.e., 4%.

Performance-Triggered Option with Declared Rate: A flat or positive index return triggers the declared interest rate to be credited to the contract value. If the index return is negative, no interest is credited; however, there will be no loss, and the contract value will remain unchanged. The declared interest rate is set at the time of contract issue. In this case, the performance-triggered rate for the S&P 500 Index is 3.75%. It means that if the S&P Index doesn’t go negative for a given 1-year period (even if the growth is 0% and not negative), the interest credited to the annuity will be 3.75% irrespective of the S&P 500's actual return.

Fixed Rate: If you opt for a fixed account rate, you simply earn the fixed rate for a particular period specified by the company before your policy begins. These rates are usually low/at par as compared to other fixed avenues, such as CDs and MYGAs, so you should avoid fixed rates in a general scenario. The 1-year fixed rate on this policy at the time of writing this article was 3.00%.

You will notice that the F&G SecureIncome annuity offers lower cap and participation rates compared to growth-oriented annuities such as the F&G Accumulator Plus. This is because SecureIncome is designed primarily to deliver guaranteed lifetime withdrawal benefits through its Enhanced Guaranteed Minimum Withdrawal Benefit (EGMWB) rider, rather than to maximize accumulation or market-linked growth. The product’s core objective is to provide predictable and sustainable income throughout retirement, not higher upside potential. We explore this trade-off in greater detail in the following section of this annuity review.

Riders

The core feature of the F&G SecureIncome Fixed Indexed Annuity is its Enhanced Guaranteed Minimum Withdrawal Benefit (EGMWB) rider, which is designed to provide predictable and sustainable lifetime income while preserving principal protection.

How the EGMWB Rider Works

At the heart of the rider is the “Income Base”, which is separate from the account value and is used exclusively to calculate lifetime withdrawal payments and rider fees. The Income Base is not a cash value and cannot be surrendered or withdrawn. Instead, it serves as a reference value for income calculations.

The Income Base is determined as the greatest of:

The initial premium (plus 7% Income Base Bonus, where available),

Guaranteed growth of 7.0% per year on the first-year premium, applied for up to 10 years or until age 85, whichever comes first, or

The actual account value, if it exceeds the rolled-up Income Base.

During the accumulation phase, the Income Base grows at a guaranteed 7.0% annual roll-up rate. If income is not started after the initial 10-year period, the annuitant may elect to restart a new 10-year roll-up period after year five but before year ten, provided the annuitant has not reached age 85. Upon restart, the roll-up rate is guaranteed to be at least 2.0%.

How Withdrawals Are Calculated

The amount that an annuitant can withdraw each year under the EGMWB rider is determined by the following formula:

Income Base × Payout Factor = Annual Lifetime Withdrawal Amount The payout factor is based on the annuitant’s age at the time withdrawals begin and the number of years since the contract was issued. These rates are pre-determined when you sign up for the annuity contract. The following are the payout factors of the SecureIncome annuity at the time of writing this article:

The Income Base refers to the current balance of the “Income Base” account at the time of starting lifetime withdrawals, net of any prior withdrawals.

Even if the account value reaches zero, the annuitant will continue to receive the guaranteed withdrawal amount for life, provided no excess withdrawals have taken place from the contract.

Example Illustration

Consider an investor who allocates $100,000 at age 55 into the F&G SecureIncome annuity and does not take withdrawals for 10 years. With the 7.0% guaranteed roll-up, the Income Base grows to approximately $196,715 by age 65.

If the investor initiates lifetime income at age 65, applying the 7.84% withdrawal rate results in annual guaranteed income of roughly $15,422 for life ($196,715 × 7.84%), regardless of future market performance or account value fluctuations.

Enhanced Income During Impairment

A distinctive feature of the EGMWB rider is the enhanced income benefit in the event of impairment. If certain conditions are met—including being unable to perform at least two of six activities of daily living—the guaranteed withdrawal amount can increase to:

2× the standard payment for single annuitants, or

1.5× the standard payment for joint annuitants.

This enhancement applies while the account value remains above zero and is designed to help offset healthcare or long-term care expenses.

Rider Fees

The EGMWB rider carries an annual fee of 1.15% of the Income Base, deducted on each contract anniversary from the Account Value. If the roll-up period is restarted, the fee is guaranteed not to exceed 1.50%.

My Views on the EGMWB Rider

The EGMWB rider is the core feature of the F&G SecureIncome annuity. It trades higher upside potential for income predictability, longevity protection, and simplicity. For retirees seeking to cover essential living expenses with guaranteed lifetime income and minimal reliance on market returns, this rider forms a transparent income foundation within a broader retirement strategy. However, if predictable lifetime income is not the primary objective and the annuitant’s focus is on accumulation or higher growth potential, this product may be less suitable compared to growth-oriented fixed indexed annuities.

Also, as with most annuities, the SecureIncome offers free in-built home health care, nursing home, and terminal illness waivers.

Nursing Home Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is confined to a Qualified nursing home for at least 60 consecutive days. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Terminal Illness Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is diagnosed with a terminal illness with a prognosis of 12 months or less. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Home Health Care Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is unable to perform at least 2 of 6 activities of daily living (for at least 60 days and is expected to continue for at least 90 days after requesting withdrawal. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician. While many annuities offer Nursing Home and Terminal Illness Waivers, the Home Health Care waiver is not something that many annuities offer.

Accessing your Money

Each year, you are entitled to a 10% free withdrawal of your contract value without incurring any charges, fees, or penalties.

Should your needs change unexpectedly and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies; although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for the F&G SecureIncome annuity:

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8+ |

|---|---|---|---|---|---|---|---|---|

Surrender Charge % | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 0% |

Market Value Adjustments - In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period. The surrender charge schedule is different for the different tenures of annuities and also changes for some states.

The surrender charge of F&G SecureIncome Fixed Indexed Annuity is in line with all the other annuity issuers.

Once the surrender charge period ends, you can typically access your full contract value without fees. However, any withdrawal reduces both your contract value and, if applicable, the income base tied to optional riders, which may impact future guaranteed income.

An annuitant can also convert the contract into a stream of guaranteed income, known as annuitization. They can choose from various payout options designed to meet different needs.

Life Only – Provides income for as long as you live.

Joint and Survivor Life – Continues payments over two lifetimes, often used by couples.

Life with Period Certain (up to 30 years) – Pays income for life, but guarantees payments for a minimum period even if death occurs earlier.

Period Certain (up to 30 years) – Provides guaranteed payments for a set number of years, regardless of lifespan.

Single Life or Joint Life with Cash Refund – Ensures that if the annuitant(s) pass away before receiving payments equal to the original premium, the difference is refunded to beneficiaries.

Single Life or Joint Life with Installment Refund – Similar to the cash refund, but any remaining balance is paid out over time in installments.

Note that annuitization is different from the lifetime income rider offered by many annuities. For a detailed explanation of the differences between annuitization and a lifetime income rider, please refer to my post on annuitization.

Death Benefit

Upon the annuitant’s death, the beneficiary will get the greater of (i) the Account Value or (ii) the Surrender Value

Contract/Administrative Charge

The F&G SecureIncome fixed indexed annuity levies no annual contract or administrative fees.

What Makes this Product Stand Out?

The F&G SecureIncome Fixed Indexed Annuity offers a few features that make a favorable case for this annuity. The ones that I like the most are

Enhanced Guaranteed Minimum Withdrawal Benefit (EGMWB): The rider offers a clearly defined income base with guaranteed roll-up growth, providing visibility and certainty around future income.

Impairment-Based Income Boost: Payments can increase in the event of qualifying health impairments, offering added support during periods of elevated medical or care-related expenses.

Flexibility Without Annuitization: Lifetime income can be activated without surrendering control of the contract through formal annuitization, preserving optionality.

No annual contract, mortality & expense, or administrative fees

Free Confinement and Terminal Illness Waiver Benefit

Multiple Payout Options: Lump sum or Annuitization option with Life Only, Life with Period Certain, Joint and Survivor Life, etc.

What I Don't Like

There are certain aspects of the product that could offer more value to annuitants. Some of the features that I find less favorable include:

Lower Crediting Rates vs. Accumulation FIAs: Compared to growth-focused FIAs, index caps and participation rates tend to be lower due to the income-centric structure.

Limited Indexing Options: The product offers fewer index choices compared to similar annuities in the market, which may restrict diversification opportunities and limit growth potential.

Higher Income Rider Cost: The cost of the Enhanced Guaranteed Minimum Withdrawal Benefit (EGMWB) rider is relatively higher compared to other similar annuities.

Long-Term Commitment: Like most income-focused annuities, SecureIncome works best when held long term, which may not suit investors with uncertain liquidity needs.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Fidelity National Financial

F&G is a subsidiary of Fidelity National Financial. Fidelity National Financial is one of the oldest title insurance companies and has been in the business for over 18 decades. It is a Fortune 500 company ranking #313.

It is rated as follows by the rating agencies:

| AM Best | A (3rd of 13 ratings) |

|---|---|

Moody’s | A3 (7th of 21 ratings) |

S&P | A- (7th of 21 ratings) |

Fitch | A- (7th of 21 ratings) |

Fidelity has consistently maintained strong ratings for many years. Fidelity is considered to be financially strong and stable. As of year-end 2024, some of the other financial highlights for Fidelity include its:

$15.3 billion in total sales / direct written premium

$50 billion of a total investment portfolio

$51.6 billion Assets Under Management (AUM)

$85 billion in total assets

$622 million in net income

Thus, by using the operating history and financial numbers, we can safely gauge that you can trust your savings with F&G.

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. So, it’s very important to have a stream of income that can grow safely and steadily. This not only helps you mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

The F&G SecureIncome Fixed Indexed Annuity is best viewed as an income-first retirement solution rather than a growth or accumulation product. Its strength lies in providing a predictable and guaranteed stream of lifetime income, supported by a clearly defined income base, guaranteed roll-up features, and downside protection. While its crediting rates and upside potential are more modest than those of accumulation-focused annuities, this trade-off is intentional and aligns with the needs of conservative retirees who prioritize income certainty, longevity protection, and simplicity. For individuals seeking to cover essential retirement expenses with guaranteed income and reduce reliance on market performance, the F&G SecureIncome annuity can serve as a component of a broad retirement income strategy.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. Delve deeper into our extensive reviews here.