American General Life Insurance Co. Power 10 Protector and Protector Plus Income Annuity Review

byAnnuityRatesHQ Staff

Tue Apr 09 2024

Introduction

Fixed Index Annuities are contracts between the annuitant and an insurance company in which the insurance company pays interest based on the performance of a certain stock market index. Fixed Index Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down, this is typically called the annual lock-in. Every year on the contact anniversary the earned interest is locked in, and you cannot lose the value of that interest or principle. Annuities are complex products, and many advisors often do a poor job of relating the complexities to their customers. And worse, often do not take the customers’ full financial context into consideration when making their sales pitch. It is imperative to educate yourself on these products and not solely depend upon the annuity agent’s oversimplified and uncontextualized sales pitch.

In this article, we delve into the American General Life Insurance Company’s Power 10 Protector and Power 10 Protector Plus Income fixed indexed annuities. The Power 10 Protector series is an “index annuity focusing on asset accumulation” and “Index annuity focusing on retirement income with a guaranteed living benefit rider.1” Following comprehensive due diligence, this report aims to present an objective analysis of these financial products.

Company Info

The Power 10 Protector Series is issued by the American General Life Insurance Company which is a now a part of Corebridge Financial2 (formerly AIG Life & Retirement). Corebridge was spun off AIG in 2022 and was listed the same year on the NYSE: CRBG. As of the end of 2022 they managed or administered $357.2 billion in client assets. According to their 2022 annual report3, “For the year ended December 31, 2022, our businesses generated spread income of $3.3 billion, fee income of $2.1 billion and underwriting margin of $1.4 billion, resulting in a balance mix of 49%, 31% and 20% respectively, among these income sources. We are well-diversified across our operating businesses with our Individual Retirement, Group Retirement, Life Insurance and Institutional Markets businesses representing 30%, 15%, 27% and 23% of total adjusted revenue, respectively, for the year ended December 31, 2022.”

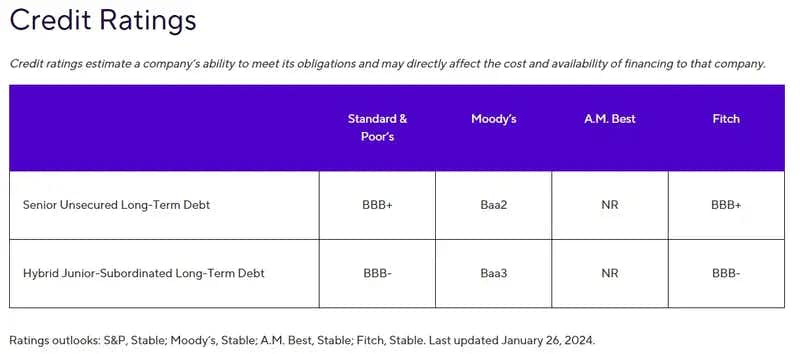

Financial Strength and Credit Ratings

Power 10 Protector Product Description

The Power 10 Protector is an FIA that provides the annuitant the opportunity to earn returns tied to a market index, without exposing them to the downside risks of the market (interest earned is never zero in flat or down markets). This plan may be particularly fitting for those nearing retirement, who have dual objectives of growing and preserving their retirement savings. For risk-averse investors seeking alternatives to bank CDs, indexed annuities offer a very good fit.

| Tenure | 10 Years |

|---|---|

| Issue Age | 0 – 75 |

| Minimum Initial Purchase Amount | $25,000 |

| Surrender Charge Schedule | Withdrawals in excess of the Free Withdrawal Amount are subject to the following charges that decline over 10 years: 10-9-8-7-6-5-4-3-2-0% |

| Indexes | See below |

| Death Benefit | Greater of the annuity contract value adjusted for any premium enhancement recapture or Minimum Withdrawal Value |

| Free Withdrawals | After the first contract year, you can withdraw up to 10% of your contract value (based on your prior anniversary value) without incurring any company-imposed charges (see withdrawal charges) |

| Cash Surrender Value | Greater of the Minimum Withdrawal Value or contract value adjusted for any MVA, withdrawal charge and premium enhancement recapture |

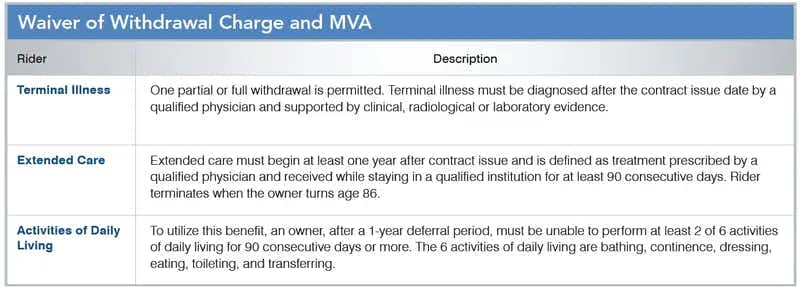

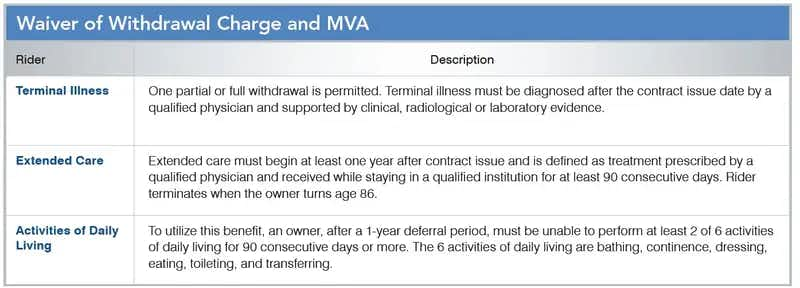

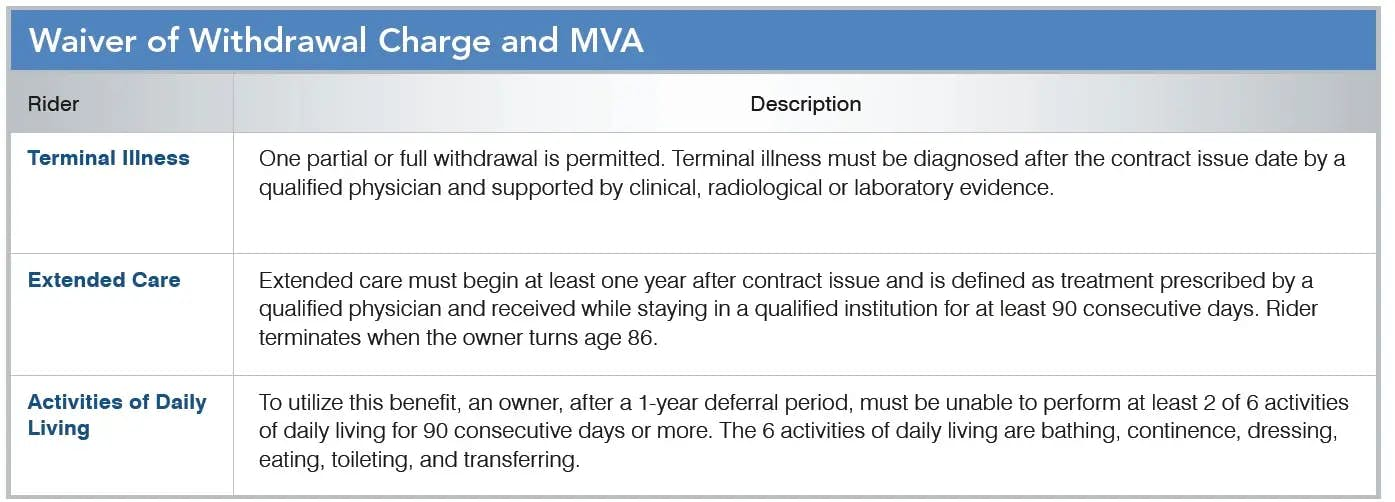

| Terminal Illness | Charges and Market Value Adjustments may be waived if diagnosed with a terminal illness, have extended care needs, confined to a nursing home or in an assisted living facility. Talk to your representative about restrictions/limitations that may apply. |

| Riders | No guaranteed living benefit rider. Terminal Illness, Extended Care and Activities of Daily Living (see below for more information) |

| Annuitization Choices | Life income; joint/survivor annuity; 10-20 year period certain; specified period (5-30 years) |

How does the Power 10 Protector Annuity Work?

Any annuitant (maximum age at the time of policy issue: 75) can purchase this annuity with a minimum initial purchase amount of $25,000, and in return, will earn market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period.

There are two ways to help provide growth in this FIA5:

Earn interest based on your choice of four (4) indices:

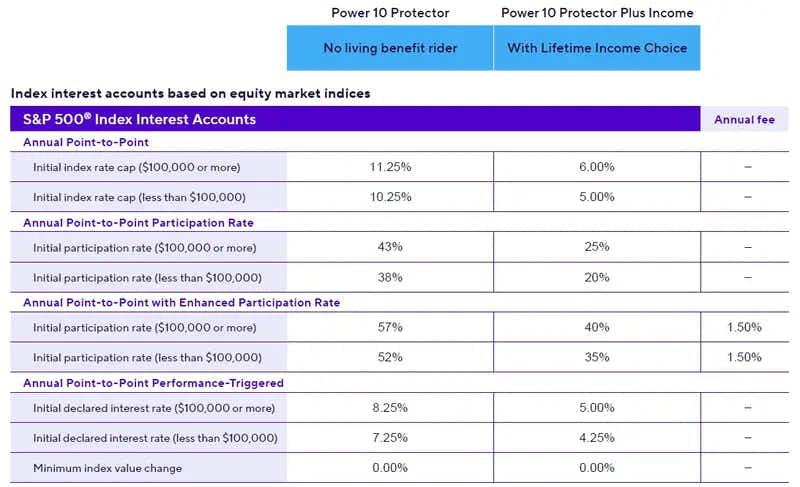

Index Interest Accounts based on equity market indices

S&P 500 - The S&P 500® is an equity index that tracks the performance of 500 of the largest companies in the U.S. It is a product of S&P Dow Jones Indices LLC (“SPDJI”) and has been licensed for use by American General Life Insurance Company (“AGL”) and affiliates.

Credit Period

Annual Point-to-Point

Annual Point-to-Point Participation Rate

Annual Point-to-Point Enhanced Participation Rate

Annual Point-to-Point Performance-Triggered

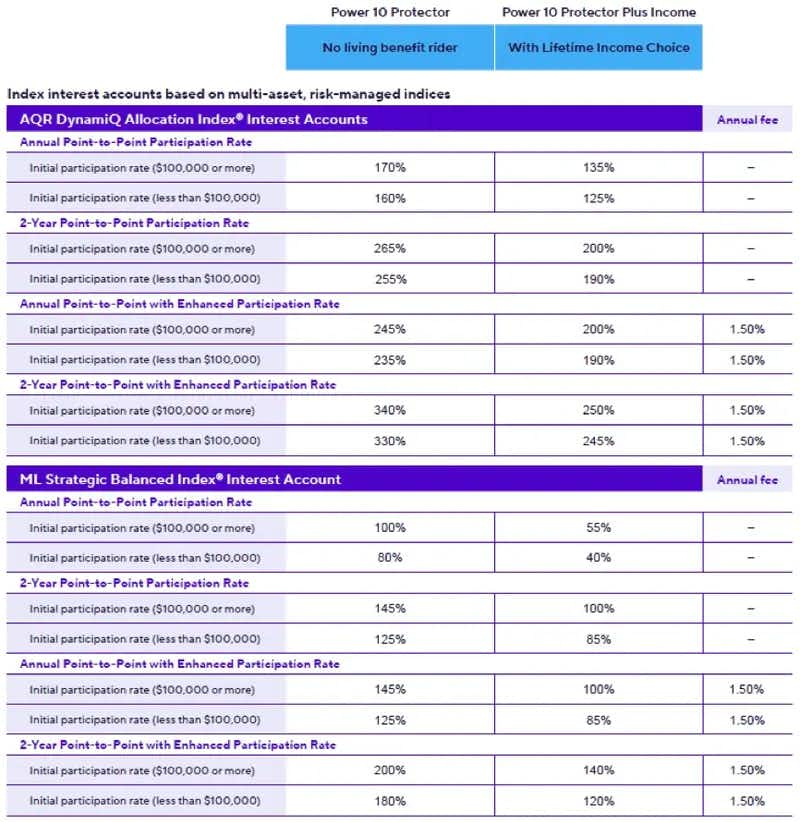

Interest Accounts based on multi-asset, risk-managed indices

AQR DynamiQ Allocation Index - The AQR and the AQR DynamiQ Allocation Index® are trademarks or service marks of AQR Capital Management, LLC or one of its affiliates and have been licensed for use by American General Life Insurance Company for use as a benchmark for an annuity (inclusive of all applicable riders). The AQR DynamiQ Allocation Index® seeks to maximize returns by delivering diversified exposure to global equity and fixed income markets.

ML Strategic Balanced Index- The ML Strategic Balanced Index® is a hybrid index that seeks growth and risk management by actively allocating to equities, fixed income and cash. It embeds an annual index cost in the calculations of the change in index value over the index term. This “embedded index cost” will reduce any change in index value over the index term that would otherwise have been used in the calculation of index interest, and it funds certain operational and licensing costs for the index. It is not a fee paid by you or received by American General Life Insurance Company (“AGL”). AGL’s licensing relationship with Merrill Lynch, Pierce, Fenner & Smith Incorporated for use of the ML Strategic Balanced Index® and for use of certain service marks includes AGL’s purchase of financial instruments for purposes of meeting its interest crediting obligations. Some portion of those instruments will, or may be, purchased from Merrill Lynch, Pierce, Fenner & Smith Incorporated or its affiliates. The ML Strategic Balanced Index® provides systematic, rules-based access to the blended performance of the S&P 500® (without dividends), which serves to represent equity performance, and the Merrill Lynch 10-year U.S. Treasury Futures Total Return Index, which serves to represent fixed income performance. To help manage overall return volatility, the Index may also systematically utilize Cash performance in addition to the performance of these two underlying indices.

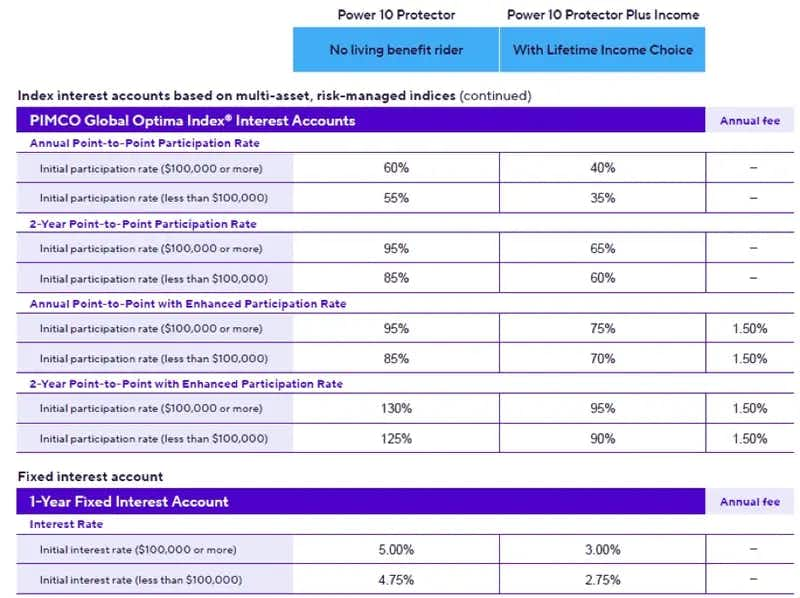

PIMCO Global Optima Index - The PIMCO Global Optima Index®is a comprehensive equity and bond index, offering exposure to global equity and U.S. fixed income markets. The Index is a trademark of Pacific Investment Management Company LLC and has been licensed for use for certain purposes by American General Life Insurance Company with the Power Series of Index Annuities.

Credit Period

Annual Point-to-Point Participation Rate

2-Year Point-to-Point Participation Rate

Annual Point-to-Point Enhanced Participation Rate

2-Year Point-to-Point Enhanced Participation Rate

1-Year Fixed Interest Account

$100k or more – 5%

Less than $100k – 4.75%

Rates and Costs

The earnings crediting formula is the most important part of almost any annuity discussion. It is important to know that we don’t simply get the index return credited to the annuity. There are a few rates and caps that the company has in place that affect earnings. These rates tend to change over time, and the updated rates can always be checked with the help of your advisor. The rates listed below are for information only, please check the latest rates on their website.

From the above it should be noted that there are four types of rates across this fund and the rates are dependent upon the amount purchased (greater than or less than $100k).

With most fixed index annuities, you can allocate the money to one or more of the indexes listed above. At the contract anniversary date, the index performance is measured, and the interest rate is calculated using the applicable formula for the indexes selected. This annual reset means that the index performance is reset and re-measured at the next contract anniversary and your account value is locked in.

Key terms are defined, and example calculations given below:

Index Rate Cap: Maximum percentage of index performance that can be credited as interest over an index term. For example: 10% index change > 5% cap = 5% interest earned.

Participation Rate (PAR Rate): Percentage of index performance that is used to calculate interest. For example: 10% index change x 50% PAR rate = 5% interest earned.

Premium: Money used to purchase the annuity.

Performance-Triggered: Initial declared interest rate is credited to the account if index performance is equal to or greater than the minimum index value change. For example: 10% index change → 5% declared interest rate = 5% interest earned.

Enhanced Participation Rate (EPR): These accounts are available for an annual fee. You may receive higher interest credits in EPR accounts, but interest credits are not guaranteed. At the end of your contract's withdrawal charge period, if the total amount of EPR strategy fees exceeds the total interest earned in the annuity, the difference will be credited to your annuity. Annuities are issued by American General Life Insurance Company

Surrender Charges

Should your needs change unexpectedly, and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies, although certain charges and penalties may apply. Any amount withdrawn more than the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule:

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Surrender Charge | 10% | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 2% | 1% |

Riders

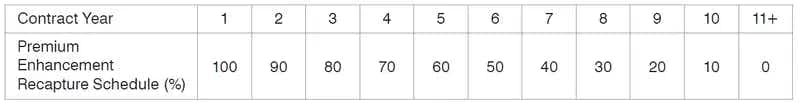

Premium Enhancement

With the Power 10 Protector annuity, you can receive a 3% premium enhancement (also known as a premium bonus) on premiums made in the first 30 days of the contract. This premium enhancement or bonus vests after the first 10 years of the contract. According to the company literature, “During this period, if you pass away, annuitize the contract, take withdrawals that are greater than the available Free Withdrawal amount or fully surrender the contract, you will give up a portion of your premium enhancement.” Carefully read and understand the rules that apply to this bonus. The premium enhancement is subject to a recapture schedule which is shown below. After the first contract year, 10% of the enhancement bonus is vested and locked in. Another 10% vests for every subsequent contract year up to the 10th year.

Power 10 Protector Plus Income Product Description

The Power 10 Protector Plus Income is an FIA that provides the annuitant the opportunity to earn returns tied to a market index, without exposing them to the downside risks of the market (interest earned is never zero in flat or down markets). This plan may be particularly fitting for those nearing retirement, who have dual objectives of growing and preserving their retirement savings. For risk-averse investors seeking alternatives to bank CDs, indexed annuities offer a very good fit.

Power 10 Protector Plus Income Product Description

The Power 10 Protector Plus Income is an FIA that provides the annuitant the opportunity to earn returns tied to a market index, without exposing them to the downside risks of the market (interest earned is never zero in flat or down markets). This plan may be particularly fitting for those nearing retirement, who have dual objectives of growing and preserving their retirement savings. For risk-averse investors seeking alternatives to bank CDs, indexed annuities offer a very good fit.

| Tenure | 10 Years |

|---|---|

| Issue Age | 50 – 75 |

| Minimum Initial Purchase Amount | $25,000 |

| Surrender Charge Schedule | Withdrawals in excess of the 10% Free Withdrawal Amount or the Maximum Annual Withdrawal Amount under the Lifetime Income Plus, whichever is greater are subject to the following charges that decline over 10 years: 10-9-8-7-6-5-4-3-2-0% |

| Indexes | See below |

| Free Withdrawals | Up to 10% of the annuity contract value if taken after the first contract year, or the Maximum Annual Withdrawal Amount under the Lifetime Income Plus, whichever is greater |

| Cash Surrender Value | Greater of the Minimum Withdrawal Value or contract value adjusted for MVA, living benefit fee and withdrawal charge |

| Death Benefit | Greater of contact value or Minimum Withdrawal Value |

| Riders | Lifetime Income Plus Guaranteed Living Benefit Rider is automatically included as part of the contract for an annual fee of 0.95% of the Income Base, Terminal Illness, Extended Care and Activities of Daily Living (see below for more information) |

| Annuitization Choices | Life income; joint/survivor annuity; 10-20 year period certain; specified period (5-30 years) |

How does the Power 10 Protector Plus Income Annuity Work?

Any annuitant (maximum age at the time of policy issue: 75) can purchase this annuity with a minimum initial purchase amount of $25,000, and in return, will earn market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period.

There are two ways to help provide growth in this FIA5:

Earn interest based on your choice of four (4) indices:

Index Interest Accounts based on equity market indices

S&P 500 - The S&P 500® is an equity index that tracks the performance of 500 of the largest companies in the U.S. It is a product of S&P Dow Jones Indices LLC (“SPDJI”) and has been licensed for use by American General Life Insurance Company (“AGL”) and affiliates.

Credit Period

Annual Point-to-Point

Annual Point-to-Point Participation Rate

Annual Point-to-Point Enhanced Participation Rate

Annual Point-to-Point Performance-Triggered

Interest Accounts based on multi-asset, risk-managed indices

AQR DynamiQ Allocation Index - The AQR and the AQR DynamiQ Allocation Index® are trademarks or service marks of AQR Capital Management, LLC or one of its affiliates and have been licensed for use by American General Life Insurance Company for use as a benchmark for an annuity (inclusive of all applicable riders). The AQR DynamiQ Allocation Index® seeks to maximize returns by delivering diversified exposure to global equity and fixed income markets.

ML Strategic Balanced Index- The ML Strategic Balanced Index® is a hybrid index that seeks growth and risk management by actively allocating to equities, fixed income and cash. It embeds an annual index cost in the calculations of the change in index value over the index term. This “embedded index cost” will reduce any change in index value over the index term that would otherwise have been used in the calculation of index interest, and it funds certain operational and licensing costs for the index. It is not a fee paid by you or received by American General Life Insurance Company (“AGL”). AGL’s licensing relationship with Merrill Lynch, Pierce, Fenner & Smith Incorporated for use of the ML Strategic Balanced Index® and for use of certain service marks includes AGL’s purchase of financial instruments for purposes of meeting its interest crediting obligations. Some portion of those instruments will, or may be, purchased from Merrill Lynch, Pierce, Fenner & Smith Incorporated or its affiliates. The ML Strategic Balanced Index® provides systematic, rules-based access to the blended performance of the S&P 500® (without dividends), which serves to represent equity performance, and the Merrill Lynch 10-year U.S. Treasury Futures Total Return Index, which serves to represent fixed income performance. To help manage overall return volatility, the Index may also systematically utilize Cash performance in addition to the performance of these two underlying indices.

PIMCO Global Optima Index - The PIMCO Global Optima Index®is a comprehensive equity and bond index, offering exposure to global equity and U.S. fixed income markets. The Index is a trademark of Pacific Investment Management Company LLC and has been licensed for use for certain purposes by American General Life Insurance Company with the Power Series of Index Annuities.

Credit Period

Annual Point-to-Point Participation Rate

2-Year Point-to-Point Participation Rate

Annual Point-to-Point Enhanced Participation Rate

2-Year Point-to-Point Enhanced Participation Rate

1-Year Fixed Interest Account

$100k or more – 3.00%

Less than $100k – 2.75%

Rates and Costs

The earnings crediting formula is the most important part of almost any annuity discussion. It is important to know that we don’t simply get the index return credited to the annuity. There are a few rates and caps that the company has in place that affect earnings. These rates tend to change over time, and the updated rates can always be checked with the help of your advisor. You can also check the latest rates on their website.

See Rates schedule above under Power 10 Protector.

It should be noted that that there are four types of rates across this fund and the rates are dependent upon the amount purchased (greater than or less than $100k).

With most fixed index annuities, you can allocate the money to one or more of the indexes listed above. At the contract anniversary date, the index performance is measured, and the interest rate is calculated using the applicable formula for the indexes selected. This annual reset means that the index performance is reset and re-measured at the next contract anniversary and your account value is locked in.

Key terms are defined, and example calculations given below:

Index Rate Cap: Maximum percentage of index performance that can be credited as interest over an index term. For example: 10% index change > 5% cap = 5% interest earned.

Participation Rate (PAR Rate): Percentage of index performance that is used to calculate interest. For example: 10% index change x 50% PAR rate = 5% interest earned.

Premium: Money used to purchase the annuity.

Performance-Triggered: Initial declared interest rate is credited to the account if index performance is equal to or greater than the minimum index value change. For example: 10% index change → 5% declared interest rate = 5% interest earned.

Enhanced Participation Rate (EPR): These accounts are available for an annual fee. You may receive higher interest credits in EPR accounts, but interest credits are not guaranteed. At the end of your contract's withdrawal charge period, if the total amount of EPR strategy fees exceeds the total interest earned in the annuity, the difference will be credited to your annuity. Annuities are issued by American General Life Insurance Company

Surrender Charges

Should your needs change unexpectedly, and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies; although certain charges and penalties may apply. Any amount withdrawn more than the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule:

| Completed Contract Years | 10 | 9 | 8 | 7 | 6 | 5 | 4 | 3 | 2 | 1 |

|---|---|---|---|---|---|---|---|---|---|---|

| Surrender Charge | 10% | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 2% | 1% |

Riders

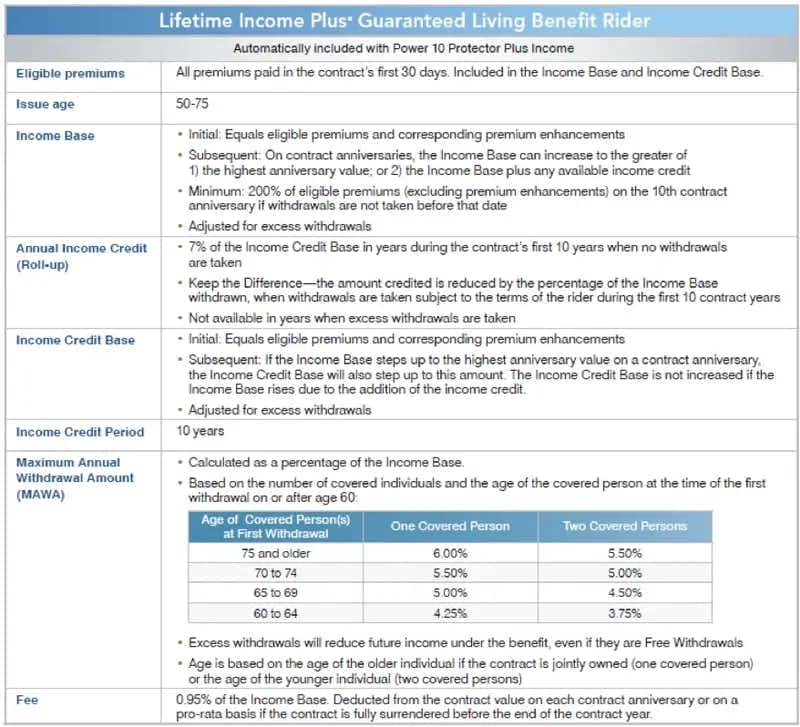

The Power 10 Protector Plus Income offers the Lifetime Income Plus Guaranteed Living Benefit Rider1 for an annual fee of 0.95% of the income base. According to AGI literature this rider offers three primary benefits:

Guarantee rising income (up to the first 10 years of the contract)

Income base will increase by 7% (for every year withdrawals are not taken for the first 10 years)

Income base can rise for the first 10 years (as long as withdrawals are taken in accordance with the rider)

Income base can continue to step up after 10 years if applicable

Guarantee doubling of retirement income potential after 10 years (no withdrawals taken)

Guarantee more retirement income for life (annual withdrawals up to 6% maximum)

Flexibility

With this rider the owner does have the option of penalty free withdrawals after the first contract year and up to 10% of the contract value. There are also no withdrawal charges up the Maximum Annual Withdrawal Amount (MAWA) and Market Value Adjustments (MVAs) do not apply.

The owner also has access to the money if diagnosed with a terminal illness, need extended care or is confined to a nursing home/assisted living facility. Restrictions apply so consult the salesman and company literature.

More information is tabulated below (table taken from AGI literature available online).

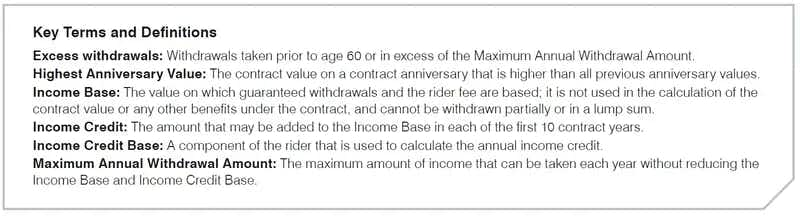

Key Definitions1

The following are also riders included with the Power 10 Protector Plus Income annuity.

What Makes these Products Stand Out?

The Power 10 Protector Plus Income does offer a somewhat unique optional rider to increase potential returns. But keep in mind that this rider does come with a substantial fee.

Corebridge Financial seems to be doing well as a company and has relatively high ratings.

Relatively flexible withdrawal options.

What I don’t Like

This has a relatively high initial purchase amount ($25k vs $10k for many).

There are very few indexing options compared to other products.

Relatively high surrender charge compared to some similar products.

Subsequent premiums only allowed in the first 30 days after contract issue

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. At the same time, fewer and fewer companies offer traditional pension plans. The type of plans that can form a solid foundation for a retirement strategy. Thus, it is important to have a steady stream of guaranteed income (aside from Social Security). This not only helps you mitigate the risk of outliving your income but diversifies your portfolio to help smooth the volatility of retirement planning.

The Power 10 Protector and Power 10 Protector Plus Income annuities are products that, for the right individual or couple, can offer a more secure source of income. And judging by the most recent annual reports, Corebridge Financial is on a solid foundation. In the opinion of this author, these would be good insurance products to investigate if in the market for an index annuity.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. To delve deeper into our extensive reviews, click here.

Annuities are not direct investments in stocks or mutual funds. They are life insurance products backed by the claims paying ability of the issuing insurance company. Be sure to read all the fine print and make sure you are aware of all the fees, charges, commissions and potential taxes that could be incurred. Make sure to read reviews of the company and salesman also and ask for references of previous annuitants.

This is a review of this insurance product and does not serve as specific or individual financial advice. Please speak with a qualified financial advisor prior to purchasing any annuity product.

References

The following are also riders included with the Power 10 Protector Plus Income annuity.

What Makes these Products Stand Out?

What I don’t Like

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. At the same time, fewer and fewer companies offer traditional pension plans. The type of plans that can form a solid foundation for a retirement strategy. Thus, it is important to have a steady stream of guaranteed income (aside from Social Security). This not only helps you mitigate the risk of outliving your income but diversifies your portfolio to help smooth the volatility of retirement planning.

The Power 10 Protector and Power 10 Protector Plus Income annuities are products that, for the right individual or couple, can offer a more secure source of income. And judging by the most recent annual reports, Corebridge Financial is on a solid foundation. In the opinion of this author, these would be good insurance products to investigate if in the market for an index annuity.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. To delve deeper into our extensive reviews, click here.

Annuities are not direct investments in stocks or mutual funds. They are life insurance products backed by the claims paying ability of the issuing insurance company. Be sure to read all the fine print and make sure you are aware of all the fees, charges, commissions and potential taxes that could be incurred. Make sure to read reviews of the company and salesman also and ask for references of previous annuitants.

This is a review of this insurance product and does not serve as specific or individual financial advice. Please speak with a qualified financial advisor prior to purchasing any annuity product.

References