Pacific Life Index Foundation Fixed Indexed Annuity Review

byNikhil Bhauwala

Sun Mar 10 2024

Introduction

Fixed Index Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index. Fixed Index Annuities have an inbuilt capital protection feature, so even if the index goes down, your principal will remain safe.

Annuities are complex products, and many advisors try to sell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.This article discusses an in-depth review of the Pacific Life Index Foundation Fixed Indexed Annuity Review. Pacific Index Foundation is a deferred, fixed-indexed annuity that may be a good option if you are looking for the safety of principal, good index options, and the most popular riders. After extensive research and due diligence, I have provided an in-depth and unbiased analysis of this plan

Product Description – Pacific Life Index Foundation Fixed Indexed Annuity

The Pacific Life Index Foundation Fixed Indexed Annuity offers the annuitant (annuity investor) an opportunity to earn a market index-linked return without incurring the risk of market downside. It is a suitable plan for people who aims to grow and protect their retirement savings, with good index and cap options. This plan is also suitable for people who are looking for guaranteed lifetime income in addition to protecting and growing their retirement savings.

Let’s look at the high-level fine print of the Pacific Life Index Foundation Fixed Indexed Annuity, and then we will discuss each point in detail.

| Header | Value |

|---|---|

| Product Name | Index Foundation Fixed Indexed Plan |

| Issuing Company | Pacific Life |

| AM Best Rating | A (2nd of 13 ratings) |

| Initial Guaranteed and Withdrawal Charge Period(s) | 5, 7, and 10 years |

| Maximum Issue Age | 85 Years |

| Minimum Initial Purchase Amount | $25,000 ($5,000 for qualified) |

| Surrender Charge Schedule | Varies for different tenure policies |

| Interest Crediting Options | 1-year point to point with cap |

| 1-year performance-triggered index option | |

| Fixed interest rate | |

| Plan Types | Qualified and Non-qualified |

| Indexes | S&P 500 Index and MSCI EAFE Index |

| Free Withdrawals | 10% after the first completed contract year through the end of the Surrender Charge period |

| Death Benefit | The death benefit will be equal to the greater of the contract value or the Guaranteed Minimum Surrender Value and is paid upon the death of the first owner or last annuitant. Pro rata index-linked interest is credited to the contract value on the Notice Date (the date Pacific Life receives the death benefit claim in good order) |

| Optional Riders | This policy comes with one optional rider: |

| Optional Death Benefit | |

| Surrender Value | Guaranteed to receive the greater of the contract value (minus applicable optional benefit charges, a market value adjustment (MVA), and/or withdrawal charges) or the Guaranteed Minimum Surrender Value. |

| The Guaranteed Minimum Surrender Value equals 91% of purchase payments (minus any withdrawals), accumulated at a fixed interest rate, which is set at contract issue. |

he Pacific Life Index Foundation Annuity is almost identical for both policy tenures, except for the crediting period, surrender charge schedule, and indexing rates. For ease of discussion and better clarity, we will discuss the Pacific Life Index Foundation – 5 for the rest of the article.

How does the Pacific Life Index Foundation policy work?

Any annuitant (maximum age at the time of policy issue: 85) can purchase the Pacific Life Index Foundation Annuity with a minimum initial purchase amount of $25,000. In return, he will earn market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, various events may trigger earnings credit: On free withdrawals, for a long-term care/terminal illness/injury event, or when a death benefit is payable.

The Pacific Life Index Foundation Annuity offers the annuitant to choose from one or more of the two indexes to determine his earnings crediting formula. Each of these two indexes has different strategies and a fixed-rate guaranteed interest strategy to choose from (making a total of 5 strategy options). We will discuss each available index briefly:

S&P 500 Index

The S&P 500 index is one of the most popular and oldest indexes globally. It tracks 500 large-cap publicly traded stocks listed in the United States. It is a reliable index and has often succeeded in the test of time. The S&P 500 Index was created in March 1957 and tracks 500 of the largest companies listed on the S&P across all sectors. The 10-year historical annual return, as shown by the S&P, stands at ~12.97%.

MSCI EAFE Index

The MSCI EAFE Index is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia, and the Far East, excluding the U.S. and Canada. The Index is available for a number of regions and market segments/sizes and covers approximately 85% of the free float-adjusted market capitalization in each of the 21 countries. The 10-year historical annual return, as shown by the MSCI, stands at ~4.13%.

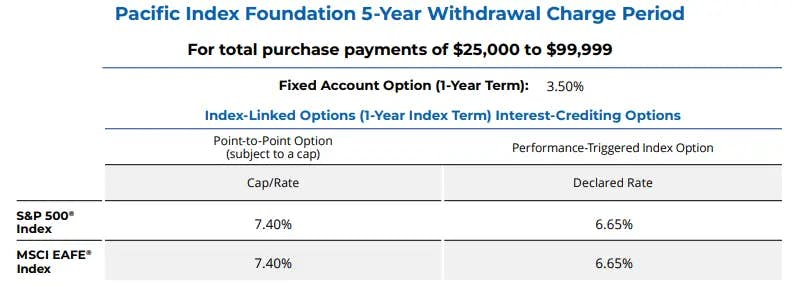

It is very important to note that the Pacific Life Index Foundation Annuity comes with cap rates or performance-triggered options for these indexes, meaning that you will be credited only a part of the index return to your annuity. These rates tend to change frequently; I will discuss more on these rates shortly. Note: In addition to allocating the funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest. These Fixed Rates tend to change from time to time. The Fixed Value Rate for the 5-year withdrawal charge period at the time of writing this article was 3.50%. You can view the latest fixed rates of this annuity here.

Rates and Costs associated with the Pacific Life Index Foundation Annuity

The earnings crediting formula

The earnings crediting formula is the most important part of this annuity discussion. It is important to know that we don’t simply get the index return credited to our annuity. There are a few rates and caps that the company has in place that affect our earnings. These rates tend to change over time, and the updated rates can always be checked with the help of your trusted advisor and/or on the company’s website. You can view the latest indexing rates of this annuity here.

The Pacific Life Index Foundation Annuity uses five crediting strategies:

| S&P 500 Index | MSCI EAFE Index |

|---|---|

| Point-to-Point Option with Cap | Point-to-Point Option with Cap |

| Performance-Triggered Index Option with Declared Rate | Performance-Triggered Index Option with Declared Rate |

| Fixed Account Option | Fixed Account Option |

Point to point with Cap

Cap rate is the most important terminology in an FIA. It means at what rate your interest-earning capacity is capped. For example, if an index returned 13% but your contract’s cap rate is 7%. In this situation, you will be eligible for an interest credit of 7% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest you can earn is the cap rate.

Performance-Triggered Index Option with Declared Rate

A flat or positive index return triggers the declared interest rate to be credited to the contract value. If the index return is negative, no interest is credited, but there will be no loss, and the contract value will remain the same. Suppose the change in the value of the index during that one year is zero or positive. In that case, the declared index gain interest rate is multiplied by the option’s account value to determine the index interest credits. The index interest credits pursuant to this option will never be less than zero. The declared interest rate is set at contract issue and applies for the entire withdrawal charge period.

Fixed Rate

If you opt for a fixed rate, you simply earn the fixed rates for a particular period specified by the company before your policy begins. These rates usually tend to be very low compared to other fixed avenues, such as CDs and MYGAs, so you should avoid fixed rates in a general scenario. The 1-year fixed rate on this policy at the time of writing this article was 3.5%.

These strategies can be mixed and matched with different indexes, tenures, and indexing options. For example, you can select the S&P 500 Index with a 1-year annual point-to-point with a cap rate, or the same with a 1-year point-to-point with performance-triggered index option, and so on.

Let’s look at the Pacific Life Index Foundation Annuity rate chart to understand better the earnings crediting strategies. Note that these rates are updated as of November 2022. These rates tend to change. Contact your trusted investment advisor to know the latest Pacific Life Index Foundation Annuity rates.

From the above rate sheet, we know that there are 5 interest-crediting strategies: two S&P 500 strategies, two MSCI EAFE strategies, and one fixed rate strategy. You will notice Cap rates and performance-triggered options in place, limiting your maximum interest-earning potential.

Based on the index constituents, past performance, and volatility, I believe that S&P 500 1-year point-to-point with Cap strategy has the highest return potential (as of November 2022).

Surrender Charge

Should your needs change unexpectedly, and you need to take an excess withdrawal (a withdrawal above the free withdrawal amounts available in a given contract year), you may be entitled to access additional monies. However, certain charges and penalties may apply. Any amount withdrawn over the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for Pacific Life Index Foundation Annuity.

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Surrender Charge % | 9% | 8% | 8% | 7% | 6% | 0% |

In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period.

This surrender charge schedule is only valid for select states (California usually has a different rate structure) for the Pacific Life Index Foundation Annuity product. For complete details about each state, you may contact your trusted financial advisor.

Contract/Administrative Charge

The Pacific Life Index Foundation Annuity levies no annual contract or administrative fees.

Riders

In an insurance policy, riders are an additional provision that can be added to enhance the benefits of the base policy. The Pacific Life Index Foundation Annuity comes with an optional death benefit, enabling annuitants to help protect and enhance the legacy they leave to their beneficiaries.

Interest Enhanced Death Benefit

Interest Enhanced Death Benefit is an optional benefit that guarantees your death benefit will grow annually by the amount of interest credited to your contract, plus an additional 2%, for either 20 years or until age 85, whichever is earlier (different terms for different states). The charge for this benefit is 0.40% of the Death Benefit Base deducted annually from your contract value (not the Death Benefit Base). Your beneficiaries will receive the greater of your Interest Enhanced Death Benefit Base or the standard death benefit amount upon your death. This optional benefit is subject to state and broker/dealer availability and variations. Please refer to the Interest Enhanced Death Benefits brochure for more information and work with your financial professional to determine if this optional benefit is appropriate for your financial needs.

What makes this product stand out?

- The plan offers well-known indexes with established histories

- No annual contract, mortality & expense, or administrative fees

- Free Enhanced Withdrawal Benefit

This no-fee rider is automatically included for owners under age 65 and includes both a Qualified Nursing Care and Terminal Illness Benefit:

- Qualified Nursing Care Benefit – After the first contract year, free withdrawal of up to 100% of the contract value is allowed if the owner is confined in a qualified care facility for a minimum of 30 days. Confinement must begin after the contract issue date, and written proof is required from both the qualified care facility and recommending physician.

- Terminal Illness Benefit – After the first contract year, free withdrawal of up to 100% of the contract value is allowed if the owner is diagnosed with a terminal illness. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

- High Guaranteed Minimum Surrender Value - The Guaranteed Minimum Surrender Value is equal to 91% of purchase payments minus prior withdrawals, accumulated at a fixed interest rate, which is set at contract issue. While for other popular annuities, this rate is usually 87.5%.

- Multiple Payout Options - Life Only, Life with Period Certain, Joint and Survivor Life, Period Certain, Single Life or Joint Life with Cash Refund, and Single Life or Joint Life with Installment Refund.

What I don’t like

This product is generally good on all fronts for people looking for both growth and lifetime income; still, there are some features that I believe could add more value for the annuitant. Some of the features that I don’t like about the policy are:

- Less Number of Indexing Options

- A limited number of riders to choose from: Only one optional rider

- High Initial Payment: $25k vs. $10k on other popular plans

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity’s “guarantee” is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Pacific Life Insurance Company

Pacific Life Insurance Company has been in business since 1868. It has been one of the largest providers of annuities in the US for many years and has regularly been in the top ten Fixed Indexed Annuity Sales.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

| AM Best | A (2nd of 13 ratings) |

| S&P | AA- (5th of 21 ratings) |

Pacific Life Insurance Company has managed to maintain decent ratings for many years. It is considered to be strong and stable financially. In 2021, the company paid out nearly $3.4 billion in claims. As of year-end 2021, some of the other financial highlights for Pacific Life include its:

- $13.7 billion in adjusted operating revenues

- $13.4 billion of total stockholders’ equity

- $983 million in adjusted operating income

- $209 billion in total assets

Thus, going by the operating history and financial numbers, we can safely gauge that you can trust your savings with Pacific Life Insurance Company.

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. So, it’s very important to have a stream of income that can grow safely, and steadily and have the ability to provide a fixed guaranteed income during the retirement years. This helps you mitigate the risk of outliving your income and ensures that you continue to live a decent life even in your retirement.

The Pacific Life Index Foundation Annuity is one such annuity that helps you grow your savings with much less risk. Through its indexed annuity, it offers principal protection and the opportunity to participate risk-free in the market index and providing a stream of guaranteed income.

If you are considering buying a Fixed Income Annuity that works on the growth front, the Pacific Life Index Foundation Annuity is an ideal product to look after. Although, you must keep in mind that this is a growth annuity and may not be the best suited for people who are super-conservative or at later stages of retirement.