Sentinel Security Life Accumulation Protector Plus Annuity Review

byAnnuityRatesHQ Staff

Wed Apr 03 2024

Introduction

The Accumulation Protector Plus Annuity (APP) is a fixed-indexed annuity that can help you accumulate wealth while also protecting your capital from any market downturns. The APP is a tax-deferred, relatively safe financial product that offers protection and growth potential no matter the economic conditions, thanks to its exclusive and flexible crediting strategies. This stability and reliability of its return make the Accumulation Protector Plus Annuity a sound investment for those with a low tolerance for risk. For example, if you are looking to retire soon and need a long-term strategy to grow your principal without putting your capital at risk then this annuity could be a good choice for you.

Before reading this review, remember that annuities are complex products, and many advisors try to missell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

This review will take an in-depth review of the Sentinel Security Life Accumulation Protector Plus Annuity and offer an unbiased opinion of whether or not this annuity is right for you. I’ve broken the article into the following subcategories:

Product Description

Rates and Costs Associated with the Sentinel Security Life Accumulation Protector Plus Annuity

Riders

What Makes This Product Stand Out?

What I Don’t Like

Company Details

Conclusion

Product Description: Sentinel Security Life Accumulation

The Sentinel Security Life Accumulation Protector Plus Annuity is a safe and reliable fixed-income annuity that offers growth potential whether the market goes up, down, or stays the same. As a fixed-income asset, this annuity competes with the likes of CDs, Savings Bonds, Money Market Funds, and Treasury Bills. If you use any of these products as part of your retirement strategy then you’ll likely want to consider the Sentinel Security Life Accumulation Protector Plus Annuity. First, I’ll take a high-level look at the Sentinel Security Life Accumulation Protector Plus Annuity. Then, I will discuss each point in detail:

Product Name: Accumulation Protector Plus Annuity

Issuing Company: Sentinel Security Life Inc

AM Best Rating: B++

Withdrawal Charge Period(s): You can withdraw up to 5% of your Account Value in the second contract year.

Maximum Issue Age: 85

Minimum Initial Purchase Amount: $5,000

Surrender Charge Schedule: 10%, 9%, 8%, 7%, 6%, 5%, 4%, 3%, 2%, 1%

Crediting Period and Strategies: This plan offers eight crediting strategies linked to two indexes.

Plan Types: Personal, Traditional IRA, Roth IRA, SEP-IRA, SIMPLE-IRA, 403(b)

Indexes: CS Momentum Index, CS ESG Macro 5 Index, S&P 500 Index

Fee Withdrawals: In the second contract year, 5% of your account value or your Required Minimum Distribution, whichever is greater. With the Rate Enhancement Rider, this 5% increases to 10%.

RMD Friendly: Yes

Death Benefit:

In non-California states, upon the annuitant’s death, the beneficiary will receive an amount equal to the greater of the Account Value less any Non-Vested Premium Bonus or the Minimum Guaranteed Surrender Value determined as of the date of death.

In California, upon the annuitant’s death, the beneficiary will receive an amount equal to the greater of the Account Value or the Minimum Guaranteed Surrender Value determined as of the date of death.

Riders: Rate Enhancement

How does the Sentinel Security Life Accumulation Protector Plus Annuity policy work?

The Sentinel Security Life Accumulation Protector Plus Annuity can help you accumulate wealth in both bull and bear markets. When you sign up for this annuity, you’ll have the ability to choose how your premium is allocated across eight different crediting strategies. These strategies are linked to two indices: the CS Momentum Index and the S&P 500 Index.

The eight strategies that you can choose from include:

Fixed Rate account: An interest rate that is linked to an index, while also offering principal protection from negative markets.

Trigger Rate account: A stated rate is received as long as the index return is not negative over a specific time, such as one year.

6 Point-to-Point with Participation Rate or Cap Rate accounts: These strategies measure the difference in the index’s value on each contract anniversary, comparing it to the value of the index either a year earlier, two years earlier, or three years earlier, depending on the option you choose.

In simple terms, if the market goes up during any given year then you can expect to earn a return that’s contingent on the crediting strategy that you selected. But, the Sentinel Security Life Accumulation Protector Plus Annuity will also protect your principal in the event of a market downturn. During a market downturn, you will not lose money, including interest. This is because your money is allocated to the annuity itself as opposed to an index. Again, this depends slightly on the crediting strategy that you select.

However, please note that while the Accumulation Protector Plus Annuity is tied to market indices that does not mean that you will earn a market-like return. You will still earn a fixed return even if the market has an exemplary year. With this in mind, the APP competes with products like CDs, bonds, money market accounts, and other types of fixed-income products. It is not a market-based product.

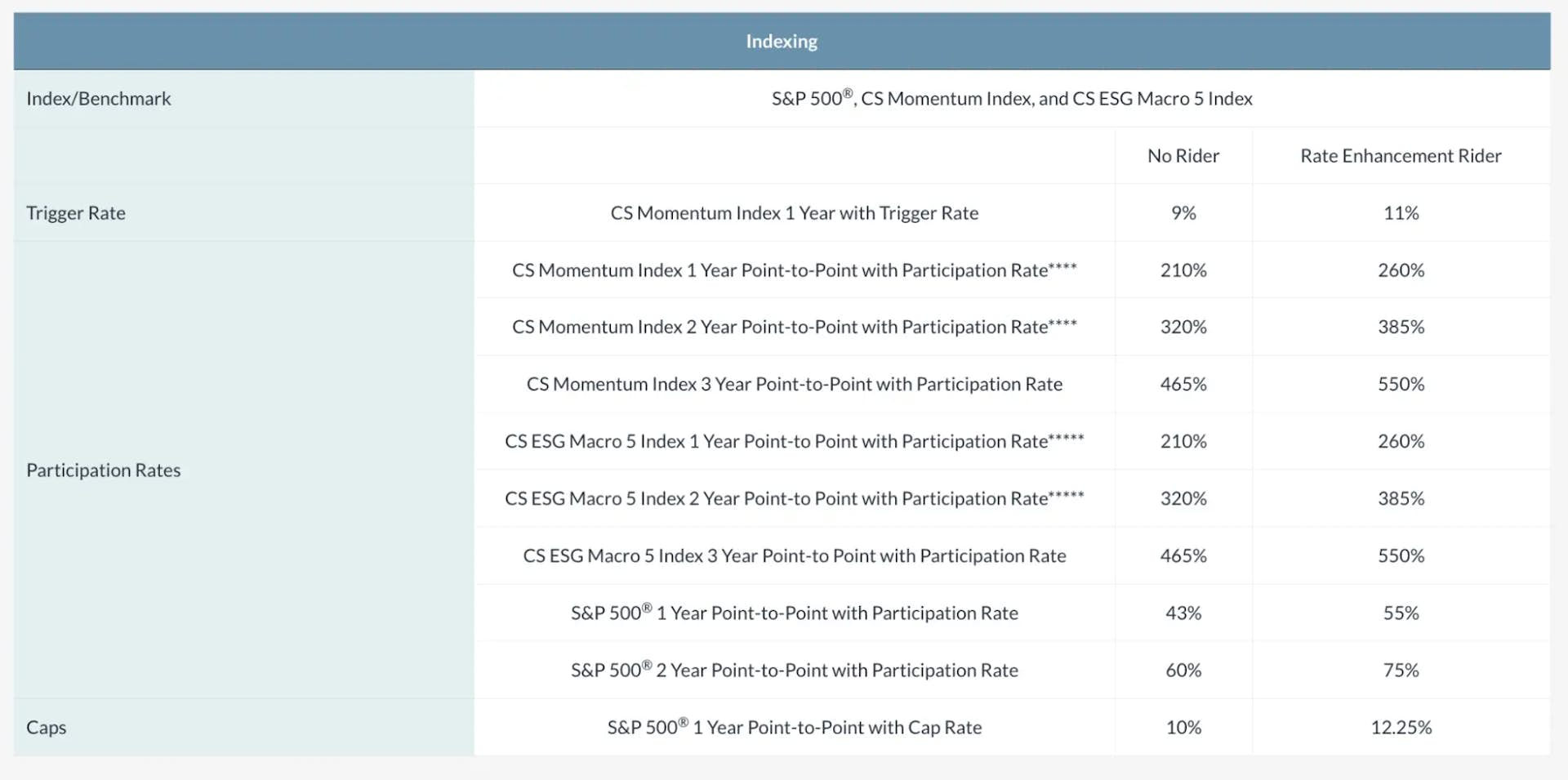

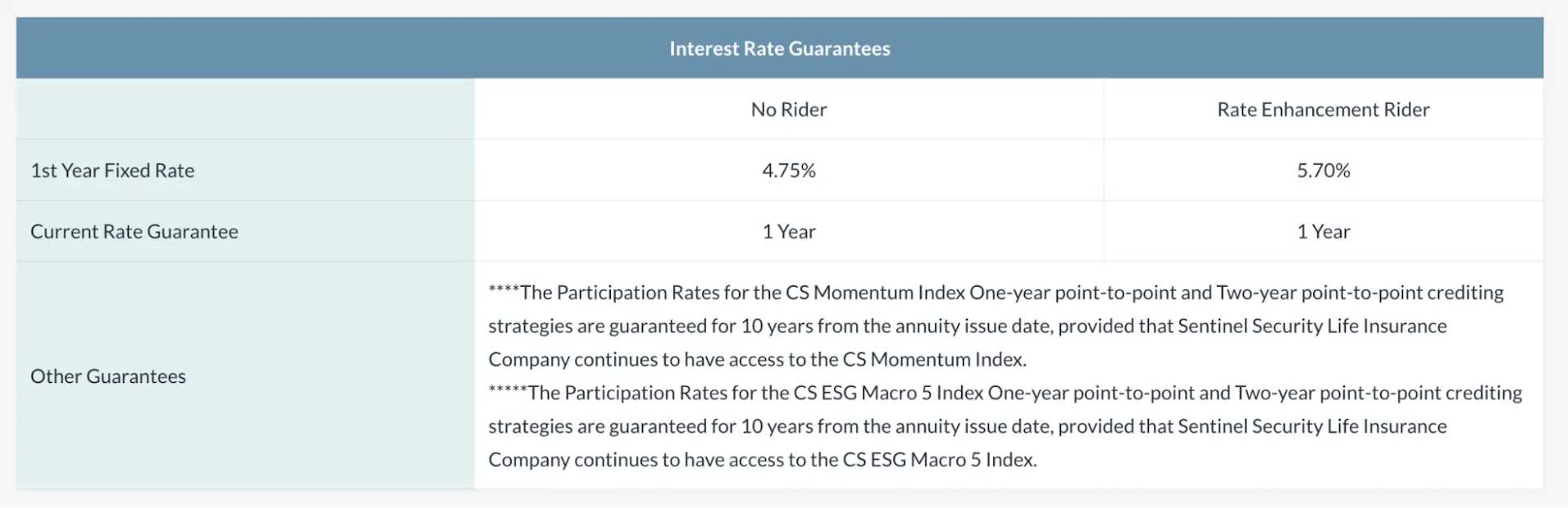

As far as its return, the Accumulation Protector Plus Annuity offers a 1st year fixed rate of 4.75% (5.70% with the rate enhancement rider). This rate is guaranteed for one year with future returns dependent on the performance of the underlying indices.

The only time that you could potentially lose part of your principal is if you select the Rate Enhancement Rider. If you select this rider then it’s possible that your principal may decrease at times due to the rider fee.

Rates and Costs associated with the Sentinel Security Life Accumulation Protector Plus Annuity

There are no unexpected rates or costs associated with the Sentinel Security Life Accumulation Protector Plus Annuity. But, the earnings crediting formula is the most important part of this annuity discussion. It is important to know that you will not simply get the index return credited to your return. There are a few participation rates, caps, and spreads that the company has in place that affect your earnings. The company has the right to change these rates at any time.

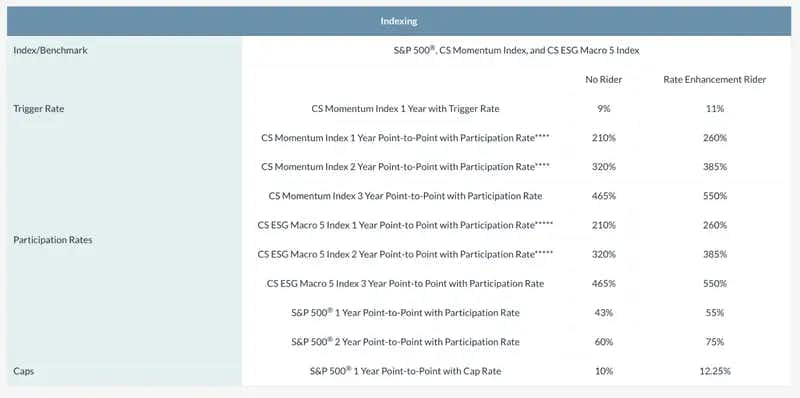

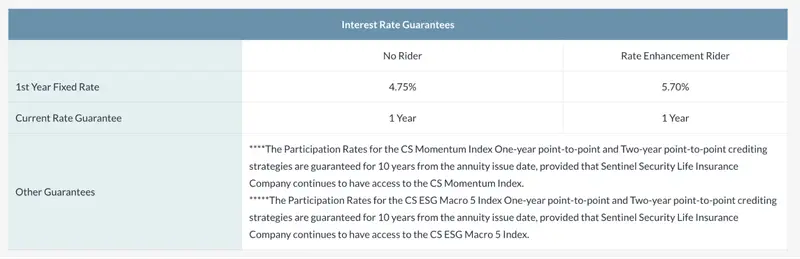

As of September 25, 2023, here is the current rate sheet for the Sentinel Security Life Accumulation Protector Plus Annuity.

To get a better understanding of how these rates will impact your return, I’d recommend speaking with a financial advisor as they will be able to provide you with specific, personalized advice on the best way to proceed. As another alternative, you can also contact Sentinel Security Life directly to learn more about the differences between their crediting options.

Riders

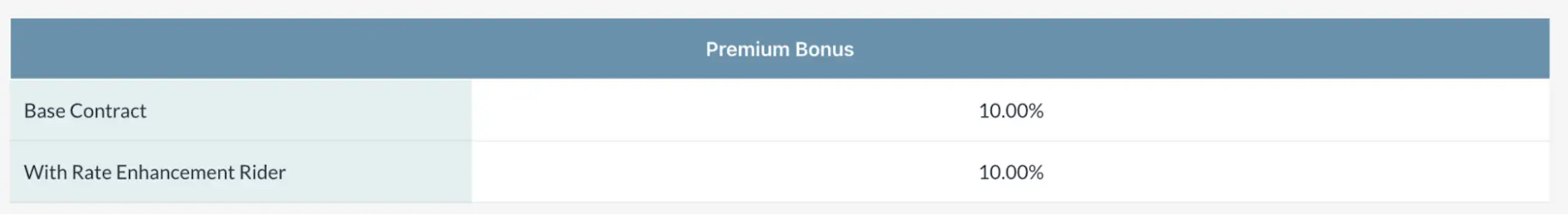

The Sentinel Security Life Accumulation Protector Plus Annuity offers just one rider: the Rate Enhancement Rider. This feature increases the amount available for free withdrawal from 5% to 10% of your annuity’s Account Value. Additionally, this rider opens the opportunity to let you earn more interest as it increases the Fixed, Participation, and Cap Rates across your annuity’s crediting strategy. This creates the potential to increase the index’s upside because your premium has access to a larger percentage of the index’s growth.

The Accumulation Protector PlusSM Annuity offers a 110% Return of Premium (ROP) Guarantee if the Rate Enhancement Rider is purchased and the contract persists to year 10. The premium is adjusted for withdrawals.

However, keep in mind that the Rate Enhancement Rider requires an additional fee which can hurt your returns over time and increase the amount that you will have to pay out of pocket. As of September 25th, 2023, the rate for the Rate Enhancement Rider is 0.95%. Again, I’d recommend speaking with a financial advisor to determine whether or not this rider is a good fit for your investment needs.

What Makes This Product Stand Out

The Sentinel Security Life Accumulation Protector Plus Annuity is unique among other annuities because it offers investors access to the CS Momentum Index. It also offers a 10-year guarantee of participation rates through the index. If you select the One-year point-to-point or Two-year point-to-point crediting strategies then the Participation Rates for the CS Momentum Index are guaranteed for 10 years.

What is the CS Momentum Index?

The CS Momentum Index offers investors exposure to a diversified range of assets across the globe. This index offers four main benefits to investors:

Diversification: This index tracks assets across four regions and three asset classes in an effort to generate consistent returns over time, while also diversifying your capital.

Momentum: The main goal of this index is to gain exposure to components that exhibit the strongest trends while reducing exposure to components with weaker trends. This strategy is designed to help track areas that have stronger momentum and capitalize on their growth.

Risk-Adjusted Weights: Index components are weighted inversely to their risk in an attempt to build a risk-balanced allocation.

Risk Control: The Index targets an annualized volatility of 5% or less to help stabilize returns.

Exposure to the CS Momentum Index can be valuable for investors who are looking to diversify their holdings outside of just U.S. markets and indices. For example, most financial products in the U.S. are tied to the S&P 500, Dow Jones Industrial Average, and NASDAQ. If you want to increase your diversification even further then the Accumulation Protector Plus Annuity can help you gain access to international assets. This can help protect your capital if you feel that there is an inherent risk in the U.S. markets over the coming decade (or if you just want to get exposure to a global range of assets).

The Accumulation Protector Plus Annuity also implements unique crediting strategies that are distinctive across the insurance industry. The APP’s crediting strategies give contract holders the ability to accumulate wealth in both bull and bear markets. This is again thanks in part to the CS Momentum Index which diversifies its underlying components across a range of assets (equities, bonds, and commodities) across four global regions. Additionally, by tracking areas that are trending, the CS Momentum Index can help this product capitalize on market momentum during bull markets.

Another benefit of the Accumulation Protector Plus Annuity is that it is Minimum Distribution friendly and requires a relatively low commitment of $5,000. This low capital commitment can be beneficial if you are looking to allocate your capital to a number of different financial products and do not want too much capital tied up in one investment. $5,000 is a fairly modest minimum investment, especially compared to other financial products on the market.

What I Don’t Like

The downside to investing in the Sentinel Security Life Accumulation Protector Plus Annuity is that it has a 10-year surrender charge. So, if you choose to invest in this annuity then make sure that you will not need to access this capital for at least 10 years. But, with that said, remember that this annuity has a fairly low commitment of just $5,000. This low minimum investment allows you to invest however much of your portfolio you’d like in this annuity.

Another potential issue with this annuity is that it charges market value adjustment. These are essentially additional charges for taking out early from an annuity if you withdraw funds early. Again, make sure that you are comfortable keeping your investment tied up for ten years before proceeding with this product.

Finally, the Accumulation Protector Plus Annuity only offers a rate enhancement rider. This means that it is fairly vanilla in terms of customization or additional extras that you can add to it.

Company Details

Sentinel Security Life is a financial services company that has been in business since 1948 and is based in Salt Lake City, Utah. This company offers a wide range of financial products including:

Personal Choice Annuity

Retirement Plus Multiplier Annuity

Guaranteed Income Annuity

Summit Bonus Index

New Vantage Life Insurance

Personal Choice+ Annuity

The Accumulation Protector Plus Annuity

Sentinel Security Life got its start when a group of Utah funeral directors saw that there was a need for an insurance product that could help families pay for funeral costs. This initial product was designed to help families pay for the final expenses of a loved one. Over the past seventy years, Sentinel Security Life has expanded to offer a more comprehensive suite of financial products and has als experienced many name changes throughout the years.

According to its 2022 financial statements, Sentinel Security Life has total assets of roughly $879 million and earned an annual net operating income of just over $17 million.

Conclusion

Today’s retirees have to plan for longer retirements than previous generations. They also have a wide range of financial products to choose from when it comes to financing their golden years. Although these are both good problems to have, they can both make the retirement planning process seem incredibly daunting.

With advancements in technology and medicine, the average American is living longer than ever. This means that it’s crucial to have a source of income that you can rely on during your retirement to help keep money coming in the door. Implementing the use of a fixed-income asset, such as the Accumulation Protector Plus Annuity, can help mitigate the risk of outliving your savings.

But, at the same time, this doesn’t necessarily mean that the Accumulation Protector Plus Annuity is the right one for you. Choosing the right annuity is a complicated, life-changing decision that depends on dozens of factors such as the current economic conditions, your personal financial goals, and life’s never-ending stream of curveballs. To help make this decision-making process easier for you, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits.

To learn more about the world of annuities and learn which products might be a good fit for you, be sure to check out our extensive reviews of annuities.