Lincoln OptiBlend Fixed Indexed Annuity Review

byNikhil Bhauwala

Sun Mar 10 2024

Introduction

Fixed Index Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index. Fixed Index Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to missell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

This article discusses an in-depth review of the Lincoln OptiBlend Fixed Indexed Annuity. OptiBlend Fixed Indexed Annuity is a deferred, fixed-indexed annuity that may be a good option if you are looking for a no-frills fixed indexed annuity with a core focus on growth and the safety of principal. This annuity offers some good indexing options, which have the ability to provide better returns than similar annuities in the market. After extensive research and due diligence, I have provided an in-depth and unbiased analysis of this plan.

Product Description – Lincoln OptiBlend Fixed Indexed Annuity

The Lincoln OptiBlend is a Fixed Indexed Annuity (FIA) plan that offers the annuitant (annuity investor) an opportunity to earn a market index-linked return without having to incur the risk of market downside. This is a suitable plan for people who are looking for a plain vanilla fixed indexed annuity (with no optional paid riders such as enhanced lifetime income, enhanced death benefit, etc.) and aim to grow and protect their retirement savings.

Let’s have a look at the high-level fine print of Lincoln OptiBlend Fixed Indexed Annuity, and then we will discuss each point in detail.

| Product Name | Issuing Company |

|---|---|

| OptiBlend | Lincoln National Life Insurance Company |

| AM Best Rating | A+ (1st of 13 ratings) |

| Withdrawal Charge Period(s) | 5, 7, and 10 years |

| Maximum Issue Age | 85 Years |

| Minimum Initial Purchase Amount | $10,000 |

| Surrender Charge Schedule | Varies for different tenure policies |

| Crediting Period and Strategies | 1-year or 2-year point-to-point with participation rate or caps, 1-year daily risk control spread, 1-year performance triggered, or 1-year fixed with interest rate guaranteed |

| Plan Types | IRA, Roth IRA, Nonqualified Account, SEP IRA, SIMPLE IRA, 401(a) |

| Indexes | S&P 500 Index, BlackRock Dynamic Allocation, Fidelity AIM Dividend |

| Free Withdrawals | 10% of the annuity’s Accumulated Value; per year. |

| Death Benefit | Upon the annuitant’s death, the beneficiary can either choose from (i) Account Value (Lumpsum) or (ii) Guaranteed Minimum Value |

| Riders | Free Nursing home and terminal illness waivers |

| No optional paid riders | |

| Surrender Value | Greater of Account Value (less any withdrawal charges/MVA) and the Minimum Guaranteed Value |

The OptiBlend Fixed Indexed Annuity is almost identical for all three policy tenures, except the crediting strategies and surrender charge schedule. For ease of discussion and better clarity, we will discuss the OptiBlend Fixed Indexed Annuity 5 for the rest of the article.

How does the Lincoln OptiBlend Fixed Indexed Annuity 5 policy work?

Any annuitant (maximum age at the time of policy issue: 85) can purchase the OptiBlend Fixed Indexed Annuity 5 with a minimum initial purchase amount of $10,000, and in return, he will earn market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, there are various events that may trigger earnings credit: On free withdrawals, for a long-term care event or terminal illness or injury event, or when a death benefit is payable.

The Lincoln OptiBlend Fixed Indexed Annuity 5 offers the annuitant to choose from one or more of the three indexes (S&P 500 Index, BlackRock Dynamic Allocation, Fidelity AIM Dividend) to determine his earnings crediting formula. The S&P 500 index has five strategies, the BlackRock Dynamic Allocation index has three strategies, and the Fidelity AIM Dividend index has one strategy. The plan also offers a fixed-rate guaranteed interest strategy to choose from, making a total of 10 strategy options. We will discuss each available index briefly:

The OptiBlend Fixed Indexed Annuity is almost identical for all three policy tenures, except the crediting strategies and surrender charge schedule. For ease of discussion and better clarity, we will discuss the OptiBlend Fixed Indexed Annuity 5 for the rest of the article.

How does the Lincoln OptiBlend Fixed Indexed Annuity 5 policy work?

Any annuitant (maximum age at the time of policy issue: 85) can purchase the OptiBlend Fixed Indexed Annuity 5 with a minimum initial purchase amount of $10,000, and in return, he will earn market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, there are various events that may trigger earnings credit: On free withdrawals, for a long-term care event or terminal illness or injury event, or when a death benefit is payable.

The Lincoln OptiBlend Fixed Indexed Annuity 5 offers the annuitant to choose from one or more of the three indexes (S&P 500 Index, BlackRock Dynamic Allocation, Fidelity AIM Dividend) to determine his earnings crediting formula. The S&P 500 index has five strategies, the BlackRock Dynamic Allocation index has three strategies, and the Fidelity AIM Dividend index has one strategy. The plan also offers a fixed-rate guaranteed interest strategy to choose from, making a total of 10 strategy options. We will discuss each available index briefly:

S&P 500 Index

The S&P 500 index is one of the most popular and oldest indexes in the world. It tracks 500 large-cap publicly traded stocks listed in the United States. It is a reliable index and has often succeeded in the test of time. It is very important to note that the Lincoln OptiBlend Fixed Indexed Annuity offers the S&P 500 index with caps, participation rates, spreads, and performance triggers in place, meaning that your interest-earning capacity is capped. These rates tend to change frequently; I will discuss more on the rates shortly.

Blackrock Dynamic Allocation Index

The BlackRock Dynamic Allocation Index is a multi-asset class index designed to deliver a globally diversified portfolio with daily volatility control to help mitigate risk. The Index is diversified across asset classes and regions, and it provides the potential for more consistent returns than a traditional stock index. Index constituents are comprised of iShares® ETFs. The Index tracks the Return of the weighted ETFs above the sum of the Return on the Interest Rate and the Index Fee. The Blackrock Dynamic Allocation Index was launched on July 30, 2021, just during the onset of market underperformance, and thus, its return has not been impressive. At the time of writing this article, the total index return since the inception stood at -15.63%. However, since this is a fixed indexed annuity, your account value doesn’t get a negative credit. The worst you can earn is 0% credit!

Fidelity AIM Dividend Index

The Fidelity AIM Dividend Index uses a set of rules that utilizes a dynamic asset allocation approach. It blends the appeal of high dividend stocks with the safety of U.S. Treasuries to help manage changes in the market and deliver a steady investment experience over time. The index targets a volatility of 5% and a maximum exposure of up to 150%. The index was launched on 31st July 2019; At the time of writing this article, the hypothetical backtested 10-year return on this index stood at 5.31%. The actual one-year return at the time of writing this article stood at -5.94%. Out of the indexes offered by this plan, I believe the wisest decision would be to choose an S&P 500-based indexing strategy for its transparency, proven returns, and global importance.

It is very important to note that the OptiBlend Fixed Indexed Annuity comes with cap rates, participation rates, performance triggers, etc., for these indexes, meaning that you will be credited only a part of the index return to your annuity. These rates tend to change frequently; I will discuss more on these rates more shortly.

Note: In addition to allocating the funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest. These Fixed Rates tend to change from time to time. The Fixed Value Rate for the 5-year withdrawal charge period at the time of writing this article was 4.90%. It is noteworthy that the fixed rates offered by Lincoln are amongst one of the highest when we compare them with other annuities. You can view the latest rates of this annuity here.

Rates and Costs associated with the Lincoln OptiBlend Fixed Indexed Annuity

The earnings crediting formula The earnings crediting formula is the most important part of this annuity discussion. It is important to know that we don’t simply get the index return credited to our annuity. There are a few rates, caps, spreads, and triggers that the company has in place that affect our earnings. These rates tend to change over time, and the updated rates can always be checked on the company’s website. The formula to calculate the earnings credited is as follows:

- For Point-to-point Strategies with Participation: (Participation Rate % X Index Return)

- For Point-to-point Strategies with Caps: Index return over a given crediting period with a maximum potential of earning the cap rate

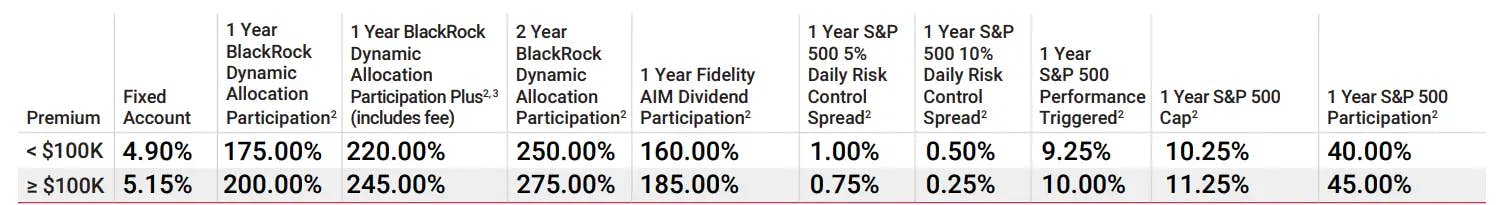

Let’s have a look at the Lincoln OptiBlend 5 rate sheet (at the time of writing this article) to understand how the earnings are determined.

The above table shows that the OptiBlend annuity offers the annuitant to choose from 10 indexing options. We can see that there are three index options and a number of crediting strategies such as participation, participation plus (with a fee), spread, performance triggered, and caps; Plus, there is also an option for a fixed account rate. Let's discuss these crediting strategies and see how they work.

- Participation: Participation rate describes the annuitant’s participation percentage in a return of an index. For example, suppose the participation rate is 150%, and the index returned 4% over the agreed time. In that case, the annuitant will be eligible for 150% of the return, i.e., 6%.

- Participation Plus: Participation plus is very similar to participation, except that it offers a higher participation rate but with an additional fee charged. At the time of writing this article, the fee charged for this higher participation rate was 1%.

In my view, the company offers a generous participation rate on the Blackrock Dynamic Allocation Index because the underlying index (Blackrock Dynamic Allocation) on which it offers the high participation rate itself is built in such a way that it limits its return earning potential. If I were at your place, I would skip the Blackrock Dynamic Allocation Index for all its strategies. On the other hand, you will notice that the company offers a very low participation rate on the S&P 500 Index.

- Performance-Trigerred Index Option with Declared Rate: A flat or positive index return triggers the declared interest rate to be credited to the contract value. If the index return is negative, no interest is credited, but there will be no loss, and the contract value will remain the same. Suppose the change in the value of the index during that one year is zero or positive. In that case, the declared index gain interest rate is multiplied by the option’s account value to determine the index interest credits. The index interest credits pursuant to this option will never be less than zero. The declared interest rate is set at contract issue and applies for the entire withdrawal charge period.

In this case, the performance-triggered rate for the S&P 500 Index is 9.25%. It means that if S&P Index doesn’t go negative for a given 1-year period (even if the growth is 0% and not negative), the interest credited will be 9.25% irrespective of the S&P 500 actual return. It is noteworthy that the company offers a very good performance triggered rate for the S&P 500 Index when compared to other similar policies.

- Cap Rates: It means at what rate your interest-earning capacity is capped. For example, if an index returned 12% but the contract’s cap rate is 6%. In this situation, the annuitant will be eligible for an interest credit of 6% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest that can be earned is the cap rate.

It is noteworthy that the company offers a very good cap rate (10.25%) for the S&P 500 Index when compared to other similar policies.

- Spread: The amount of interest that the Company will credit is based on a declared spread on the selected index on an annual point-to-point basis. Once the index gain is determined (if any), the spread amount is subtracted. The remaining amount is what is credited to the contract for that term. In this case, the company offers a spread option with a very low spread rate (which is good), but it should be noted that the underlying index(s) for the same is not the S&P 500, but S&P 500 with Daily Risk Control. The daily risk adjustment (5% and 10% in this case) in the index limits its true return earning potential and thus should not be confused with the regular S&P 500 Index.

- Fixed Account Rate/Declared Rate: If you opt for a fixed account rate, you simply earn the fixed rates for a particular period specified by the company before your policy begins. These rates usually tend to be very low as compared to other fixed avenues, such as CDs and MYGAs, so you should avoid fixed rates in a general scenario. The 1-year fixed rate on this policy at the time of writing this article was 4.9%, which is a decent rate compared to other similar annuities.

I think opting for the 1-year S&P 500 performance triggered or the 1-year S&P 500 with caps makes the most sense at the current point. For these two options, the company is offering generous rates when compared to the competitors. These rates signal that the product is truly oriented toward growth.

Surrender/Early Withdrawal Charge

Should your needs change unexpectedly, and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access.

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6+ |

|---|---|---|---|---|---|---|

| Surrender Charge % | 9% | 8% | 7% | 6% | 5% | 0% |

| Surrender Charge % (in CA) | 9.25% | 8.25% | 7.25% | 6.25% | 5.20% | 0% |

Market Value Adjustments - In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period. The surrender charge schedule is different for the different tenures of annuities and also changes for some states. For a quick comparison of surrender charges across different products of Lincoln, you may visit their annuities product page here.

The surrender charge of Lincoln OptiBlend Fixed Indexed Annuity is in line with all the other annuity issuers.

Contract/Administrative Charge

The Lincoln OptiBlend 5 Fixed Indexed Annuity levies no annual contract or administrative fees

Riders

The Lincoln OptiBlend is a plain-vanilla annuity that does not offer any optional paid riders. In my opinion, this actually appeals to many people who don’t understand or do not want to deep-dive into the complex methodologies the riders often come up with. However, as with most annuities, the OptiBlend FIA has free in-built nursing home and terminal illness waivers.

Nursing Home Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is confined to a Qualified nursing home for at least 90 consecutive days. No withdrawal charge or MVA apply if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Terminal Illness Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is diagnosed with a terminal illness with a prognosis of 12 months or less. No withdrawal charge or MVA apply if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

What makes this product stand out?

The Lincoln OptiBlend Fixed Indexed Annuity offers some features that not many fixed-indexed annuities offer. The ones that I like the most are

- The plan offers S&P Index with multiple crediting methodologies

- Higher Caps, Participation Rates, and Fixed Rate: Caps on the equity indexing strategies are a bummer! However, the good thing with the OptiBlend Fixed Indexed Annuity is that it provides higher caps, even for a very popular index like the S&P 500. Similarly, it also offers higher participation rates than many of its competitors. It also offers competitive fixed rates.

- No annual contract, mortality & expense, or administrative fees

- Free Confinement and Terminal Illness Waiver Benefit: This no-fee rider is automatically included for owners under age 65 and includes both a Qualified Nursing Care and Terminal Illness Benefit:

- High Guaranteed Minimum Surrender Value: The Guaranteed Minimum Surrender Value is equal to 100% of the premium accumulated at 0.10% annual growth (credited daily) prior withdrawals. This is one of the highest Guaranteed Minimum Surrender Values I have seen, while for other popular annuities, this rate is usually only 87.5% of the premium accumulated.

- Multiple Payout Options: Lumpsum or Annuitization option with Life Only, Life with Period Certain, Joint and Survivor Life, etc.

What I don’t like

This product is generally good on all fronts for people looking for growth; still, there are some features that I believe could add more value for the annuitant. Some of the features that I don’t like about the policy are

- No optional riders to choose from

- Although the annuity offers good strategies on the S&P 500 Index, I don’t like the other two indexes that the company offers for the interest crediting strategy.

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Lincoln National Life Insurance Company

Lincoln National Life Insurance Company has been in the business since 1905. It is one of the largest and oldest providers of fixed and fixed indexed annuities in the US and has been regularly in the top ten Fixed Indexed Annuity Sales.

| Rating Agency | Rating |

|---|---|

| AM Best | A+ |

| S&P | A+ |

| Fitch Ratings | A+ |

| Moody's Investors Service | A1 |

Lincoln National Life Insurance Company has managed to maintain decent ratings for many years. It is considered to be strong and stable financially. In 2021, the company paid out nearly $8.5 billion in claims. As of year-end 2021, some of the other financial highlights for Lincoln National Life Insurance Company include its:

- $19.23 billion in total sales / direct written premium

- $20.3 billion of stockholder’s equity

- $1.5 billion in net operating income

- $387.3 billion in total assets

Thus, going by the operating history and financial numbers, we can safely gauge that you can trust your savings with Lincoln National Life Insurance Company.

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. So, it’s very important to have a retirement corpus that can grow safely and steadily and have the ability to provide a fixed stream of income during the retirement years. This not only helps you to mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

The Lincoln OptiBlend FIA is one such annuity that helps you grow your retirement account with much less risk. Through its higher caps, participation rates, and performance-trigger rates, It offers faster growth with principal protection. The product’s plain vanilla nature (with no optional paid riders) might also appeal to people who don’t like to deep-dive into the complex methodologies associated often associated with the riders.

If you are considering buying a Fixed Indexed Annuity that is purely growth-oriented, the Lincoln OptiBlend 5 FIA is a decent product to look after.