Introduction

Fixed Indexed Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index, such as the S&P 500. Fixed Index Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to mis-sell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

In this article, we will discuss the F&G Power Accumulator Fixed Indexed Annuity in depth. F&G Power Accumulator is a deferred, fixed-indexed annuity that may be a good option if you are looking for a no-frills, fixed-indexed annuity with a core focus on accumulation, safety of the principal, and tax deferral. This annuity offers many indexing options, which can provide good index interest credits to your account. After extensive research and due diligence, I have provided an in-depth and unbiased analysis of this plan.

The review of the F&G Power Accumulator Fixed Indexed Annuity will be broken into multiple subcategories:

- Product Description

- Product Policy

- Rates and Costs

- Accessing your Money

- Riders

- What Makes This Product Stand Out?

- What I Don’t Like

- Company Details

- Conclusion

Product Description

The F&G Power Accumulator is a Fixed Indexed Annuity (FIA) plan that offers the annuitant (annuity investor) an opportunity to earn a market index-linked return without having to incur the risk of market downside. This is a suitable plan for people who are looking for a plain vanilla fixed indexed annuity (with no optional paid riders) and aim to grow and protect their retirement savings and an option of leaving a legacy for their beneficiary(s). The unique thing about this annuity is that, besides the regular indexing options that most annuities offer, this annuity also offers indexing based on Exchange-traded funds (ETFs).

Let’s have a look at the high-level fine print of the F&G Power Accumulator Fixed Indexed Annuity, and then we will discuss each point in detail.

| Product Name | F&G Power Accumulator |

|---|---|

Issuing Company | |

AM Best Rating | A (3rd of 13 ratings) |

Withdrawal Charge Period(s) | 7 and 10 years |

Maximum Issue Age | 85 Years |

Minimum Initial Purchase Amount | $10,000 |

Surrender Charge Schedule | Varies for different tenure policies |

Crediting Period and Strategies |

|

Plan Types |

|

Indexes |

|

Free Withdrawals | 10% of the annuity’s Accumulated Value per year, starting from year 2 |

Death Benefit | Upon the annuitant’s death, the beneficiary will get Account Value as lumpsum |

Benefits |

No optional paid riders |

Surrender Value | Account Value (less any withdrawal charges/MVA) |

RMD Friendly | Yes |

The F&G Power Accumulator Fixed Indexed Annuity is almost identical for both policy tenures, except for the crediting strategies and surrender charge schedule. For ease of discussion and better clarity, we will discuss the F&G Power Accumulator 10 Fixed Indexed Annuity (unless mentioned otherwise) for the rest of the article.

Product Policy

How does the F&G Power Accumulator Annuity policy work?

Any annuitant (maximum age at the time of policy issue: 85) can purchase the F&G Power Accumulator annuity with a minimum initial purchase amount of $10,000, and in return, they will earn market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, various events may trigger earnings credit, including on-free withdrawals, long-term care events, terminal illness or injury events, or when a death benefit is payable.

The F&G Power Accumulator annuity offers the annuitant the ability to choose from one or more crediting strategies tied to 8 indexes or ETFs to determine their earnings crediting formula. They are the Balanced Asset 5 Index, Balanced Asset 10 Index, BlackRock Market Advantage Index, iShares Core S&P 500 ETF, iShares Gold Trust, iShares MSCI EAFE ETF, Morgan Stanley US Allocator Index, and iShares U.S. Real Estate ETF. All in all, the annuity offers annuitants the choice of one or more strategies from a total of 23 index or ETF-based strategies. Additionally, it offers the option to choose from a fixed interest rate. We will discuss each available index briefly:

Index-based Interest Credit Options:

The Balanced Asset 10 Index takes a classic approach to its portfolio construction with a 60/40 allocation. Combined with rebalancing and volatility control features, the index seeks to provide excess returns across market conditions through a tactical combination of equity and fixed-income ETFs. The Balanced Asset 10 Index targets a 10% annualized realized volatility. While these volatility controls may result in less fluctuation in rates of return when compared with indexes that don’t use them, they also may reduce the overall rate of return compared with those other indexes.

2. Balanced Asset 5 Index

The Balanced Asset 5 Index takes a classic approach to its portfolio construction with a 60/40 allocation. Combined with rebalancing and volatility control features, the index seeks to provide excess returns across market conditions through a tactical combination of equity and fixed-income ETFs. The CIBC Balanced Asset 5 Index was created in June 2020 and targets a 5% annualized realized volatility. While these volatility controls may result in less fluctuation in rates of return when compared with indexes that don’t use them, they also may reduce the overall rate of return compared with those other indexes.

3. BlackRock Market Advantage Index

The BlackRock Market Advantage Index is structured to provide an investment portfolio that is both diversified and managed for volatility. The index seeks to outperform traditional multi-asset class benchmarks by balancing investments across five key macroeconomic drivers that influence asset classes' performance, ensuring a more stable risk-adjusted return profile. Key components of this index include various iShares® ETFs, the iShares S&P GSCI Commodity-Indexed Trust, and cash holdings. The primary aim is to limit risk through a daily volatility-control mechanism. With a 6% Target Volatility, it has the flexibility to leverage up to 125% exposure. While these volatility controls may result in less fluctuation in rates of return when compared with indexes that don’t use them, they also may reduce the overall rate of return compared with those other indexes.

4. Morgan Stanley US Allocator Index

The Morgan Stanley US Equity Allocator Index is a rules-based benchmark designed to provide exposure to U.S. equities, particularly large-cap and technology sectors. It employs a momentum-based strategy, adjusting allocations daily based on the relative strength of its components. The index aims to maintain a 12% volatility target by rebalancing both intraday and at the end of each day, allowing it to respond swiftly to changing market conditions.

ETF-based Interest Credit Options:

The iShares Core S&P 500 ETF (Exchange Traded Fund), symbolized as IVV, is a prominent financial instrument designed to track the performance of the S&P 500 Index. This ETF offers investors exposure to the large-cap segment of the U.S. stock market, encompassing about 500 leading companies in key industries. Managed by BlackRock, IVV is known for its low expense ratio and high liquidity, making it an attractive option for both retail and institutional investors. By mirroring the S&P 500, this ETF provides a diversified portfolio in a single transaction, reflecting sectors like technology, health care, financials, and consumer discretionary. IVV's performance is typically a close representation of the U.S. stock market's overall health, making it a fundamental tool for investors seeking to gain or maintain exposure to the core aspects of the U.S. economy.

6. iShares Gold Trust

The iShares Gold Trust ETF, commonly referred to by its ticker symbol IAU, is a significant exchange-traded fund that offers investors a straightforward and cost-effective means to gain exposure to gold, a key commodity often used as a hedge against inflation and currency fluctuations. Managed by BlackRock, IAU aims to reflect the performance of the price of gold bullion, less the Trust's expenses. Unlike investing directly in physical gold, which may involve higher transaction costs and storage issues, IAU provides the ease of trading like a stock with the added benefit of a relatively low expense ratio. This ETF is particularly appealing to a diverse range of investors, including those looking to diversify their portfolios, mitigate risk, or capitalize on potential market movements influenced by economic and geopolitical factors. By holding gold in trust, IAU offers a practical option for investors seeking exposure to gold without the complexities of managing physical assets.

7. iShares MSCI EAFE ETF

The iShares MSCI EAFE ETF, symbolized as EFA, is a widely recognized exchange-traded fund that provides investors with exposure to a broad range of equities from developed markets outside of the United States and Canada. Specifically, it tracks the MSCI EAFE Index, which includes stocks from Europe, Australasia, and the Far East, encompassing a diverse portfolio of companies across various sectors and countries. Managed by BlackRock, EFA is designed for investors seeking international diversification in their portfolios. It offers the advantages of a large and liquid investment vehicle with a relatively low expense ratio. The ETF encompasses a mix of large- and mid-cap companies, reflecting key sectors like financials, industrials, consumer discretionary, and healthcare. By investing in EFA, individuals and institutions can gain broad exposure to developed international markets, which is crucial for a well-rounded investment strategy, especially for those looking to hedge against country-specific risks and capitalize on global economic growth.

8. iShares U.S. Real Estate ETF

The iShares U.S. Real Estate ETF, trading under the ticker IYR, is a specialized exchange-traded fund designed to offer investors exposure to the U.S. real estate sector. This ETF tracks the Dow Jones U.S. Real Estate Index, comprising stocks of companies primarily engaged in real estate, such as real estate investment trusts (REITs) and other companies in the real estate industry. Managed by BlackRock, IYR provides a convenient way to invest in a broad range of real estate businesses, including commercial, residential, and industrial real estate. It's particularly attractive to investors seeking diversification, as the real estate sector often exhibits a different performance pattern compared to traditional equities and fixed-income assets. Moreover, real estate investments are known for their potential to offer stable income through dividends, making IYR a potentially appealing option for income-focused investors. The ETF's diversified portfolio within the real estate sector, combined with its liquidity and relatively low cost, makes it a strategic choice for those looking to gain exposure to U.S. real estate.

Note: In addition to allocating the funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest. These Fixed Rates tend to change from time to time. The Fixed Value Rate at the time of writing this article was 3.75%.

Rates and Costs

The earnings crediting formula

The earnings crediting formula is the most important part of this annuity discussion. It is essential to note that we don’t simply receive the index return credited to our annuity. The company has several rate-limiting mechanisms (such as cap rates and participation rates) in place that impact our earnings. These rates are subject to change over time, and you can always verify the updated rates with the assistance of your advisor. You can also check out their website for the latest rates.

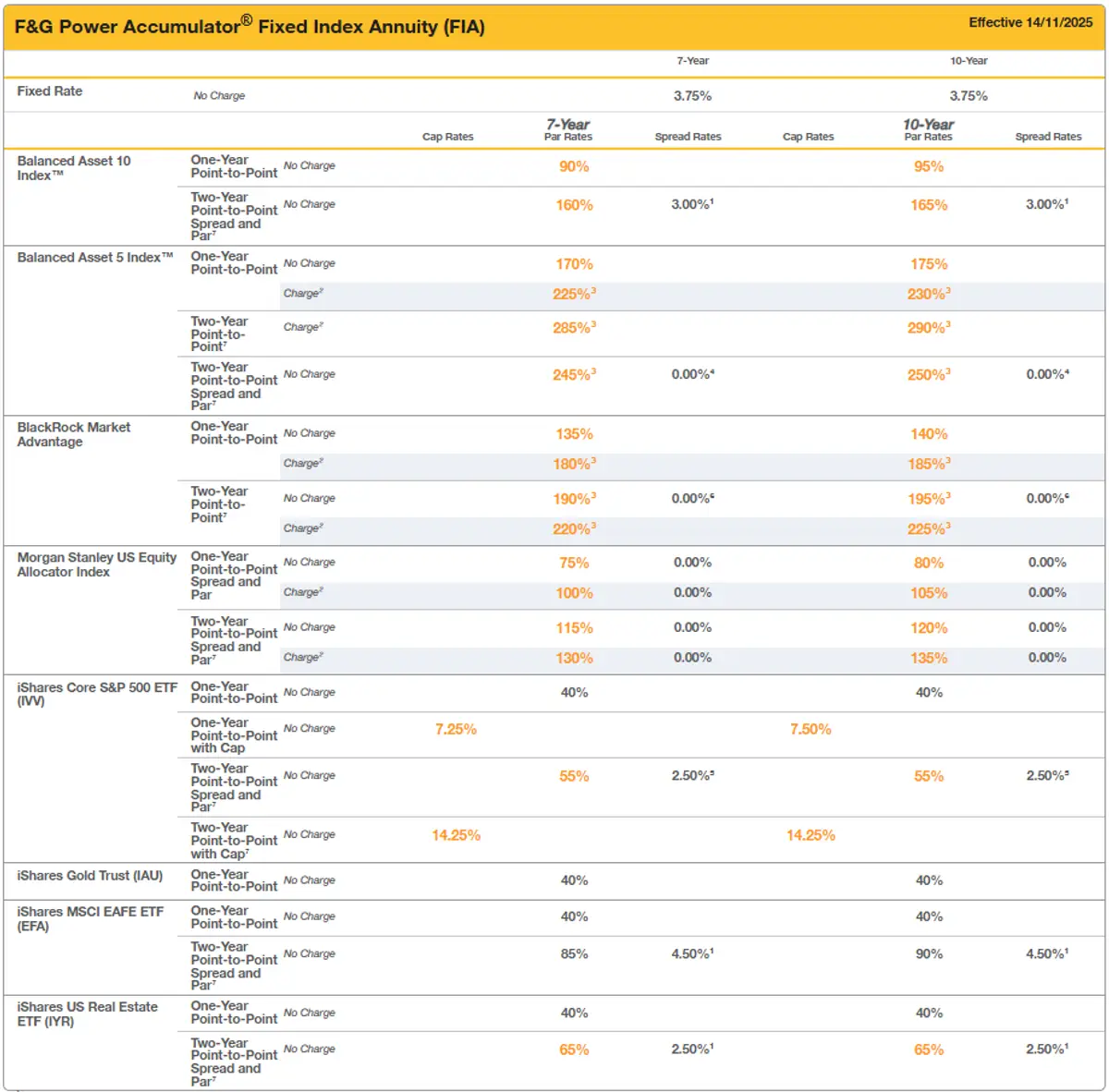

Let’s have a look at the F&G Power Accumulator rate sheet (as of December 2025) to understand how the earnings are determined.

The first thing to note is that we have an option to choose between eight indexes/ETFs, and each index has multiple strategies. All in all, it gives us an option to allocate our contract to a maximum of 24 strategies (23 index-based and one fixed). The company displays three types of rates across all strategies.

- Point to point with Participation Rate: The participation rate describes the annuitant’s participation percentage in a return of an index. For example, suppose the participation rate is 60%, and the index returned 10% over the agreed time (generally one year). In that case, the annuitant will be eligible for only 60% of the return, i.e., 6%. The formula for this is (Participation Rate% × Index Return).

- Point to point with Cap rate: Cap rate is another important terminology in an FIA. It means at the rate at which your interest-earning capacity is capped. For example, if an index returned 13% but your contract’s cap rate is 7%. In this situation, you will be eligible for an interest credit of only 7%. It doesn’t matter how much the index goes above the cap rate; the maximum interest you can earn is the cap rate.

- Point to point with Spread and Par Rate: This indexing strategy applies BOTH the participation rate and the spread to determine the index interest credit. Let’s take an example where the participation rate is 60%, the spread is 2%, and in a given year, the index returned 10%. In this case, the interest credited to the annuity account would be 60% of 10% (PR), less 2% (SP), i.e., 4%. Ideally, you should never opt for the Spread + Participation index crediting strategy.

When allocating premiums in a fixed-indexed annuity, individuals can distribute their money across these different indexing strategies. This means you can decide how much of your premium goes into each strategy, allowing for a tailored approach to potential growth and risk based on your financial goals and comfort level.

Performance Enhancement by Paying a Charge: The F&G Power Accumulator annuity has an option to enhance Performance by paying a charge. Through this, you can opt to increase the Participation Rates and/or reduce the spreads. In the above chart, you will notice that the indexing options with “charge” have higher participation rates and caps when compared to their “no charge” counterparts. At the time of writing this article, this charge was set at 1.25% annually. It is subtracted from the crediting option’s account value at the beginning of the interest crediting period.

If I were to choose the indexing strategies, I would have opted for one or many of the following strategies:

- iShares S&P 500 ETF 1-year point-to-point with Cap rate (No charge)

- BlackRock Market Advantage 1-year point-to-point with Participation rate (No charge)

- Balanced Asset 5 one-year point-to-point with Participation rate (No charge)

- Balanced Asset 5 two-year point-to-point with Participation rate (Charge)

Accessing your Money

Each year, you are entitled to a 10% free withdrawal of your contract value without incurring any charges, fees, or penalties.

Should your needs change unexpectedly and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies; although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for the F&G Power Accumulator 10 annuity

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11+ |

|---|---|---|---|---|---|---|---|---|---|---|---|

Surrender Charge % | 12% | 11% | 10% | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 0% |

Any time a withdrawal incurs a surrender charge, a Market Value Adjustment (MVA) will be made. For withdrawals above the annual penalty-free withdrawal amount for the purpose of a required minimum distribution, F&G will waive any surrender charges and market value adjustments.

Note that this surrender charge schedule is only valid for the F&G Power Accumulator 10 annuity product for select states. For complete details about each state, you may contact your trusted financial advisor.

Once the surrender charge period ends, you can typically access your full contract value without fees. However, any withdrawal reduces both your contract value and, if applicable, the income base tied to optional riders, which may impact future guaranteed income.

An annuitant can also convert the contract into a stream of guaranteed income, known as annuitization. They can choose from various payout options designed to meet different needs.

Life Only – Provides income for as long as you live.

Joint and Survivor Life – Continues payments over two lifetimes, often used by couples.

Life with Period Certain (up to 30 years) – Pays income for life, but guarantees payments for a minimum period even if death occurs earlier.

Period Certain (up to 30 years) – Provides guaranteed payments for a set number of years, regardless of lifespan.

Single Life or Joint Life with Cash Refund – Ensures that if the annuitant(s) pass away before receiving payments equal to the original premium, the difference is refunded to beneficiaries.

Single Life or Joint Life with Installment Refund – Similar to the cash refund, but any remaining balance is paid out over time in installments.

These options allow flexibility in balancing lifetime income needs with legacy goals, offering a way to customize how and when funds are accessed in retirement.

Death Benefit

Greater of account value or minimum guaranteed surrender value (MGSV).

Riders

The F&G Power Accumulator is a plain-vanilla annuity that does not offer any optional paid riders. In my opinion, this actually appeals to many people who don’t understand or do not want to deep-dive into the complex methodologies the riders often come up with. However, as with most annuities, the Power Accumulator has free in-built home health care, nursing home, and terminal illness waivers.

Nursing Home Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is confined to a Qualified nursing home for at least 60 consecutive days. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Terminal Illness Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is diagnosed with a terminal illness with a prognosis of 12 months or less. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Home Health Care Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is unable to perform at least 2 of 6 activities of daily living (for at least 60 days and is expected to continue for at least 90 days after requesting withdrawal. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician. While many annuities offer Nursing Home and Terminal Illness Waivers, the Home Health Care waiver is not something that many annuities offer.

Contract/Administrative Charge

The F&G Power Accumulator annuity levies no annual contract or administrative fees.

What Makes this Product Stand out?

The F&G Power Accumulator is a decent fixed-indexed annuity for accumulation. This annuity offers some of the features that not many fixed-indexed annuities offer. The ones that I like the most are:

- Good indexing options with uncapped strategy options: The F&G Power Accumulator annuity provides a diverse range of crediting strategies linked to well-performing indexes/ETFs, including the S&P 500 ETF. This annuity offers uncapped interest credit strategies with higher participation rates compared to many other similar fixed-indexed annuities.

- Penalty-free withdrawal on terminal illness or home or nursing care: This no-fee rider is automatically included for the annuity owner at issue and includes a Qualified Nursing Care, Terminal Illness, and Home Health Care waiver.

- Rate enhancement rider to increase potential returns: The Performance Rate rider helps to increase cap, participation rate, etc, on available strategies for more accumulation options that can align with a wide variety of goals. But one must keep in mind that it comes with a fixed fee, varied according to the strategy selected.

- Low minimum purchase amount: The minimum purchase amount for this annuity is low at $10,000. Many popular annuities available on the market require a high minimum purchase amount, ranging from $25,000 to $100,000. The low minimum purchase requirement enables even small investors to purchase annuity products.

What I Don’t Like

This product is generally good on all fronts for people looking for income growth; still, there are some features that I believe could add more value for the annuitant. Some of the features that I don’t like about the policy are:

- High Surrender Charge - The surrender charge of the F&G Power Accumulator fixed indexed annuity is on the higher side when compared to similar annuities in the market. If you think that there is a possibility that you will need to surrender the policy, the F&G Accumulator Plus annuity may not be the perfect annuity for you.

- No Optional Income or Death Riders - The F&G Accumulator Plus annuity doesn’t offer any enhanced living or death benefit riders, so, it may not be useful for people who are sure that they will need a guaranteed income stream from this annuity.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Fidelity National Financial

F&G is a subsidiary of Fidelity National Financial. Fidelity National Financial is one of the oldest title insurance companies and has been in the business for over 18 decades. It is a Fortune 500 company ranking #313.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

AM Best | A (3rd of 13 ratings) |

Moody’s | A3 (7th of 21 ratings) |

S&P | A- (7th of 21 ratings) |

Fitch | A- (7th of 21 ratings) |

Fidelity has managed to maintain strong ratings for many years. Fidelity is considered to be strong and stable financially. As of year-end 2024, some of the other financial highlights for Fidelity include its:

- $15.3 billion in total sales / direct written premium

- $50 billion of a total investment portfolio

- $51.6 billion Assets Under Management (AUM)

- $85 billion in total assets

- $622 million in net income

Thus, by using the operating history and financial numbers, we can safely gauge that you can trust your savings with F&G.

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. So, it’s very important to have a stream of income that can grow safely and steadily. This not only helps you mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

The F&G Power Accumulator annuity is one such annuity that helps you grow your savings with less risk. Through its Fixed Indexed Annuity, It offers tax deferral, principal protection, and the opportunity to participate risk-free in the market index. If you are considering buying a fixed indexed annuity with a major focus on accumulation, the F&G Power Accumulator annuity is an ideal product to look at.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. Delve deeper into our extensive reviews.