Global Atlantic ForeAccumulation II Fixed Indexed Annuity Review

byNikhil Bhauwala

Tue Feb 20 2024

Introduction

Fixed Index Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index. Fixed Index Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to missell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

This article discusses an in-depth review of the Global Atlantic ForeAccumulation II Fixed Indexed Annuity. Global Atlantic ForeAccumulation II is a deferred, fixed-indexed annuity that may be a good option if you are looking for steady growth, greater withdrawals, the safety of the principal, and leaving a legacy. After extensive research and due diligence, I have provided an in-depth and unbiased analysis of this plan.

The review of the Global Atlantic ForeAccumulation II Fixed Indexed Annuity will be broken into multiple subcategories:

- Product Description

- Rates and Costs Associated with the Global Atlantic ForeAccumulation II Fixed Indexed Annuity

- Riders

- What Makes This Product Stand Out?

- What I Don’t Like

- Company Details

- Conclusion

Product Description - Global Atlantic ForeAccumulation II Fixed Indexed Annuity

The Global Atlantic ForeAccumulation II is a Fixed Indexed Annuity (FIA) plan that offers the annuitant (annuity investor) an opportunity to earn a market index-linked return without having to incur the risk of market downside. This is a suitable plan for people who are looking for a plain vanilla fixed indexed annuity (with an optional paid enhanced death benefit rider) and aim to grow and protect their retirement savings.

Let’s have a look at the high-level fine print of Global Atlantic ForeAccumulation II Fixed Indexed Annuity, and then we will discuss each point in detail.

| Product Name | ForeAccumulation II |

|---|---|

| Issuing Company | Forethought Life Insurance Company |

| AM Best Rating | A (3rd of 13 ratings) |

| Withdrawal Charge Period(s) | 5, 7, and 10 years *varies as per states |

| Maximum Issue Age | 85 Years |

| Minimum Initial Purchase Amount | $25,000 |

| Surrender Charge Schedule | aries for different tenure policies |

| Crediting Period and Strategies | 1-year point-to-point with participation rate, caps, 1-year performance trigger, 2-year point-to-point with participation rate, 2-year point-to-point with spread, and 1-year fixed with interest rate guaranteed; with bailout provision |

| Plan Types | IRA, Roth IRA, Nonqualified Account, SEP IRA, SIMPLE IRA, 401(a) |

| Indexes | S&P 500 Index, MSCI EAFE Index, BlackRock Diversa® Volatility Control Index, PIMCO Balanced Index, Franklin US Index, and JP Morgan Cross-Asset Strategy Index |

| Free Withdrawals | 10% of the annuity’s Accumulated Value; per year. |

| Death Benefit | Upon the annuitant’s death, the beneficiary is entitled to the remaining contract value at no additional charge |

| Riders | Free Nursing home and terminal illness waivers Optional paid Enhanced Death Benefit |

| Surrender Value | Contract value less Market Value Adjustment (MVA) |

The ForeAccumulation II Fixed Indexed Annuity is almost identical for all three policy tenures, except the crediting strategies and surrender charge schedule. For ease of discussion and better clarity, we will discuss the ForeAccumulation II 5 Fixed Indexed Annuity (unless other withdrawal charge policies are mentioned) for the rest of the article.

How does the Global Atlantic ForeAccumulation II Fixed Indexed Annuity Policy Work?

Any annuitant (maximum age at the time of policy issue: 85) can purchase the Global Atlantic ForeAccumulation II Fixed Indexed Annuity 5 with a minimum initial purchase amount of $25,000, and in return, he will earn market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, there are various events that may trigger earnings credit: On free withdrawals, for a long-term care event or terminal illness or injury event, or when a death benefit is payable.

The Global Atlantic ForeAccumulation II Fixed Indexed Annuity 5 offers the annuitant to choose from one or more of the six indexes (S&P 500 Index, MSCI EAFE Index, JP Morgan Cross-Asset Strategy Index, BlackRock Diversa® Volatility Control Index, PIMCO Balanced Index, and Franklin US Index) to determine his earnings crediting formula. Each index has multiple strategies to choose from. The plan also offers a fixed-rate guaranteed interest strategy to choose from, making a total of 14 strategy options. We will discuss each available index briefly:

- S&P 500 Index: The S&P 500 index is one of the most popular and oldest indexes in the world. It tracks 500 large-cap publicly traded stocks listed in the United States. It is a reliable index and has often succeeded in the test of time. It is very important to note that, similar to most other annuities, the Global Atlantic ForeAccumulation II Fixed Indexed Annuity offers the S&P 500 index with caps, and performance-triggers in place, meaning that your interest-earning capacity is limited. These rates tend to change frequently; I will discuss more on the rates shortly.

- MSCI EAFE Index: MSCI EAFE is a widely recognized international equities index consisting of large companies across developed countries in Europe, Australasia, and the Far East, excluding the U.S. and Canada. MSCI EAFE includes equities across a range of industries and regions, providing broad opportunities for growth. Again, It is important to note that the Global Atlantic ForeAccumulation II plan has caps in place for the MSCI EAFE index, meaning that you will be credited only a small part of the MSCI EAFE return to your annuity. These rates tend to change frequently.

- JP Morgan Cross-Asset Strategy Index: Details Awaited

- PIMCO Balanced Index: The PIMCO Balanced Index allocates to U.S. large-cap equities, U.S. fixed income, and cash. Weights are rebalanced daily based on two mechanisms aimed at navigating changing equity and bond markets. As market volatility increases, the allocation to equities decreases in favor of the bond allocation in order to stabilize risk and potentially mitigate losses. As interest rates trend higher and bond prices fall, the Index targets lower treasury futures exposure with the potential to take a short position that can enhance returns.

- BlackRock Diversa Volatility Control Index: The BlackRock iBLD Diversa® VC7 ER Index is a multi-asset Index designed to deliver a globally diversified portfolio with daily volatility controls to help mitigate downside risk. Because the multi-asset Index is diversified across assets and regions, it provides the potential for more consistent returns than a traditional stock index. The index seeks to capture market opportunities in various environments by dynamically responding to trends in asset returns. Index constituents are comprised of iShares® ETFs. The Index tracks the excess return of the selected iShares® ETF constituents above the return on cash. The index targets a low annualized realized volatility, which limits the return potential of the index.

- Franklin US Index: The Franklin US Index is designed to deliver long-term stable growth and limit downside exposure by dynamically shifting between high-quality US stocks, bonds, and cash to take advantage of changing marketing conditions. The back-tested 10-year historical annual return (as of year-end 2022), as shown by Franklin Templeton, stands at ~5.50%.

I will discuss more on these strategies in the next section of this review.

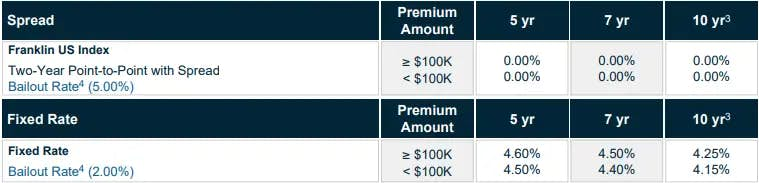

Note: In addition to allocating the funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest. These Fixed Rates tend to change from time to time. The Fixed Value Rate for the 5-year withdrawal charge period at the time of writing this article was 4.60%. It is noteworthy that the fixed rates offered by Global Atlantic are better when we compare them with other annuities. You can view the latest rates of this annuity here.

Rates and Costs associated with the Global Atlantic ForeAccumulation II Fixed Indexed Annuity

The earnings crediting formula

The earnings crediting formula is the most important part of this annuity discussion. It is important to know that we don’t simply get the index return credited to our annuity. There are a few rates, caps, spreads, and triggers that the company has in place that affect our earnings. These rates tend to change over time, and the updated rates can always be checked on the company’s website.

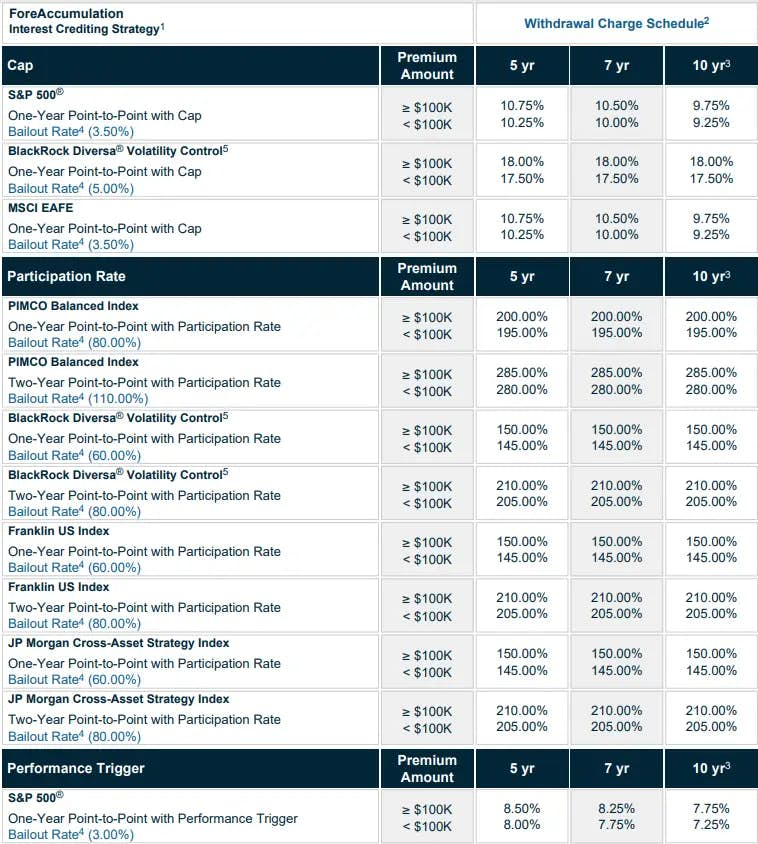

Let’s have a look at the Global Atlantic ForeAccumulation II Fixed Index Annuity rate sheet (as of January 2024) to understand how the earnings are determined.

From the above rate chart, you will notice that there are 14 interest crediting options (1 fixed and 13 indexed). Let’s have a look at different terms that are used by the company in the Global Atlantic ForeAccumulation II chart rate:

- Participation Rate (PR): Participation rate describes the annuitant’s participation percentage in a return of an index. For example, suppose the participation rate is 150%, and the index returned 4% over the agreed time. In that case, the annuitant will be eligible for 150% of the return, i.e., 6%.

- Cap Rates: It means at what rate your interest-earning capacity is capped. For example, if an index returned 12% but the contract’s cap rate is 6%. In this situation, the annuitant will be eligible for an interest credit of 6% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest that can be earned is the cap rate.

- Performance-Trigerred Index Option with Declared Rate: A flat or positive index return triggers the declared interest rate to be credited to the contract value. If the index return is negative, no interest is credited, but there will be no loss, and the contract value will remain the same. Suppose the change in the value of the index during that one year is zero or positive. In that case, the declared index gain interest rate is multiplied by the option’s account value to determine the index interest credits. The index interest credits pursuant to this option will never be less than zero. The declared interest rate is set at contract issue and applies for the entire withdrawal charge period. In this case, the performance-triggered rate for the S&P 500 Index is 9.25%. It means that if S&P Index doesn’t go negative for a given 1-year period (even if the growth is 0% and not negative), the interest credited will be 8.25% irrespective of the S&P 500 actual return. It is noteworthy that the company offers a good performance-triggered rate for the S&P 500 Index when compared to other similar policies.

- Spread: The amount of interest that the Company will credit is based on a declared spread on the selected index on an annual point-to-point basis. Once the index gain is determined (if any), the spread amount is subtracted. The remaining amount is what is credited to the contract for that term. In the current case, the company offers a spread option with 0% spread rate (which is good), but it should be noted that the underlying index(s) for the same is the BlackRock Diversa Volatility Control Index and the Franklin US Index, both of which have volatility control, which limits the actual return.

- Fixed Account Rate: If you opt for a fixed account rate, you simply earn the fixed rates for a particular period specified by the company before your policy begins. These rates usually tend to be low/at par as compared to other fixed avenues, such as CDs and MYGAs, so you should avoid fixed rates in a general scenario. The 1-year fixed rate on this policy at the time of writing this article was 4.60%.

- Bailout Provision: If the company lowers any rate below the Bailout Cap rate, you’ll have full access to withdraw your annuity’s accumulated value - free of any charges.

Amongst these indices, I would prefer the strategies with the S&P 500 Index, MSCI EAFE Index, and PIMCO Balanced Index because of the proven historical track record and performances of these indexes.

Surrender/Early Withdrawal Charge

Should your needs change unexpectedly, and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies, although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for the Global Atlantic ForeAccumulation II Fixed Indexed Annuity.

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11+ |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Surrender Charge % (5-year) | 8% | 8% | 7% | 6% | 5% | 0% | |||||

| Surrender Charge % (7-year) | 8% | 8% | 7% | 6% | 5% | 4% | 3% | 0% | |||

| Surrender Charge % (10-year) | 9% | 9% | 8% | 7% | 6% | 5% | 4% | 3% | 2% | 1% | 0% |

Market Value Adjustments - In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period. The surrender charge schedule is different for the different tenures of annuities and also changes for some states. For a quick comparison of surrender charges across different products of Global Atlantic, you may visit their annuities product page here.

The surrender charge of Global Atlantic ForeAccumulation II Fixed Indexed Annuity is in line with all the other annuity issuers.

Contract/Administrative Charge

The Global Atlantic ForeAccumulation II Fixed Indexed Annuity levies no annual contract or administrative fees

Riders

The Global Atlantic ForeAccumulation II Fixed Indexed Annuity comes with an optional Enhanced Death Benefit riderfor an additional fee, that enables you to potentially leave your beneficiary with more than your contract value.

This optional benefit is separate and distinct from your contract value and, if selected, provides steady and predictable growth toward your death benefit. Initially, your EDB figure is equal to your original ForeAccumulation premium. Each year, your EDB grows by a guaranteed simple interest of 7% of the premium for up to 15 years. If the amount ends up being greater than your contract value, your beneficiary receives the EDB value.

An example of the ForeAccumulation II Enhanced Death Benefit:

Let’s say you purchase a $50,000 ForeAccumulation FIA. That premium equals your starting contract value and your initial EDB. While your contract value potentially grows over time as per your indexing strategies, your EDB amount separately grows at a guaranteed simple interest of 7% ($3,500) every year for 15 years. After 15 years, your EDB more than doubles to $102,500, as a result of simple 7% annual crediting.

| Initial Premium | $50,000 | $50,000 |

|---|---|---|

| Annual Simple 7% Interest Credit | $52,500 | $52,500 |

| EDB at end of 15 years *Assuming no withdrawals |

After your passing, your beneficiary either gets the EDB or your contract value as a death benefit – whichever is greater. If you don’t elect the EDB option, your contract value will pass on to your beneficiary after your death, guaranteed.

Cost: The optional Enhanced Death Benefit is available at an annual cost of 0.50%, assessed at the end of the contract year. All withdrawals will reduce the benefit. Also, a maximum age of 75 applies.

In my opinion, it is a decent, straightforward rider for people who are looking to leave a legacy without worrying about the market's ups and downs. Even if you consider 0.5% cost, you still get close to a 6.5% guaranteed upside every year. In case your original contract performs well and the contract value is above the EDB value, you will be entitled to your contract value. You can even think of this rider as an insurance to secure a pre-determined death benefit.

Besides the Enhanced Death Benefit rider, the ForeAccumulation II also provides Nursing Home and Terminal Illness waiver as most other plans:

Nursing Home Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is confined to a Qualified nursing home for at least 90 consecutive days. No withdrawal charge or MVA apply if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Terminal Illness Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is diagnosed with a terminal illness with a prognosis of 12 months or less. No withdrawal charge or MVA apply if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

What makes this product stand out?

The Global Atlantic ForeAccumulation II Fixed Indexed Annuity offers some features that not many fixed-indexed annuities offer. The ones that I like the most are

- The plan offers S&P Index with good indexing options

- Plenty of index options to choose from

- Higher Caps, Participation Rates, and Fixed Rate: Caps on the equity indexing strategies are a bummer! However, the good thing with the ForeAccumulation II Fixed Indexed Annuity is that it provides higher caps, even for a very popular index like the S&P 500. Similarly, it also offers higher participation rates than many of its competitors. It also offers competitive fixed rates.

- No annual contract, mortality & expense, or administrative fees

- Free Confinement and Terminal Illness Waiver Benefit: This no-fee rider is automatically included for owners under age 65 and includes both a Qualified Nursing Care and Terminal Illness Benefit:

- Multiple Payout Options: Lupsum or Annuitization option with Life Only, Life with Period Certain, Joint and Survivor Life, etc.

What I don’t like

This product is generally good for people looking to buy a simple fixed-indexed annuity and are looking for growth; still, there are some features that I believe could add more value for the annuitant. Some of the features that I don’t like about the policy are

- A limited number of riders to choose from: Only one optional rider

- High Initial Payment: $25k vs. $10k on other popular plans

- I couldn’t find any minimum surrender value on the company’s marketing material for this plan

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity's "guarantee" is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Forethought Life Insurance Company

Forethought Life Insurance Company has been in business since 1980. It is a direct subsidiary of Global Atlantic Financial Group, which is one of the largest providers of fixed and fixed-indexed annuities in the US, serving more than two million policyholders through its retirement and life insurance products. It has been regularly in the top ten Fixed Indexed Annuity Sales. It offers annuities for individuals through a network of banks, broker-dealers, and insurance agencies, as well as life insurance for individuals. Global Atlantic is also a leader in the institutional channel, providing customized reinsurance solutions to its life and annuity company clients. It offers capabilities across the block, flow, and pension risk transfer reinsurance to meet its client’s needs.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

| AM Best | A |

| S&P | A- |

| Fitch Ratings | A |

| Moody's Investors Service | A2 |

Global Atlantic Financial Group has managed to maintain decent ratings for many years. It is considered to be strong and stable financially. In February 2021, Global Atlantic became a majority-owned subsidiary of the KKR public company, operating as a standalone business. KKR is a leading global investment firm that manages multiple alternative asset classes, including private equity, credit and real assets, with strategic partners that manage hedge funds. KKR invests its own capital alongside the capital it manages for fund investors and provides financing solutions and investment opportunities through its capital markets business.

Going by the operating history and the partnership with KKR & Co., we can safely gauge that you can trust your savings with Forethought Life Insurance/Global Atlantic Group.

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. So, it’s very important to have a stream of income that can grow safely and steadily and have the ability to provide a guaranteed income during the retirement years. This not only helps you to mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

The Global Atlantic ForeAccumulation II annuity is a straightforward product that helps you grow your savings with much less risk. Through its higher cap, higher participation, higher performance-triggered declared rates, and optional enhanced death benefit rider, it offers principal protection and the opportunity to participate risk-free in the market index and also provides a means to leave a legacy for your loved ones. If you are considering buying a Fixed Indexed Annuity that works for both income growth and legacy planning, the Global Atlantic ForeAccumulation II FIA may be a decent product to look after.

We understand that choosing the right annuity can be a complex decision, influenced by a myriad of factors such as market conditions, individual financial goals, and evolving life circumstances. To better serve you in this critical decision-making process, we regularly conduct in-depth reviews of various annuity products, examining features, costs, and potential benefits. To delve deeper into our extensive reviews, click here.