Introduction

Fixed Indexed Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index. Fixed Indexed Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to mis-sell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

This article provides an in-depth review of the Corebridge Power Select AICO Fixed Indexed Annuity, a deferred FIA that offers a unique AICO feature that provides enhanced upside potential in low-to-moderate return environments. Power Select AICO is designed for individuals who want a fixed-indexed annuity that offers a kind of “growth insurance” while protecting principal. If you are evaluating options that balance market-linked growth potential, growth security, and downside protection, this product may be worth considering. After extensive research and due diligence, I present a comprehensive and unbiased analysis of this plan.

The review of the Corebridge Power Select AICO Fixed Indexed Annuity will be broken into multiple subcategories:

Product Description

Rates and Costs Associated with the Corebridge Power Select AICO Fixed Indexed Annuity

Riders

Accessing your Money

What Makes This Product Stand Out?

What I Don’t Like

Company Details

Conclusion

Product Description - Corebridge Power Select AICO Fixed Indexed Annuity

The Corebridge Power Select AICO is a Fixed Indexed Annuity (FIA) that offers annuitants the opportunity to earn a portion of market index-linked returns without exposure to market downside risk. It is designed for individuals seeking a fixed indexed annuity with the potential to deliver upside in low-to-moderate return environments. However, this added upside potential comes at a cost, which we will examine in this review to assess whether the trade-off is worthwhile.

Let’s have a look at the high-level fine print of the Corebridge Power Select AICO Fixed Indexed Annuity, and then we will discuss each point in detail.

| Product Name | Corebridge Power Select AICO |

|---|---|

Issuing Company | Corebridge Financial (Formerly AIG) |

AM Best Rating | A+ (3rd of 13 ratings) |

Withdrawal Charge Period(s) | 5 years |

Maximum Issue Age | 85 Years |

Minimum Initial Purchase Amount | $25,000 |

Crediting Period and Strategies | 1-year point-to-point with participation rate, 1-year point-to-point with cap rate, or 1-year fixed with interest rate guaranteed |

Plan Types | IRA, Roth IRA, Nonqualified Account, SEP IRA, SIMPLE IRA, 401(a), etc. |

Indexes | S&P 500 Index, Nasdaq-100 Index, Dimensional US Foundation Index, ML Strategic Balanced Index, and PIMCO Global Optima Index |

Free Withdrawals | 10% of the annuity’s Accumulated Value per year |

Death Benefit | Upon the annuitant’s death, the beneficiary will get the greater of (i) Account Value or (ii) Surrender Value |

Riders | Built-in (paid) AICO Rider that acts as a “growth insurance.” |

Free Benefits | Extended Care and Terminal Illness Waivers |

Surrender Value | Account Value less any withdrawal charges/ MVA |

Surrender Charge Schedule | 8%, 7%, 6%, 5%, 4%, 0% |

Minimum Withdrawal Value | 87.5% of the initial premium, less withdrawals, growing at a minimum guaranteed annual rate |

RMD Friendly | Yes |

How does the Corebridge Power Select AICO Fixed Indexed Annuity policy work?

An annuitant (maximum age at the time of policy issue: 85) can purchase the Corebridge Power Select AICO Fixed Indexed Annuity with a minimum initial purchase amount of $25,000, and in return, they will earn a portion of market index returns (calculated through a formula that we will discuss shortly), credited to the contract’s account value as per the chosen crediting period. Apart from the regular crediting period, various events may trigger earnings credit, including free withdrawals, long-term care events, terminal illness or injury events, or when a death benefit is payable.

The CoreBridge Power Select AICO FIA includes a built-in paid Additional Interest Credit Overlay (AICO) rider, which is designed to provide upside potential based in part on the performance of equity and multi-asset indices, while offering 100% protection against market losses. We will discuss the mechanics, costs, and income calculations of this rider in more detail later in this review.

Coming back to the growth of the account value, the Corebridge Power Select AICO Fixed Indexed Annuity allows annuitants to allocate their premium across one or more indexing strategies tied to five indexes (the S&P 500 Index, the Nasdaq-100 Index, the Dimensional U.S. Foundations Index, the ML Strategic Balanced Index, and the PIMCO Global Optima Index) to determine how interest is credited. The S&P 500 Index offers two crediting strategies, while each of the other indexes offers a single crediting strategy. In addition, the plan includes a fixed-rate guaranteed interest option. In total, the annuity provides seven crediting strategy choices. Below, we briefly discuss each available index.

S&P 500 Index – The S&P 500 Index is a widely recognized benchmark for the U.S. stock market, tracking the performance of 500 large publicly traded companies listed on American stock exchanges. It is a market-capitalization-weighted index, meaning larger companies have a greater impact on its value. The index covers approximately 80% of the total U.S. equity market capitalization and is considered one of the best representations of the overall U.S. stock market and economy.

Nasdaq-100 Index - The Nasdaq-100 Index is a market-capitalization-weighted index that tracks the performance of 100 of the largest non-financial companies listed on the Nasdaq Stock Market. It is heavily tilted toward technology, communication services, and consumer discretionary sectors, and includes well-known companies such as Apple, Microsoft, Amazon, and NVIDIA. Compared to broader indexes like the S&P 500, the Nasdaq-100 tends to offer higher long-term growth potential but also experiences greater volatility, making it more suitable for investors with a higher risk tolerance seeking growth-oriented exposure.

Dimensional US Foundation Index – The Dimensional US Foundations Index is an investment strategy designed exclusively for use in fixed index annuities, specifically The Power Series of Index Annuities® offered by Corebridge Financial. It emphasizes small-cap, value, and high profitability stocks to pursue higher expected returns compared to the overall market, while incorporating a multi-asset approach that includes equities, fixed income, and commodities. The index adapts exposures across these asset classes using a rules-based methodology and aims to maintain a targeted level of volatility using Salt Financial's truVol® Risk Control Engine, which captures higher-frequency, intraday data for more responsive adaptation to market trends. However, this focus on controlling volatility may also cap the potential for higher gains.

ML Strategic Balanced Index – The ML Strategic Balanced Index® is a hybrid index that seeks growth and risk management by actively allocating to equities, fixed income, and cash. The ML Strategic Balanced Index® provides systematic, rules-based access to the blended performance of the S&P 500® (without dividends), which serves to represent equity performance, and the Merrill Lynch 10-year U.S. Treasury Futures Total Return Index, which serves to represent fixed income performance. It embeds an annual index cost in the calculations of the change in index value over the index term. This “embedded index cost” will reduce any change in index value over the index term that would otherwise have been used in the calculation of index interest, and it funds certain operational and licensing costs for the index. To help manage overall return volatility, the Index may also systematically utilize Cash performance in addition to the performance of these two underlying indices. However, this focus on controlling volatility may also cap the potential for higher gains.

PIMCO Global Optima Index – The PIMCO Global Optima Index® is a quantitative, rules-based index designed to capture upside from a diverse array of global equity and U.S. bond markets. This innovative index focuses on equity for robust growth potential and embraces global diversification to enhance the set of opportunities available. It is crafted for total return potential, featuring no embedded index-level performance drag and no allowable leverage.

It is very important to note that, like other Fixed Indexed Annuities, the Power Select AICO Fixed Indexed Annuity comes with cap rates and participation rates for these indexes, meaning that you will be credited only a part of the index return to your annuity. These rates change frequently; I will discuss these rates more briefly.

Note: In addition to allocating funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest rate. These fixed rates are subject to change over time. The first-year fixed rate for the 5-year withdrawal charge period, as of the time of writing this article, was 2.25%.

The earnings crediting formula

The earnings crediting formula is one of the most important parts of this annuity discussion. It is important to know that we don’t simply get the index return credited to our annuity. The company has rate-limiting mechanisms in the form of cap rates and participation rates that affect our earnings. These rates are subject to change over time, and the updated rates can be checked with your financial advisor or on the company’s website.

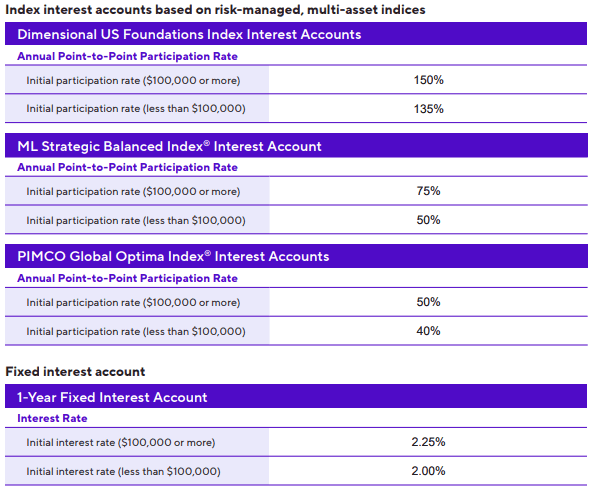

Let’s have a look at the Corebridge Power Select AICO Fixed Index Annuity rate sheet (as of December 2025) to understand how the earnings are determined.

From the above rate chart, you will notice that there are 7 interest crediting options (6 indexed and 1 fixed), each with two premium bands (if you put $100,000 or more as an initial investment, you qualify for the high-band, and thus a higher cap or participation rate). Let’s have a look at different terms that are used by the company in the Power Select AICO Fixed Indexed Annuity rate chart:

Participation Rate (PR): The participation rate describes the annuitant’s participation percentage in the return of an index. For example, suppose the participation rate is 150%, and the index returned 4% over the agreed time. In that case, the annuitant will be eligible for 150% of the return, i.e., 6%.

Cap Rate: This refers to the rate at which your interest-earning capacity is capped. For example, if an index returns 12% but the contract’s cap rate is 6%, the annuitant will be eligible for an interest credit of 6% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest that can be earned is the cap rate.

Fixed Account Rate: If you opt for a fixed account rate, you simply earn the fixed rate for a particular period specified by the company before your policy begins. These rates are usually low/at par as compared to other fixed avenues, such as CDs and MYGAs, so you should avoid fixed rates in a general scenario. The 1-year fixed rate on this policy at the time of writing this article was 2.25%.

Among these indexes, I prefer the S&P 500 Index with a cap rate option, the Nasdaq-100 Index with a cap rate option, and the Dimensional U.S. Foundations Index with a participation rate strategy. I would avoid the other strategies because (i) the remaining indexes are all volatility-controlled, which limits upside potential, and (ii) the participation rates offered for those strategies are relatively low.

Riders

The AICO rider is the defining feature of the Corebridge Power Select AICO Fixed Indexed Annuity, designed to enhance growth potential in low-to-moderate return environments while maintaining full principal protection. Unlike traditional FIAs that rely solely on annual index credits, AICO adds an Additional Interest Credit Overlay that effectively acts as “growth insurance” on your accumulated interest.

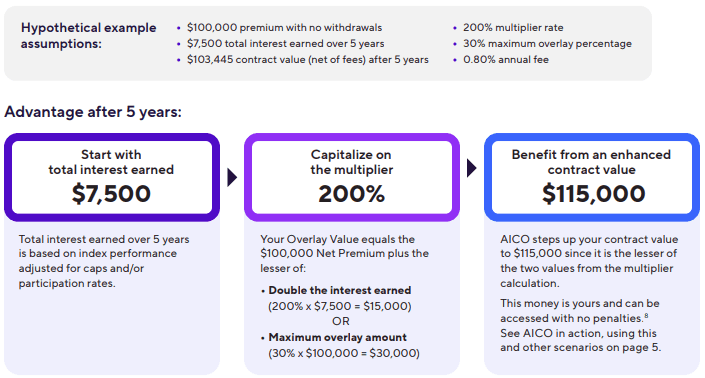

How the AICO Overlay Works

During the first five contract years, your annuity earns interest in the usual way through selected index crediting strategies or a fixed account. At the same time, AICO tracks your total interest earned over those five years. On the 5th contract anniversary, Corebridge applies a 200% multiplier to that total interest and compares it to a maximum overlay amount, which is currently capped at 30% of your initial premium. Your contract value is then stepped up to the lower of:

Net premium plus 200% of total interest earned, or

Net premium plus the maximum overlay percentage (30% of the initial premium).

If the resulting Overlay Value is higher than your existing contract value, the difference is credited as the Overlay Credit and added directly to your contract value. This credit becomes fully accessible after the five-year withdrawal-charge period. This is a compulsory paid rider, with an annual fee of 0.80% of the contract value.

Example

Assume an investor allocates $100,000 to the Power Select AICO annuity, earns $7,500 in total index interest over five years, and pays the 0.80% annual AICO fee during that period.

200% of interest earned = $15,000

Maximum overlay amount = 30% × $100,000 = $30,000

The overlay is based on the lower amount, so the annuity is stepped up to $115,000. If the contract value after fees is $103,445, AICO adds an Overlay Credit of $11,555, more than offsetting the cumulative fees deducted during the five years

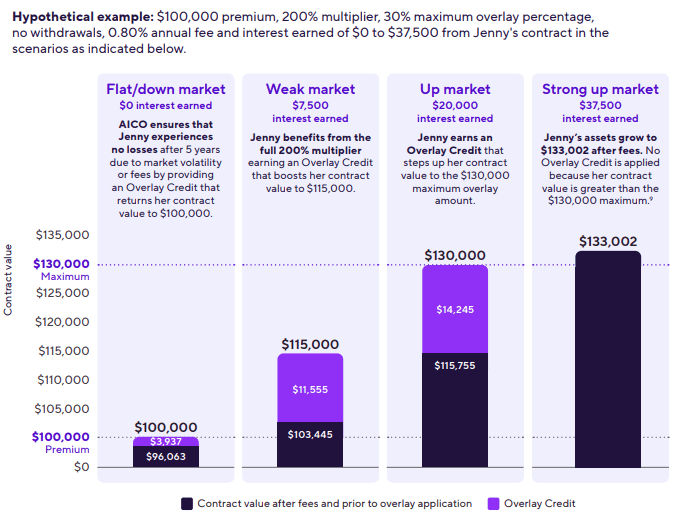

Market Scenarios and Trade-Offs

Flat or down markets: AICO can restore the contract value back to the original premium, effectively neutralizing both market losses and fees.

Low to moderate up markets: The rider shines here, as the 200% multiplier can materially boost returns beyond what standard FIA crediting alone would provide.

Strong up markets: The overlay may not apply if the contract value already exceeds the maximum overlay amount, meaning the investor still pays the AICO fee without receiving an additional credit

Key Considerations

The AICO fee (0.80% annually) applies only during the first five years and then permanently terminates.

The overlay credit, if applied, is added only once at the end of year five.

AICO is best viewed as a return-smoothing and enhancement tool, not a pure growth accelerator in strong bull markets.

Is the AICO Rider Useful?

The AICO rider is most useful in low to moderate growth market environments, where traditional indexed crediting may struggle to generate meaningful returns. In such scenarios, the 200% interest multiplier and the end-of-year-five overlay can help lift outcomes and partially offset periods of muted index performance, while still preserving principal protection. This is where the rider’s design intent is most evident: smoothing results and enhancing returns when markets are choppy or deliver only modest gains.

However, the rider is less compelling in decent or strong growth markets. The maximum overlay credit is capped at 30% over five years, which equates to an approximate 5.39% compound annual growth rate (CAGR) before fees. While this is slightly better than many fixed-rate options offered by annuities, it can lag what a well-performing indexed strategy might deliver in favorable markets. Moreover, the rider carries an annual fee of 0.80% on the account value during the first five years, which further reduces net returns if the overlay credit does not meaningfully apply. As a result, investors should view AICO as a defensive enhancement tool rather than a long-term growth accelerator, best suited for those prioritizing stability and return smoothing over maximizing upside.

Extended Care and Terminal Illness Waivers

Also, as with most annuities, the Corebridge Power Select AICO has free in-built extended care and terminal illness waivers.

Extended Care Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is confined to a care facility for at least 90 consecutive days. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Terminal Illness Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is diagnosed with a terminal illness with a prognosis of 12 months or less. No withdrawal charge or MVA applies if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Accessing your Money

Each year, you are entitled to a 10% free withdrawal of your contract value without incurring any charges, fees, or penalties.

Should your needs change unexpectedly and you need to take an excess withdrawal (a withdrawal that exceeds the free withdrawal amount available in a given contract year), you may be entitled to access additional funds, although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for the Power Select AICO Fixed Indexed Annuity.

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6+ |

|---|---|---|---|---|---|---|

Surrender Charge % | 8% | 7% | 6% | 5% | 4% | 0% |

Market Value Adjustments - In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period. The surrender charge schedule is different for the different tenures of annuities and also changes for some states.

The surrender charge of Power Select AICO Fixed Indexed Annuity is in line with all the other annuity issuers.

Once the surrender charge period ends, you can typically access your full contract value without fees. However, any withdrawal reduces both your contract value and, if applicable, the income base tied to optional riders, which may impact future guaranteed income.

An annuitant can also convert the contract into a stream of guaranteed income, known as annuitization. They can choose from various payout options designed to meet different needs.

Life Only – Provides income for as long as you live.

Joint and Survivor Life – Continues payments over two lifetimes, often used by couples.

Life with Period Certain (up to 30 years) – Pays income for life, but guarantees payments for a minimum period even if death occurs earlier.

Period Certain (up to 30 years) – Provides guaranteed payments for a set number of years, regardless of lifespan.

Single Life or Joint Life with Cash Refund – Ensures that if the annuitant(s) pass away before receiving payments equal to the original premium, the difference is refunded to beneficiaries.

Single Life or Joint Life with Installment Refund – Similar to the cash refund, but any remaining balance is paid out over time in installments.

These options allow flexibility in balancing lifetime income needs with legacy goals, offering a way to customize how and when funds are accessed in retirement.

Death Benefit

Upon the annuitant’s death, the beneficiary will get the greater of (i) the Account Value or (ii) the Surrender Value

Contract/Administrative Charge

The Power Select AICO Fixed Indexed Annuity levies no annual contract or administrative fees. However, it comes with a compulsory paid rider, the Additional Interest Credit Overlay (AICO), which, at the time of writing this article, costs 0.80% of the contract amount, deducted from your account value for the first five years. This rider is discussed in detail in the previous section.

What Makes this Product Stand Out?

The Power Select AICO Fixed Indexed Annuity offers a few features that make a favorable case for this annuity. The ones that I like the most are:

AICO Growth Overlay for Return Smoothing: The AICO rider adds an Additional Interest Credit Overlay that can enhance outcomes in low-to-moderate growth environments by applying a 200% multiplier to cumulative interest over the first five years, while preserving principal protection.

Decent cap and participation rates, even on the popular broad-market indices like the S&P 500 and Nasdaq-100

Free Confinement and Terminal Illness Waiver Benefit: This no-fee rider is automatically included for owners under age 65 and includes both a Qualified Nursing Care and Terminal Illness Benefit.

Multiple Payout Options: Lump sum or Annuitization option with Life Only, Life with Period Certain, Joint and Survivor Life, etc.

What I Don’t Like

Limited Benefit in Strong Market Environments: The AICO rider’s maximum overlay is capped at 30% over five years, which can significantly limit upside potential in strong equity markets. In such environments, traditional indexed strategies without the overlay may deliver better long-term returns.

Additional Cost Reduces Net Returns: The rider carries an annual fee of 0.80% on the account value during the first five years. If the overlay credit does not meaningfully apply, this fee can erode overall performance.

Rider-Driven Value Proposition: The product’s overall attractiveness is heavily dependent on the AICO rider. It makes the most sense only if one expects market performance to remain low to moderate over the next five years.

Low Fixed Account Rate: At the time of writing this article, the product offered a relatively low fixed rate of just 2.25%, while many comparable annuities were offering fixed rates above 4%.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Corebridge Financial

Corebridge Financial is a U.S.-based, publicly traded financial services company (NYSE: CRBG) specializing in retirement and life insurance solutions. Formed through a spin-off from American International Group (AIG) in 2022, Corebridge represents AIG’s former retirement and protection business. The company focuses on offering annuities, life insurance, and other long-term savings products designed to help individuals plan for retirement, manage risk, and achieve financial security. Leveraging decades of industry experience and a broad product portfolio, Corebridge serves annuitants and investors with an emphasis on product innovation, capital strength, and long-term reliability.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

AM Best | A |

S&P | A+ |

Fitch Ratings | A+ |

Moody’s | A2 |

Corebridge Financial has consistently maintained decent ratings for many years. It is considered to be financially strong and stable. As of December 2024, the company reported

Premiums and deposits of $41.7 billion

Total assets under management (AUM) of $404 billion

Net income of $2.2 billion

Stockholder return of $2.3 billion

Thus, based on the operating history and financial numbers, we can confidently conclude that you can trust your savings with Corebridge Financial.

Conclusion

With advancements in healthcare and technology, the average American today lives longer than ever before. Therefore, it’s crucial to have a steady stream of income that can grow safely and reliably, providing a guaranteed income during retirement years. This not only helps you to mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

The Corebridge Power Select AICO Fixed Indexed Annuity is a specialized product designed for investors who value stability and principal protection over aggressive growth. Its primary appeal lies in the AICO rider, which can help improve outcomes in low to moderate growth markets by providing an additional interest credit at the end of the initial five-year period. However, the capped overlay and the annual rider fee reduce its effectiveness in stronger market environments, where traditional fixed indexed annuities may offer better growth potential. Overall, this annuity is best suited for conservative investors who are comfortable accepting limited upside in exchange for more predictable results over a defined time horizon.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. To dive deeper into our extensive reviews, click here.