Introduction

Fixed Indexed Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index. Fixed Indexed Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to mis-sell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

This article offers a thorough review of the American National Rate Certainty Indexed Annuity (Fixed Indexed Annuity). This financial product combines traditional features, such as tax-deferred growth, principal protection, and various indexing strategies, with straightforward methods for determining earned interest, specifically the Trigger Rate feature, which is discussed in detail. After conducting extensive research and due diligence, I provide a comprehensive and unbiased analysis of this plan.

The review of the American National Rate Certainty Fixed Indexed Annuity will be broken into multiple subcategories:

Product Policy

Product Description

Rates and Costs

Accessing your Money

Riders

What Makes This Product Stand Out?

What I Don’t Like

Company Details

Conclusion

Product Description - American National Rate Certainty Fixed Indexed Annuity

The American National Rate Certainty is a Fixed Indexed Annuity (FIA) that offers annuitants the opportunity to earn a portion of index-linked returns (based on the S&P 500 Dynamic Intraday TCA Index) without taking on the risk of market downturns. It is well-suited for retirees or individuals approaching retirement who aim to grow and protect their savings. The plan uniquely features Trigger Rate strategies, allowing annuitants to earn declared interest credits based on the performance of the S&P 500 Dynamic Intraday TCA Index. This is discussed in detail in the latter part of this annuity product review.

Let’s look at the high-level fine print of American National Rate Certainty FIA, and then we will discuss each point in detail.

| Product Name | Rate Certainty Annuity |

|---|---|

Issuing Company | American National Insurance Company |

AM Best Rating | A (3rd of 13 ratings) |

Withdrawal-charge Term | 5, 7, 10, and 20 Year |

Maximum Issue Age | 85 Years for 5, 7, and 10-year terms 50 Years for a 20-year term |

Minimum Initial Purchase Amount | $10,000 ($5,000 for qualified) |

Surrender Charge Schedule | Varies as per the withdrawal-charge term |

Plan Types | Nonqualified, IRA, Roth IRA, SEP IRA, SIMPLE IRA, 401(a), Charitable trust. |

Crediting Strategies | 1-year protected performance trigger, 1-year performance trigger, 1-year enhanced performance trigger, and 1-year declared rate |

Indexes | S&P 500 Dynamic Intraday TCA Index |

Free Withdrawals | 10% of the contract value through the end of the Surrender Charge period |

Free Benefits |

|

Surrender Value | Greater of Accumulated Value (less any withdrawal charges/MVA) or minimum required distribution |

Death Benefit | The death benefit will be equal to the greater of the accumulated value or the surrender value |

RMD Friendly | Yes |

The American National Rate Certainty Annuity is almost identical for all policy tenures, except for the withdrawal-charge period and surrender charge schedule. For ease of discussion and clarity, we will refer to the American National Rate Certainty Annuity 10 (unless otherwise specified) for the remainder of the article.

How does the American National Rate Certainty Indexed Annuity policy work?

An annuitant (with a maximum age at the time of policy issue of 85) can purchase the American National Rate Certainty FIA with a minimum initial purchase amount of $10,000. In return, they will earn market index returns (calculated using a formula that we will discuss shortly), credited according to the chosen crediting period. Apart from the regular crediting period, various events may trigger earnings credits, including free withdrawals, long-term care events, terminal illness or injury events, or when a death benefit is payable.

The American National Rate Certainty Annuity allows annuitants to choose from one or more of three trigger rate indexing strategies tied to the S&P 500 Dynamic Intraday TCA Index to determine their earnings.

The S&P 500 Dynamic Intraday TCA Index provides exposure to the S&P 500 via E-mini futures while employing an intraday volatility control and trend-following overlay. The index can rebalance up to 13 times per day using a time-weighted average price (TWAP) mechanism to smooth execution and manage trade impact. The goal is to capture upside in favorable trends while reducing exposure during volatile or adverse intraday conditions. As a result, both the upside performance and downside risk of this index tend to be lower than those of a broad market benchmark, such as the regular S&P 500 Index.

The annuity offers three trigger rate options linked to the S&P 500 Dynamic Intraday TCA index, which I will explain in detail in the following section. In addition to selecting from the available index options, annuitants can also choose to allocate a portion of their premium to a fixed interest option. This fixed rate is subject to periodic changes based on market conditions. As of the time of writing this article, the fixed rate was 3.70%.

Rates and Costs associated with the American National Rate Certainty Annuity

The earnings crediting formula

The earnings crediting formula is the most important part of this annuity discussion. It is important to know that we don’t simply get the index return credited to our annuity. The company has rate-limiting mechanisms (in the form of triggers) in place that affect our earnings.

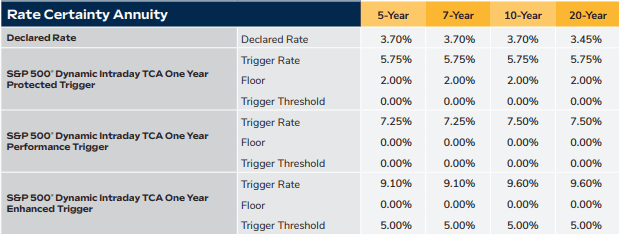

Let’s have a look at the American National Rate Certainty Fixed Indexed Annuity rate sheet (as of October 2025) to understand how the earnings are determined. Please note that these rates are subject to change over time, and you can always verify the updated rates with your financial advisor or on the company’s website.

From the above rate sheet, we can see that there are four interest crediting strategies—three indexing strategies tied to the S&P 500 Dynamic Intraday TCA Index, and one fixed-rate strategy. An annuitant can allocate their premium across multiple strategies based on their preferences. Let’s understand what these terminologies mean:

Declared Rates: If you opt for a declared rate, you simply earn the fixed rates for a particular period specified by the company before your policy begins. These rates usually tend to be low compared to other fixed avenues, such as CDs and MYGAs, so you should avoid fixed rates in a general scenario. The 1-year fixed rate on this policy at the time of writing this article was 3.70%, which is not that good compared to other FIA’s fixed-rate offerings.

1-Year Protected Performance Trigger: This strategy is ideal for conservative investors seeking consistent returns with built-in downside protection. It offers a Trigger Rate of 5.75% (across 5-, 7-, 10-, and 20-year terms) and a 2% protected floor. If the index performance for the year is flat or positive, the annuity earns the full 5.75%. If the index ends negatively, a 2% protected interest credit still applies, ensuring growth even during minor market declines. This approach provides both safety and modest growth potential.

Example:

If the index increases or remains unchanged → 5.75% credited

If the index decreases → 2.00% credited (protected interest)

1-Year Performance Trigger: The Performance Trigger strategy is designed for moderate investors looking for higher upside while maintaining principal protection. It offers a Trigger Rate of 7.25%–7.50% depending on the term length. If the index closes at or above its starting value, the full Trigger Rate is credited for that year. If the index declines, no interest is credited, but the 0% floor ensures no loss of principal.

Example:

If the index increases or remains unchanged → 7.25% credited

If the index decreases → 0% credited

1-Year Enhanced Performance Trigger: This strategy targets more growth-oriented investors willing to accept slightly higher risk for potentially stronger returns. It offers a Trigger Rate of 9.10%–9.60% with a 5% performance threshold. If the index increases by 5% or more, the full Trigger Rate is credited. If the index gain is below 5%, remains unchanged, or declines, no interest is credited.

Example:

If the index increases by 5% or more → 9.10% credited

If the index increases by less than 5%, remains unchanged, or declines → 0% credited

In my view, the Protected Performance Trigger is the most balanced of the three options, as it combines a respectable crediting rate with a built-in 2% floor, ensuring modest growth even when markets decline. The Performance Trigger is suitable for investors seeking slightly higher upside while maintaining full principal protection, making it a reasonable middle-ground choice.

However, I would generally not recommend the Enhanced Performance Trigger option. While it advertises the highest potential return, it requires the S&P 500 Dynamic Intraday TCA Index to rise by at least 5% within a year to receive any credit. Given that this index is volatility-controlled and designed to limit large fluctuations, crossing that 5% threshold consistently is statistically less likely. As a result, many investors may experience years with no credited interest, which can significantly reduce long-term accumulation potential.

Guaranteed Crediting Rate to Avoid the Stress of Declining Renewal Rates

One of the standout advantages of the American National Rate Certainty Annuity is its guaranteed crediting rate for the entire selected rate guarantee period. Unlike most Fixed Indexed Annuities (FIAs) that typically declare rates for only one contract year and adjust them annually based on market conditions, this product locks in the crediting rate at the time of issue. This means you can count on the same rate throughout your chosen 5-, 7-, 10-, or 20-year term, without worrying about declining renewal rates.

This feature provides long-term predictability and stability, key factors for retirees and conservative investors seeking a dependable growth path without the uncertainty of fluctuating renewal rates.

Accessing your Money

Each year, you are allowed a 10% free withdrawal of your contract value without incurring charges, fees, or penalties.

Should your needs change unexpectedly, and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies; however, certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for the American National Rate Certainty Annuity.

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5-Year | 9 | 8 | 7 | 6 | 5 | |||||||||||||||

7-Year | 9 | 8 | 7 | 6 | 5 | 4 | 3 | |||||||||||||

9-Year CA | 9 | 8 | 7 | 6 | 5 | 4 | 3 | 2 | 1 | |||||||||||

10-Year | 9 | 8 | 7 | 6 | 5 | 5 | 4 | 3 | 2 | 1 | ||||||||||

19-Year CA | 9 | 8 | 7 | 6 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 4 | 3 | 2 | 1 | |

20-Year | 9 | 8 | 7 | 6 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 4 | 3 | 2 | 1 |

In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period.

Please note that this surrender charge schedule is only applicable to the American National Rate Certainty Annuity product for select states. For complete details about each state, you may seek information from your financial advisor or from the company’s website.

Once the surrender charge period ends, you can typically access your full contract value without fees. However, any withdrawal reduces your contract value.

An annuitant can also convert the contract into a stream of guaranteed income, known as annuitization. They can choose from various payout options designed to meet different needs.

Life Only – Provides income for as long as you live.

Joint and Survivor Life – Continues payments over two lifetimes, often used by couples.

Life with Period Certain (up to 30 years) – Pays income for life, but guarantees payments for a minimum period even if death occurs earlier.

Period Certain (up to 30 years) – Provides guaranteed payments for a set number of years, regardless of lifespan.

Single Life or Joint Life with Cash Refund – Ensures that if the annuitant(s) pass away before receiving payments equal to the original premium, the difference is refunded to beneficiaries.

Single Life or Joint Life with Installment Refund – Similar to the cash refund, but any remaining balance is paid out over time in installments.

These options allow flexibility in balancing lifetime income needs with legacy goals, offering a way to customize how and when funds are accessed in retirement.

Death Benefit

The death benefit will be equal to the greater of the accumulated value or the surrender value

Riders

The American National Rate Certainty Annuity is a straightforward, plain-vanilla annuity designed for simplicity. It does not include any paid riders, such as lifetime income or enhanced death benefit options. This streamlined approach may actually appeal to investors who prefer a product that’s easy to understand—without the added complexity, cost, or long-term commitment often associated with rider-based annuities.

However, like most fixed indexed annuities, the Rate Certainty Annuity includes several standard waiver benefits that provide flexibility and liquidity in special circumstances:

Confinement Waiver: Surrender charges and Market Value Adjustments (MVA) may be waived if the contract owner is confined for 30 days or more to a licensed hospital, skilled nursing facility, custodial care facility, convalescent care center, or licensed hospice. This waiver becomes available 90 days after issue.

Disability Waiver: Available immediately after issue and prior to age 65, this waiver removes surrender charges and MVA if the contract owner becomes physically disabled or is diagnosed with a disabling terminal illness.

Terminal Illness Waiver: Surrender charges and MVA are waived if the contract owner is diagnosed with an injury or illness expected to result in death within 12 months.

Contract/Administrative Charge

The American National Rate Certainty Annuity levies no annual contract or administrative fees.

What Makes the Product Stand Out

The American National Rate Certainty Annuity distinguishes itself through its simplicity, stability, and long-term rate guarantees. While many fixed indexed annuities can be complex and rate-sensitive, this product is designed to provide clarity and predictable growth. The following aspects, in my view, make it stand out:

Simple, Easy-to-Understand Structure: This is a straightforward, plain-vanilla annuity without layered riders or complicated crediting rules. It’s well-suited for investors who value transparency and stability over intricate features.

Rates Locked for the Entire Term: Unlike most FIAs that renew rates annually, the Rate Certainty Annuity locks in its crediting rate for the full 5-, 7-, 10-, or 20-year term. This eliminates the uncertainty of declining renewal rates and provides consistent accumulation over time.

No Paid Riders: The absence of optional paid riders such as income or death benefit add-ons simplifies the contract and avoids additional costs. This structure appeals to investors seeking a low-maintenance annuity focused purely on accumulation and protection.

Comprehensive Waiver Benefits: Built-in Confinement, Disability, and Terminal Illness waivers enhance liquidity during unforeseen circumstances, allowing penalty-free access to funds when needed most.

What I Don’t Like

While the American National Rate Certainty Annuity offers valuable simplicity and predictability, there are a few aspects that, in my view, limit its overall growth potential:

Limited Index Options: The product offers very few indexing choices, all tied to the S&P 500 Dynamic Intraday TCA Index, which is a volatility-controlled index. This significantly restricts diversification opportunities across broader market benchmarks.

Volatility-Control Design Limits Upside: Because the TCA Index adjusts exposure to reduce volatility, it inherently caps strong market performance during bullish periods. This means that while downside protection is strong, the upside potential is also muted, making it less attractive for investors seeking higher accumulation when markets are performing well.

Not Ideal for Aggressive Growth Investors: The overall design focuses on rate stability rather than maximizing returns. As a result, this annuity may not appeal to those with a longer investment horizon or a higher risk tolerance looking to capture meaningful market-linked growth.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

American National Insurance Company

American National Insurance Company has been in the business since 1973. It has been one of the largest providers of annuities in the US for many years and has regularly been in the top ten Fixed Indexed Annuity Sales.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

AM Best | A (3rd of 16 ratings) |

Fitch | A (6th of 19 ratings) |

S&P | A (6th of 21 ratings) |

American National Insurance Company has managed to maintain decent ratings for many years. It is considered to be strong and stable financially. In 2024, the company paid out nearly $5.4 billion in claims. As of year-end 2024, some of the other financial highlights for American National include its:

$5.5 billion in total sales / direct written premium

$10 billion of total stockholders’ equity

$680 million in net income

$121 billion in total assets

Thus, based on the operating history and financial numbers, we can confidently conclude that you can trust your savings with American National.

Conclusion

With advancements in healthcare and technology, the average American today lives longer than ever. Therefore, it’s very important to have a stream of income that can grow safely and provide a fixed, guaranteed income during retirement. This helps mitigate the risk of outliving your income and ensures that you continue to live a decent life even in retirement.

The American National Rate Certainty Annuity is best suited for investors who value stability, simplicity, and guaranteed returns over market-driven growth. Its standout feature, a guaranteed crediting rate locked for the entire term, provides a level of predictability that removes the uncertainty of fluctuating renewal rates common in most fixed indexed annuities. Combined with its clean, no-rider structure and built-in waiver benefits, it offers a transparent, low-maintenance solution for conservative savers and retirees seeking dependable accumulation.

That said, the product’s limited index selection and reliance on a volatility-controlled index make it less appealing for those pursuing higher growth potential in strong markets. Overall, the Rate Certainty Annuity fits best within a capital-preservation strategy, providing steady, reliable growth without the complexity or unpredictability of more aggressive FIA products.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. To dive deeper into our extensive reviews, click here.