Athene Performance Elite Fixed Indexed Annuity Review

byNikhil Bhauwala

Mon Mar 11 2024

Introduction

Fixed Index Annuities are contracts between the annuitant and an insurance company in which the insurance company promises to credit interest based on the performance of a certain stock market index. Fixed Index Annuities have an inbuilt capital protection feature, so your principal will remain safe even if the index goes down.

Annuities are complex products, and many advisors try to missell them without properly understanding the buyer’s needs. Thus, you must educate yourself on these products and not solely depend upon the annuity agent’s high-pressure sales pitch.

This time we will be covering another popular annuity from Athene. This article discusses an in-depth review of the Athene Performance Elite Fixed Indexed Annuity. Athene Performance Elite is a deferred, fixed-indexed annuity that may be a good option if you are looking for growth, safety of principal, good indexing options, and the most popular riders. After extensive research and due diligence, I have provided an in-depth and unbiased analysis of this plan.

Product Description – Athene Performance Elite Fixed Indexed Annuity

The Athene Performance Elite is a Fixed Indexed Annuity (FIA) plan that offers the annuitant (annuity investor) an opportunity to earn a market index-linked return without having to incur the risk of market downside. This is a suitable plan for people who are approaching retirement and aim to grow and protect their retirement savings. This plan is also suitable for people who are looking for guaranteed lifetime income or plan to leave a legacy for their loved ones, in addition to protecting and growing their retirement savings.

Let’s have a look at the high-level fine print of Athene Performance Elite Fixed Indexed Annuity, and then we will discuss each point in detail.

| Product Name | Performance Elite |

|---|---|

| Issuing Company | Athene Annuity and Life Company |

| AM Best Rating | A (2nd of 13 ratings) |

| Withdrawal Charge Period(s) | 7, 10, and 15 years |

| Maximum Issue Age | 83, 78, and 73 Years (for 7, 10, and 15 Years Withdrawal Charge Period). May vary with some states |

| Minimum Initial Purchase Amount | $10,000 |

| Surrender Charge Schedule | Varies for different tenure policies |

| Crediting Period and Strategies | 1-year or 2-year point to point with participation rate or caps, or 1-year fixed with interest rate guaranteed |

| Plan Types | IRA, Roth IRA, Nonqualified Account, SEP IRA, SIMPLE IRA, 401(a) |

| Indexes | S&P 500 Index, BNP Paribas Multi-Asset Diversified 5 Index, NASDAQ FC Index, AI-Powered US Equity Index, AI-Powered Global Opportunities Index, UBS Innovative Balanced Index |

| Free Withdrawals | 10% of the annuity’s Accumulated Value; per year. Enhanced Withdrawal Benefits are available in the plus option |

| Death Benefit | Upon the annuitant’s death, the beneficiary can either choose from (i) Accumulated Value (Lumpsum) or (ii) Minimum Guaranteed Contract Value |

| *If death occurs after annuitization, payments will be consistent with the Settlement Option selected | |

| Riders | An optional premium bonus rider available that is discussed in the later part of the article |

| Surrender Value | Greater of Accumulated Value (less any withdrawal charges/MVA) and the Minimum Guaranteed Contract Value |

The Athene Performance Elite Fixed Indexed Annuity is almost identical for all three policy tenures, except the crediting strategies and surrender charge schedule. For ease of discussion and better clarity, we will discuss the Athene Performance Elite 7 Fixed Indexed Annuity for the rest of the article.

How does the Athene Performance Elite 7 Fixed Indexed Annuity policy work?

Any annuitant (maximum age at the time of policy issue: 83) can purchase the Athene Performance Elite 7 Fixed Indexed Annuity with a minimum initial purchase amount of $10,000, and in return, he will earn market index returns (calculated through a formula that we will discuss shortly), credited as per the chosen crediting period. Apart from the regular crediting period, there are various events that may trigger earnings credit: On free withdrawals, for a long-term care event or terminal illness or injury event, or when a death benefit is payable.

The Athene Performance Elite 7 Fixed Indexed Annuity offers the annuitant to choose from one or more of the five indexes to determine his earnings crediting formula. The S&P 500 Index offers 2 strategies, and the other four indexes have four strategies each. The plan also offers a fixed-rate guaranteed interest strategy to choose from (making a total of 19 strategy options). We will discuss each available index briefly:

S&P 500 Index

The S&P 500 index is one of the most popular and oldest indexes in the world. It tracks 500 large-cap publicly traded stocks listed in the United States. It is a reliable index and has often succeeded in the test of time. It is very important to note that the Athene Performance Elite Fixed Indexed Annuity offers the S&P 500 index with caps in place, meaning that your interest-earning capacity is capped. These rates tend to change frequently; I will discuss more on the rates shortly.

S&P 500 Daily Risk Control 2 8%™ Index TR (Total Return)

This is the same S&P 500 index but with a volatility control mechanism. Because the index applies a volatility control mechanism, the range of both the positive and negative performance of the index is limited. I would not suggest going with this index as, in its true sense, this index appears similar to the S&P 500 Index, but its returns can vary greatly from the S&P 500 Index.

BNP Paribas Multi Asset Diversified 5 Index

The BNP Paribas Multi Asset Diversified 5 Index is a rules-based index that seeks to measure the performance of a diverse range of asset classes comprised of eight components (three equity futures indexes, three bond futures indexes and two commodities index. On a daily basis, the BNPP MAD 5 Index dynamically rebalances the weightings of the components according to a proprietary methodology that seeks to identify weights for the components that would have resulted in the Hypothetical Portfolio with the highest past returns. The BNP Paribas MAD 5 Index was created in January 2016 and targets a 5% annualized realized volatility.

NASDAQ Fast Convergence Index

The NASDAQ Fast Convergence Index is powered by BofA (Bank of America) and uses a proprietary technology that aims to reduce risk and increase performance by adapting faster to changing market conditions. It has a 107.95% exposure in the NASDAQ 100 TR Index (which contains 100 of the most prominent large-cap stocks). It is important to know that this index employs a performance control mechanism wherein a portion of the returns of the Nasdaq FC Index is capped at 4% for the preceding one-month period. The NASDAQ FC Index was created in January 2020 and targets a 12.5% annualized realized volatility.

HSBC AI-Powered US Equity Index

The HSBC AI-Powered US Equity Index (AiPEX) is an index developed by HSBC that uses IBM Watson’s AI engine to create a risk-controlled, excess return index comprised of approximately 250 U.S. publicly traded companies, adjusted monthly, that is intended to provide growth through a variety of market conditions. The AiPEX Index was created in August 2019 and targets a 6% daily volatility.

AI-Powered Global Opportunities Index

AI-Powered Global Opportunities Index (AiGO) is a multi-asset strategy that uses the power of IBM Watson and Equbot's proprietary Artificial Intelligence capabilities to turn data into investment insight. AiGO is designed to track a strategic combination of a diversified portfolio of ETFs (and one HSBC index) that represents global equities, fixed income, and inflation-sensitive assets in an attempt to deliver resilient market growth across different market cycles. This is a very new index that was launched in March 2023, and it targets a 7% volatility.

UBS Innovative Balanced Index

The UBS Innovative Balanced Index (UBSIBAL) leverages unique signals that aim to provide an early read into the U.S. macro environment and inform an all-weather tactical allocation to equities, commodities and bonds. The signals include US inflation expectations and a Nowcast of US economic growth, generated using key datasets from UBS Evidence Lab, the largest sell-side alternative data offering of its kind. This is also a very new index and applies a volatility control mechanism.

Note: In addition to allocating the funds in the following indexes, the annuitant also has the option to allocate funds at a fixed interest. These Fixed Rates tend to change from time to time. The Fixed Value Rate at the time of writing this article was 4.60%.

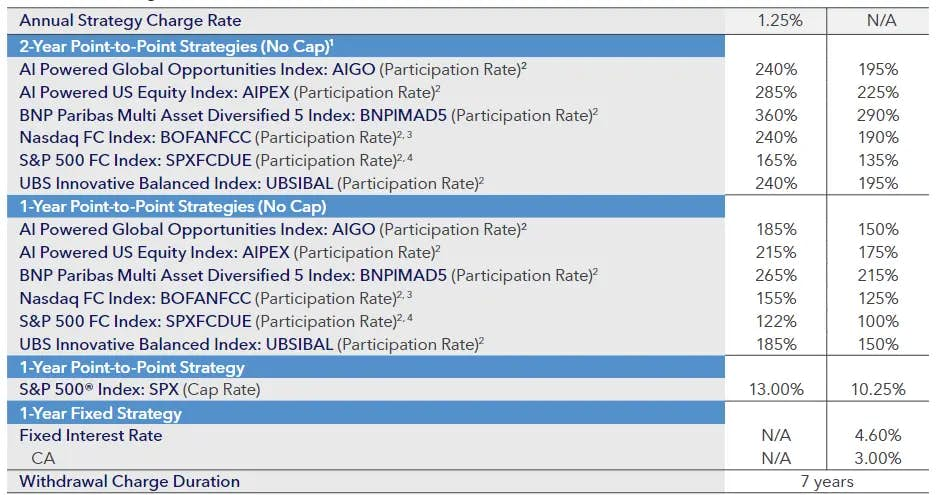

Rates and Costs associated with the Athene Performance Elite Fixed Indexed Annuity

The earnings crediting formula The earnings crediting formula is the most important part of this annuity discussion. It is important to know that we don’t simply get the index return credited to our annuity. There are a few rates and caps that the company has in place that affect our earnings. These rates tend to change over time, and the updated rates can always be checked on the company’s website. The formula to calculate the earnings credited is:

- For Strategies with Participation: (Participation Rate % X Index Return)

- For Strategies with Caps: Index return over a given crediting period with a maximum potential of earning the cap rate

The first thing to note is that we have seven indexes, and each index has point-to-point strategies. Additionally, we have a fixed rate strategy to choose from. All in, we get to choose from a total of fourteen strategies (thirteen index-based and one fixed). The charge options with each strategy will be discussed shortly. The company displays three types of crediting strategies across these rates (Participation, Cap, and Fixed). The Participation rate (index allocation rate) and the strategy caps are the most important.

- Participation Rate (PR)

The participation rate describes the annuitant’s participation percentage in a return of an index. For example, suppose the participation rate is 150%, and the index returned 4% over the agreed time. In that case, the annuitant will be eligible for 150% of the return, i.e., 6%.

- Cap Rates

It means at what rate your interest-earning capacity is capped. For example, if an index returned 12% but the contract’s cap rate is 6%. In this situation, the annuitant will be eligible for an interest credit of 6% only. It doesn’t matter how much the index goes above the cap rate; the maximum interest that can be earned is the cap rate.

- Fixed Account Rate

If you opt for a fixed account rate, you simply earn the fixed rates for a particular period specified by the company before your policy begins. These rates usually tend to be very low as compared to other fixed avenues, such as CDs and MYGAs, so you should avoid fixed rates in a general scenario. The 1-year fixed rate on this policy at the time of writing this article was 4.15%.

- Charge Options

All the “strategies with charge” can be selected by paying an annual strategy charge rate, which, during the time of writing this article, was 1.25%. You will notice that all the strategies with a charge rate offer higher cap and participation rates. The charge is calculated by multiplying the Strategy Value of the associated Strategy and an Annual Strategy Charge Rate on each contract anniversary. A portion of that charge (1/12th) is deducted from the applicable Strategy Value each month. The Initial Annual Strategy Charge Rate is set at contract issue and guaranteed for the first Index Term Period. A new Annual Strategy Charge Rate will be declared at the start of each Index Term Period.

Strategy Charge Credit: A one-time Strategy Charge Credit will be added to the Accumulated Value at the end of the Withdrawal Charge Period if the sum of all strategy charges applied, minus the sum of all interest credits, is greater than zero. If withdrawals subject to a Withdrawal Charge are taken (including a full surrender), the Credit will not be applied.

It is very important to always check the latest rates before choosing your preferred index.

Out of all these indexes, at this point in time, I would prefer the NASDAQ FC index and the S&P 500 index (not the S&P 500 Daily Risk Control) the most because of their decent back-tested returns, good real performance, and relatively high index participation/cap rates offered by the company. It’s up to you if you are willing to take the additional risk (charge rate) for an additional return (higher participation rates). If the index goes up, your charge rate will be more than covered, but if the index goes down, you will forfeit the charge rate.

- Surrender Charge

Should your needs change unexpectedly, and you need to take an excess withdrawal (a withdrawal that is above the free withdrawal amount available in a given contract year), you may be entitled to access additional monies, although certain charges and penalties may apply. Any amount withdrawn in excess of the remaining free withdrawal amount is subject to a Surrender Charge. Below is the Surrender Charge schedule for Athene Performance Elite 7 Fixed Indexed Annuity.

| Completed Contract Years | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8+ |

|---|---|---|---|---|---|---|---|---|

| Surrender Charge % | 9% | 8.8% | 7.9% | 6.9% | 5.9% | 5% | 4% | 0% |

| Surrender Charge % (in CA) | 9% | 8% | 6.9% | 5.8% | 4.7% | 3.6% | 2.4% | 0% |

In case you need to surrender your policy, a Market Value Adjustment (MVA) will be applied to the portion of the withdrawal or surrender that exceeds the free withdrawal amount during the withdrawal charge period.

The surrender charge schedule is different for the different tenures of annuities. For a quick comparison of surrender charges across different products of Athene, you may visit their fixed indexed annuities product page.

The surrender charge of Athene Performance Elite Fixed Indexed Annuity is pretty much in line with all the other annuity issuers.

Contract/Administrative Charge

The Athene Performance Elite Fixed Indexed Annuity levies no annual contract or administrative fees.

Riders

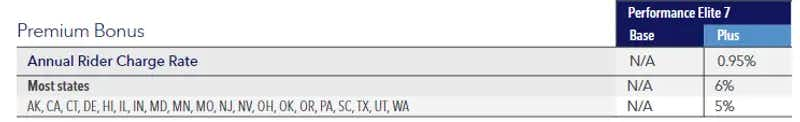

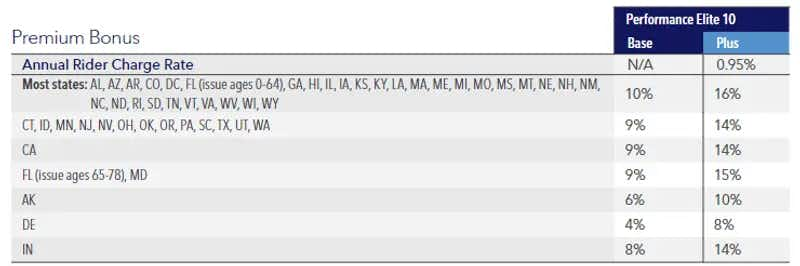

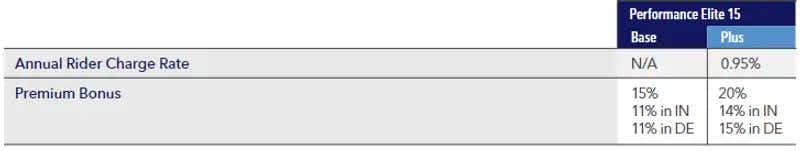

The Liquidity Rider is one of the main highlights of the Athene Performance Elite Fixed Indexed Annuity. The Athene Performance Elite Fixed Indexed Annuity comes with an optional paid rider that enables an annuitant to avail of certain benefits in terms of a higher premium bonus, enhanced withdrawals, etc. I will be discussing the rider in depth.

Rider Cost: For the Performance Elite 7 liquidity rider, an annual 0.95% charge is deducted from the Accumulated Value during the Rider Charge Period (same duration as the Withdrawal Charge period). The Charge is assessed upon the following: (i) end of each contract year; (ii) when a withdrawal is taken; (iii) on the Annuity Date; (iv) upon surrender; (v) upon the date of proof of death. The rider may not be terminated during the Withdrawal Charge period.

The Liquidity Rider offers the following enhanced benefits:

- Enhanced Premium Bonus

The Athene Performance Elite annuities include a one-time Premium Bonus that is credited at issue and provides an immediate increase to your annuity’s Accumulated Value. This premium bonus is enhanced when you take the liquidity rider. For the Performance Elite annuity, the existing premium bonus is 0%, but when you take this rider, you are entitled to a 6% premium bonus. For the Performance Elite 10 Annuity, the existing premium bonus is 10%, but if you opt for the rider, your premium bonus becomes 16%. At the time of writing this article, the following premium bonuses were applicable for 7, 10, and 15 years withdrawal charge periods.

| Contract Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8+ |

|---|---|---|---|---|---|---|---|---|

| Vesting % | 0% | 5% | 15% | 25% | 40% | 60% | 80% | 100% |

Enhanced Free Withdrawals

The free withdrawal amount is increased to 10% per year and may be taken as early as the first contract year. If no withdrawals are taken in a given year, up to 20% of the Accumulated Value is available for withdrawal in the next year.

Return of Premium

After the fourth contract year, the Cash Surrender Value will never be less than the premium minus premium taxes (if applicable) and prior withdrawals, including Withdrawal Charges, Premium Bonus Vesting Adjustment, and Market Value Adjustment (if applicable) on those withdrawals.

Enhanced Annuitization

After the fifth contract year, you may elect to surrender your contract and apply the Accumulated Value to one of five settlement options. No Withdrawal Charges, Premium Bonus Vesting Adjustments, or Market Value Adjustments will apply upon the election of this feature, provided one of the Settlement Options is elected, and annuity payments commence. You can refer to the Certificate of Disclosure for specific settlement options.

Now, the rider does offer some greater benefits, but the main highlight is the one-time premium bonus. Do keep in mind that a 5-7% premium bonus is one-time, but a ~1% rider charge is applied annually. In my opinion, this rider is a suitable option if you anticipate higher liquidity needs.

The Athene Performance Elite annuity also comes with complementary Confinement and Terminal Illness Waivers

Confinement Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is confined to a Qualified nursing home. No withdrawal charge or MVA apply if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

Terminal Illness Waiver: After the first contract year, an annuitant can withdraw up to 100% of the contract’s accumulated value if he is diagnosed with a terminal illness. No withdrawal charge or MVA apply if the owner qualifies for this benefit. Diagnosis must occur after the contract is issued, and written proof with supporting documentation is required from a qualified physician.

What makes this product stand out?

The Athene Performance Elite Fixed Indexed Annuity offers some of the features that not many fixed-indexed annuities offer. The ones that I like the most are

- Higher Free Withdrawal Rate

The Athene Performance Elite Fixed Indexed Annuity has a free withdrawal rate of 10% of the initial premium or 10% of the annuity’s Accumulated Value; each year. The plus version (with rider) enhances this free withdrawal rate to 20% if no withdrawals are taken in the previous year.

- Option of Uncapped Strategies on a Few Good Indexes

Caps on the equity indexing strategies is a bummer! Strategies with Caps should not be considered true indexing strategies because these Caps limit the earning potential of an index big time. If I choose a good index, but it has a Cap of, say, 4%, then essentially, I am settling for 4% right from the beginning; so why should it be called an “indexing” strategy in the first place? But, the good thing with the Athene Performance Elite Fixed Indexed Annuity is that it provides uncapped strategies with higher participation rates for many indexes like BNPP MAD 5 Index, NASDAQ FC Index, and the AiPEX Index. Uncapped strategies are a true way of taking an upside exposure of an index.

- Multiple Lifetime Withdrawal Options

- Free Confinement and Terminal Illness Waiver

- No annual contract, mortality & expense, or administrative fees

What I don’t like

The only popular index that this plan offers is the S&P, that too with caps in place.

A limited number of riders to choose from: Only one optional chargeable rider

Company Details

You must always keep in mind that, unlike CDs, annuities are not guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other federal insurance agency. An annuity’s “guarantee” is only as strong as the insurance company that issues the annuity, so it is always important to assess the issuing company before buying an annuity.

Athene Annuity and Life Company

Athene Annuity and Life Company have been in the business since 2009. It has been one of the largest providers of fixed and fixed indexed annuities in the US for many years and has been regularly in the top ten Fixed Indexed Annuity Sales.

It is rated as follows by the rating agencies:

| Rating Agency | Rating |

|---|---|

| AM Best | A (2nd of 13 ratings) |

| Fitch | A+ (5th of 19 ratings) |

| S&P | A+ (5th of 21 ratings) |

Athene Annuity and Life Company have managed to maintain decent ratings for many years. It is considered to be strong and stable financially. In 2020, the company paid out nearly $12.6 billion in claims. As of year-end 2020, some of the other financial highlights for Athene Annuity include its:

- $36.7 billion in total sales / direct written premium

- $18.7 billion of total stockholders’ equity

- $1.24 billion in net operating income

- $202.8 billion in total assets

Thus, going by the operating history and financial numbers, we can safely gauge that you can trust your savings with Athene Annuity and Life Company.

On January 1, 2022, Athene Holding Ltd. merged with Apollo Global Management, Inc. (NYSE: APO). Apollo is a high-growth, global alternative asset manager listed on the NYSE that serves institutional and individual investors across the risk-return spectrum in yield, hybrid, and equity strategies.

Conclusion

With the advancement in healthcare and technology, the average American today is living longer than ever. So, it’s very important to have a stream of income that can grow safely and steadily and have the ability to provide a guaranteed income during the retirement years. This not only helps you to mitigate the risk of outliving your income but also ensures that you continue to live a decent life even in your retirement.

The Athene Performance Elite is one such annuity that helps you grow your savings with much less risk. Through its Fixed Indexed Annuity and liquidity rider, It offers growth, principal protection, and access to higher liquidity without incurring any adverse Market Value Adjustments (MVA) charges.

If you are considering buying a Fixed Indexed Annuity that works best for growth and liquidity, the Athene Performance Elite FIA is a decent product to look after.